Logistics in eCommerce

eCommerce Logistics 2024: Market Size, Consumer Preferences & Analysis

Curious about the journey of your online purchases? Explore the dynamic growth and complexities of global eCommerce logistics, uncover consumer preferences, and see how the pandemic has transformed the sector.

Article by Cihan Uzunoglu | June 21, 2024

eCommerce Logistics Market 2024: Key Insights

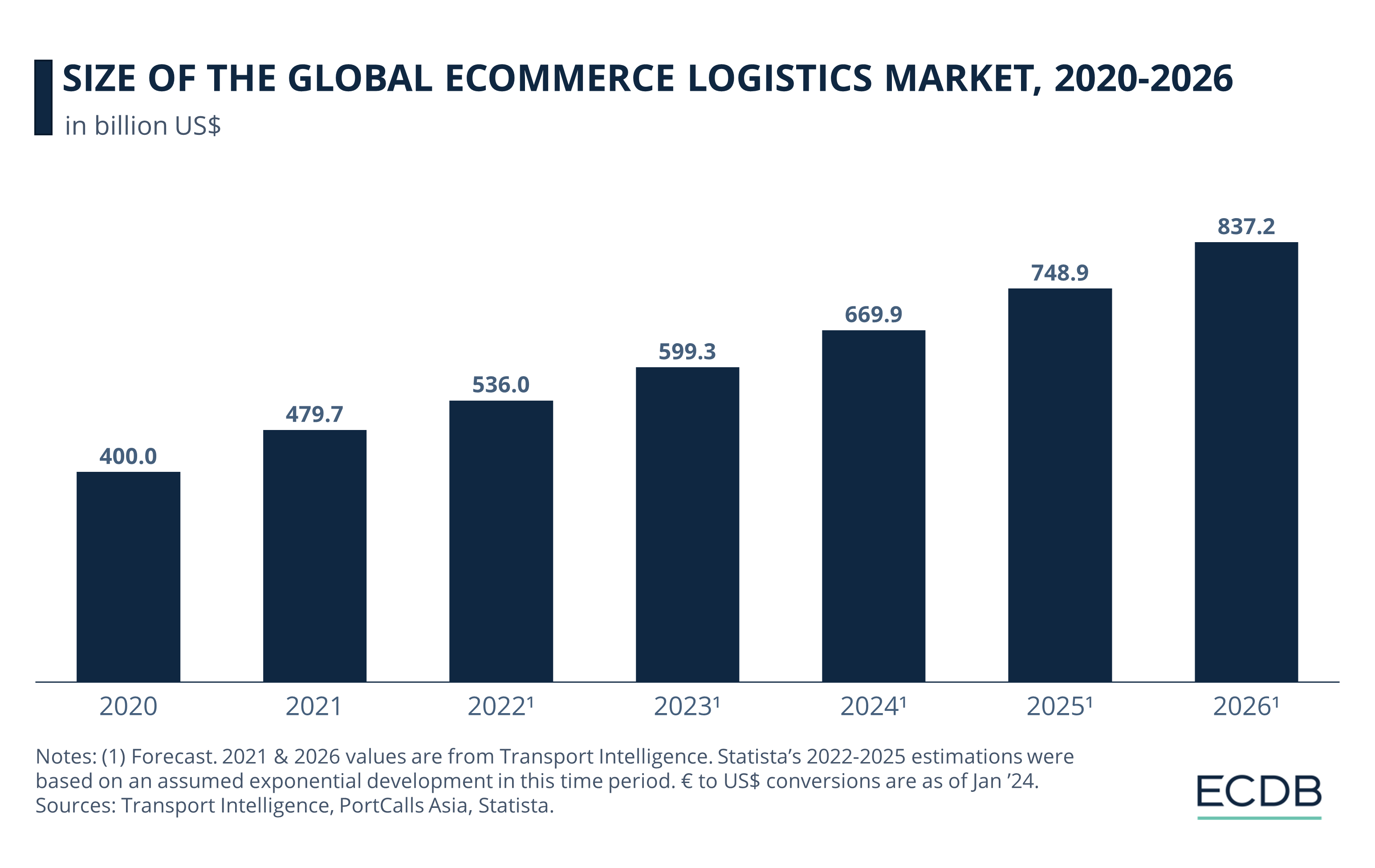

Market Growth: The global eCommerce logistics market is witnessing robust growth, projected to increase from US$400 billion in 2020 to US$837 billion by 2026, despite challenges such as the recent pandemic.

Consumer Preferences: Research shows that online shoppers worldwide prioritize faster delivery (48%), affordable shipping (43%), and accurate delivery time information (39%).

Returns: The UAE leads in product returns, with 40% of online orders sent back. European shoppers strongly prefer clear, cost-free, and simple return policies. Additionally, the global trend towards using parcel lockers for order collection is growing, though acceptance varies by country.

Pandemic's Impact: The COVID-19 pandemic significantly affected eCommerce logistics, leading to labor shortages, increased customer expectations for quicker deliveries, higher order volumes, and more complex order fulfillment. This has shifted demand patterns towards services like last-mile delivery and on-demand options, with Sub-Saharan Africa surprisingly leading market growth in 2020.

Have you ever thought about the journey of the package you eagerly open from your favorite online store? What's behind its carefully planned route, speed, and timely (or sometimes not-so-timely) arrival at your doorstep?

Now, multiply this by billions of packages shipped worldwide. The expansive global eCommerce logistics market manages this complex dance of goods and services. Between 2020 and 2021, the market saw a revenue increase of US$80 billion, and it continues to grow.

eCommerce Logistics Market:

Growth Continues

The global eCommerce logistics market has shown a significant trajectory of growth over the recent years. Let’s take a closer look:

According to data compiled by Statista, Transport Intelligence and PortCalls Asia, the market stood at US$400 billion in 2020.

By the next year, it had surged by US$80 billion to a value of almost US$480 billion.

The forecast for 2023 indicates a continuation of this trend, with the market predicted to reach nearly US$600 billion.

By 2026, it's projected to soar further to an impressive US$837.2 billion.

The global landscape offers a comprehensive overview of the eCommerce logistics market's trajectory. However, focusing on specific regions, such as Europe, reveals more nuanced insights.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

European eCommerce Logistics Market:

A Closer Look

The parcel market in Europe, as detailed by data from The European Regulators Group for Postal Services (ERGP), exhibited a distinct trajectory over the years.

The annual revenue in 2015 stood at €31.29 billion. While the general trend moved towards growth, there were specific downturns, particularly in 2017 and 2018, where the market saw reductions in its annual revenue. Nevertheless, the market rebounded, and by 2021, revenue surged to €62.63 billion.

Having charted the trajectory of market development both globally and in Europe, we now turn our focus to the consumer-centric dynamics defining the eCommerce landscape.

Speed is the Top Consumer Priority

According to the results of a worldwide survey involving consumers who make online purchases at least once a month, published by Wunderman Thompson Commerce:

Almost half (48%) believe that products should be delivered faster, emphasizing the importance of speed in the delivery process.

The cost of delivery is another significant concern, with 43% feeling that what they pay for shipping is too high, indicating a desire for more affordable, if not free, delivery options.

Furthermore, 39% of these global shoppers want more exact information about their delivery times, signaling the importance of predictability and transparency in the online shopping experience.

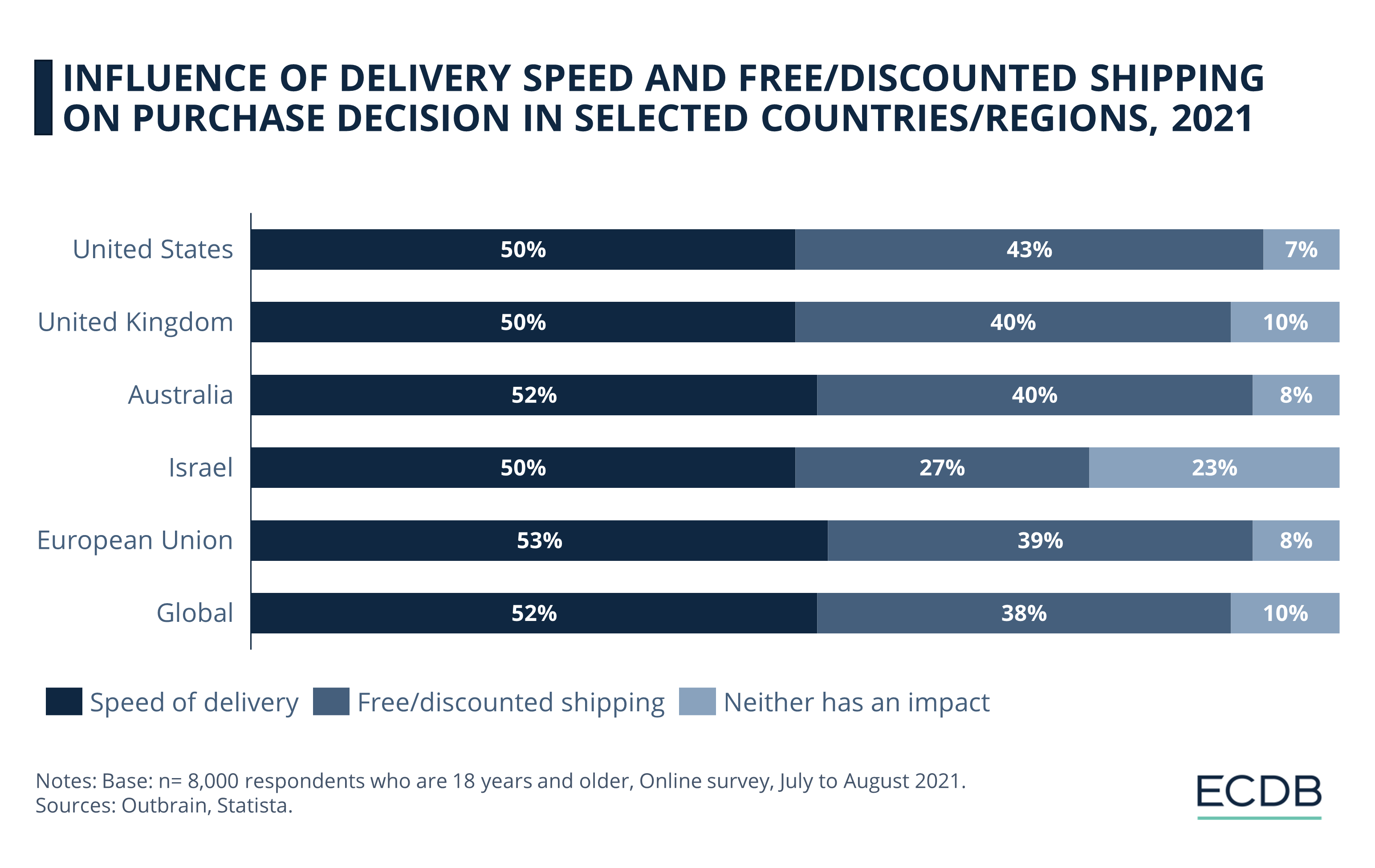

Delivery speed and costs play pivotal roles in shaping consumer preferences worldwide. However, diving deeper into regional nuances presents varied emphases on these factors. As a case in point, consider the distinct preferences emerging from places like Israel compared to the broader trends.

In a 2021 survey by Outbrain, around 50-53% of respondents from the United States, United Kingdom, Australia, and the European Union emphasized the importance of delivery speed in online shopping, with 38-43% highlighting the appeal of free or discounted shipping. Only a minor portion (7-10%) in these regions believed neither factor influenced their purchasing decisions.

Online Shopping in UAE: 40% are Returned

Although the speed and cost of delivery are undoubtedly crucial, another significant facet of the eCommerce experience is the return policy. Data from Wunderman Thompson Commerce reveals the countries where online shoppers are most likely to return their purchases.

The United Arab Emirates (UAE) leads the list with a significant 40% of online orders being returned. Following closely, India has a return rate of 37%. Thailand is not far behind, with 34% of online purchases making their way back. Meanwhile, in Europe, the Netherlands sees 26% of its online orders returned. The United States, a major eCommerce market, has a return rate of 25%.

A Clear Return Policy Goes a Long Way

The phenomenon of product returns is not merely about statistics; it's intrinsically tied to shopper sentiments and policies that govern these returns. European shoppers, in particular, have voiced clear concerns regarding return procedures.

In a 2022 survey by DPD and Geopost, the European e-shopper landscape revealed consistent concerns about online return policies:

In general, 78% of respondents across Europe found tedious return processes off-putting.

Additionally, 75% disliked the idea of shouldering return costs, and a substantial 88% stressed the need for clear return policies upfront.

Diving deeper into specific countries: France saw 90% hesitant due to unclear return policies and 85% daunted by complex return procedures. About 69% were reluctant, fearing return charges.

Germany and Spain shared this sentiment, with roughly 75% deterred by complex returns and over 70% anxious about potential costs.

Italy and the UK mirrored these concerns, with figures fluctuating between 75-88% on these barriers.

European Shoppers: 95% Want to Return Products at a Parcel Shop or Retailer’s Store

Continuing the exploration of the European e-shopper landscape, it's crucial to determine consumers' primary desires regarding the return process. In another 2022 survey by DPD and Geopost, European online shoppers delineated their return preferences.

The majority, around 95%, favored the option to drop off returns at parcel shops or the retailer's stores. Equally valued was the need for transparent return costs and a clear return policy, with approvals around 94% and 89%, respectively. The ability for items to be picked up from home was also important for many, averaging at 90%.

"Free returns", however, garnered varied interest across countries: the UK led at 76%, followed by France (74%), Germany (71%), Italy (69%), and Spain (66%). This suggests that while most return criteria are almost universally desired, attitudes towards free returns show notable differences among European shoppers.

Another emerging trend in the eCommerce logistics sector is the increasing reliance on lockers for order collection. But how widespread is this preference?

Smart Lockers: Benelux is Not a Fan

Based on data from Parcel Monitor, the global use of parcel lockers for collecting online purchases has witnessed significant growth between 2018 and 2020.

In 2018, just 10% of online shoppers chose to collect their orders using parcel lockers. This figure saw a slight increase in 2019, with 12% opting for locker pickups. However, 2020 marked a substantial surge, as 39% of online purchases were collected via parcel lockers, indicating a rapidly growing preference for this method of order collection among consumers worldwide.

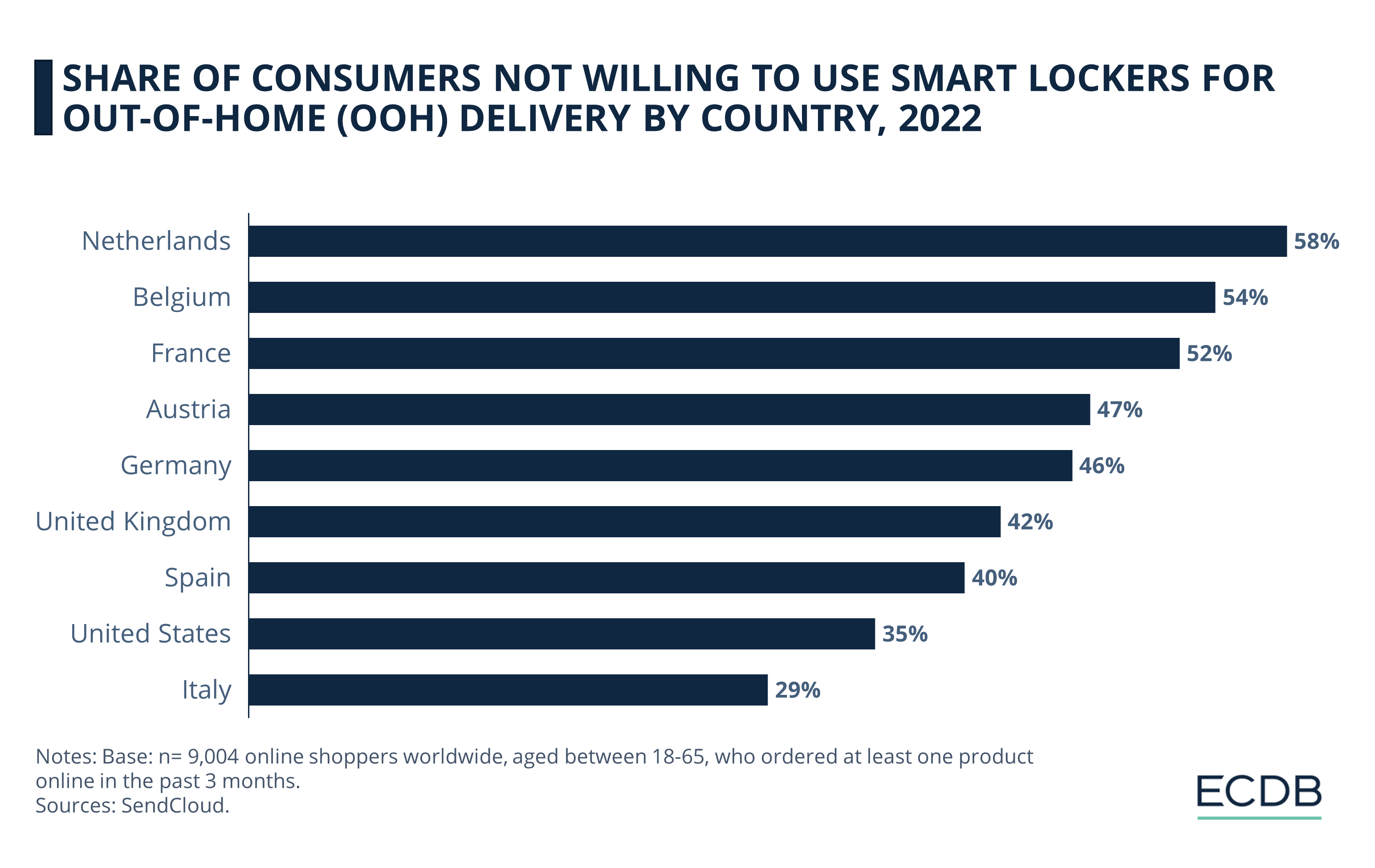

The growth in parcel locker usage showcases a changing dynamic in delivery preferences. Still, not everyone is on board with this method. In a 2022 survey conducted by SendCloud and Nielsen, consumer willingness to use smart lockers for out-of-home (OOH) deliveries varies significantly by country:

The Netherlands shows the highest reluctance, with 58% of respondents indicating they are not willing to use such services.

This sentiment is similarly echoed in Belgium (54%) and France (52%).

In Austria and Germany, the figures are marginally lower, with 47% and 46% respectively expressing their unwillingness.

The United Kingdom, Spain, and the United States showcase greater acceptance, but still have significant portions resisting the idea, with figures of 42%, 40%, and 35% respectively.

Italy is the most open to the concept among the countries surveyed, with only 29% of respondents showing aversion to using smart lockers for OOH deliveries.

COVID-19: Labor Shortages & eCommerce Order Complexities

For better context, let's take a look at how COVID-19 has impacted the eCommerce logistics market and how the sector has bounced back from the difficulties created by the pandemic.

In a survey published by the Switzerland-based company Kardex, several challenges stood out regarding the impact of COVID-19 on order management processes. The primary issues included labor shortages (40.2%), rising customer expectations around expedited deliveries (35.9%), an increased volume of eCommerce orders (35%), and the need to fulfill more orders rapidly and affordably (34.2%).

Other responses highlighted concerns around order accuracy, physical space constraints, multiple order fulfillment channels, order management complexity, visibility, return order management, and a global view of orders and inventory. Interestingly, 8.5% of respondents indicated they were unaffected by the challenges listed.

What Did the Pandemic Change in eCommerce Logistics?

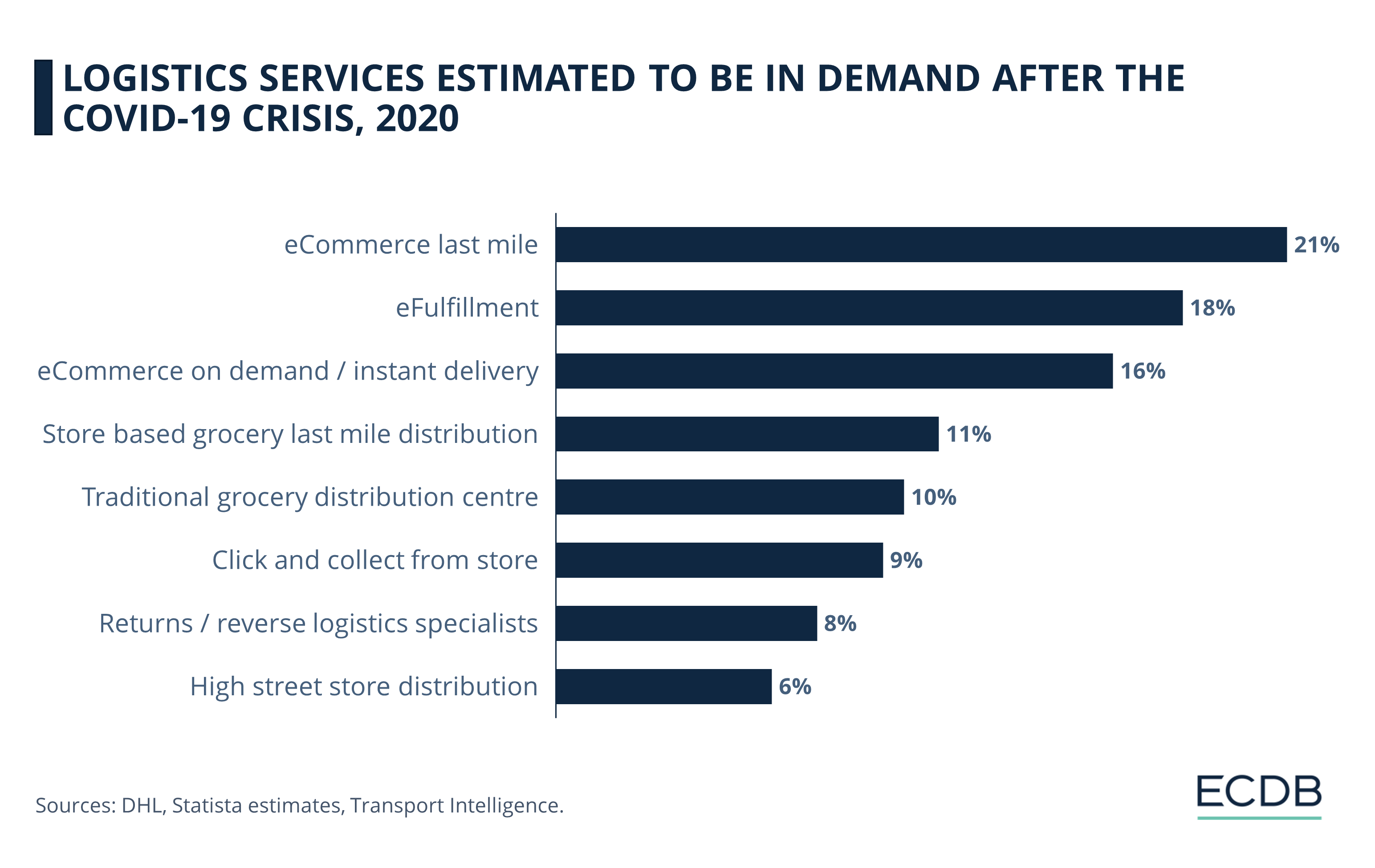

While the challenges brought about by COVID-19 have been manifold, they also led to shifts in the demand patterns within the logistics sector.

According to data collated from DHL, Transport Intelligence, and estimates provided by Statista, leading the pack was the eCommerce last mile service, often defined as the final step of the delivery process from a distribution center or facility to the end user, which experienced a demand of 21%. This was closely followed by eCommerce fulfillment, registering an 18% demand.

The urgency of online shopping was further underscored by the 16% demand for eCommerce on-demand/instant delivery services. In the realm of groceries, store-based grocery last mile distribution was sought after, with a demand of 11%, and the traditional grocery distribution center wasn't far behind, clocking in at 10%.

Services such as click and collect from stores, returns or reverse logistics, and high street store distribution also witnessed notable demand.

eCommerce Logistics Growth:

Sub-Saharan Africa Led in 2020

To top things off, we'll examine the eCommerce logistics market growth across different regions for the year 2020, which reveals a surprising surge in Sub-Saharan Africa.

According to Transport Intelligence, Sub-Saharan Africa led the pack with a year-on-year change of 36.3%, making it the fastest-growing region in this sector. This impressive growth rate is particularly noteworthy because Sub-Saharan Africa isn't often the center of conversations in eCommerce circles, despite its evident potential.

Following closely, South America recorded a 34.8% increase, while North America, a significant player in the eCommerce space, experienced a 33.9% uptick. The Middle East and North Africa weren't far behind, posting a 30.4% growth rate. Europe, another substantial eCommerce market, saw its logistics market grow by 26.5%. Meanwhile, the Asia-Pacific region, which houses some of the biggest eCommerce giants, experienced a growth rate of 22%.

Sources: Transport Intelligence, PortCalls Asia, Kardex, The European Regulators Group for Postal Services (ERGP), Wunderman Thompson Commerce, Outbrain, DPD, Geopost, Parcel Monitor, SendCloud, Nielsen, Statista

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

DoorDash and Uber Eats on the Hunt for the Number One Express Online Delivery Service

DoorDash and Uber Eats on the Hunt for the Number One Express Online Delivery Service

Deep Dive

Regional Carriers Over Larger Shipping Conglomerates in European eCommerce

Regional Carriers Over Larger Shipping Conglomerates in European eCommerce

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

Peak Season of eCommerce & Air Cargo Capacity Crisis

Peak Season of eCommerce & Air Cargo Capacity Crisis

Back to main topics