eCommerce: Eyewear

Top 5 Online Opticians in Germany

Innovations like virtual try-ons and online eye tests drive competition among Germany's online opticians. Discover how Mister Spex and Fielmann lead the way.

Article by Cihan Uzunoglu | June 11, 2024Download

Coming soon

Share

Top 5 Online Opticians in Germany: Key Insights

Innovation Driving Growth: The pandemic accelerated the adoption of online solutions in the eyewear industry, including virtual try-ons and eye tests.

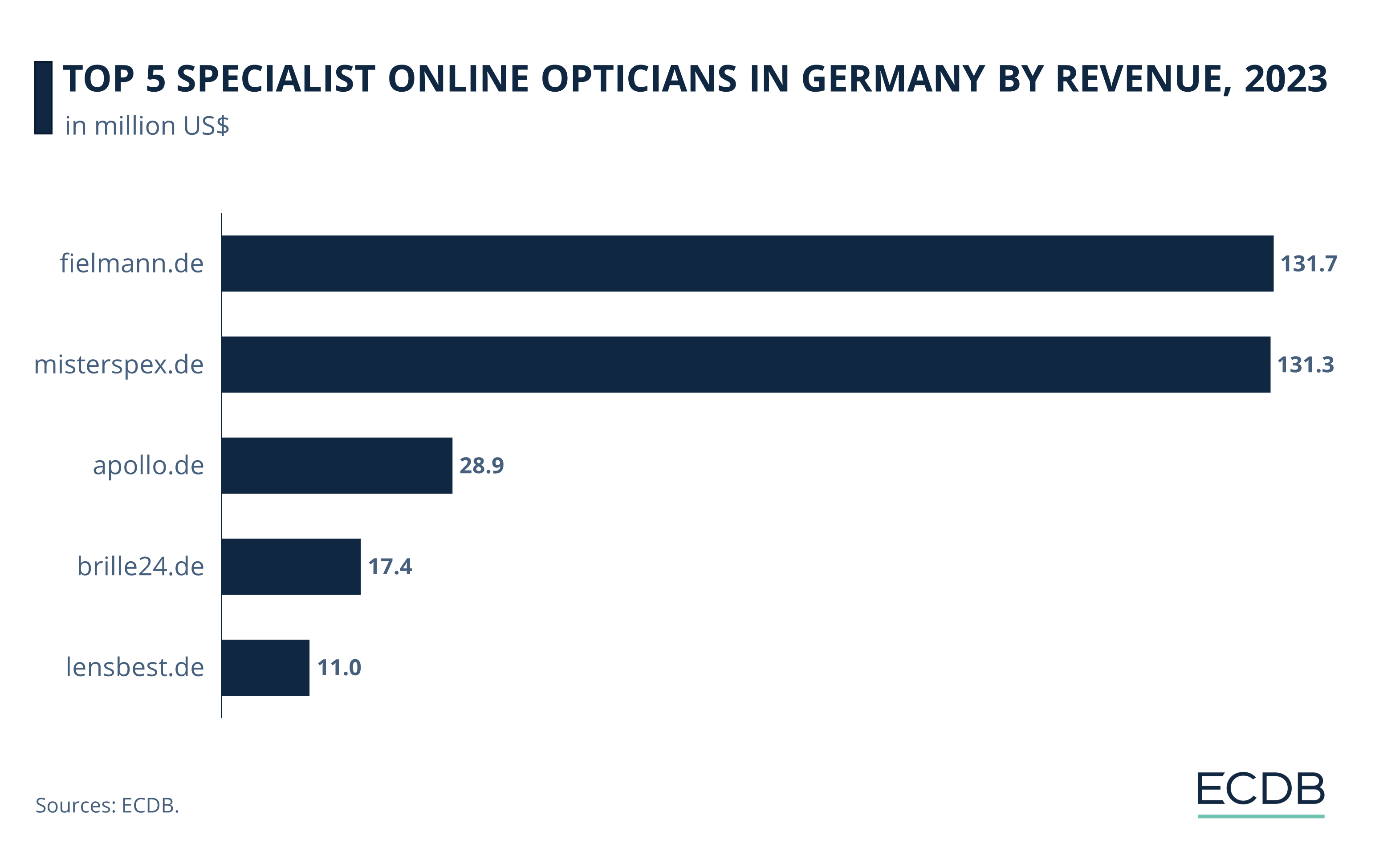

Fielmann Takes the Lead: Fielmann.de leads the ranking of leading German online opticians with US$131.7 million in 2023 online net sales, closely followed by Misterspex.de at US$131.3 million.

Market Concentration: Intense competition exists among online opticians, with only a few capturing the largest market share, while others strive to gain recognition and sales through brand reputation.

The pandemic has been a turning point for many industries, creating the need for online solutions where physical retail was once the norm. The same is true for opticians and the sale of eyeglasses, sunglasses, and protective eyewear.

As technological innovations like augmented reality (AR) and machine learning algorithms have entered the mainstream, opticians are benefiting from their use as well. Where formerly customers could only try on eyewear in a brick-and-mortar store, they can nowadays do so virtually, as well as measure the necessary frame size and even perform eye tests.

Germany is not only a primary market for eCommerce, but also home to renowned opticians who have expanded into various European countries. Do you think of Fielmann first? There is another retailer that has closely matched this household name in the industry. Find out more below.

Top 5 Online Opticians in Germany: Fielmann and Mister Spex in Close Competition

A look at our ECDB store rankings shows two players battling it out at the top, with the rest of the players following at a considerable distance:

Fielmann.de leads the ranking of leading online opticians in Germany, having generated online revenues of US$131.7 million in 2023.

It is closely followed by Misterspex.de, a prominent name in the industry with online net sales of US$131.3 million in 2023.

Apollo.de is another online store that developed out of an established brick-and-mortar business based in Germany. With an extensive multichannel network such as the previous two opticians on the list, Apollo operates 900 physical stores in the country. However, the company’s online revenue lags significantly behind, at US$28.9 million in 2023.

The rest of the top 5 opticians by 2023 online net sales are Brille24.de, a pure online retailer with US$17.4 million, and Lensbest.de with US$11 million.

Now let's take a closer look at each of these players to better understand what sets them apart from the rest of the competition.

1. Fielmann.de

Fielmann is a well-established name in the optical industry, having opened its first store in 1972. Over the decades, it has grown into one of the largest optician chains in Europe, with a strong presence in Germany.

Fielmann's success is attributed to its wide range of affordable eyewear, comprehensive eye care services, and a customer-centric approach. The company has invested heavily in its online platform, offering virtual try-ons and online eye tests, which have become increasingly popular. Recent developments include expanding their eCommerce capabilities and integrating advanced AR technology to enhance the online shopping experience.

2. Misterspex.de

Mister Spex has been a pioneer in the online eyewear market since its inception in 2007. The Berlin-based company offers a vast selection of designer eyewear at competitive prices, alongside advanced online tools for virtual try-ons and prescription services.

Mister Spex stands out for its seamless omnichannel experience, where customers can purchase online and pick up in partner stores across Europe. The company has seen steady growth, thanks to its innovative use of technology and strategic partnerships. Recently, Mister Spex has focused on expanding its physical presence with more brick-and-mortar stores to complement its robust online platform.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

3. Apollo.de

Apollo Optik, established in 1972, operates one of the largest networks of optical stores in Germany, with around 900 locations. The company's transition to online retail has been marked by its strong multichannel strategy, combining physical stores with a comprehensive online presence.

Apollo's online store offers a wide range of products, from budget-friendly options to premium brands, along with virtual try-ons and online consultations. Despite its extensive store network, Apollo's online revenue growth has been slower, and it faces challenges from more digitally native competitors. Recent efforts have focused on enhancing the online shopping experience and integrating more advanced technologies.

4. Brille24.de

Brille24 was founded in 2007 as one of Germany's first online opticians. The company has built a reputation for offering high-quality eyewear at affordable prices. Brille24's business model focuses on eliminating the middleman, directly sourcing frames and lenses to keep costs low. This approach has resonated with price-conscious consumers, driving steady growth.

The company offers a variety of online tools, including virtual try-ons and home trial services, to enhance the customer experience. Recently, Brille24 has been investing in marketing and technology to expand its market share in the competitive online eyewear industry.

5. Lensbest.de

Lensbest specializes in contact lenses and related products, catering to a niche but significant segment of the optical market. Founded in 1995, the company has grown to become a leading online retailer for contact lenses in Germany.

Lensbest's success is driven by its wide selection of products, competitive pricing, and excellent customer service. The company also offers a variety of eye care products and accessories. Recent developments at Lensbest include expanding its product range and enhancing its online platform to improve user experience and customer engagement.

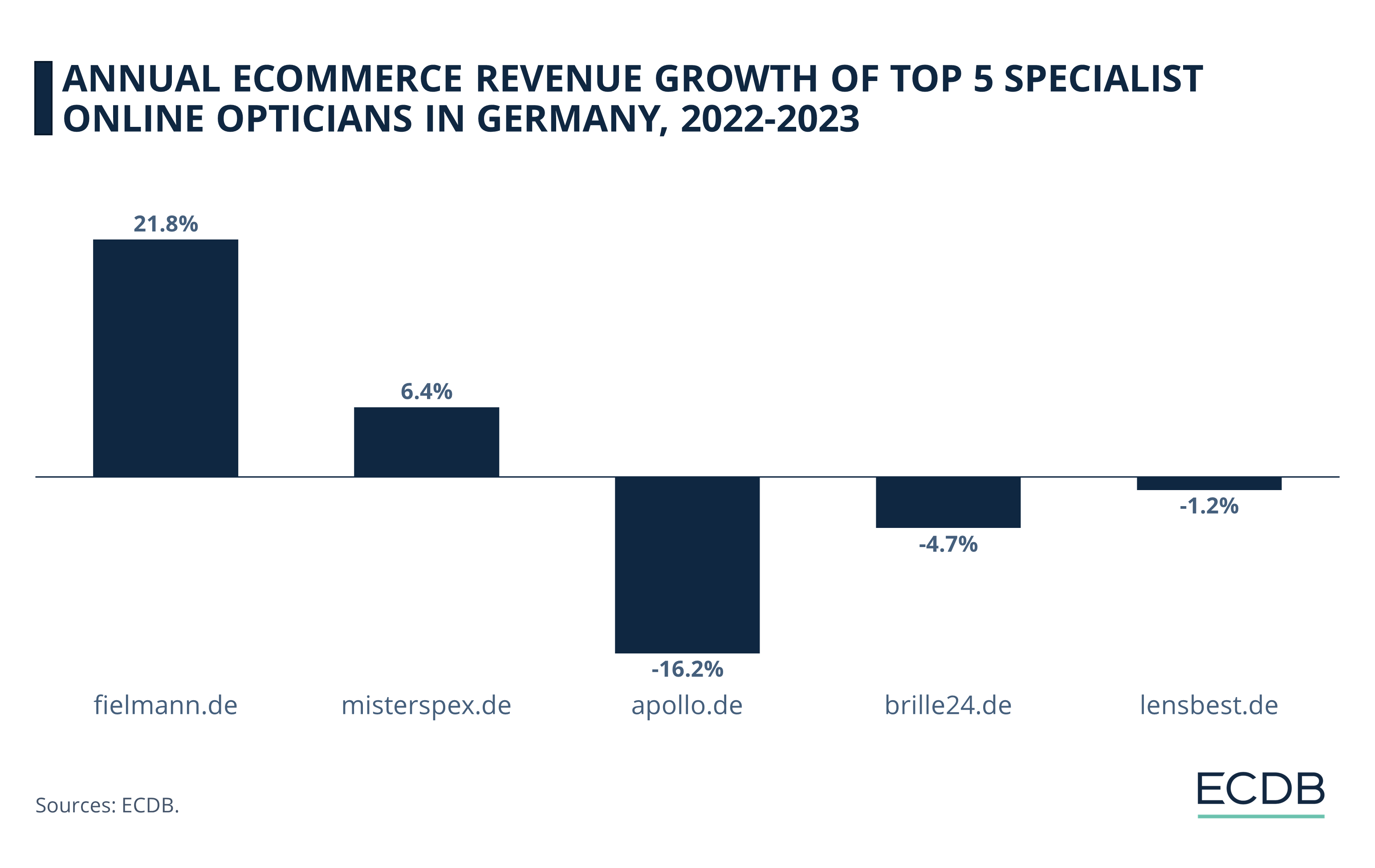

Fielmann With the Highest Growth of

the Top 5 in 2023

Business has varied for most of the online retailers in this ranking, with Fielmann.de leading the growth rate at 21.8% in 2023. Misterspex.de followed with a 6.4% increase in online revenues. In contrast, Apollo.de recorded a decline of 16.2%, whereas Brille24.de and Lensbest.de saw declines of 4.7% and 1.2%, respectively.

These growth rates indicate the intense competition among online opticians, with only a few retailers capturing the largest share of the market, while others are vying for consumer recognition and sales. As eyeglasses and sunglasses are infrequent purchase items, opticians rely on their brand name to encourage repeat purchases or attract new customers.

See further emphasis on this point below.

Fielmann and Mister Spex Compete at the Top

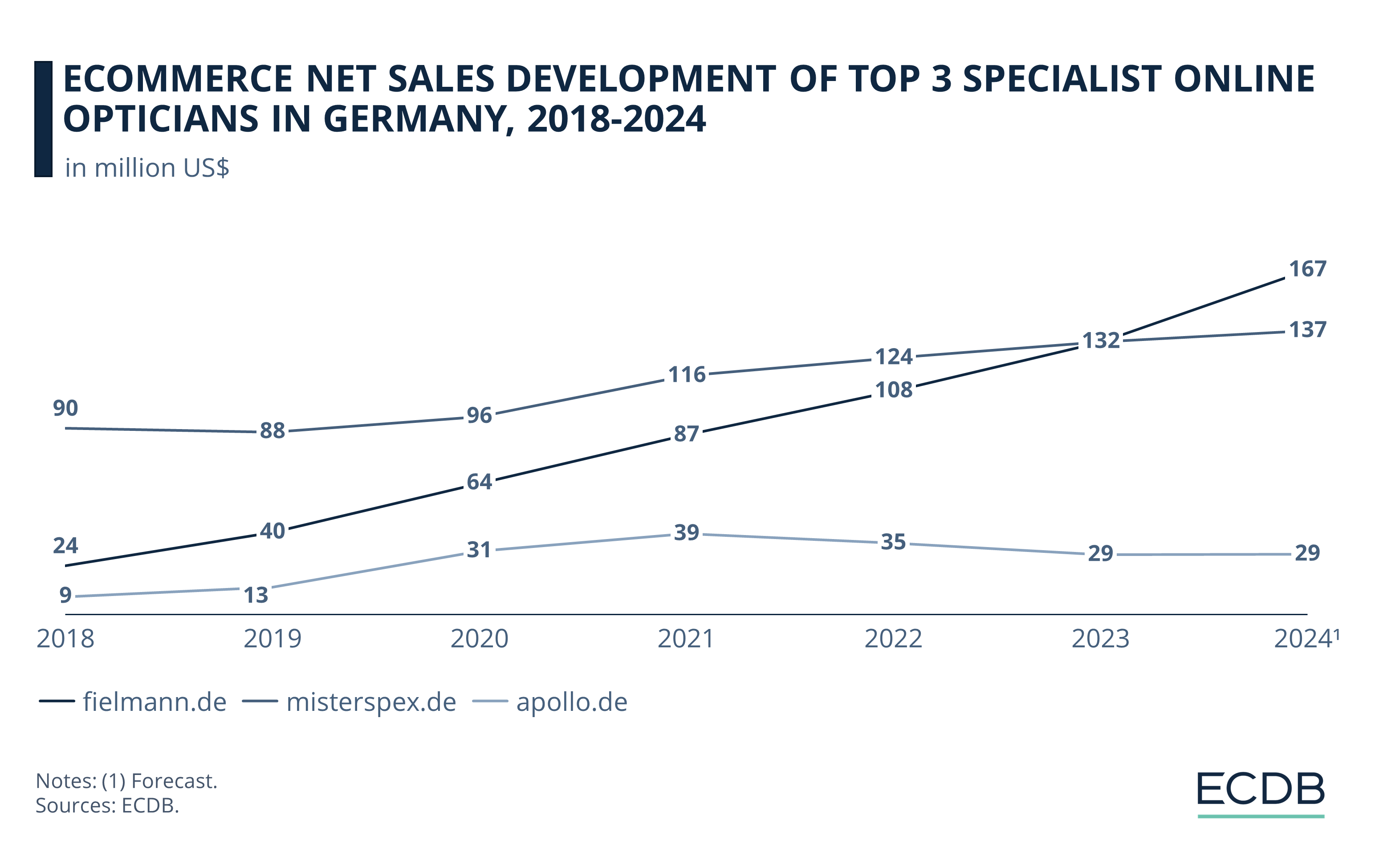

The high concentration of the online optical market becomes more apparent when plotting the online revenues of the top three retailers on a timeline from 2018 to 2024.

While Mister Spex and Fielmann have continuously increased their online net sales since before the pandemic and consolidated their position in the years after, Apollo remains at a fraction of the online revenues generated by the others over this period.

Another notable trend is the extent to which Fielmann has caught up with Mister Spex’s online revenues over the period. A gap of US$66 million difference in annual net sales in 2018 essentially disappeared between the two by 2023.

Beyond the numbers, consumer-centric strategies further define who wins in this market. What is meant by this statement is explained in the next section.

Omnichannel: A Clear Competitive Advantage

Given the clear lead that established offline opticians have over the remaining competition in the market, it is reasonable to assume that the use of multichannel services is the most appealing to customers.

Virtually all of the retailers examined in this insight are using AR technology and information on frame compatibility with facial features to help customers find the right product. But online stores with physical retail locations are leading the way by offering customers the option of checking product size and fit in person.

Multichannel services offer customers security and convenience in choosing the best possible option: Whether consumers prefer to try out a wide range of styles online and confirm which ones fit best in-store, or vice versa, try frames in-store and order their favorite online. The scale of leading online opticians allows them to invest in innovative technologies and products, such as AR and RFID (Radio Frequency Identification) technology in physical stores and smart glasses.

Online Opticians in Germany:

Closing Thoughts

An examination of the online optical market in Germany highlights the competitive nature of the field, which requires intensive investment to meet the demands that consumers have become accustomed to in recent years.

Sources: Apollo, Edel-Optics, EQS, Handelsjournal, Misterspex, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics