eCommerce: Top Fashion Stores

Zara Online Sales: Global Store Count, Revenue, Markets

Zara online sales help supplement its total revenue. Learn about Zara's global online sales, number of stores and markets served.

October 18, 2024Download

Coming soon

Share

Zara Online Sales: Key Insights

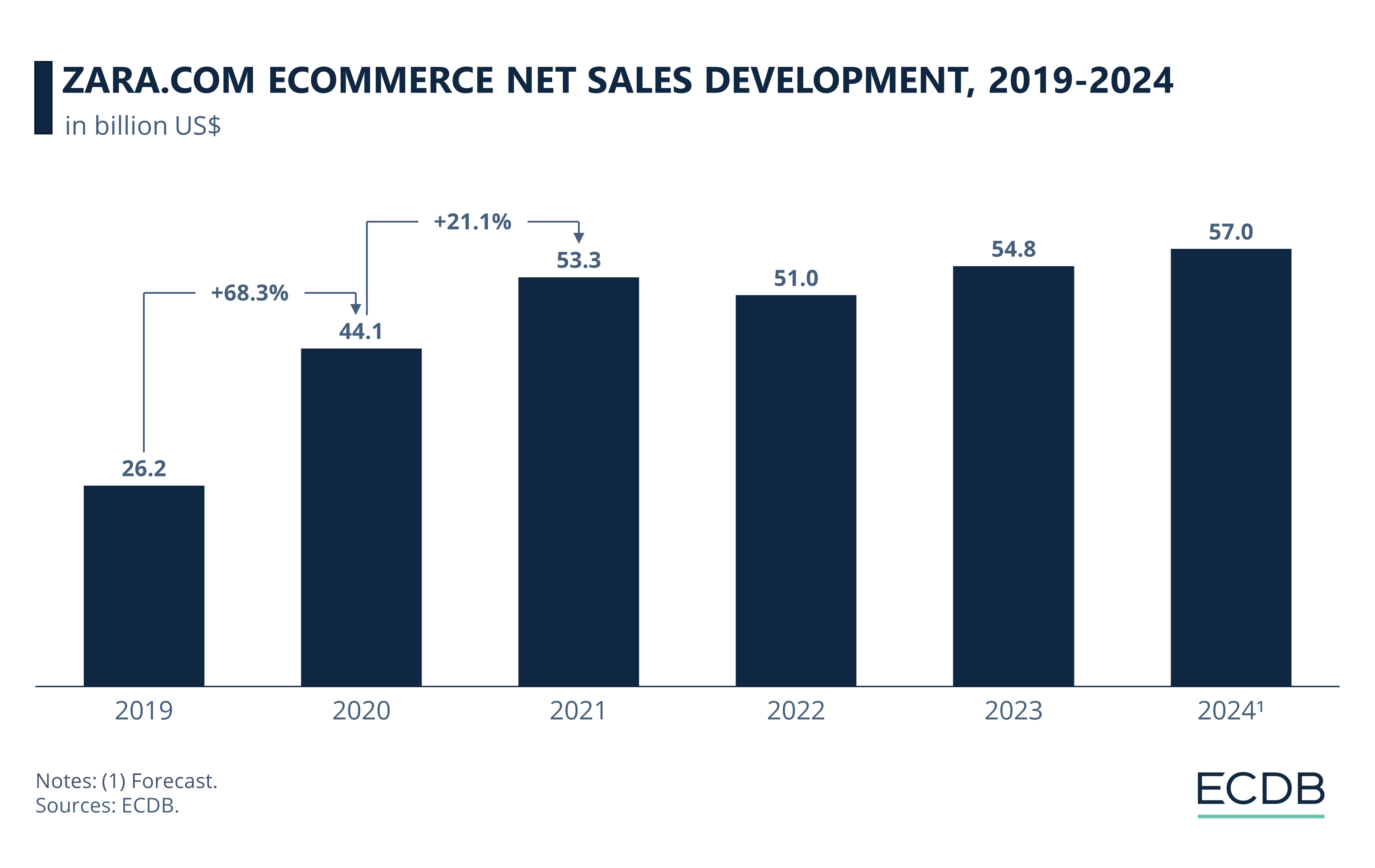

Zara Performance Statistics 2024: Zara's online net sales increased during the pandemic, but dropped in 2022. ECDB forecasts expect Zara's eCommerce performance to improve through 2024.

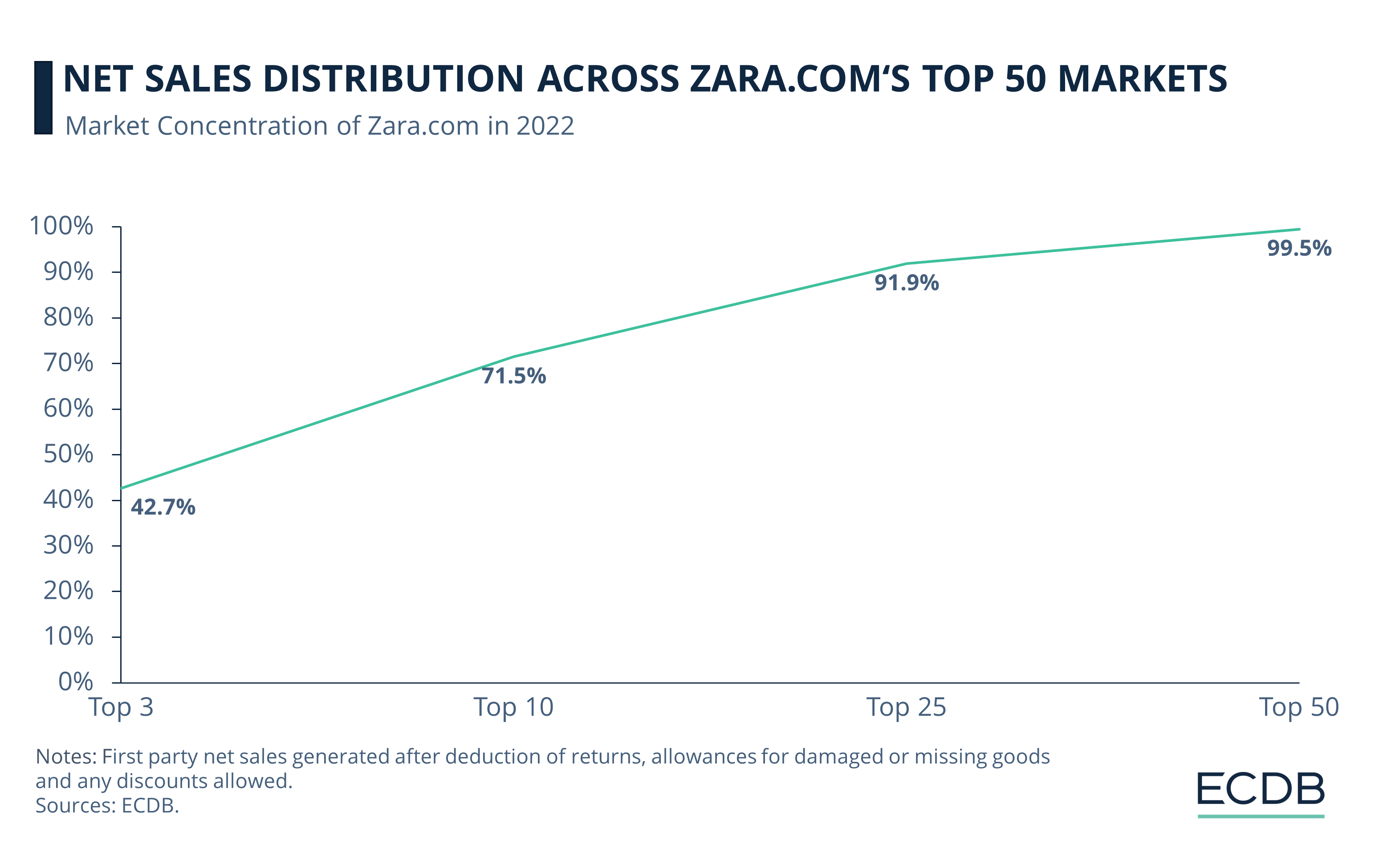

Market Concentration: Zara.com's target markets are quite diverse: Its top 10 countries account for 71.5% of online revenues, while many smaller markets make up the rest.

Fashion Market: Competition from pure-play online stores like Shein is putting pressure on established retailers like Zara and H&M. Zara is reducing store count while modernizing existing locations to offer a more integrated hybrid experience.

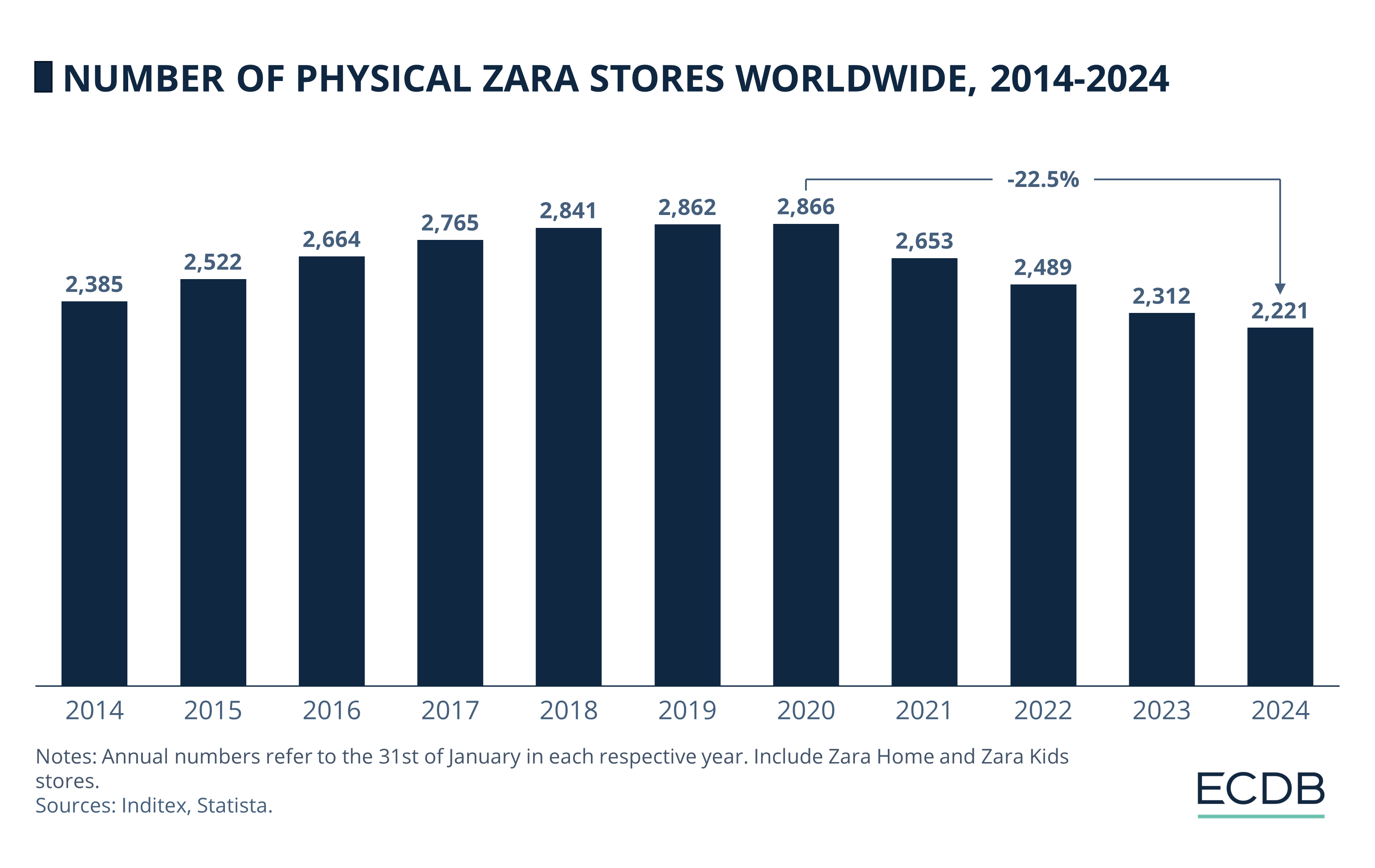

Physical Store Count Decreases: The total number of physical stores, including Zara Home and Zara Kids, decreased by 22.5% to 2,221 stores at the beginning of 2024.

Take a stroll through any city center and you may notice familiar storefronts giving way to new businesses or disappearing altogether. Covid has left a lasting mark on the way retailers engage with their customers: Retailers can cut costs by selling through a hybrid strategy, combing online and offline channels.

Major fashion brands are reducing physical retail space to make way for a hybrid approach, fueled by the success of online-only rivals like Shein and Asos.

Zara, as Inditex' flagship brand, has been cutting back on physical retail space since 2020. At the same time, a rebranding strategy aims to differentiate Zara from its competitors in the fashion market. Here is more about Zara's sales performance, restructuring efforts and market share.

Zara Statistics 2024: Online Sales Prove Resilient

Zara's shift to online has been accelerated by the pandemic, with a 68.3% growth in eCommerce net sales from 2019 to 2020. The following year of the pandemic still saw positive growth at a 21.1% rate, reaching online revenues of US$53.3 billion in 2021.

In 2022, global online revenues declined to US$51 billion. While the post-pandemic downturn was common across many industries and tied into macroeconomic difficulties like the inflation, Zara's recovery arrived quick in 2023.

With US$54.8 billion online net sales, the pandemic peak of 2021 was overcome in 2023.

Predictions for 2024 anticipate further growth.

Zara.com serves all of Zara's markets. Here is what they are in detail.

How Much Do Zara.com's Top Markets Contribute to Online Revenues?

Based on the top markets in which Zara operates with its .com domain, the histogram visualizes net sales distribution:

Of all the countries in which zara.com operated in 2022, the United States is the number one market, accounting for 23% of Zara’s total online revenues.

Including the United Kingdom (11.1%) and Spain (8.6%), these top 3 markets represent a total revenue share of 42.7%.

Zara.com's top 10 markets comprise Canada (5.9%), France (5.1%), Germany (4.5%), Poland (4%), Italy (3.9%), Portugal (2.8%) and the Netherlands (2.6%). Taken together, the top 10 contribute 71.5% of the domain's total revenues.

There are many other markets with marginal percentages that collectively round out zara.com's total net sales. The top 25 markets of the domain account for 91.9% of revenues, while the top 50 reach 99.5%. We can see that this includes 25 markets that together generate 7.6% of zara.com's net sales.

Competitor Analysis: Zara's Online Net Sales Lag Behind Its Competitors

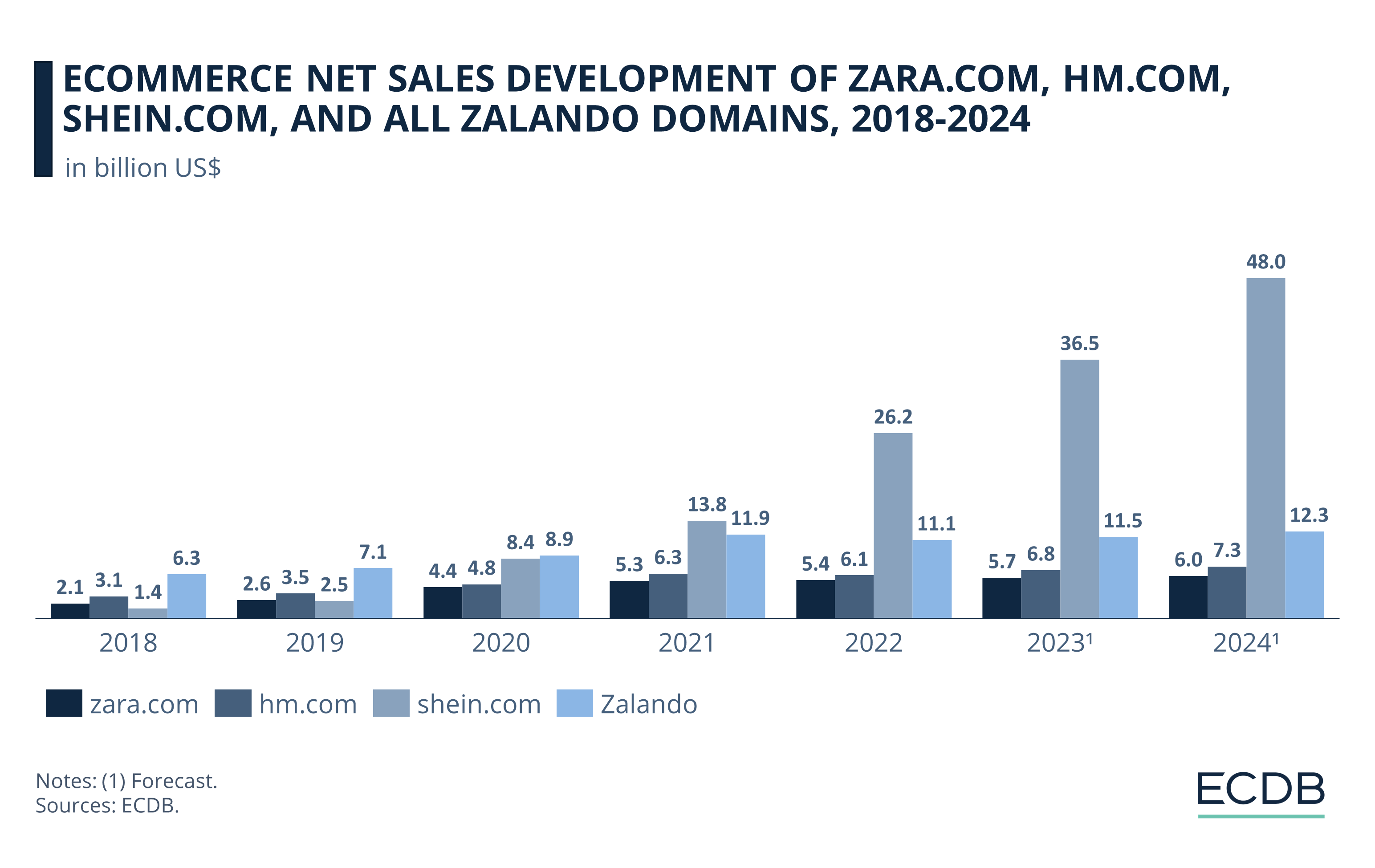

Comparing the respective eCommerce net sales of key players in the global online fashion market shows that Zalando and Shein are increasingly outpacing H&M and Zara.

While Zara and H&M generated online net sales of around US$2.3 billion and US$3.3 billion in 2018 and 2019, respectively, Zalando outshone both of them with online net sales of around US$6.7 billion. Note that Zara and H&M generated additional offline sales that are not included in the eCommerce net sales development shown in this chart.

The most notable development, however, is the meteoric rise of Shein in the online fashion market. By 2020, the Chinese online player had already drawn level with Zalando at online net sales of US$8.4 billion. According to projections, there is no sign of Shein's growth slowing: From online net sales of US$26.2 billion in 2022, shein.com is expected to reach online revenues of US$48 billion by 2024.

The other brands are well behind Shein's growth over this period. Zalando still stands out with the second-highest net sales, which are projected to stabilize at around US$11 billion to US$12 billion by 2024. But Zara and H&M are further behind, with Zara consistently generating lower online net sales than the others, ranging from US$5.3 billion in 2021 to US$6 billion in 2024.

Zara: Innovations to Its Business Model

The pandemic had a lasting impact on global fashion sales. Inditex reported overall revenue losses during the pandemic, which were mitigated by online channels. Inditex' most recent results confirm that the conglomerate is back on track.

As Inditex’s flagship store, Zara is leading the operational changes envisioned by the parent company. The company will need to stand against increasing online competition, shifting consumer tastes and rising fixed costs.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

1. Downsizing Physical Outlets by 22.5% Since 2020

The most notable shift is the global reduction of physical stores. Here is what that looks like:

Up until 2020, Zara's store count had been on an upward trajectory, peaking at 2,866 stores that year.

The pandemic led to a significant decline in numbers.

Over the course of four years, the total physical store count, including Zara Home and Zara Kids, fell 22.5% to 2,221 stores as of early 2024.

This move is in line with broader industry trends, exemplified by competitors like H&M. Inditex's strategy involves closing underperforming stores to strengthen its digital and hybrid offerings, while enlarging remaining outlets.

2. Enhancing Online and In-Store Synergy

The function of the remaining stores is also being transformed: Zara stores are repurposed to include digital conveniences, such as real-time fitting room bookings, 2-hour click & collect services, online inventory checks, self-checkout and automated online returns.

These improved stores will serve as both warehouses and distribution hubs, so they can ensure a more integrated hybrid retail model. Zara has also expanded its product lines to include new cosmetics, shoes, and athletic wear.

At the same time, Zara expands its global presence. The fashion retailer has opened its first physical store in Cambodia, where the brand also has an online presence.

Zara's Strategy: Closing Remarks

Zara's store closures reflect shifting market dynamics in the fashion industry, driven by emerging online players that are undercutting established retailers on turnaround time and price. With a strategy that prioritizes quality over quantity, Inditex's moves can help Zara gain new recognition as a brand beyond the fast-fashion label.

For the low-income customer, Inditex is in any case marching out new store concepts, as seen with the rise of the economical fashion brand "lefties", which is designed to take on the price battle with the low-cost competition.

Sources: Financial Times - Guardian - Inditex - Reuters

FAQ: Zara Online Sales

How many stores does Zara have worldwide 2024?

As of early 2024, Zara has a total of 2,221 stores worldwide. This number reflects a 22.5% reduction from its peak of 2,866 stores in 2020 due to a online sales shift.

Who owns Zara?

Zara is owned by Inditex. Inditex stands for Industria de Diseño Textil, S.A. It is a Spanish multinational clothing company that is one of the largest fashion retailers in the world.

Are Zara and H&M owned by the same company?

No, Zara and H&M are not owned by the same company. Zara is owned by Inditex, a Spanish multinational clothing company, while H&M is owned by the Swedish company Hennes & Mauritz AB. Both companies are major players in the global fashion industry but operate independently of each other.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics