Company Insight

H&M’s Offline-Online Evolution: Fashion Player Expanding Its Hybrid Model

With its hybrid model, the Swedish fashion giant is following a well-planned concept to stay up-to-date. However, H&M's physical stores are decreasing - what is behind this?

Article by Antonia Tönnies | August 07, 2024Download

Coming soon

Share

H&M’s Offline-Online Evolution: Key Insights

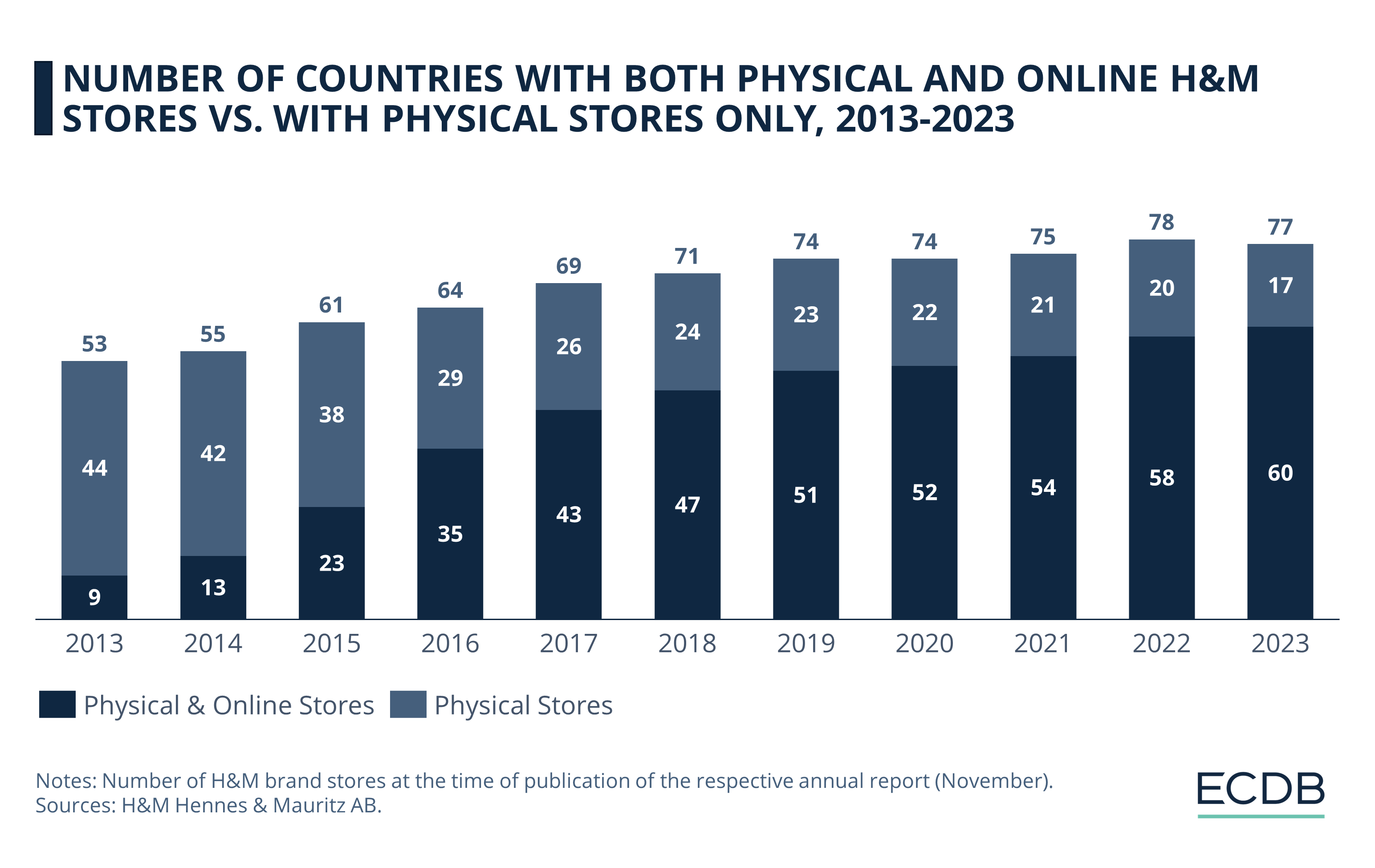

H&M’s Expansion Trends: From 2013 to 2023, Hennes and Mauritz expanded from 53 to 77 countries, with a notable shift towards the hybrid model of both physical and online stores.

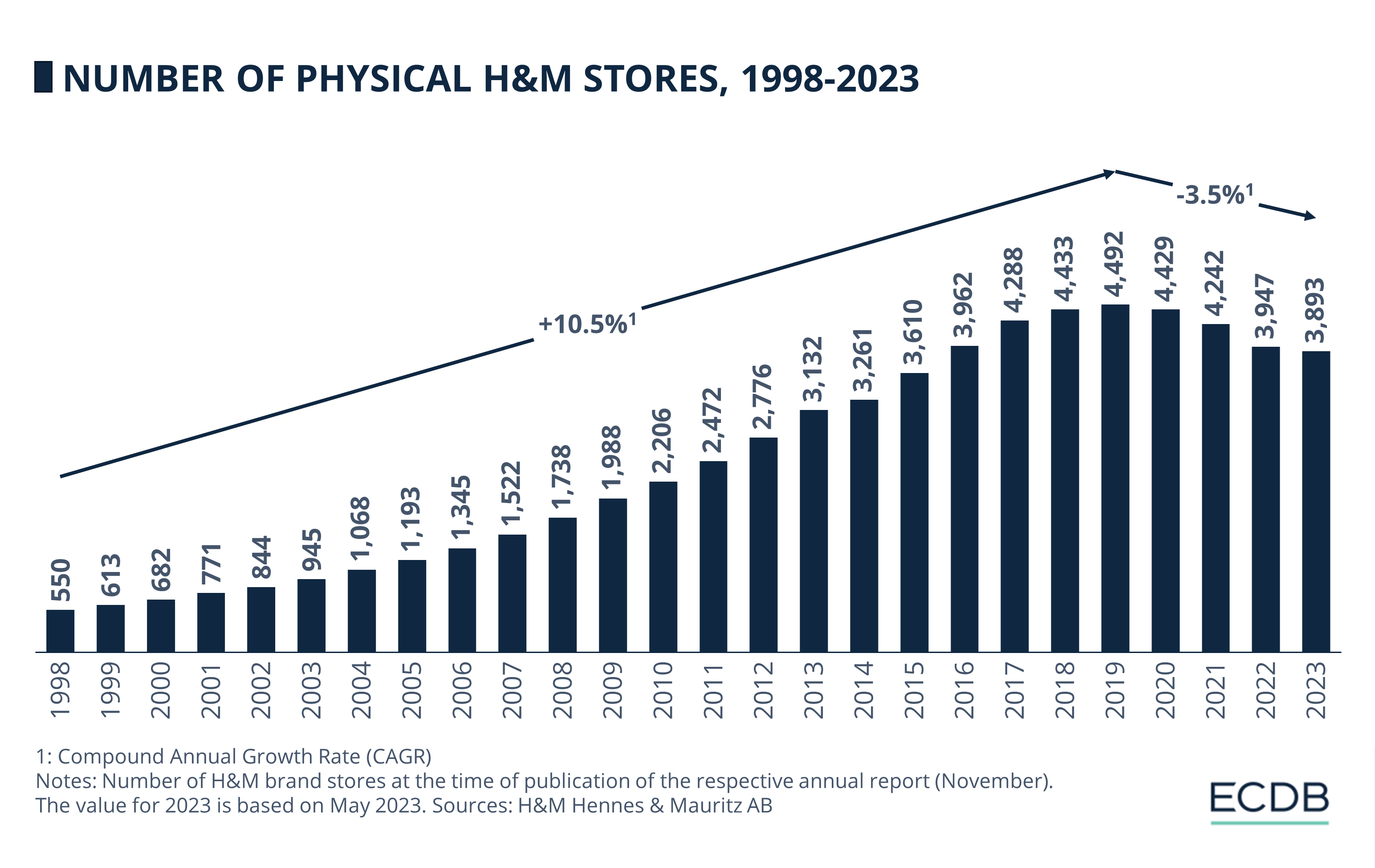

Physical Fashion Store Decline: Since 2019, the number of H&M's physical stores has decreased annually, dropping from a peak of 4,492 to 3,893 in 2023.

Future Focus: H&M plans to close more physical stores in established markets while opening new ones in growing economies, emphasizing a balanced store portfolio and omnichannel approach.

Swedish fast fashion retailer H&M is constantly adjusting its expansion strategy to improve its market performance. However, recent developments have cast doubt on H&M's omnichannel strategy. Frequently, H&M closes offline stores and even pulls out of a market.

Does offline retail still work today? How does the brand work with both physical and online stores? ECDB has the answers.

H&M's Offline vs. Hybrid Model: A Timeline

At the latest since the Corona pandemic, many people have become aware of the trend towards online shopping - including Hennes and Mauritz. The Swedish fashion giant has been investing in its H&M online shops year after year for some time now. When analyzing the data, the trend towards an increasing adoption of the hybrid model comes to surface:

The data shows that H&M has continued to expand its online retail business into new markets, while its physical stores are experiencing a downturn. In total, the number of countries where H and M operates has increased from 53 in 2013 to 77 in 2023 – let’s take a closer look:

From 2013 to 2017, the growth of physical stores along with online stores increased remarkably.

Between 2014 and 2015, the number of countries joining this model increases by 10, and the number of countries opening physical stores increases by a total of six.

The numbers don't change much from 2019 to 2021, with the total number of countries with H&M stores remaining almost the same. Meanwhile, the mix of online and offline stores increases slightly, from 51 in 2019 to 54 in 2021.

In 2022, the number of countries the fashion retailers enter increases by 3, until H&M closes for the first time in a country in 2023. Today, 17 of H&M's 77 markets operate brick-and-mortar stores, while the other 60 have both physical and online stores.

The decline of physical stores in combination with the growth of the company's online presence underscores H&M's commitment to catering to the changing preferences of global consumers. While in 2013, an overwhelming majority of 83% of H&M’s target markets operated in physical retail exclusively, this ratio shifted ten years later. Today, 78% of the countries in which H&M operates have both offline and online H&M stores.

Number of Physical H&M Stores Shrinks – an eCommerce Paradigm Shift?

Despite the worldwide shift to online, H&M continues to be a strong physical fashion retailer and brick-and-mortar remained an important pillar in the company’s multichannel business concept alongside the eCommerce boom. But more recent developments raise questions:

Although H&M increasingly invested in the expansion of its eCommerce business during the early 2000s, brick-and-mortar remained equally important on the agenda. A look at the development of physical H&M stores reveals a constant increase well into 2019. The number of H&M brick-and-mortar stores grew quite steadily by around 10% to 12% each year since 1998.

But the trend has apparently come to an end. Since 2019, the number of physical H&M stores has gone down each year to currently 3,893 stores – 599 stores less than in the peak year 2019. It might not be a coincidence that 2019 was the peak year for the number of offline stores, as the Covid-19 pandemic with its unprecedented eCommerce boom broke out in 2020. But even after the end of this global health crisis, H&M's physical store presence continues to decline.

Stay Competitive: Our constantly updated rankings provide you with the latest insights to improve your business strategy. Discover which stores and companies are at the top of the eCommerce world and which categories are driving the highest sales. Dive into our rankings for companies, stores, and marketplaces. Stay a step ahead in the market with ECDB.

H&M’s Retail Strategy Continues to Rely on Omnichannel

H&M's approach to retail expansion reflects its commitment to meeting evolving consumer needs. By maintaining a global network of physical stores and simultaneously investing in online retail, the brand ensures that customers can engage with H&M in a way that suits their preferences.

According to the company, a well-established omnichannel approach including website sales, physical stores, marketplaces, social media and more is key to their future vision. The company plans to close more physical stores in established markets but open new brick-and-mortar locations in growing economies to ensure a well-established store portfolio in each target market.

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

Wayfair Launches Paid Loyalty Program Wayfair Rewards

Wayfair Launches Paid Loyalty Program Wayfair Rewards

Deep Dive

China's eCommerce Market Shifts Focus to Offline Channels

China's eCommerce Market Shifts Focus to Offline Channels

Deep Dive

Online Fashion in Poland: Zalando dominates the Market with Its Online Stores

Online Fashion in Poland: Zalando dominates the Market with Its Online Stores

Deep Dive

Poland’s eCommerce Trends 2023: Market Share, Payment Methods & Amazon

Poland’s eCommerce Trends 2023: Market Share, Payment Methods & Amazon

Back to main topics