eCommerce: Alcoholic & Non-Alcoholic Drinks

Beer and Beverage Online Sales in Germany: Market Size, Consumer Preferences & Growth

The pandemic was a profitable period for the online beer market in Germany, but what about the following years? Learn about market revenues, soft drink sales, and the most preferred channels for German consumers to purchase their brew.

March 27, 2024Download

Coming soon

Share

Online Beer and Beverages in Germany: Key Insights

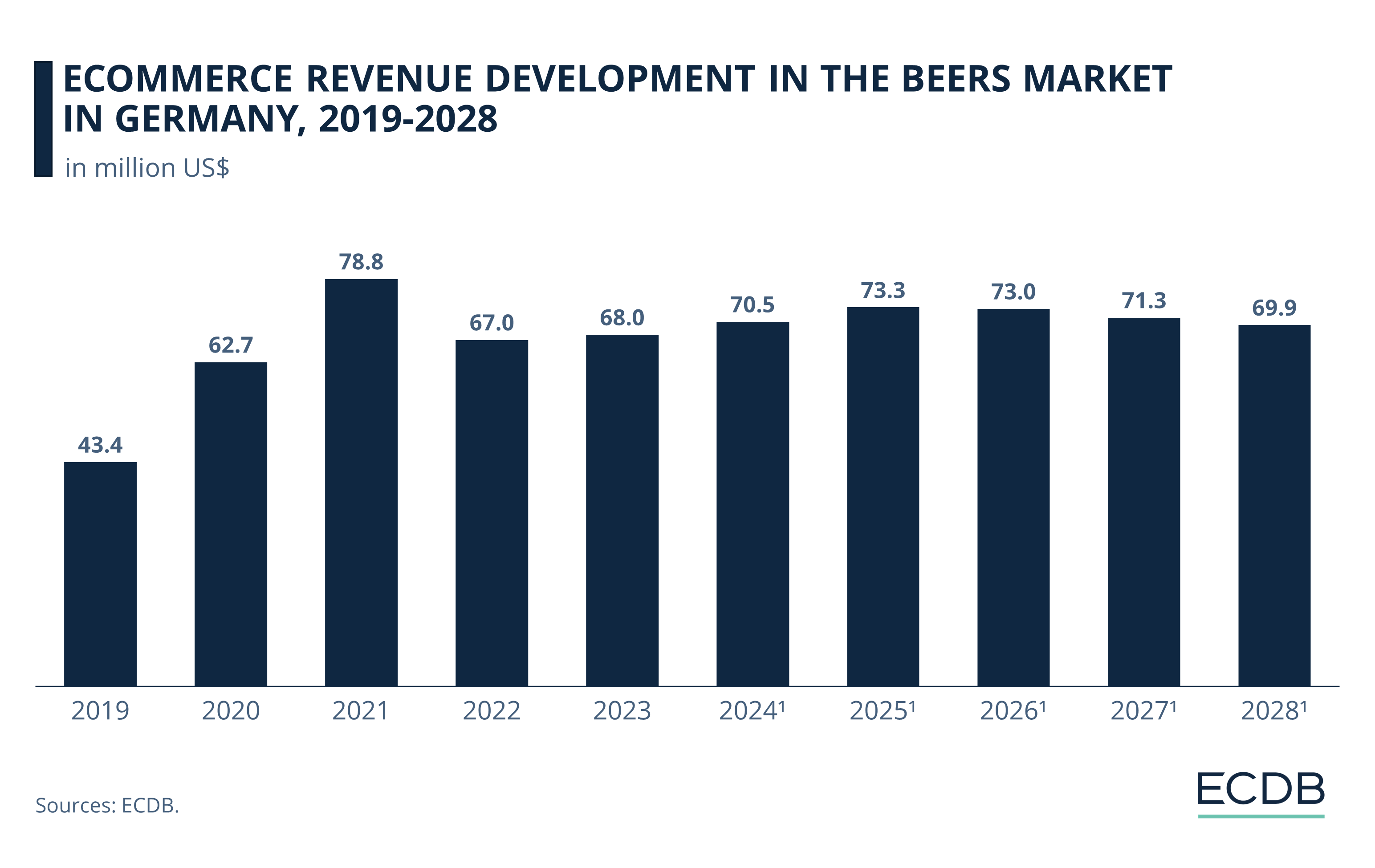

Beer Online Sales Peaked in 2021: At the height of the pandemic, beer online revenues in Germany peaked at US$78.8 million. Sales have slowed notably since then and are not expected to repeat the pandemic surge.

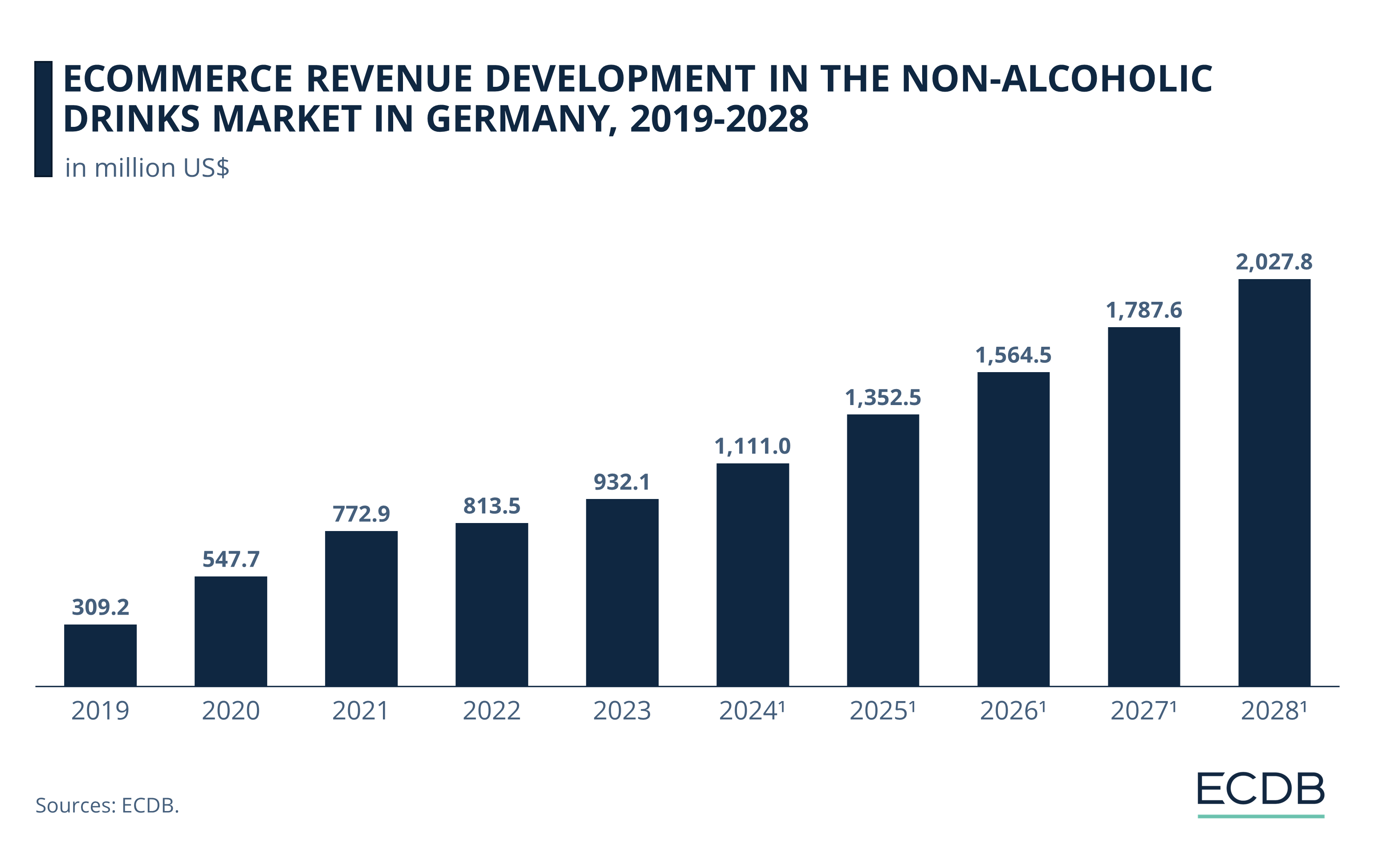

Online Sales of Non-Alcoholic Drinks Are Growing: In contrast to beer online sales, non-alcoholic beverages are performing better in the German online market. Their growth path is steadily advancing, according to projections through 2028.

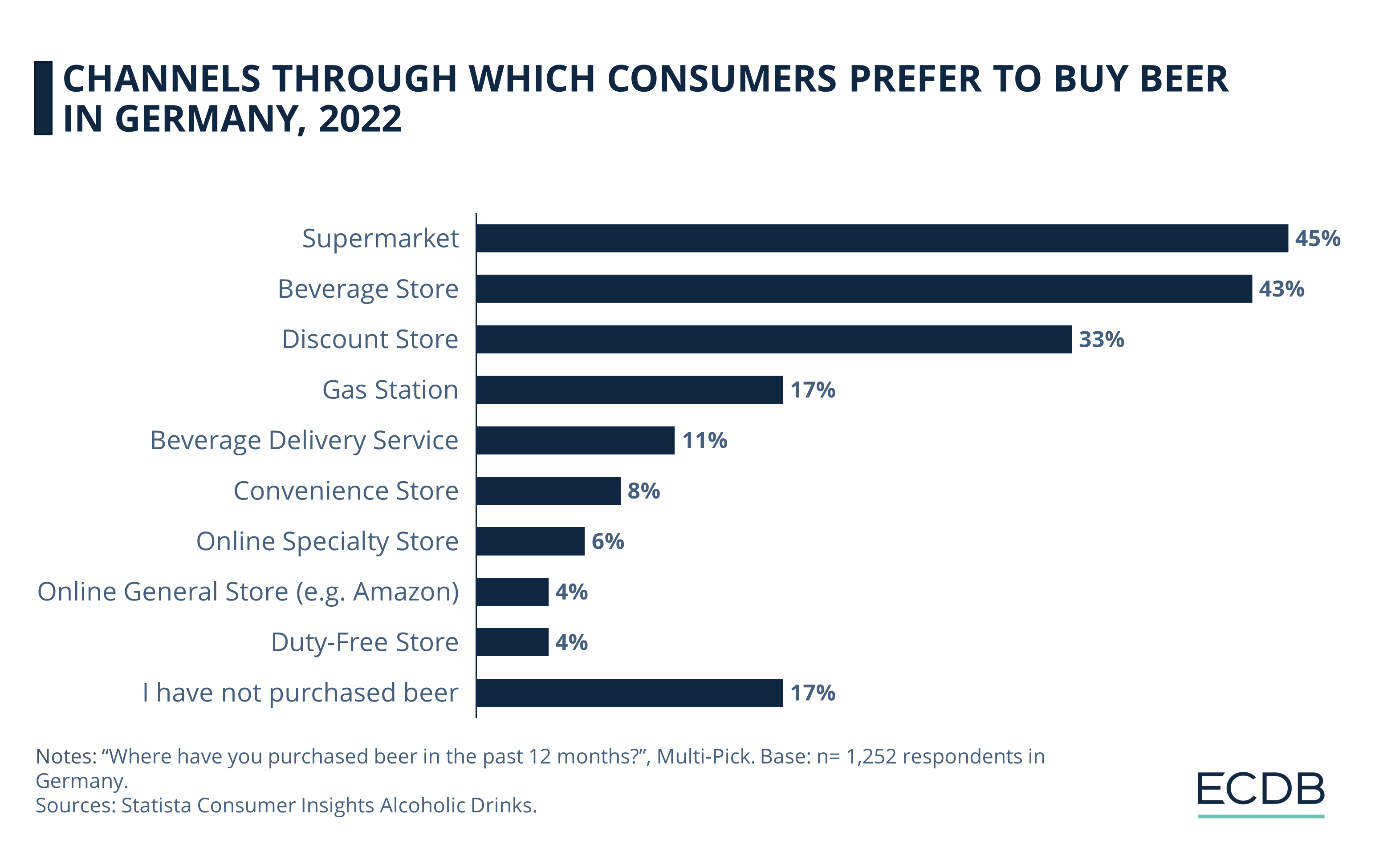

German Consumers Buy Beer Offline: In a 2022 Statista Consumer Insights survey, supermarkets, beverage stores and discounters emerged as the preferred channels for purchasing beer. Online outlets were much less common, due to a number of factors.

When one thinks of Germany, one of the first things that comes to mind is the beer culture. Drinking beer is as much of a German cliché as schnitzel or bratwurst, but what about the online market?

Is ordering beer online part of the German culture? And what about other drinks? With the German Beer Day coming up on April 23, ECDB dedicates an insight to these questions.

Pandemic (After)Effects in the German Beer Online Market

Until recently, beer was not a popular product for eCommerce. But the pandemic changed the demand for ordering beer online. According to the IWSR, empty grocery store shelves motivated consumers to look for other ways to quench their thirst during lockdowns, preferably ones that met social distancing measures: Ordering beer online became more common.

ECDB's market data reflects this trend: Revenues in the German online beer market increased by 26% from 2020 to 2021, the largest increase compared to the previous years in this market.

After 2021, the demand for online beer fell again and market revenues shrank accordingly. Consumers were allowed to return to bars and public spaces again, and prices increased due to inflation and higher costs for raw materials, energy, packaging, and labor costs.

Specifically, market revenues declined from US$78.8 million in 2021 to US$67 million in 2022. In 2023, revenues recovered slightly by about US$1 million and are expected to continue growing through 2025, reaching US$73.3 million. Beyond that year, beer online market revenues are projected to decline again.

Sobering Up: Non-Alcoholic Drinks Market Grows More Steadily

In contrast, online sales of non-alcoholic drinks, i.e. bottled water, soft drinks, juices, and others, have grown steadily over the years and are expected to continue their upward trend.

Online sales of non-alcoholic beverages grew during the pandemic, but have continued to grow since then. The decline in the beer market in 2022 only translated into slower growth within the non-alcoholic drinks market. Overall, eCommerce revenues of non-alcoholic drinks are expected to exceed US$1 billion by 2024 and reach US$2.03 billion by 2028.

Fluctuating online net sales in the beer market are therefore not due to a reluctance on the part of German consumers to order beverages online: Rather, it seems to be a matter specific to beer.

Offline Beer Sales Still More Common

A consumer survey on alcoholic drinks preferences in Germany shows that physical retail is still by far the most common channel to buy beer:

Only farther down the list, in fifth place, comes beverage delivery service, with 11% of consumers having ordered beer this way. Even less common than that are online specialty stores (6%) and lastly online general stores such as Amazon (4%).

Reasons for the low adoption rate of online channels for beer purchases in Germany may be due to long-standing consumer habits, wider and faster access to supermarkets and other physical outlets, as well as their lower costs.

Beer Online Market in Germany: What's Next?

Buying beer online faces certain barriers related to consumer preferences and the characteristics of the online market. It is evident that after the pandemic, consumers in Germany returned to bars or public places and bought their beer in supermarkets, beverage stores and gas stations, rather than waiting days for their online orders and paying more than the usual price.

To tap into this walled-off market, companies need to meet immediate demand with real-time delivery services, lower costs, and specialized offerings.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics