Online Hot Drinks Market in the United Kingdom

Download

Coming soon

Share

The COVID-19 pandemic has resulted in significant changes across numerous industries, one of which is eCommerce. Specifically, the online hot drinks market has seen a noticeable increase in growth rates in various countries. The United Kingdom, ranked as the fourth biggest eCommerce market in the world, has seen one of the most striking growth spikes in this market. As lifestyles and daily habits change, the online hot drinks market in the UK has flourished, undergoing a dramatic expansion.

As offices moved into homes and traditional coffee shops closed, for instance, UK consumers turned to online platforms to fulfill their cravings. With a mix of necessity and convenience, the digital market for hot drinks has gone beyond its usual limits. Based on a survey conducted in 2021, over half (52%) of UK coffee drinkers who work remotely stated they consumed more coffee. Additionally, 29% reported no change in their coffee intake, while 19% said they drank less coffee.

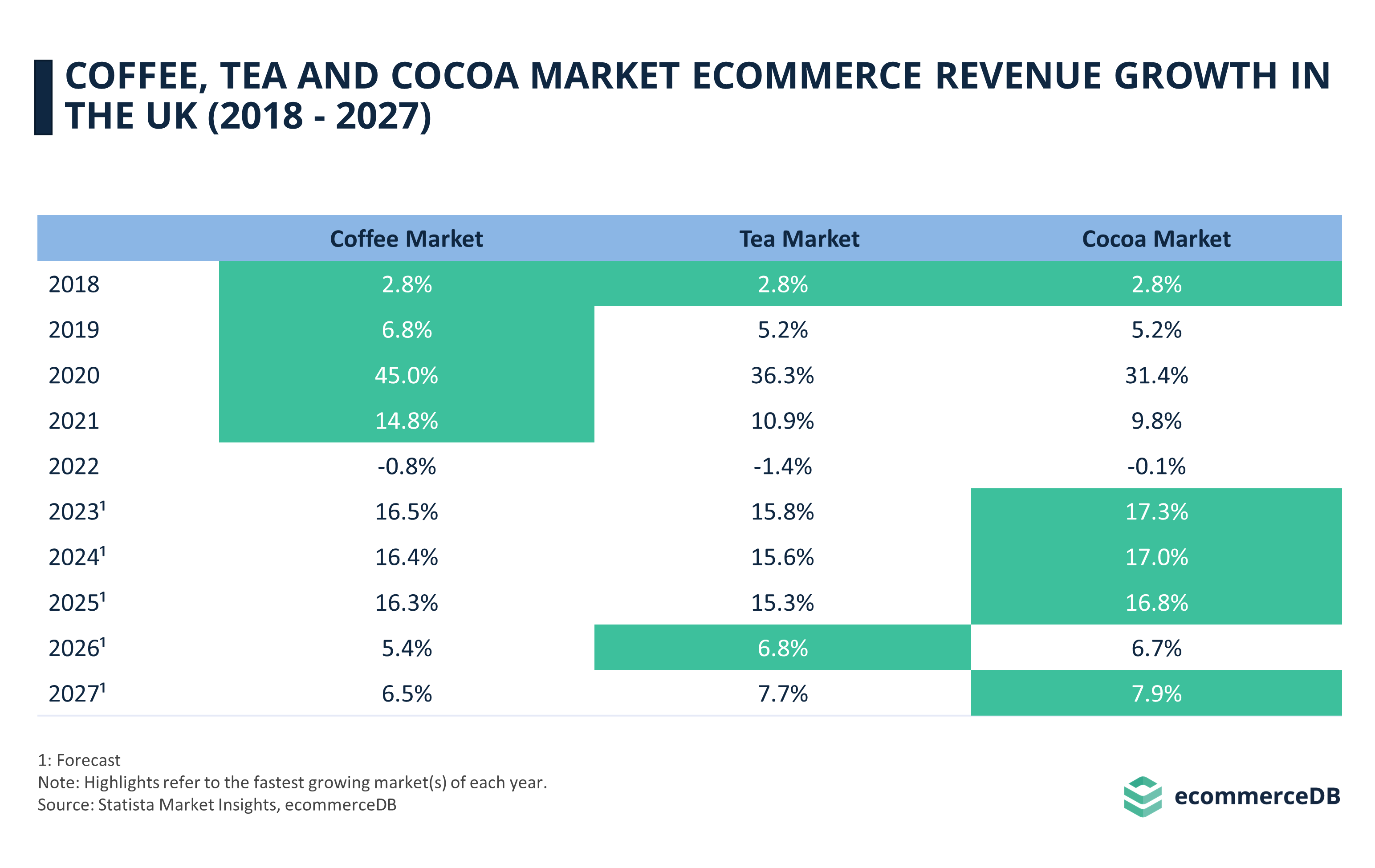

Accounting for 81% of the UK's online hot drinks market revenue in 2022, the online coffee sub-market is the most substantial segment of the online hot drinks market. To gain a deeper understanding of the topic, we will first examine the growth trajectory of the overall online hot drinks market in the UK, explore its relation to the country's overall eCommerce growth, and then delve into its sub-markets - namely coffee, tea, and cocoa.

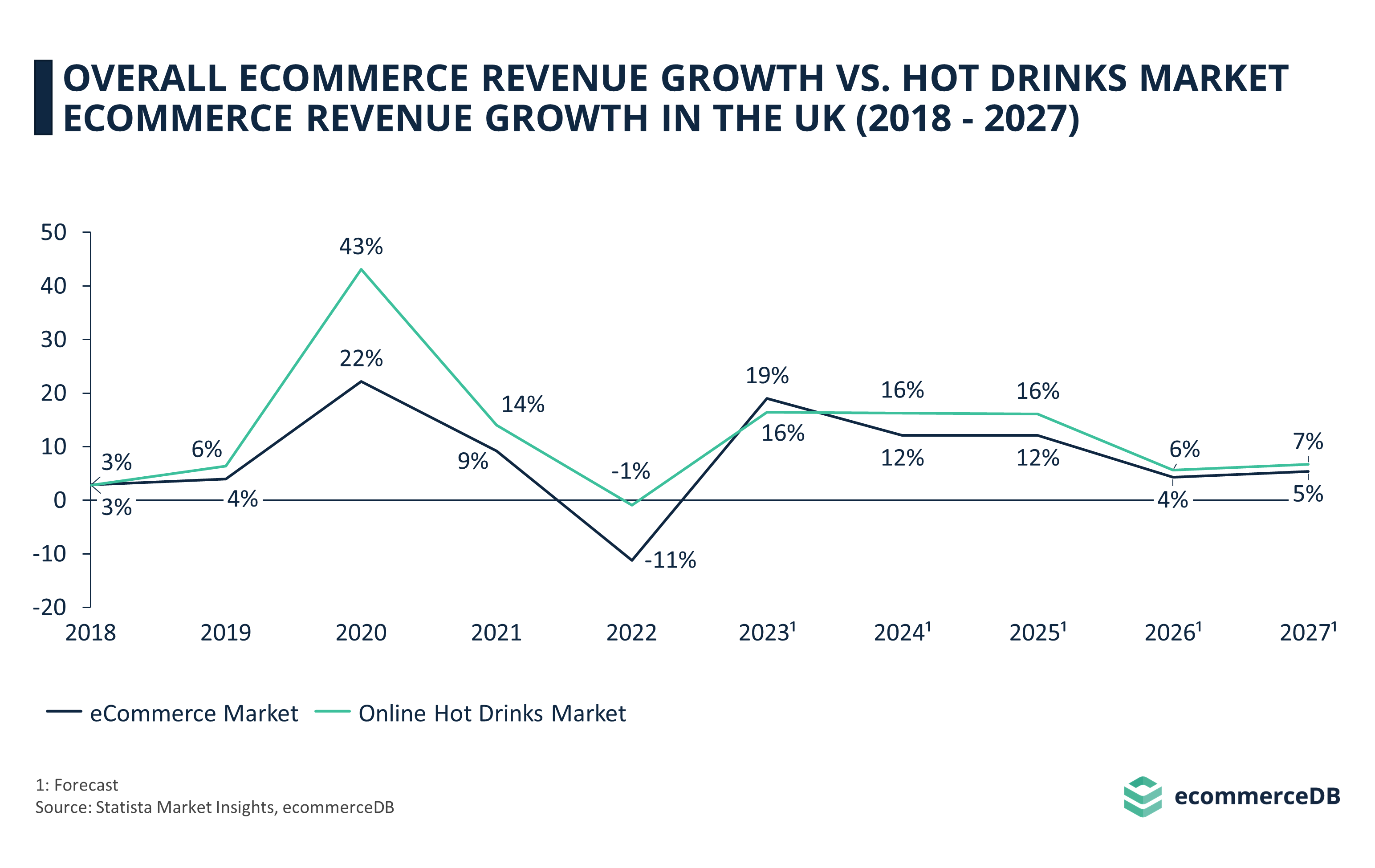

Online Hot Drinks Market in the UK Grew by 43% in 2020

Following 2019’s 6% growth, the UK online hot drinks market saw a 43% growth in 2020, reaching US$650.9 million. As the growth rate plummeted down to 14%, the market revenue amounted to US$741.9 million by the end of 2021. As for the most current numbers on the market, we see that the market shrunk by –1% in 2022, going down to US$735.2 million.

Looking ahead, the UK online Hot Drinks market is projected to reach US$855.8 million by 2023. After that, a 16% annual growth until the end of 2025 is anticipated. While the market’s growth rates for 2026 and 2027 are expected to be smaller (6% and 7%, respectively), they still stay at the pre-pandemic level.

For full context, it is important to note that over the preceding five years, the online hot drinks sub-market in the UK has generally grown faster than the overall eCommerce sector. While the difference in growth rates was nearly zero by 2018, this gap began to widen from 2019 onward, peaking at 21 percentage points by 2020. The pandemic's second year witnessed a decrease in both growth rates, along with the gap between them. This trend carried on into 2022, with both the entire market and the online hot drinks sub-market experiencing a contraction. By the end of the current year, the growth of the overall market is predicted to outpace that of the online hot drinks sub-market. With the balance turning in favor of the online hot drinks market in 2024, the gap between the two growth rates is projected to be more or less at the pre-pandemic level until the end of 2027.

Coffee, Tea and Cocoa Markets

As previously mentioned, the coffee sub-market makes up a sizable chunk of the online hot drinks market in the UK. Accordingly, the sub-market's growth course is quite close to that of the main market. As for the other sub-markets, after a 5% growth in 2019, the tea market enjoyed a growth rate of 36% in 2020. The same year, the cocoa market experienced a similar level of growth at 31%. While 2021 brought about the same growth rate for both sub-markets (9-10%), 2022 was a year of degrowth for all sub-markets. The predictions for upcoming years indicate that all sub-markets are forecasted to experience a yearly 15% to 17% growth by 2025. As for 2026 and 2027, all growth rates vary between 5% and 8%.

The Overall UK eCommerce Market and Online Hot Drinks Market Will Grow at Similar Levels

The dramatic changes brought about by the COVID-19 pandemic have precipitated a significant surge in the UK's eCommerce sector, notably in the online hot drinks market. This shift, in large part due to the transition to remote work and the closure of traditional coffee shops, has led UK consumers to increasingly depend on online platforms for their hot drink needs. Within this burgeoning market, coffee has emerged as the dominant sub-market, forming a substantial portion and closely paralleling the growth of the overall online hot drinks market.

Despite experiencing substantial growth in 2020, the UK's online hot drinks market underwent a slowing trend and a slight contraction in 2022. However, it is forecasted to bounce back, growing steadily through 2025 and reverting to pre-pandemic growth rates in the following years. This trajectory is in sync with the broader eCommerce sector, but the online hot drinks market has generally grown at a faster pace. Predictions indicate a return to this pattern by 2024, with the growth rate of the online hot drinks market expected to stabilize at pre-pandemic levels by 2027.

In addition to the coffee sub-market, the tea and cocoa sub-markets, after enjoying growth in 2020, experienced a slowdown and minor contraction in 2022. These sub-markets are nevertheless projected to grow consistently until 2025, followed by a more moderate expansion in the next two years.

Despite some fluctuations, the future of the online hot drinks market in the UK remains promising, underpinned by a shift in consumer habits and the overall expansion of the eCommerce sector.

Sources: ecommerceDB, Statista Market Insights, Statista Consumer Insights

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics