eCommerce: South Korea

South Korea Adjusts Legal Requirements for eCommerce Marketplaces

South Korea recently adjusted the legal requirements for eCommerce marketplaces in regards to seller payments. The default of Qoo10-owned marketplaces led the South Korean government to act. Here is what these changes are.

Article by Nadine Koutsou-Wehling | August 08, 2024

South Korea eCommerce Regulations: Key Insights

Qoo10-Owned Marketplaces Default on Merchants: TMON and WeMakePrice collectively default on around US$150 million in payments to thousands of merchants on their marketplaces, due to financial miscalculations.

South Korea Government Reacts: The legal requirements for eCommerce marketplaces have been updated in response to the recent incident. The government shortened the statutory payment period and required marketplaces to restructure financial resource management to ensure seller compensation.

Bailout Fund to Secure Future Liquidity: Another measure taken by the South Korean government was the establishment of a national bailout fund to prevent future cases of merchants not receiving payments.

South Korea’s eCommerce market has recently faced problems when online marketplaces owned by the Southeast Asian conglomerate Qoo10 failed to make payments to sellers. Since many of these sellers are small businesses that rely on the income generated on these online marketplaces, the South Korean government stepped in to prevent future occurrences like this.

Government Shortens Legal Payment Period

As a first step, the government reduced the amount of time marketplace operators have to settle payments to sellers. From the previous 60 days that eCommerce marketplaces had to settle payments, South Korea has now set a 40-day period.

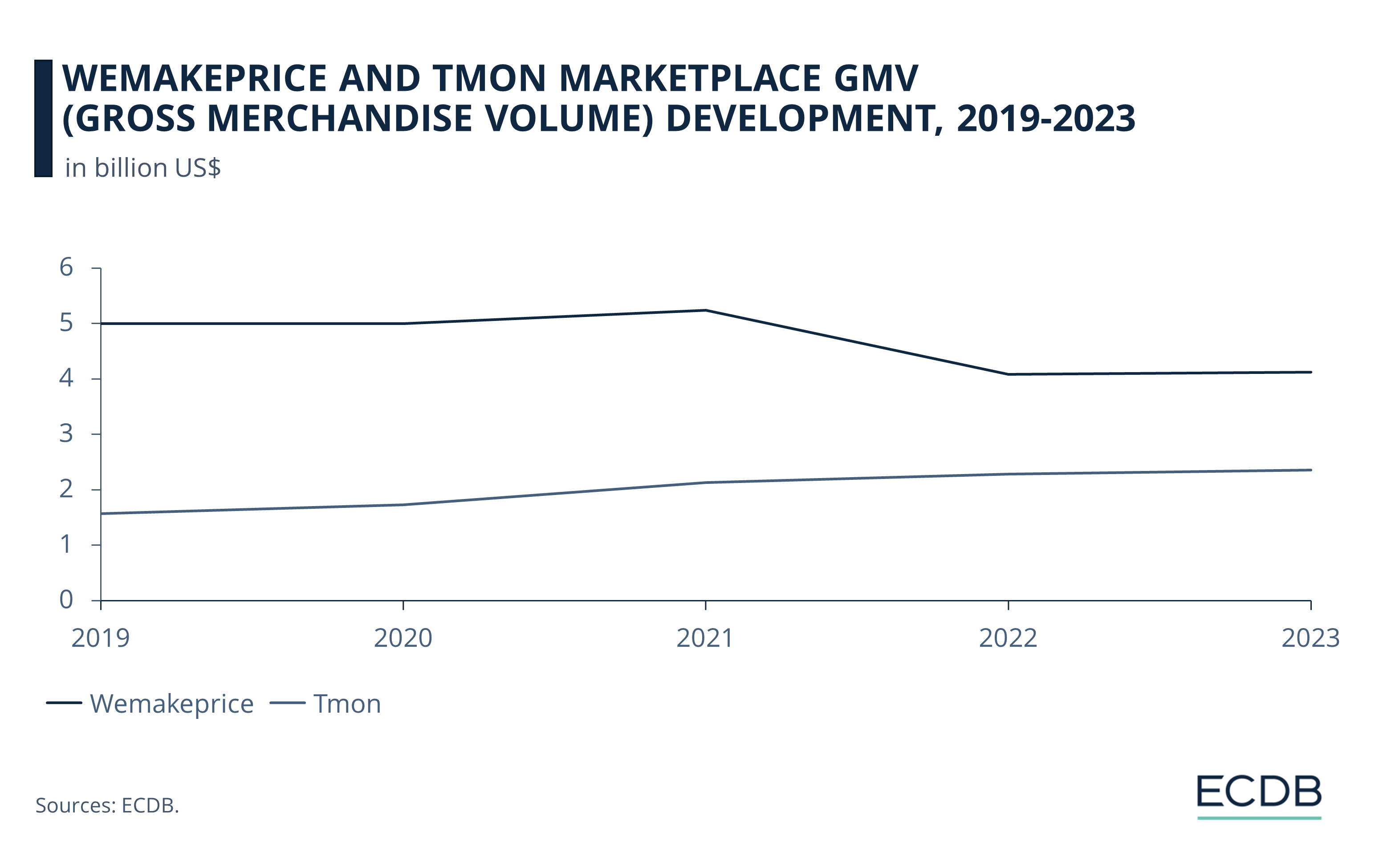

Because the marketplaces Ticket Monster (TMON) and WeMakePrice delayed payments well beyond the legal deadline, it is believed that they faced liquidity problems. This was likely the result of an aggressive acquisition strategy across a variety of industries. To prevent this type of problem in the future, the South Korean government has also established a requirement for eCommerce platforms to manage financial resources in a manner that leaves ample room for seller compensation.

Recent slowdowns in marketplace activity on TMON and WeMakePrice, combined with increased costs, have resulted in seller payment defaults.

Creation of a Bailout Fund to Ensure Liquidity

The second step involves the creation of a national bailout fund of ₩560 billion (US$445 million) to provide low-interest loans to affected sellers in the event of marketplace default.

South Korea’s finance ministry reported that TMON and WeMakePrice have still not settled payments to sellers, which vary between US$120 million and US$200 million, according to different sources.

The Register quotes the finance ministry: “So far, it is estimated that there are 3,395 sellers who have suffered from delayed settlement. The amount of damage to consumers related to general products is estimated to be at least six billion won, and it is likely to be further expanded if gift certificates and travel products are included”.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

Sources: The Korea Times, The Register: 1 2

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Temu Is the Second Most Visited eCommerce Website in the World

Temu Is the Second Most Visited eCommerce Website in the World

Deep Dive

Indonesia Urges Apple and Google To Restrict Temu

Indonesia Urges Apple and Google To Restrict Temu

Back to main topics