eCommerce: German Market Trends

EHI & ECDB: Top Three Marketplaces in the German eCommerce Market

“The E-Commerce Market Germany 2024" report provides valuable insights into the German online retail landscape, including a list of the top marketplaces. Here are the top 3.

Article by Patrick Nowak | October 01, 2024Download

Coming soon

Share

Top Three Marketplaces in the German eCommerce Market: Key Insights

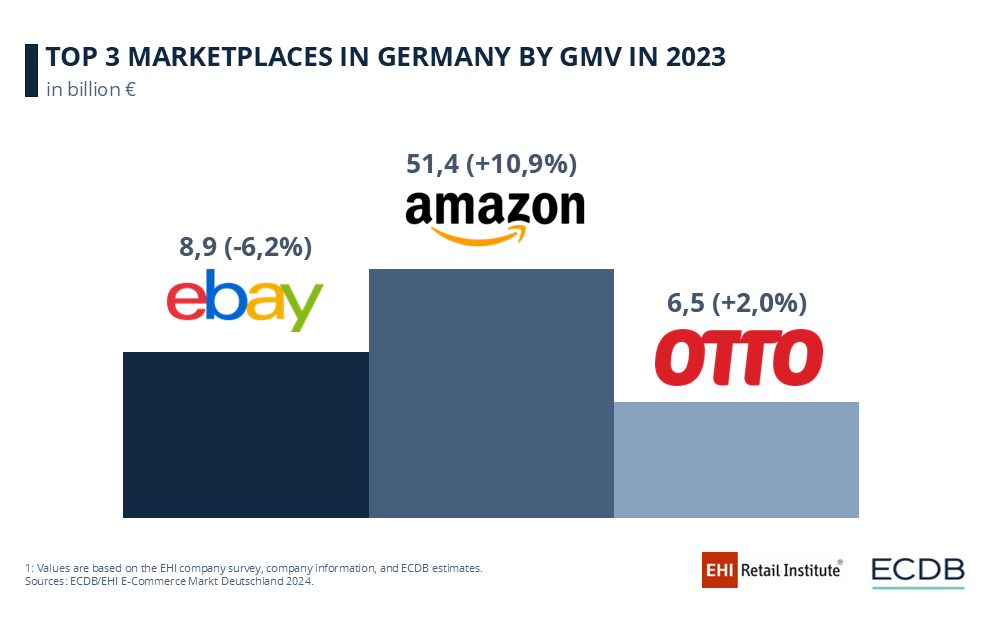

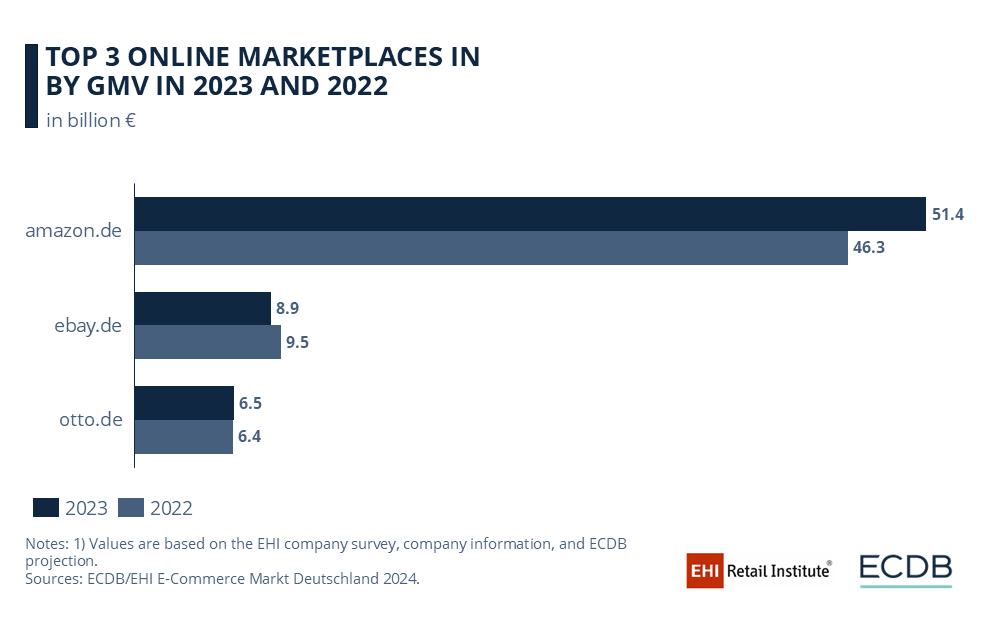

Amazon's Growth: Amazon grew from €46.3 billion in 2022 to €51.4 billion in 2023, while Otto and eBay saw no significant growth.

eBay in Second Place: eBay holds the second spot with €8.9 billion GMV, but far behind Amazon.

Otto Stays Strong Locally: Otto maintains its third position with €6.5 billion GMV, appealing to German consumers with its focus on fashion and home goods.

After a slight decline in 2021, the German eCommerce market is growing again. As online shopping becomes more integrated into daily life, one of the leading marketplaces is pulling ahead with significant market shares and increased gross merchandise value (GMV).

In collaboration with the EHI Research Institute, the German eCommerce market has been analyzed for the 16th consecutive year. Before you order the full 50-page report, which includes detailed sales data, GMV insights, and other key indicators, take a look at the initial findings. Who are the top three marketplaces in German eCommerce? And what role does Amazon play?

Top German eCommerce Marketplaces: Amazon.de Grows in Germany

In 2023, none of the other big three experienced growth, except Amazon. In 2022, Amazon generated €46.3 billion, and in 2023, this figure increased to €51.4 billion. Meanwhile, eBay lost 6% and Otto stagnated, showing nearly the same figures as the previous year.

1. Amazon Europe Core S.à r.l. – Still the Giant

Amazon remains the indisputable leader in Germany’s eCommerce sector, with a staggering GMV of €51.4 billion. The platform continues to leverage its vast product selection, efficient logistics networks, and customer loyalty through programs like Amazon Prime. The marketplace not only dominates in Germany but maintains a central role in Europe’s broader eCommerce ecosystem. Its GMV in Germany alone surpasses the combined value of several other top players in the market.

2. eBay Marketplaces GmbH – A Distant Second

Trailing far behind Amazon, eBay holds the second spot with a GMV of €8.9 billion. While eBay's platform remains a popular choice for both businesses and individual sellers, its market share pales in comparison to Amazon. However, eBay continues to carve out a niche, particularly in second-hand goods and specialty items, benefiting from the growing circular economy trends in Germany.

3. Otto (GmbH & Co. KG) – A Strong Domestic Competitor

In third place is Otto, one of Germany’s most recognized domestic eCommerce brands, with a GMV of €6.5 billion. Otto has managed to maintain its relevance through consistent digital innovation and a strong focus on fashion, home goods, and appliances. The company also benefits from its ability to cater to German consumers who prefer shopping from local platforms.

Amazon's Continued Dominance

While Otto and eBay are formidable competitors, Amazon’s overwhelming GMV illustrates the scale of its dominance. With a GMV nearly six times larger than eBay's and eight times larger than Otto's, Amazon’s ecosystem of services—from its retail platform to AWS cloud services—continues to entrench its leadership in the German market. It is also the only marketplace with a significant growth of 11%.

As we move forward in 2024, it is clear that while several companies are competing for market share, Amazon is widening the gap between itself and the rest of the industry. The coming year may offer more opportunities for smaller marketplaces to innovate, but the top three appear set in their positions for now.

Otto And eBay Far Away

Both the second- and third-ranked marketplace domains on this list, ebay.de and otto.de, have shown mixed performance in their 2023 GMV year-over-year. eBay experienced a decline of 6%, with approximately €8.9 billion worth of transactions on its marketplace in 2023. Third-ranked Otto saw a modest growth of 2%, with a GMV of €6.5 billion in 2023.

Can you guess which marketplaces rank fourth and fifth in German eCommerce? Representing the two popular product segments of fashion and electronics, Zalando takes fourth place, and Media Markt ranks fifth. Check out the report if you’re interested in more GMV data and the other marketplaces that made the list.

"E-Commerce Market Germany 2024" - Order the Report Now

Curious about more information on the German eCommerce landscape, including leading players, product categories, and revenue distribution? Secure your copy of the 2024 report here.

ECDB, in partnership with the EHI Retail Institute, presents these and numerous other data points on relevant aspects of eCommerce, charting the evolution of the German online market.

For global eCommerce updates and the latest trends, connect with us on LinkedIn.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Temu Is the Second Most Visited eCommerce Website in the World

Temu Is the Second Most Visited eCommerce Website in the World

Deep Dive

Indonesia Urges Apple and Google To Restrict Temu

Indonesia Urges Apple and Google To Restrict Temu

Back to main topics