eCommerce: Furniture & Homeware

Online Furniture & Homeware Market in Germany: Top Stores & Market Revenue

Top stores like Amazon and Ikea dominate Germany's online Furniture & Homeware market, with sales over US$1 billion in 2023 and strong mid-tier growth.

Article by Cihan Uzunoglu | August 21, 2024Download

Coming soon

Share

Online Furniture & Homeware Market in Germany:

Key Insights

Market Leaders:

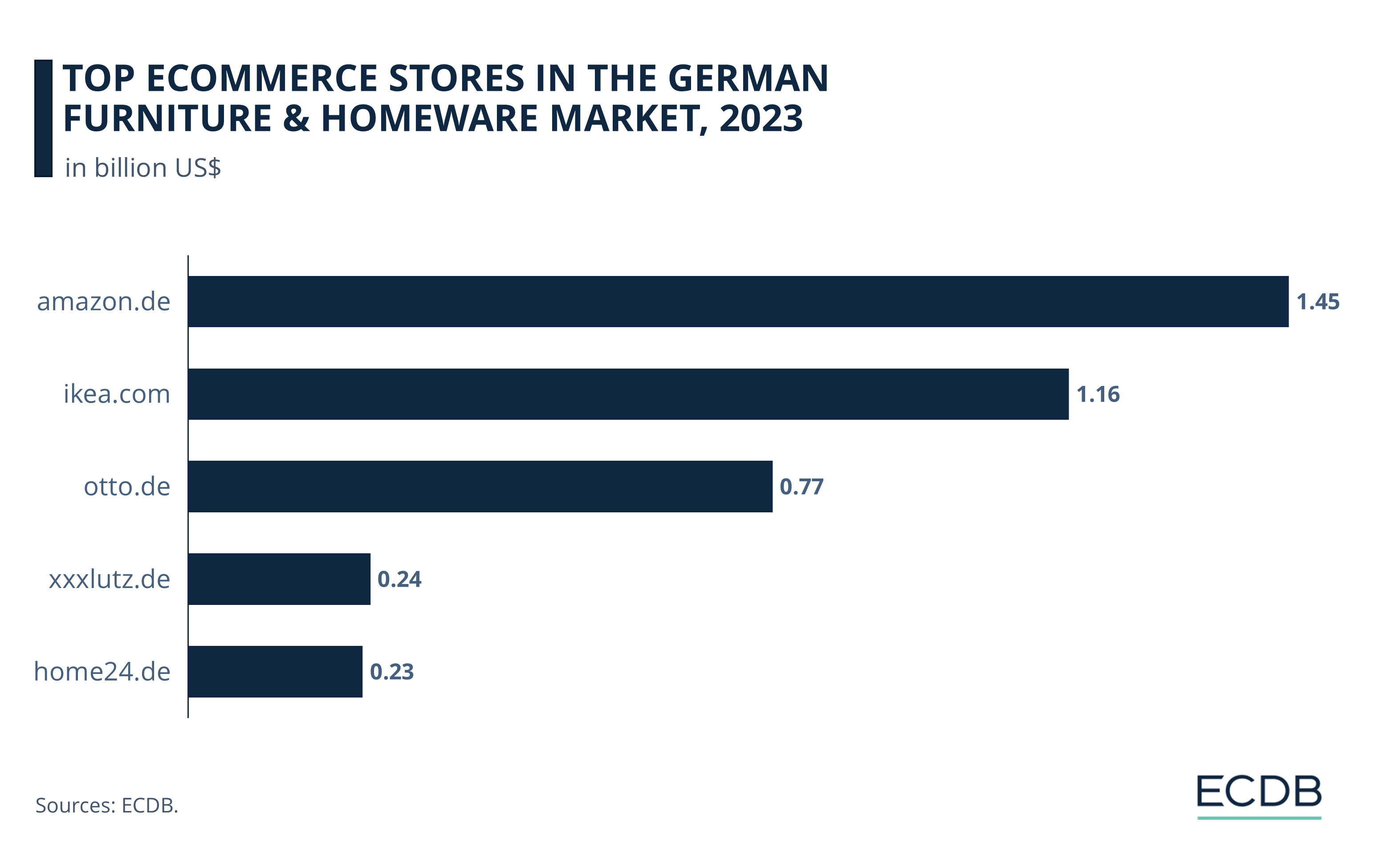

The German furniture & homeware eCommerce market is dominated by Amazon with US$1.45 billion in revenue, followed by Ikea at US$1.16 billion, Otto at US$772 million, and strong performances from XXXLutz and Home24, each generating around US$240 million.

Revenue Trends:

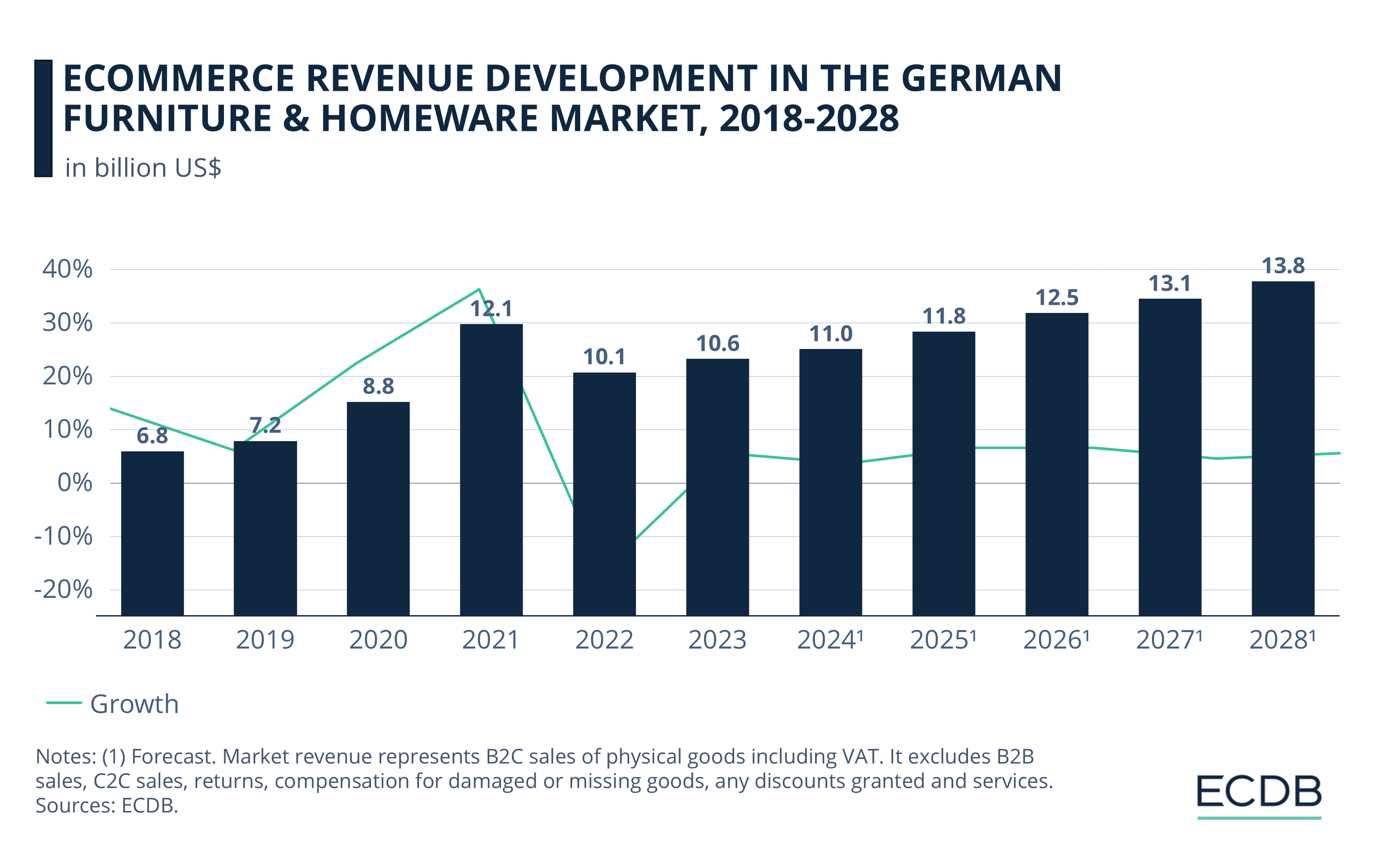

The market grew from US$6.8 billion in 2018 to US$12.06 billion in 2021, then dipped to US$10.06 billion in 2022. Recovery began in 2023, with revenues reaching US$10.62 billion, and forecasts predict growth to US$13.83 billion by 2028.

Online Market Share:

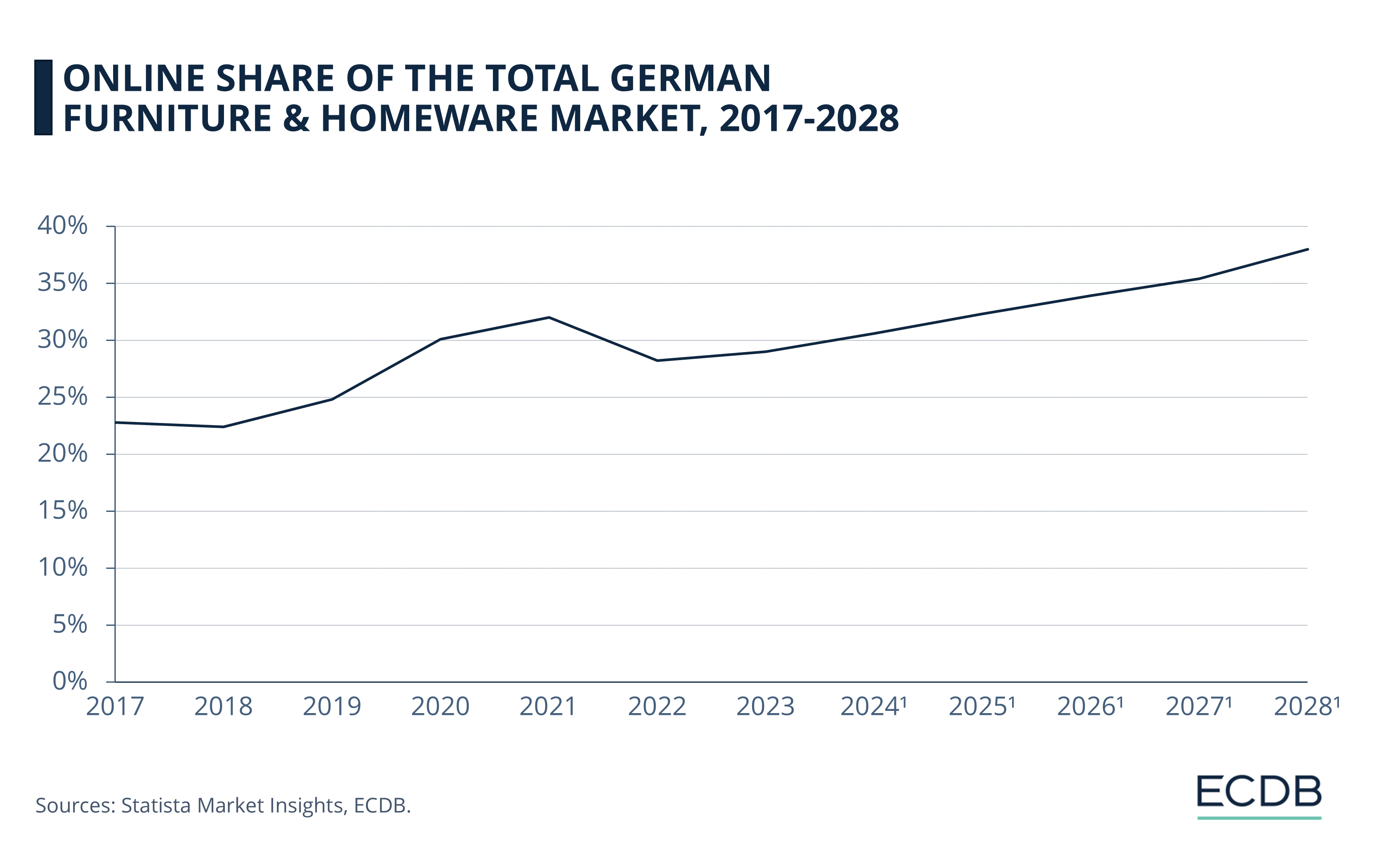

The online share of the German furniture & homeware market is projected to increase steadily, reaching 38% by 2028, following a rebound from a dip in 2022.

Germany's furniture & homeware market has seen a major shift online, driven by changing consumer habits and accelerated by the pandemic. The rise of eCommerce giants like Amazon and Ikea shows how quickly the market has adapted, with online sales becoming a significant part of the overall sector.

As we look ahead, the question isn't just who will lead, but how these companies will continue to innovate and compete. Will Amazon's dominance continue, or will other players like Otto and XXXLutz find new ways to capture market share? Let's dive into the key players shaping this market.

Top Online Stores for Furniture & Homeware in Germany

The German Furniture & Homeware eCommerce sector is distinguished by a tiered and dynamic landscape:

Amazon.de continues to lead the market in online sales for the furniture & homeware category, generating US$1.45 billion in 2023.

It's followed by Ikea.com, with sales amounting to US$1.16 billion. Close behind, the third position is held by Otto.de, reaching net sales of US$772 million.

XXXLutz.de and Home24.de also performed solidly last year, both generating around US$240 million.

Let's take a close look at these players to see their development.

1. Amazon.de

In 2023, Amazon.de's Furniture & Homeware category accounted for 8.5% of its total eCommerce net sales. Launched in 1998, the online store ranks #9 globally and dominates the German market at #1, with 90.9% of its sales generated within the country.

Amazon has committed to further strengthening its presence in Germany, announcing a €10 billion (US$11.12 billion) investment focused on innovation, logistics, and cloud infrastructure. This investment will create 4,000 new jobs across three new fulfillment centers and significantly expand AWS’s cloud capabilities in Germany. Since 2010, Amazon’s investments in Germany have exceeded €77 billion (US$85.66 billion), contributing an estimated €50 billion to the GDP (US$55.62 billion).

2. Ikea.com

Launched in 1997, Ikea.com has established itself as a major force in the global eCommerce landscape, ranking #19 worldwide and #5 in Germany. In Germany, the site contributes 15.3% of its total eCommerce net sales, with the United States being its largest market at 19.6%.

The Furniture & Homeware category dominates Ikea's online sales, accounting for 72.2% of its revenue in 2023. Despite facing challenges, including a 20% decline in year-over-year sales in 2022, Ikea.com bounced back with an 11.9% growth in 2023.

Ikea’s strong online presence, particularly in Europe, reflects its ability to adapt to shifting consumer behavior post-pandemic. As eCommerce gains ground, Ikea remains a dominant player in the market, especially in France, Spain, and Italy, where it competes closely with Amazon for the top spot.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

3. Otto.de

Launched in 1995, Otto.de ranks #42 globally and stands as the second-largest eCommerce player in Germany, with all of its eCommerce net sales coming from the domestic market. The platform's sales are diversified, with the largest share (33%) coming from fashion and 17% from furniture & homeware in 2023.

Otto.de's year-over-year growth has shown significant volatility. After strong growth in 2020 and 2021, the platform experienced declines in the following years, driven by a challenging market environment and strategic shifts. The company’s focus on profitability and liquidity, coupled with portfolio adjustments like the closure of Mytoys and Unigro, contributed to these trends.

Despite these challenges, Otto has made substantial investments in its digital transformation and logistics capabilities. The expansion of its marketplace model has been particularly successful, with a 50% increase in gross merchandise value from external partners. The company also continues to invest in AI and robotics, further enhancing its logistics operations to adapt to changing market demands.

4. Xxxlutz.de

XXXLutz.de, part of the Austrian furniture giant XXXLutz, ranks #646 globally and #49 in Germany for eCommerce in 2023. The platform, which generates all of its eCommerce net sales in Germany, focuses heavily on the Furniture & Homeware category, accounting for 88% of its total sales.

Despite a volatile growth pattern — showing strong increases in 2020 and 2021 followed by a decline in 2022 and modest recovery in 2023 — XXXLutz.de continues to expand its market presence aggressively. The parent company aims to become the largest furniture retailer in Europe, outpacing competitors like Ikea through strategic acquisitions of smaller furniture chains across Germany and Europe.

However, this expansion has raised concerns about market power and its effects on competition. Experts warn that XXXLutz's dominance allows it to pressure suppliers into lowering prices, potentially stifling innovation and leading to higher prices for consumers. Additionally, the company’s focus on private labels complicates price transparency, limiting consumers' ability to compare prices and potentially leading to inflated costs.

5. Home24.de

Launched in 2009, Home24.de ranks #657 globally and #50 in Germany in 2023. Focused entirely on the German market, 88.6% of the online store's eCommerce net sales comes from Furniture & Homeware.

Home24.de has faced fluctuating growth, with strong gains in 2020 and 2021 followed by a downturn in 2022. However, it has maintained profitability since 2019, thanks to a business model combining third-party brands, private labels, and vertical integration. This allows for competitive pricing, with direct production reducing costs by up to 40%.

The online store has expanded its physical presence through the acquisition of Butlers, opening showrooms in key metropolitan areas to build customer trust. The company also leverages performance marketing and social media, while embracing AR and VR technologies to enhance the online shopping experience, focusing on sustainability and customer satisfaction.

Online Furniture & Homeware Market in Germany: Recovery from Decline in 2022

The eCommerce revenue in the German furniture & homeware market has seen notable fluctuations over the past decade:

2018's market revenue of US$6.8 billion surged to US$8.8 billion in 2020, driven by pandemic-related shifts in consumer behavior.

2021 continued the upward trend, with revenue reaching US$12.06 billion.

However, 2022 saw a decline to US$10.06 billion, reflecting market corrections post-pandemic.

A recovery began in 2023, with revenue climbing to US$10.62 billion.

Forecasts predict steady growth, reaching US$13.83 billion by 2028.

A Third of Furniture & Homeware in Germany Sold Online Soon

The online share of the total German furniture & homeware market has also evolved significantly.

From 2018's 22%, the online share jumped to 30% in 2020, influenced by the pandemic.

2021 saw further growth to 32%.

There was a dip in 2022, with the online share falling to 28%.

The share rebounded in 2023, rising to 29%.

Projections indicate a continuous increase, with online penetration expected to reach 38% by 2028.

Online Furniture & Homeware Market in Germany: Closing Thoughts

The German furniture & homeware eCommerce market has undergone significant transformation, especially during the pandemic, which accelerated online adoption.

The pandemic's boost to online shopping appears lasting, with steady growth projected over the next decade. As digital infrastructure and consumer habits evolve, online sales could soon dominate the market.

Key players like Amazon and Ikea are poised to maintain their lead, but the sector will likely see intensified competition, further consolidation, and continued innovation in technology and logistics. The next 5 to 10 years will likely solidify eCommerce as the primary channel for furniture & homeware sales in Germany.

Sources: Amazon, Ecommerce News, möbel kultur, NDR, Tagesspiegel, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics