eCommerce: Shop Software

Top eCommerce Software Companies in the U.S. 2024: Players, Market & Trends

Dive into the scene of eCommerce software in the United States to learn about the front-runners of the market, as well as their competitors.

Article by Cihan Uzunoglu | March 06, 2024Download

Coming soon

Share

Top eCommerce Software Companies in the U.S.:

Key Insights

Market Growth: The U.S. eCommerce software market has steadily grown to over twice the size of Europe's, with projections indicating continued expansion.

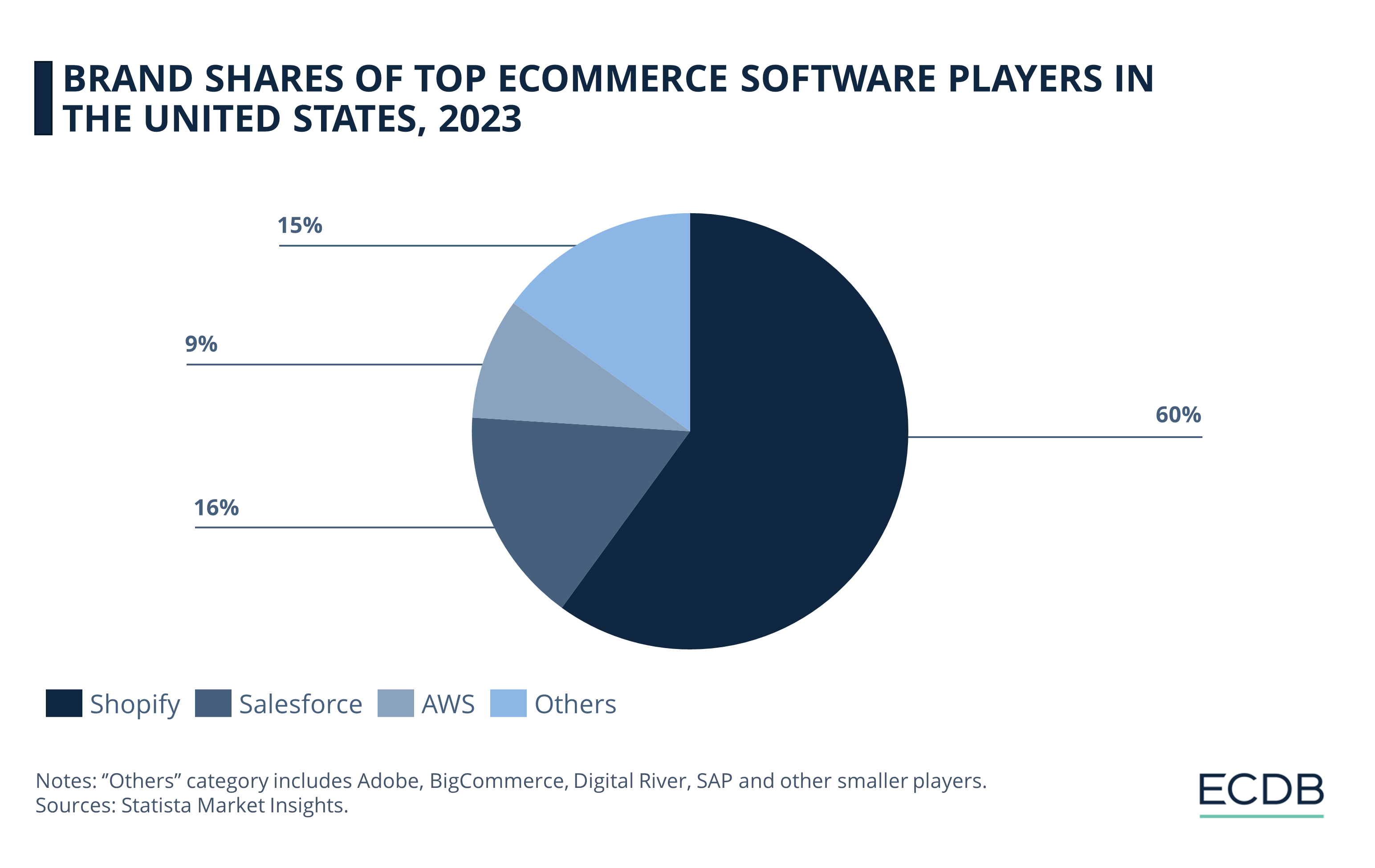

Leadership Position: Shopify leads the U.S. market with a 60% brand value share, while Salesforce and AWS follow with respective shares of 16% and 9%.

Global Dominance: The U.S. leads the global eCommerce software market with a 2023 market size of US$3.95 billion, far surpassing China, the UK, Germany, and Japan, highlighting its pivotal role in shaping the future of the eCommerce sector worldwide.

The evolution of eCommerce software has been changing the way companies handle online sales, providing essential tools for tasks ranging from displaying product catalogs to managing order fulfillment. Thanks to advancements such as cloud-based solutions and subscription models, companies are now able to optimize their online sales channels with greater efficiency.

The transformation of retail to digital platforms highlights the significant role of technology in improving interactions with customers and streamlining business operations. The adoption of innovations like artificial intelligence for tailored shopping experiences and analytics for insightful consumer behavior is key. Therefore, making the right choice in eCommerce software is vital for businesses looking to prosper.

As the market in the United States grows, several firms are emerging as leaders. Shopify has established itself as a front-runner, with Salesforce and Amazon Web Services (AWS) also making significant strides in the eCommerce software field.

Top eCommerce Software Companies in the U.S.: Shopify on Top

Based on 2023 data from Statista Market Insights, Shopify takes a commanding lead in the U.S. eCommerce software market, securing a 60% share of the brand value, which positions the company as the dominant platform in the country. Salesforce, although trailing, holds a respectable 16% market share, indicating its significant presence.

AWS stands out with a 9% slice of the market, showcasing the importance of cloud services in the eCommerce realm. The "Others" category, which encompasses Adobe, BigCommerce, Digital River, SAP, and various smaller entities, collectively accounts for 15% of the market.

Despite Slowed Growth, U.S. Market is Twice the Size of Europe’s

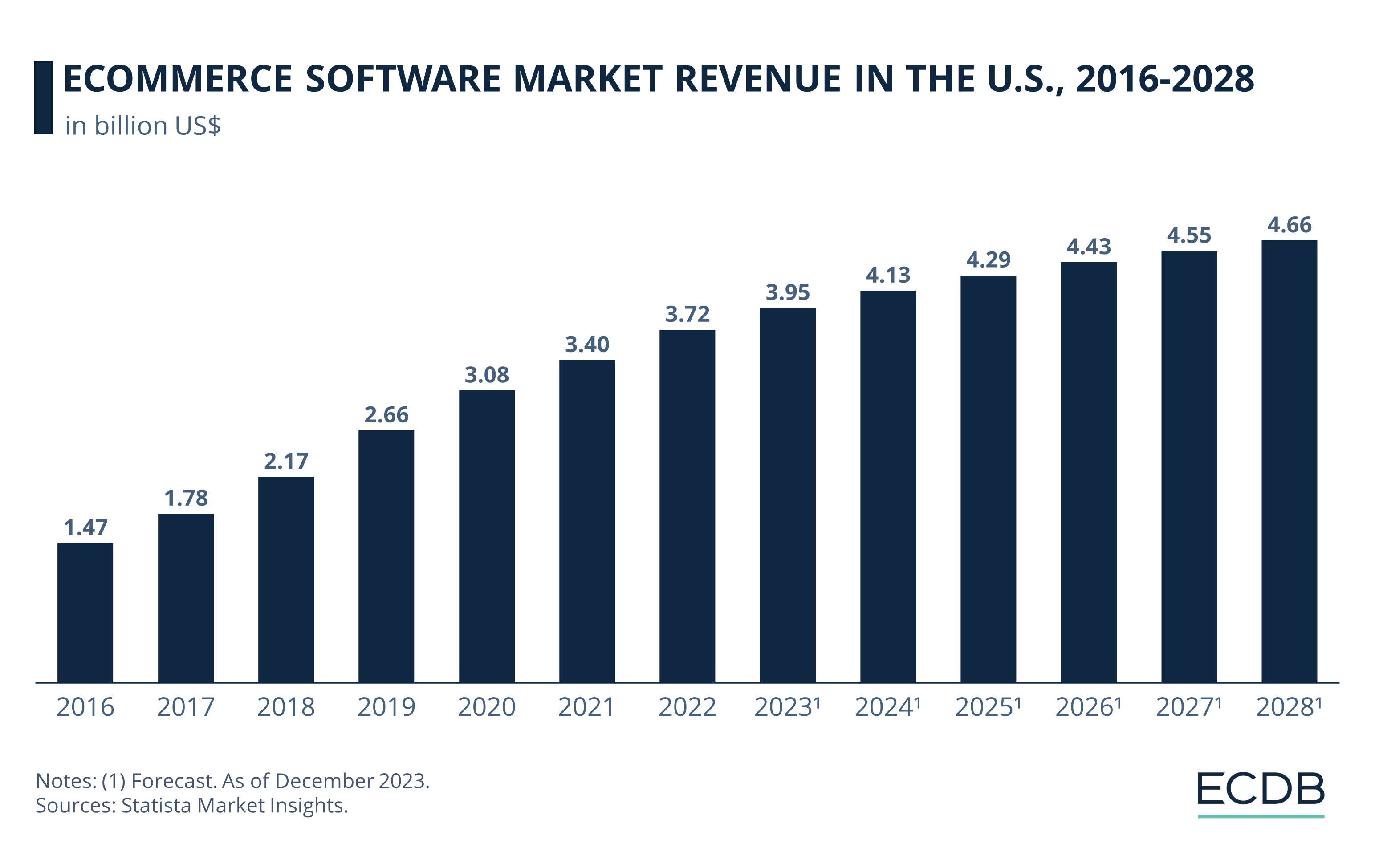

The eCommerce software market in the United States has experienced significant growth over the last decade. At US$1.47 billion in 2016, the market saw a steady rise in revenue up until 2020, after which the growth started to slow down. According to 2022 figures (US$3.72 billion in revenue), the U.S. eCommerce software market is more than twice the size of the European market.

Unlike Europe's market, which faced a slight downturn in 2022, the U.S. market continued to grow, demonstrating the demand and expansion of eCommerce solutions in the country. Projections for 2023 indicate a continued upward trajectory, with an expected revenue of US$3.95 billion.

Looking forward, forecasts from 2024 to 2028 predict a consistent growth rate, albeit at a slightly slower pace compared to the explosive growth of the early 2020s. By 2028, the market revenue is anticipated to reach US$4.66 billion.

Learn More About ECDB

eCommerce Shop Software in the U.S.:

Closing Thoughts

U.S. consumers' shift towards online purchases for convenience has led companies to invest in eCommerce software for better online experiences, including personalized services and faster delivery.

Key trends include the growth of mobile commerce due to widespread smartphone use, allowing shopping from anywhere, and the integration of artificial intelligence to offer personalized shopping experiences. The competitive landscape and strict data privacy laws demand innovative and compliant eCommerce solutions.

Economic factors like GDP growth and consumer spending also influence the market, with the COVID-19 pandemic further boosting online shopping. The U.S.'s position in the global eCommerce software market is dominant, with a market size of US$3.95 billion in 2023, significantly ahead of China, the UK, Germany, and Japan. This leadership underscores the U.S.'s critical role in the global eCommerce sector's future.

Sources: Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Shopify: The Globally Most Used Shop Software Is Growing High in Q2 2024

Shopify: The Globally Most Used Shop Software Is Growing High in Q2 2024

Deep Dive

PayPal and Shopify Partner Up for Shopify Payments in the U.S.

PayPal and Shopify Partner Up for Shopify Payments in the U.S.

Deep Dive

Top eCommerce Software Companies in Europe 2024: Market, Brands & Trends

Top eCommerce Software Companies in Europe 2024: Market, Brands & Trends

Article

Top 5 Shop Software Solutions Used by Singapore Online Stores 2023

Top 5 Shop Software Solutions Used by Singapore Online Stores 2023

Article

Top 5 Shop Software Solutions Used by Mexican Online Stores 2023

Top 5 Shop Software Solutions Used by Mexican Online Stores 2023

Back to main topics