Best eCommerce Software

Top eCommerce Software Companies in Europe 2024: Market, Brands & Trends

Here is a look into Europe's eCommerce software market: Learn who's on top, about the competition, and which tech makes online shopping smoother.

Article by Cihan Uzunoglu | July 05, 2024Download

Coming soon

Share

Europe's eCommerce Software Market 2024: Key Insights

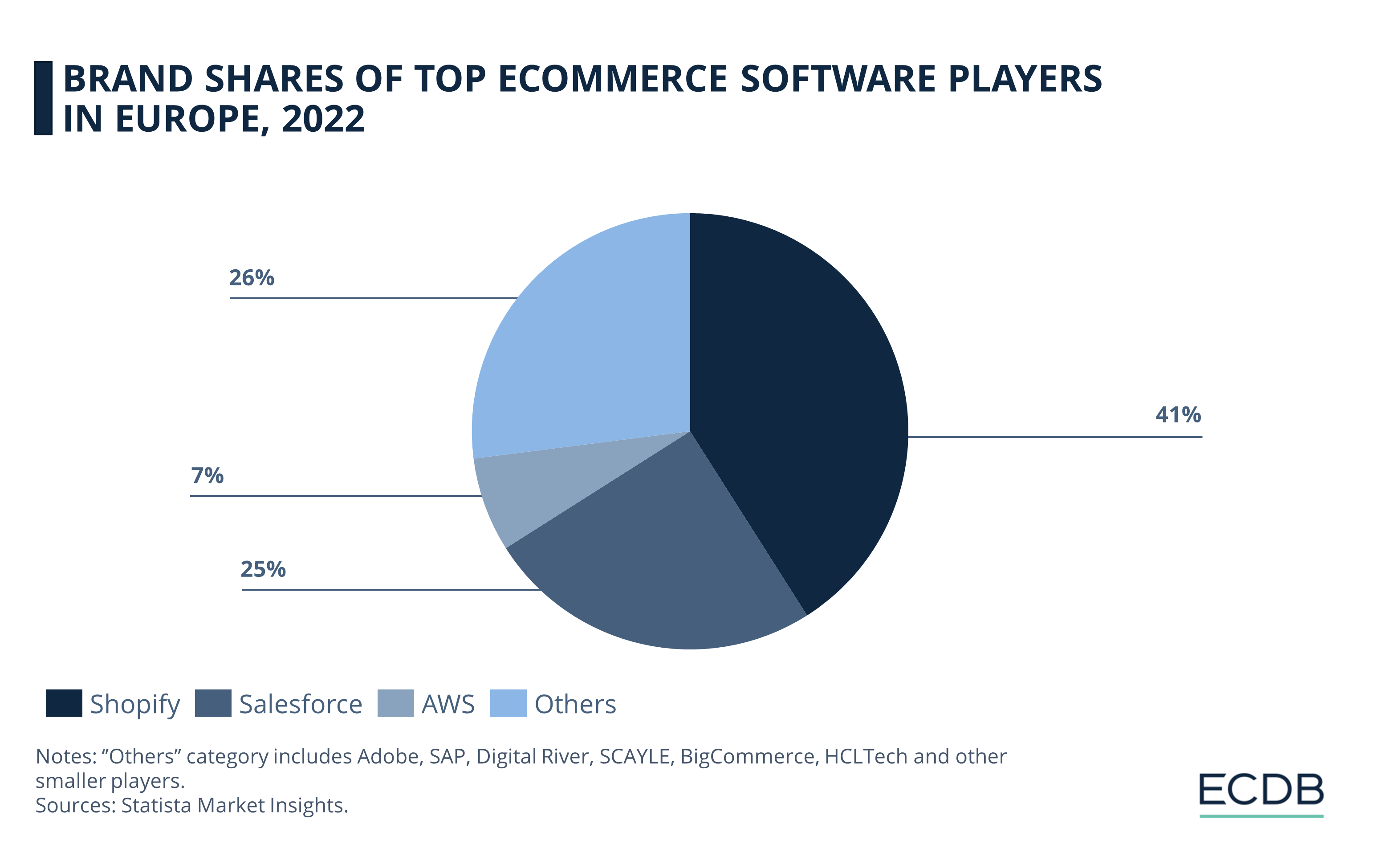

Shopify Market Leadership: Shopify is leading the European eCommerce software market with a 41% share. It is closely followed by Salesforce.

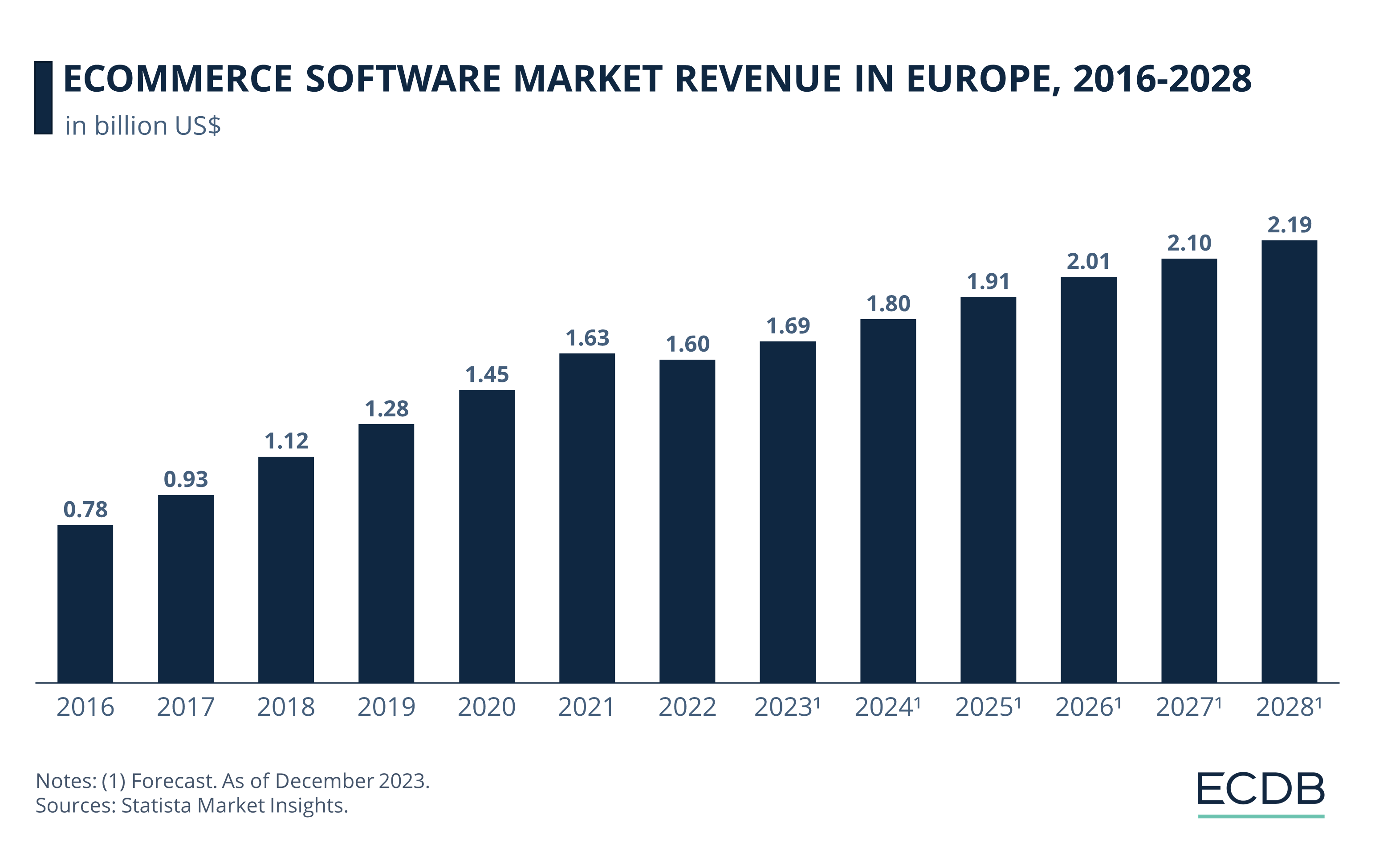

Growth Development: After a slight downturn in 2022, the market is expected to stabilize and grow steadily to US$2.19 billion by 2028.

Driving Forces: The increase in online and mobile commerce is influenced by social media and macroeconomic factors and fuels the demand for advanced eCommerce software.

eCommerce software is transforming how businesses sell online by offering tools for everything, from product catalogs to order fulfillment. With options like cloud-based software and subscription services, companies can now streamline their online sales channels much more efficiently.

This digital shift in retail of eCommerce brands emphasizes technology's role in enhancing customer engagement and operational efficiency. Innovations like artificial intelligence for personalized experiences and analytics for consumer insights are of significance. Hence, selecting the right eCommerce software is crucial for businesses aiming to thrive.

As the European market continues to expand, certain companies come to the forefront: Shopify is the most popular one in Europe. It is trailed by the likes of Salesforce and Amazon Web Services (AWS).

Top eCommerce Software Companies in Europe: Shopify Leads

Based on the 2022 data from Statista Market Insights, Shopify commands a significant lead with a 41% brand (value) share in the total European eCommerce shop software market as the go-to platform on the continent. Not far behind, Salesforce captures a solid 25% market share.

The rest of the field shows a more fragmented distribution of market shares. AWS and Adobe each carve out 7% and 6% respectively. Similarly, SAP, with its 6% share, highlights the importance of integrated business solutions in the eCommerce space.

Digital River and SCAYLE, each holding 4%, reveal the diversity of specialized platforms catering to specific eCommerce needs, from payment processing to full-scale digital commerce operations. Meanwhile, BigCommerce and HCLTech, with a modest 1% share each, showcase the variety of options available to businesses looking to differentiate themselves in a crowded market.

The remaining 5% attributed to "Other" indicates the presence of smaller, niche players that collectively represent a vital component of the ecosystem, offering tailored solutions that appeal to unique business requirements.

Market Growth Will Stabilize After 2022’s Dip

The eCommerce software market in Europe has seen a dynamic evolution in the last decade. Worth US$780 million in 2016, the market experienced a notable growth spurt, peaking in 2018 with a 20% growth rate — the highest in the last decade. By 2021, revenue had climbed to US$1.63 billion, reflecting the sector's expanding significance.

However, 2022 marked a turn with a slight decrease to US$1.6 billion, representing a -1.6% growth rate — the first degrowth in this period. Looking ahead, forecasts from 2023 show a rebound to a 5% growth rate, bringing the market revenue to US$1.69 billion. Over the next five years, the growth rate is expected to remain fairly consistent, with the market projected to steadily increase to US$2.19 billion by 2028.

Learn More About ECDB

eCommerce Shop Software in Europe:

Final Thoughts

A key driver behind the European eCommerce software market's growth has been the shift towards online shopping, fueled by its convenience and cost-effectiveness. This surge in demand has been further amplified by the adoption of mobile commerce, as customers increasingly shop on smartphones and tablets, necessitating software optimized for these devices.

Social media's role in promoting products and influencing consumer behavior has also led to software enhancements for seamless integration, offering a unified shopping experience. The competitive nature of the market, alongside diverse eCommerce maturity levels across countries, shapes the landscape. Markets like the UK show high adoption rates, while others, including Italy and Spain, present growth opportunities.

Underpinning these trends are macroeconomic factors like increased internet access, mobile device penetration, and a shift towards online shopping, especially during the COVID-19 pandemic. This convergence of factors has sparked a demand for advanced eCommerce software, driving market evolution and setting the stage for future growth.

Sources: ECDB, Statista

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Shopify: The Globally Most Used Shop Software Is Growing High in Q2 2024

Shopify: The Globally Most Used Shop Software Is Growing High in Q2 2024

Deep Dive

PayPal and Shopify Partner Up for Shopify Payments in the U.S.

PayPal and Shopify Partner Up for Shopify Payments in the U.S.

Article

Top 5 Shop Software Solutions Used by Singapore Online Stores 2023

Top 5 Shop Software Solutions Used by Singapore Online Stores 2023

Article

Top 5 Shop Software Solutions Used by Mexican Online Stores 2023

Top 5 Shop Software Solutions Used by Mexican Online Stores 2023

Article

Top 5 Shop Software Solutions Used by Irish Online Stores 2023

Top 5 Shop Software Solutions Used by Irish Online Stores 2023

Back to main topics