eCommerce: Payment Trends

Poland’s eCommerce Trends 2023: Market Share, Payment Methods & Amazon

The country's eCommerce sector has been growing rapidly in recent years, ranking 17th among the world's largest eCommerce industries by revenue last year. The country has become increasingly digital, but has the payment method done the same? Find out how Polish consumers like to shop and pay online.

Article by Nadine Koutsou-Wehling | August 15, 2024

Poland’s eCommerce Trends 2023: Key Insights

Unique Payment Preferences: Bank transfers are the most common payment method in Polish eCommerce, followed by eWallets and cards. With the introduction of buy now, pay later services, installment payments are expected to grow.

eCommerce Growth Since the Pandemic: Since 2013, around 36,000 registered pure-play online stores have joined Poland's online market. This trend has seen the most notable increase since 2019, when the pandemic accelerated market growth.

Global Players Enter the Scene: Amazon expanded its presence in Polish eCommerce in 2021 with its own domain. Amazon relied on the existing infrastructure in the country, but faces competition from Poland's top online marketplace, Allegro. While AliExpress succeeded in Poland, Shopee had to exit the market.

The Polish eCommerce industry has seen tremendous growth in recent years. Last year, the country reached the 17th place of the largest eCommerce countries in the world with a revenue of US$25.4 billion.

The country has managed to move from a primarily offline economy, where retailers engaged in eCommerce were the absolute exception, to one of the world's top 20 eCommerce nations. Yet people are still pretty old-school when it comes to payment methods.

Top Payment Method in Poland: Bank Transfers Lead in Poland

In order for businesses to offer options that resonate with consumers, it is critical to understand a market's payment proposition. Although Poland is part of the EU, this does not mean that its payment landscape is identical to other European countries.

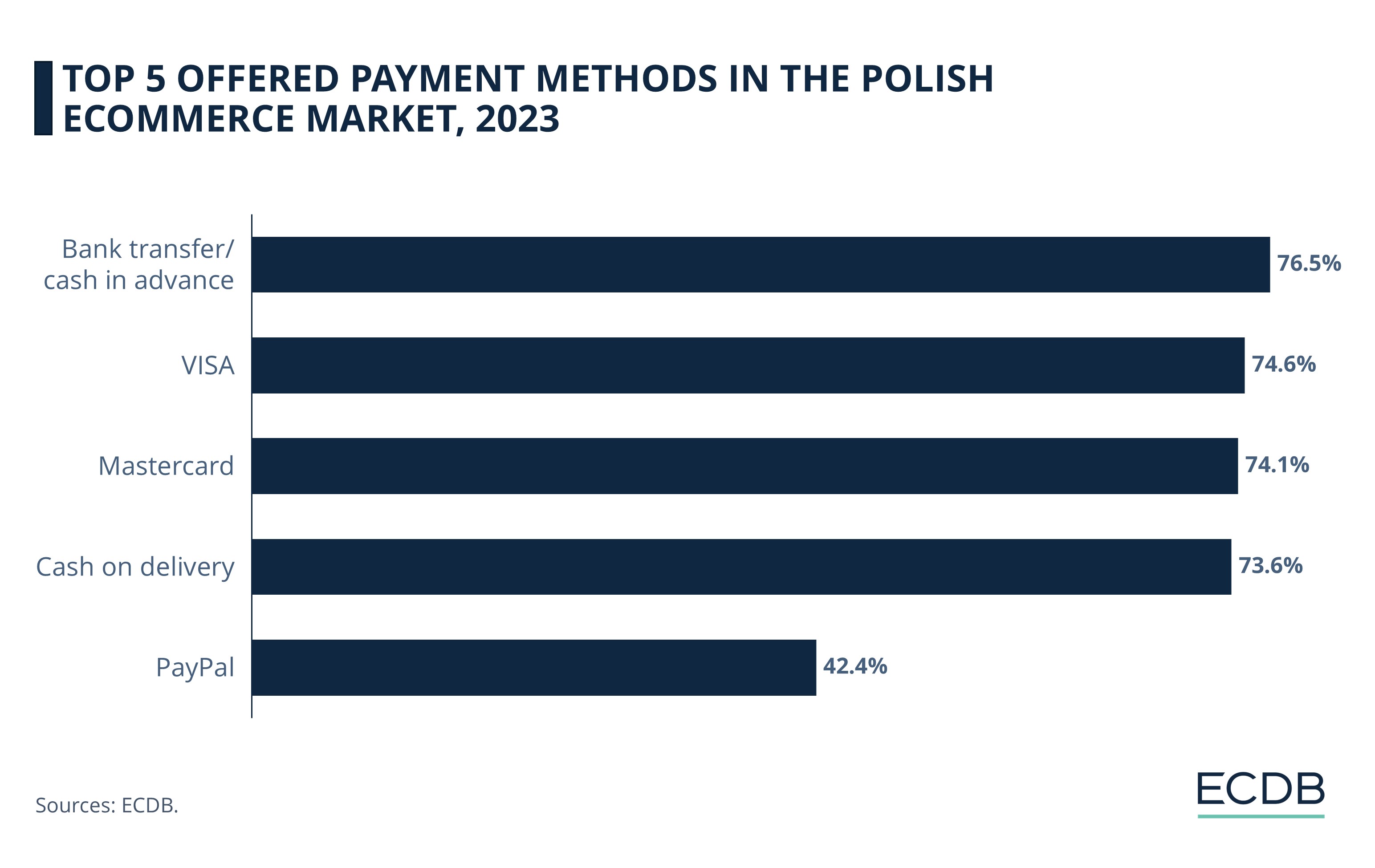

In the case of Poland, bank transfers and cash in advance are the most often offered online payment option, accounting for 76.5% of online transactions:

VISA follows in second place, offered by 74.6% of the Polish eCommerce market.

Mastercard is in third place, provided by 74.1% in Poland.

Cash on Delivery follows with 73.6%, slightly less than Mastercard.

Last but not least is the eWallet PayPal, which is offered by 42.4% in the Polish eCommerce sector.

At the same time, the popularity of Buy Now, Pay Later, or BNPL, is growing: According to Klarna Insight, shoppers around the world are increasingly opting for BNPL - including in Poland. In 2023, 45% of at least 1,000 respondents living in Poland were more interested in BNPL than in buying with a credit card, while 20% preferred a credit card to BNPL.

Consumers in Poland Look for Easy Payment Processes When Shopping Online

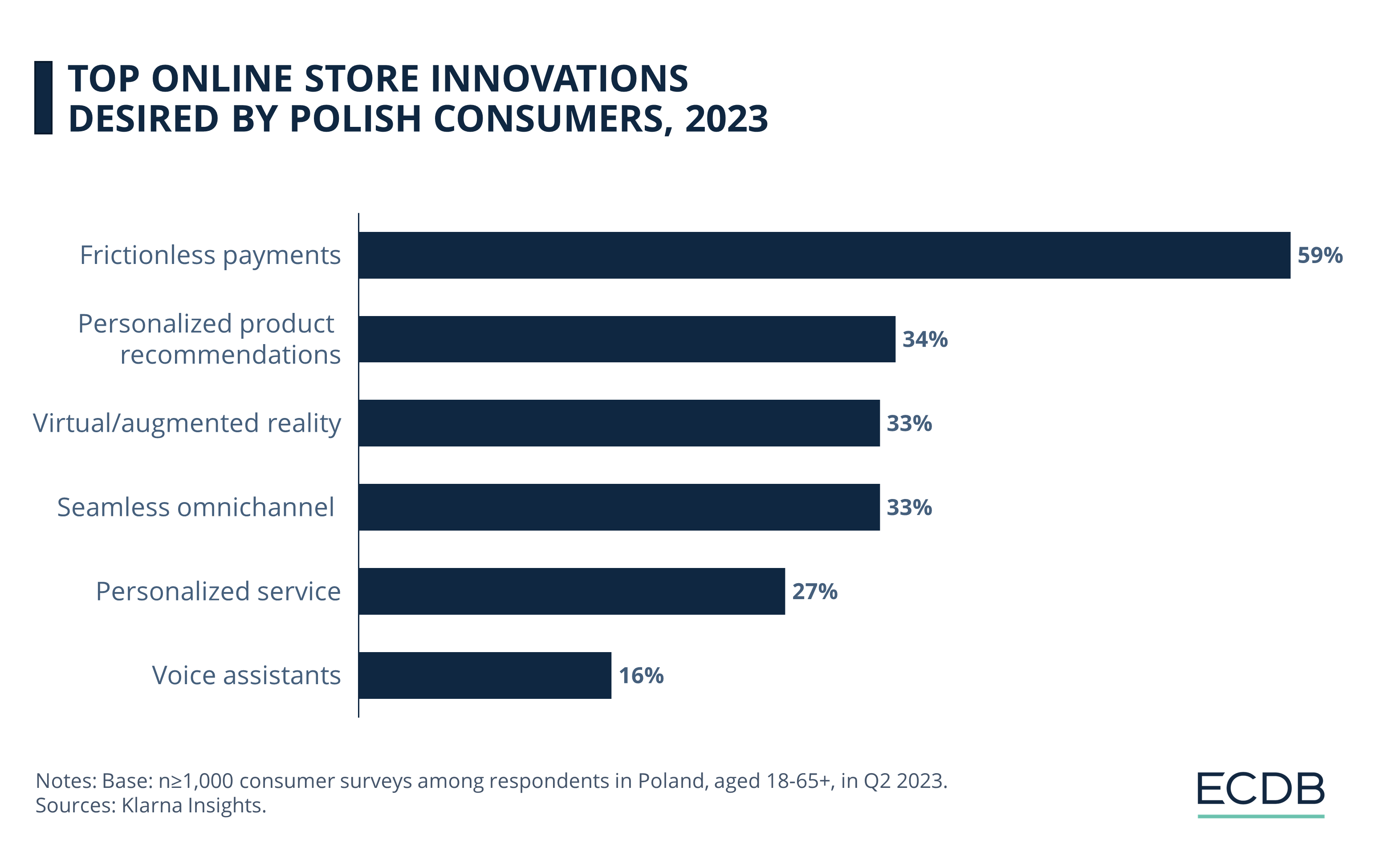

Payment is an important topic for Polish consumers, which is reflected in their preferences for eCommerce innovations. Based on data from Klarna Insights, we find the following top 5 most desired online store innovations in Poland – let's take a closer look:

This makes frictionless payments the most desired online stores innovation among polish consumers being cited by 59% of the respondents.

The second and third most desired online store innovations by Polish consumers are personalized product recommendations (34%), the use of virtual and augmented reality (33%), and a seamless omnichannel solution (33%).

Finally, personalized service is important to 27% of consumers in Poland, which can be achieved at scale by using chatbots in addition to traditional customer service agents or more recent innovations such as VR/AR and gamification tools.

Voice assistants are least important to the average Polish consumer, as only 16% of users said they would like to use a device like Amazon's Alexa to shop online.

Klarna's data shows us thatconsumers in Poland are primarily concerned with practical issues that improve their shopping experience by simplifying existing processes and adding a layer of flexibility and accessibility to online shopping. More sophisticated innovations, such as AI and machine learning technology, do not seem to excite the majority of Polish consumers as much.

Number of Registered eCommerce

Stores in Poland

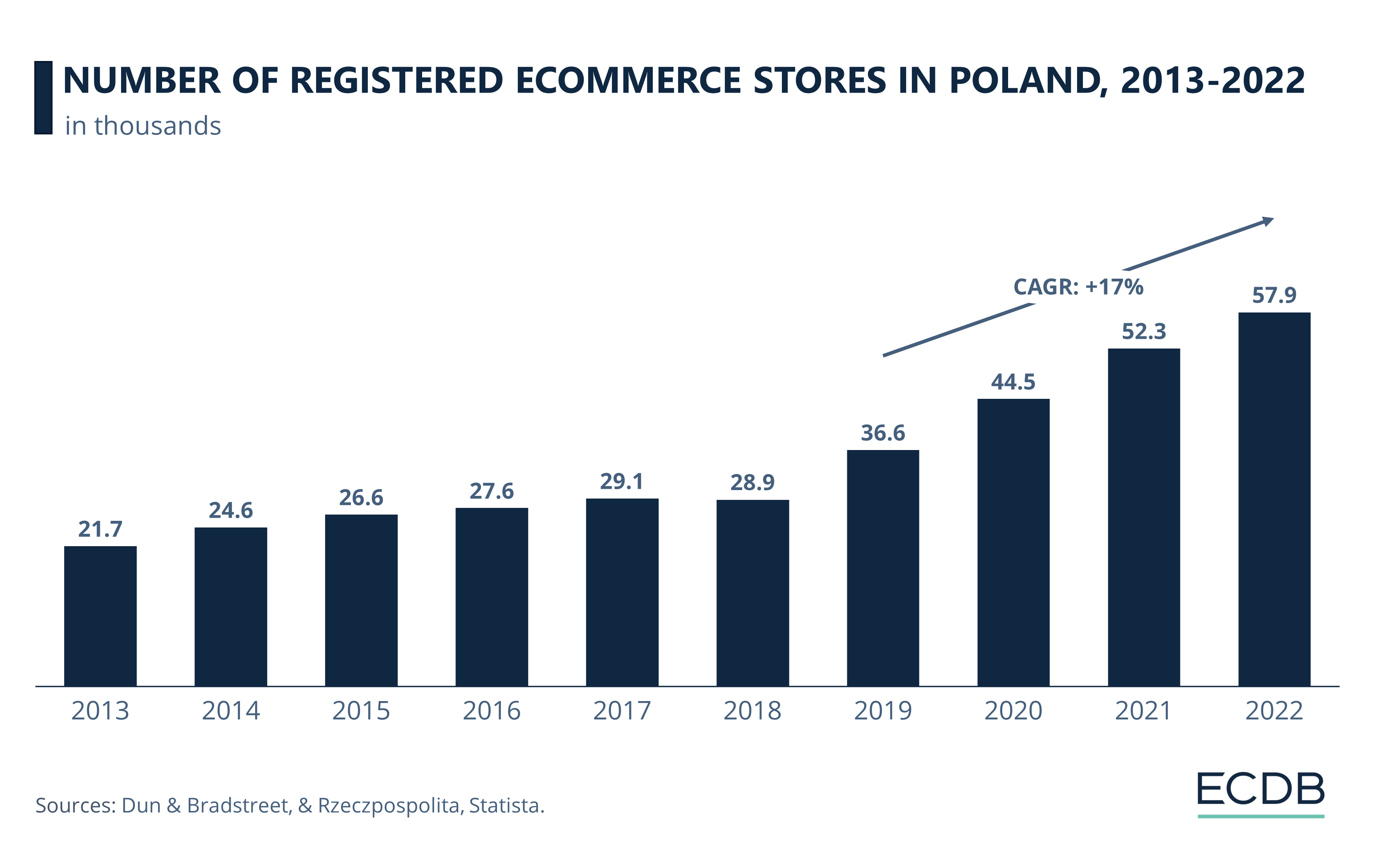

A decade ago, eCommerce was a niche sector of the Polish economy, attracting little attention from both consumers and businesses. But in recent years, eCommerce has seen a sharp increase in the number of registered stores in the country.

The development of pure-play online stores in Poland over the last 10 years is shown below:

While around 21,700 online stores were registered in Poland in 2013, the following five years saw barely more than 7,000 new online players.

It wasn't until 2019 that there was a sharp increase, with 7,700 new online stores, more new entrants in one year than in the previous five years combined.

Since then, the number of registered online stores in Poland has been growing at a consistently high rate, with a CAGR (2019-2023) of 16%.

Currently, there are around 65,600 registered pure-play online stores in Poland. This figure does not include offline retailers with an additional online store.

This was to be expected, as not only did eCommerce proliferate during the pandemic, but technological advances and changing consumer preferences in recent years have provided fertile ground for businesses looking to make a profit by selling products online.

Poland's eCommerce Attracts

Big-Name Players

The growth of the Polish market is reflected both in the absolute number of registered online shops in Poland and in the types of new shops entering the market.

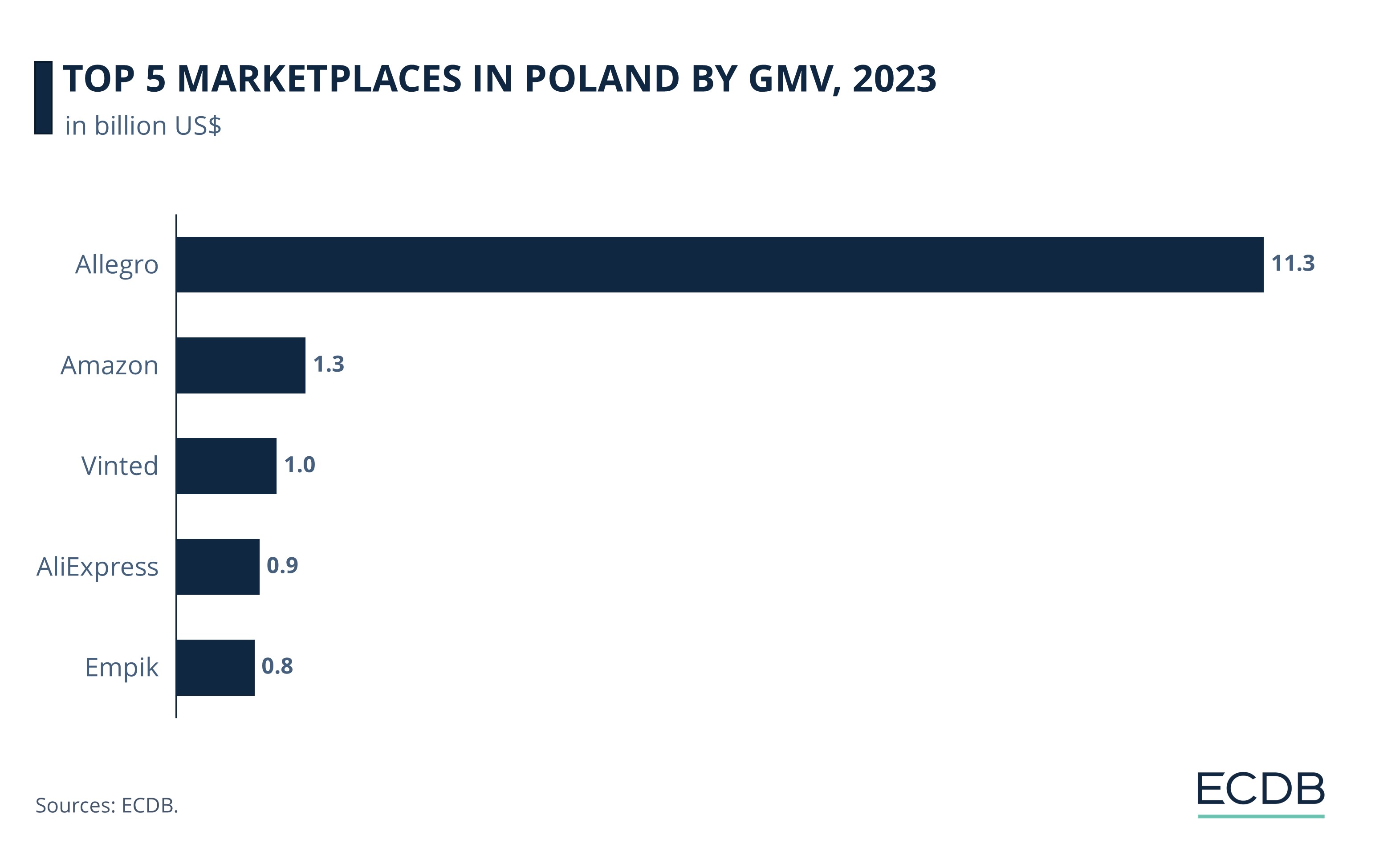

In the past few years five eCommerce player have managed to reach the positions of the top 5 marketplaces in Poland – let’s take a look at the data.

1. Allegro

The largest marketplace in terms of gross merchandise value (GMV) is the Polish eCommerce player Allegro, with a GMV of US$11.3 billion in 2023. Allegro, which means to play fast and lively music, has grown a lot in the past. Especially during the COVID-19 pandemic, the marketplace benefited from the eCommerce boom and grew by more than 50% from 2019 to 2020.

For 2024, ECDB expects GMV to continue to increase by 6.4% to US$12.6 billion. Meanwhile, Allegro expanded this year to Slovakia, extending its market in Europe, where it is already present in over twelve European countries.

2. Amazon

Much farther away is an old, familiar marketplace: Amazon. The U.S. marketplace achieved a GMV of US$1.3 billion in 2023. All in all, this only 0.2% of Amazon's total GMV is generated in Poland.

In mid-July this year, Amazon workers in Germany went on strike, later joined by workers in Poland and Spain. The U.S. tech giant is repeatedly criticized for working conditions in its warehouses, which frequently leads to strikes.

3. Vinted

In third place is the Lithuanian fashion marketplace Vinted with a total GMV of US$1 billion in 2023. The Polish eCommerce sector is the fourth most important market for Vinted, with 9.8% of its global GMV generated in Poland.

The eCommercer player is a big player in the recommerce industry, providing a platform for buying and reselling mainly fashion. Recently, the recommerce marketplace has been criticized for violating the privacy rights of its customers. According to DW, Vinted was fined nearly US$2.6 million by the Lithuanian data protection authority.

4. AliExpress

Next comes the Chinese player AliExpress, which reached a GMV of US$0.9 billion in 2023. Overall, 1.9% of AliExpress's global GMV in 2023 was generated in Poland, ranking it 19th among the other 50 countries where the marketplace is present.

The marketplace is owned by Alibaba Group Holding, Ltd., which has been criticized for working conditions, data security, and especially its monopolistic practices. As a result, the Chinese government reacted with stricter rules and penalties against such market practices, which led in 2021-2022 to the tech crackdown.

5. Empik

Empik completes the ranking of the top 5 marketplaces in Poland by GMV with US$0.8 billion. The Polish marketplace is fully focused on the Polish eCommerce industry, with most of its GMV (70%) coming from the Hobby & Leisure category.

This year, in cooperation with Mastercard and PayEye, the Polish online player launched a biometric in-store payment pilot using iris and facial biometrics. A new technology next to the newest payment method eWallet. Mastercard is planning to launch the payment technology in more countries around the world along this year.

Amazon Meets Competition With Polish Domain Launch

Two major international players stand out. The first is Amazon, which launched its Polish domain amazon.pl in 2021. The U.S. marketplace took advantage of the existing infrastructure and its understanding of the market.

Since consumers had been ordering products across borders using Amazon's international domains, the switch to a Polish domain presented both benefits and challenges. With 10 fulfillment centers as of December 2022, Amazon’s entry into the Polish market met with more favorable conditions than in other markets, such as in China.

But despite Amazon’s global leadership, its move into Polish eCommerce did not go unchallenged by established competitors. In particular, Poland’s most successful marketplace, Allegro, will prove to be a tough opponent for the eCommerce giant. Prior to the launch of amazon.pl, Allegro invested in improved customer service offerings, including loyalty rewards programs, free and same-day delivery, and deferred payment options for consumers.

AliExpress Succeeds Where Shopee Fails

Still, Poland’s growth potential has not gone unnoticed among global eCommerce players, including popular online platforms from Asia such as AliExpress and Shopee. While AliExpress entered Polish eCommerce before the pandemic and managed to expand its platform throughout the global health crisis, Shopee was less fortunate.

A year after entering the Polish market in 2021, Shopee representatives announced the platform’s departure again, citing structural economic barriers and low profitability in the market. According to trans.info, it was also due to an advertising campaign unsuitable for the Polish market, which kept Shopee from effectively reaching Polish customers.

These instances show that Polish eCommerce is not only highly competitive, but also has specific market characteristics that make a one-size-fits-all approach unfeasible in the long run. The following subsection examines an important aspect of eCommerce conversion: digital payment.

Online Market Trends in Poland:

Closing Thoughts

Polish eCommerce is growing, as indicated by the large increase in the number of registered pure-play online stores. Poland's attractiveness to established online retailers like Amazon and AliExpress is evidenced by their entry into the market in recent years.

But Polish consumers have specific tastes that not everyone can cater to. This is one of the reasons why Shopee failed in the market. A payment preference for bank transfers distinguishes Polish eCommerce, while in addition, companies such as Empik and Mastercard are investing into new payment method.

Sources: About Amazon – Exorigo - International Trade Association – Klarna Insights – OOSGA – PPRO – Retail Insight Network - trans.info

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Deep Dive

Payment Options Matter: Retailers Face A Persistent Challenge With Shopping Cart Abandonment

Payment Options Matter: Retailers Face A Persistent Challenge With Shopping Cart Abandonment

Deep Dive

Buy Now, Pay Later (BNPL) Explained: What Is It & How Does It Work?

Buy Now, Pay Later (BNPL) Explained: What Is It & How Does It Work?

Deep Dive

Buy Now, Pay Later (BNPL) in the U.S: Top Providers, Market Analysis & Consumer Behavior

Buy Now, Pay Later (BNPL) in the U.S: Top Providers, Market Analysis & Consumer Behavior

Deep Dive

Buy Now, Pay Later in Germany: Top Providers, Consumer Behavior, PayPal & Klarna

Buy Now, Pay Later in Germany: Top Providers, Consumer Behavior, PayPal & Klarna

Back to main topics