eCommerce Consumers by Generation

Gen Z's Chronic Online Being with Implications for the eCommerce Landscape

Gen Z, one of the most digitized generations, plays a big role in China's eCommerce market. What do they prefer in online shopping and how are they like when it comes to spending?

Article by Cihan Uzunoglu | March 27, 2024We often talk about China. It's the largest eCommerce market, with projected sales of US$2.4 trillion by the end of this year. The country's Generation Z - individuals born between 1997 and 2012 - is emerging as a significant driving force in shaping the digital landscape.

Between 2018 and 2022, China's Generation Z active internet users witnessed an impressive 60% increase, rising from 213 million to 342 million, as reported in a study from QuestMobile. That's about a quarter of the country's population. Another survey by QuestMobile shows that, as of June 2022, a little less than one fifth (18.5%) of Gen Z consumers in China were willing to spend money online. While more than half (54%) showed moderate willingness towards online shopping, just above a quarter (27.5%) had low enthusiasm in shopping online.

The rise of this digitally native generation, with their distinctive purchasing habits, preferences, and technological prowess, is transforming China's eCommerce industry and setting the stage for exciting new developments.

Almost All Gen Z in China Shop Mobile

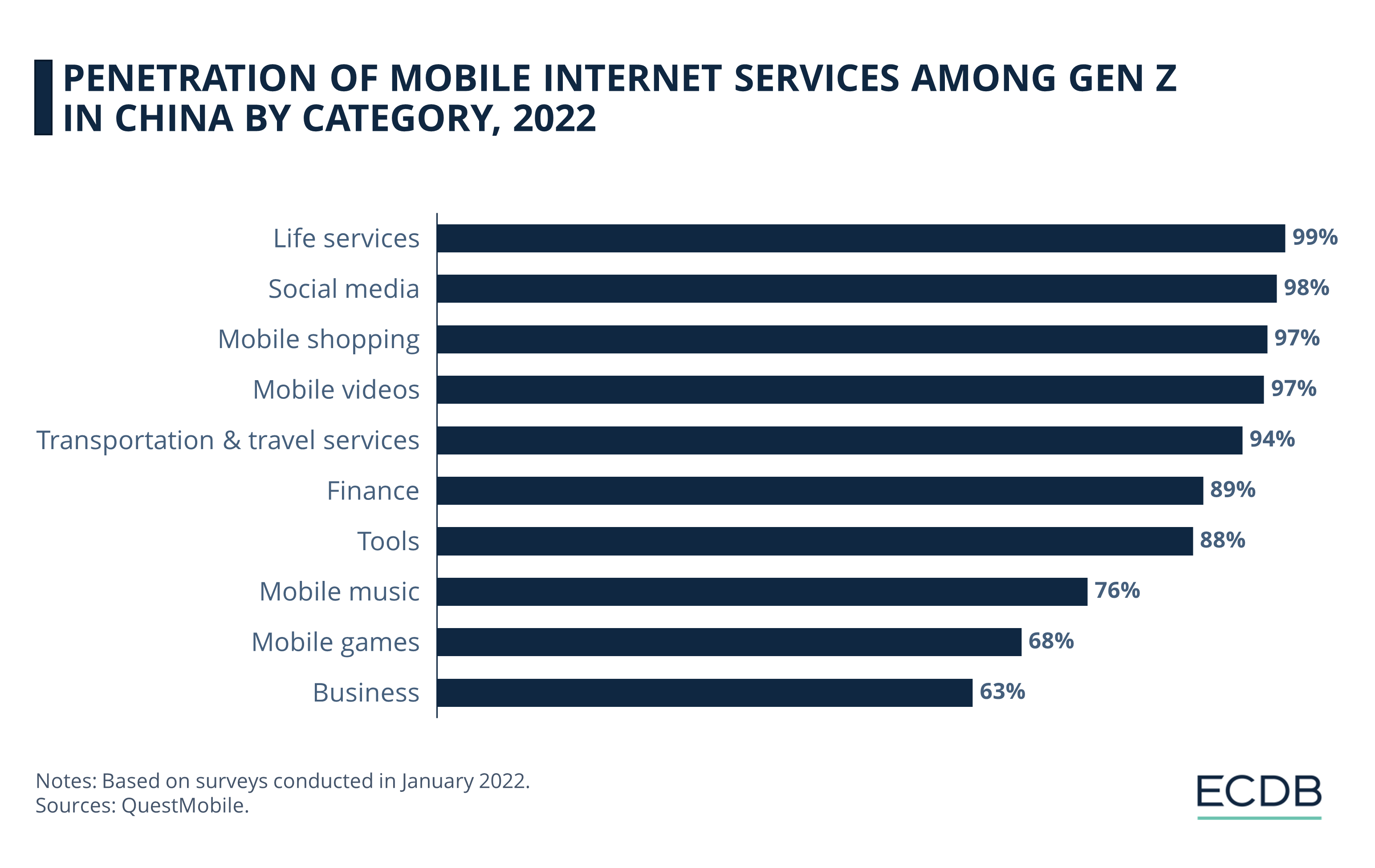

More data from QuestMobile displays how integral mobile internet services are to Gen Z in China, especially in the realms of social media, shopping, and video consumption.

A whopping 99% use their mobile devices to access life services, which include anything that makes daily tasks easier, such as food delivery and appointment bookings. Close behind, social media and mobile shopping have the attention of 98% and 97% of young people respectively, showing a near universal usage of social platforms and online shopping among this age group.

Watching videos on mobile also holds a significant place, tying with shopping at 97%. Meanwhile, transportation and travel services are used by 94%. Financial services and tools are used by 89% and 88%, showing a high level of financial engagement and reliance on mobile apps for practical needs.

Listening to music on mobile is popular among 76%, and playing mobile games and engaging with business-related services had a slightly lower, yet substantial, reach with 68% and 63% usage rates respectively.

Most Gen Z in China Use Online Stores for Product Research

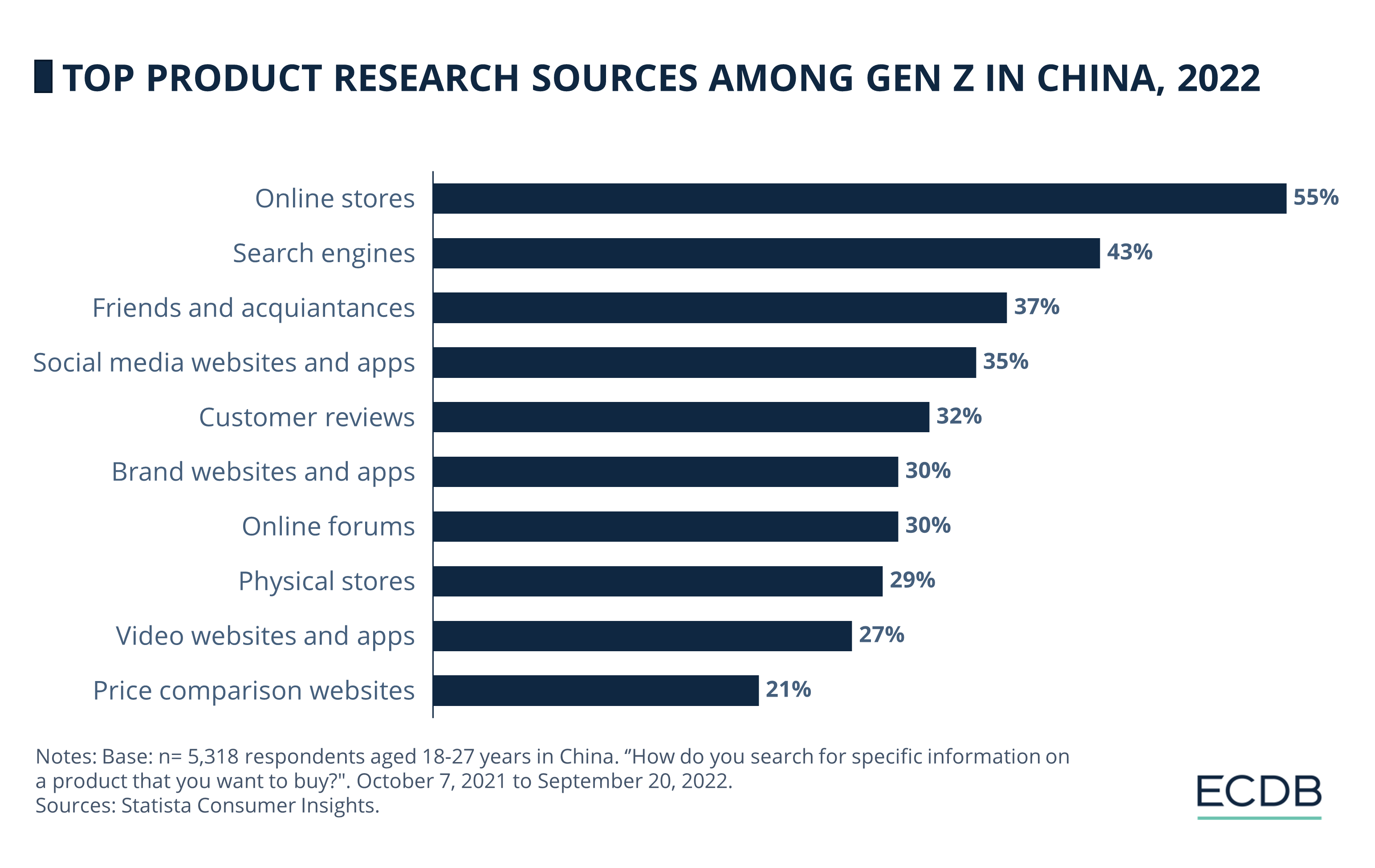

When it comes to finding out about products, Gen Z consumers in China have a clear preference for digital sources, but they still value word-of-mouth recommendations.

The top spot in the Statista survey goes to online stores, with 55% of young consumers turning to them first for product research. Search engines are also a popular starting point for 43% of this age group. Personal connections still play a significant role for Gen Z in China, with 37% relying on friends and acquaintances for product information, underscoring the continued importance of social influence in purchasing decisions.

Social media platforms and apps are close behind at 35%, while customer reviews are trusted by 32%. Brand-owned websites and apps, along with online forums, each capture 30% of young consumers, suggesting that both direct brand engagement and community discussions are valuable research tools.

Looking at the bottom three results, we see that physical stores are still in the mix at 29%. Video websites and apps are used by 27%, and lastly, price comparison websites are utilized by 21%, pointing to a budget-conscious segment within Gen Z that prioritizes finding the best deals.

Speed, Convenience & Information

The shopping patterns of Gen Z in China reveal a group that's not just tech-savvy, but also discerning, seeking a blend of speed, convenience, and informed purchasing that online shopping environments can provide.

A significant 43% of young shoppers find customer reviews on the internet very helpful. Speed is also of the essence, with 41% stating a preference for express shipping when they order an item. Managing routine orders through smartphones or tablets is a habit for 40%. Nearly as many, 39%, express the wish to get their purchases immediately, preferring to hold items in their hands the same day they buy them.

When it comes to significant purchases, a third always do their homework online first. This due diligence reflects their cautious approach to bigger investments, which we will touch upon in the next section. Finally, 32% usually make these major new purchases directly via their smartphone or tablet, signaling a trust in and reliance on mobile commerce, as highlighted earlier.

Gen Z in China is More Careful with BNPL Than Millennials

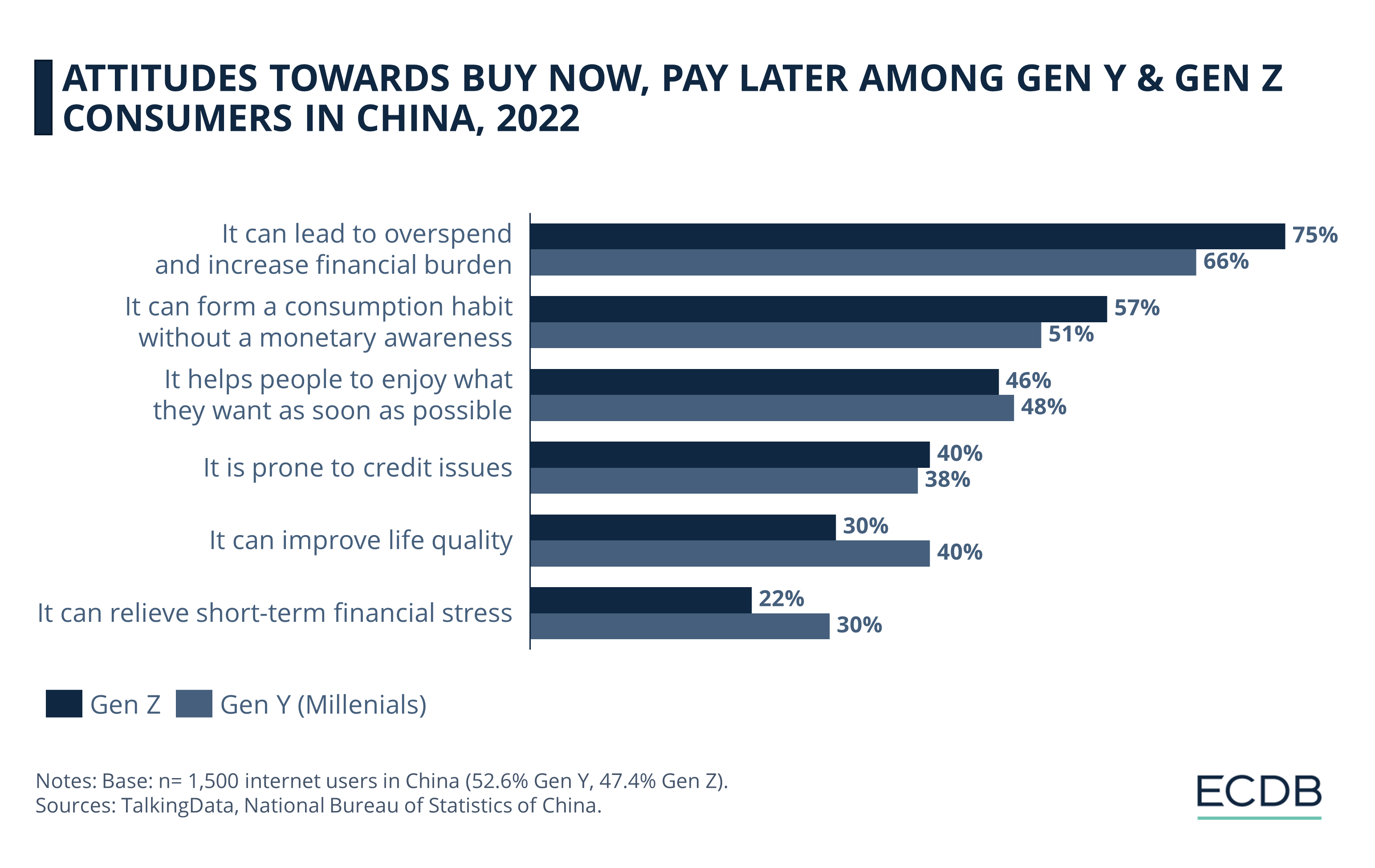

Far from being the reckless spenders they're sometimes assumed to be, Gen Z consumers in China are actually rather prudent with their finances.

The attitude towards Buy Now, Pay Later (BNPL) options among younger generations in China reveals a cautious approach by Gen Z compared to Millennials. Based on 2022 findings from TalkingData and National Bureau of Statistics of China, three quarters of Gen Z believe that BNPL could lead to overspending and increase financial burdens, a view less commonly held by Millennials, at 66%. Additionally, 57% of Gen Z are wary of forming consumption habits without real money awareness, compared to 51% of Gen Y.

Gen Z also shows more caution in other areas, with 40% concerned about potential credit issues due to BNPL, slightly higher than the 38% of Millennials sharing this worry. While both generations see the appeal of enjoying purchases immediately, with 46% of Gen Z and 48% of Gen Y in agreement, it's Gen Y who are more inclined to believe that BNPL can improve life quality, with 40% endorsing this view against only 30% of Gen Z.

Furthermore, only 22% of Gen Z feel that BNPL can relieve short-term financial stress, a sharp contrast to the 30% of Millennials.

Gen Z in China: Closing Thoughts

It's clear that China's Gen Z are not merely participants but are crafting the very future of online shopping. Their growth in numbers, reaching 342 million active internet users, shows their digital foothold. Yet, their careful engagement with BNPL services hints at a generation as cautious as it is tech-forward, perhaps hinting at an underlying mindfulness in consumption.

The rise of live commerce, a blend of livestreaming and shopping, captivates them, yet they haven't turned their backs on traditional methods. Their preference for apps like Mobile Taobao, with a 79% penetration rate among active users, underscores their influence in shaping the tools and platforms of tomorrow's eCommerce.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

More Top Companies Call Europe Their Home Than the U.S.

More Top Companies Call Europe Their Home Than the U.S.

Deep Dive

Online Platforms Are the Number One Purchase Channels for Christmas Gifts

Online Platforms Are the Number One Purchase Channels for Christmas Gifts

Deep Dive

Thanksgiving Weekend GMV in the U.S. to Reach US$30 Billion in 2024

Thanksgiving Weekend GMV in the U.S. to Reach US$30 Billion in 2024

Deep Dive

#sephorakids and Social Media Junkies – What’s Behind the “Gen Alpha”?

#sephorakids and Social Media Junkies – What’s Behind the “Gen Alpha”?

Back to main topics