Buy Now, Pay Later (BNPL) in Germany

Buy Now, Pay Later in Germany: Top Providers, Consumer Behavior, PayPal & Klarna

Buy Now, Pay Later is almost a must-have for shops in Germany: BNPL offers customers payment flexibility. But which providers do German users prefer, and what other factors play a role in their purchasing decisions?

Article by Cihan Uzunoglu | June 20, 2024Download

Coming soon

Share

Buy Now, Pay Later in Germany: Key Insights

Market Leaders: PayPal and Klarna significantly lead the BNPL market in Germany, outperforming other competitors.

Age & Gender Preferences: The 25-44 age group and men prefer PayPal, whereas Klarna is favored by those under 25 and women.

Income & Household Size: Klarna is more appealing to those with lower incomes and larger households, whereas PayPal is popular across all household sizes.

City Size Impact: In mid-sized cities, PayPal leads, while Afterpay is preferred in larger cities; other BNPL services are more popular in big cities.

Buy Now, Pay Later (BNPL) is a popular service through which consumers get to purchase goods or services immediately and defer payment for a later date. As is the case with most services, there are many providers out there offering BNPL options to shoppers.

Findings of a survey conducted by ECDB and Statista provide valuable insights regarding the most popular BNPL providers among online shoppers in Germany.

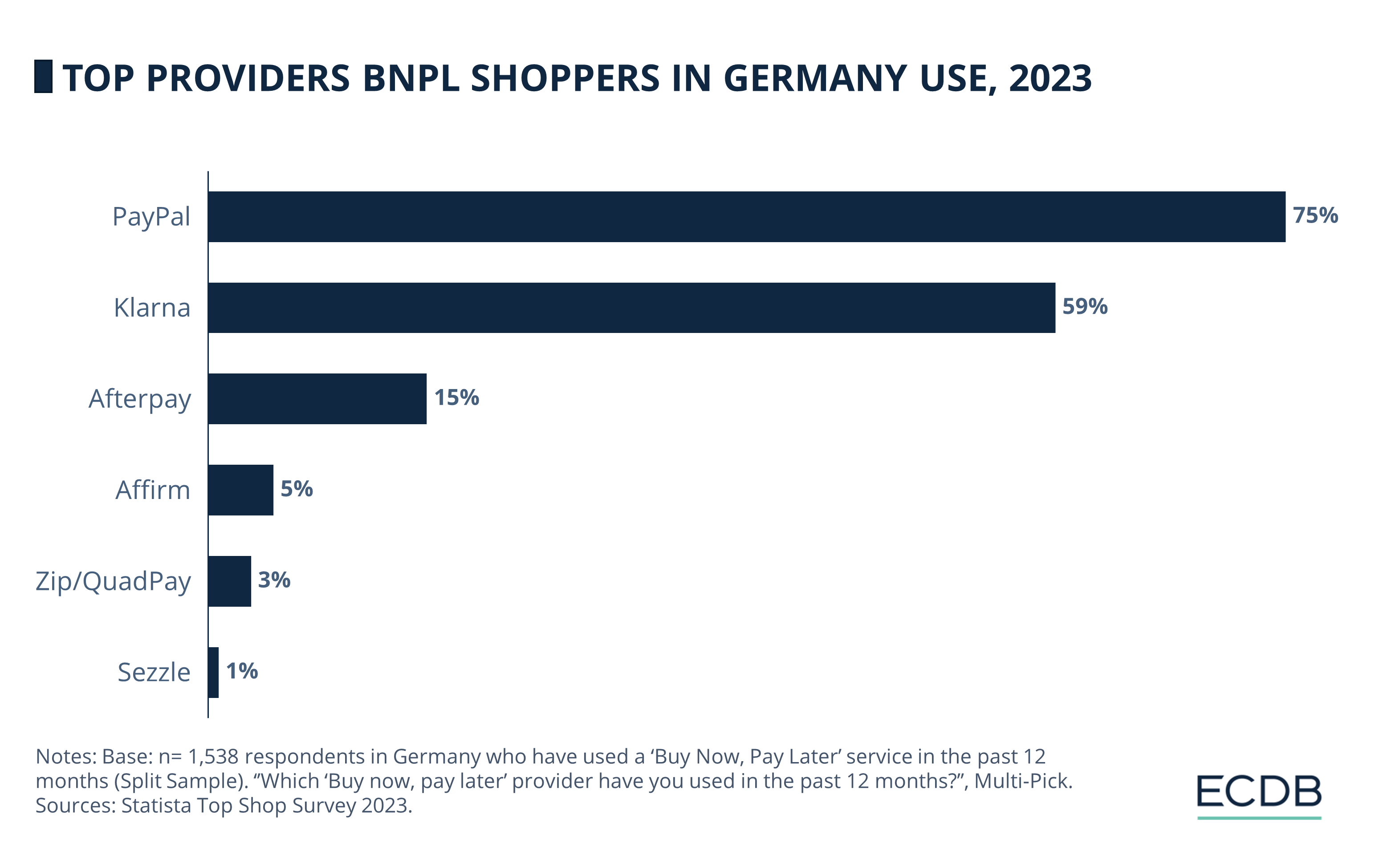

BNPL Provider Preferences in Germany

As BNPL has grown in popularity over the years, competition has increased, and many players have entered the market. Below is the ranking of BNPL providers based on the preferences of shoppers in Germany.

1. PayPal

Usage: 75%

PayPal's BNPL service has been the most popular among shoppers in Germany over the past 12 months. Its extensive user base and trusted brand name contribute significantly to its dominance in the BNPL market.

2. Klarna

Usage: 59%

Klarna is the second most preferred BNPL provider. Known for its flexible payment options and user-friendly app, Klarna has built a strong presence in the German market.

3. Afterpay

Usage: 15%

Afterpay takes the third place with a noticeable drop from the top two providers. Its straightforward payment plan appeals to a segment of shoppers, though it remains behind PayPal and Klarna.

4. Affirm

Usage: 5%

Affirm is in fourth place, with a smaller share of the market. Its focus on transparent and flexible payment terms has garnered a niche but dedicated user base.

5. Zip/QuadPay

Usage: 3%

Zip, also known as QuadPay in some regions, holds the fifth spot. Despite its lower market share, it offers a competitive BNPL option with its easy-to-use platform and clear repayment plans.

6. Sezzle

Usage: 1%

Sezzle rounds out the list in sixth place. While its market presence is modest, it provides an alternative for consumers looking for a simple BNPL solution.

This ranking highlights the significant lead of PayPal and Klarna in the BNPL market in Germany, with the other providers trailing behind by a considerable margin..

Klarna Favored by Women

and Users Under 25

Concerning the age distribution of users for each provider, it is clear that BNPL buyers between 25 and 44 are more likely to use PayPal's BNPL service, while users younger than 25 are more likely to use Klarna. Other providers – namely, Afterpay, Affirm, Zip/Quadpay, and Sezzle – are used evenly across all age groups.

The gender distribution of users in this context also reveals an interesting pattern. While women are more likely to use Klarna, Afterpay or Sezzle, men are more likely to use PayPal or Affirm. In addition to this, women and men were found to be just as likely to have used Zip/QuadPay.

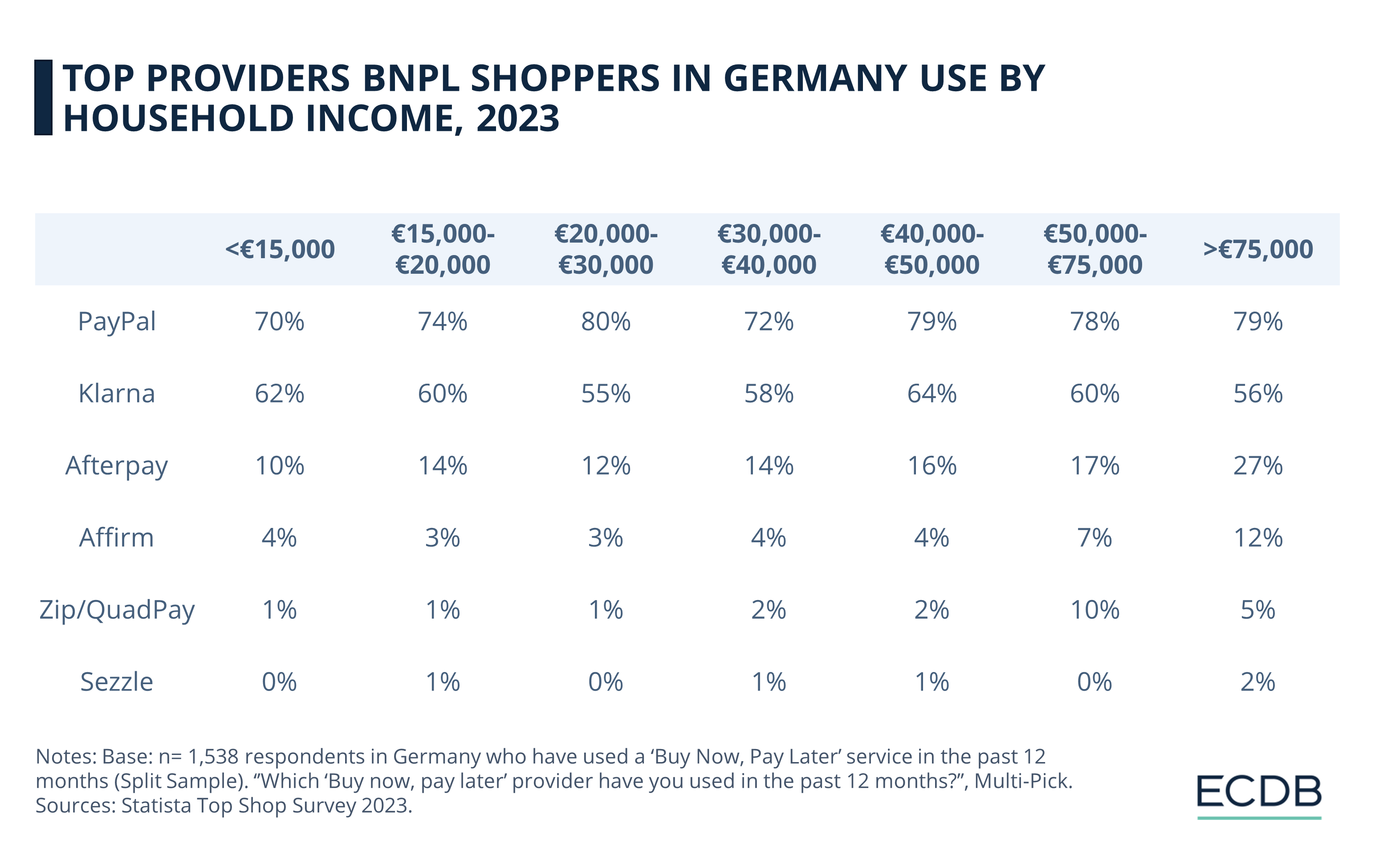

Afterpay Preferred by High-Income

and 3-Person Households

In addition to aspects we covered so far, household income and household size also determine which providers consumers choose. In terms of annual disposable household income, we see that Klarna is relatively stronger than PayPal in the “<€15.000” bracket than in the high income brackets, while others (Afterpay, Affirm, etc.) are particularly used in high-income households.

Another aspect of households that is highly influential in this context is the household size – the number of people living in a household. Regarding household size, BNPL shoppers living in 1 and 2-person households are reported to be much less likely to use BNPL, compared to other households.

In addition, Afterpay and Affirm are most popular in 3-person households compared to other household sizes, while Klarna is often used in larger households of 5 or more people. PayPal, on the other hand, remains the preferred BNPL option across all household sizes.

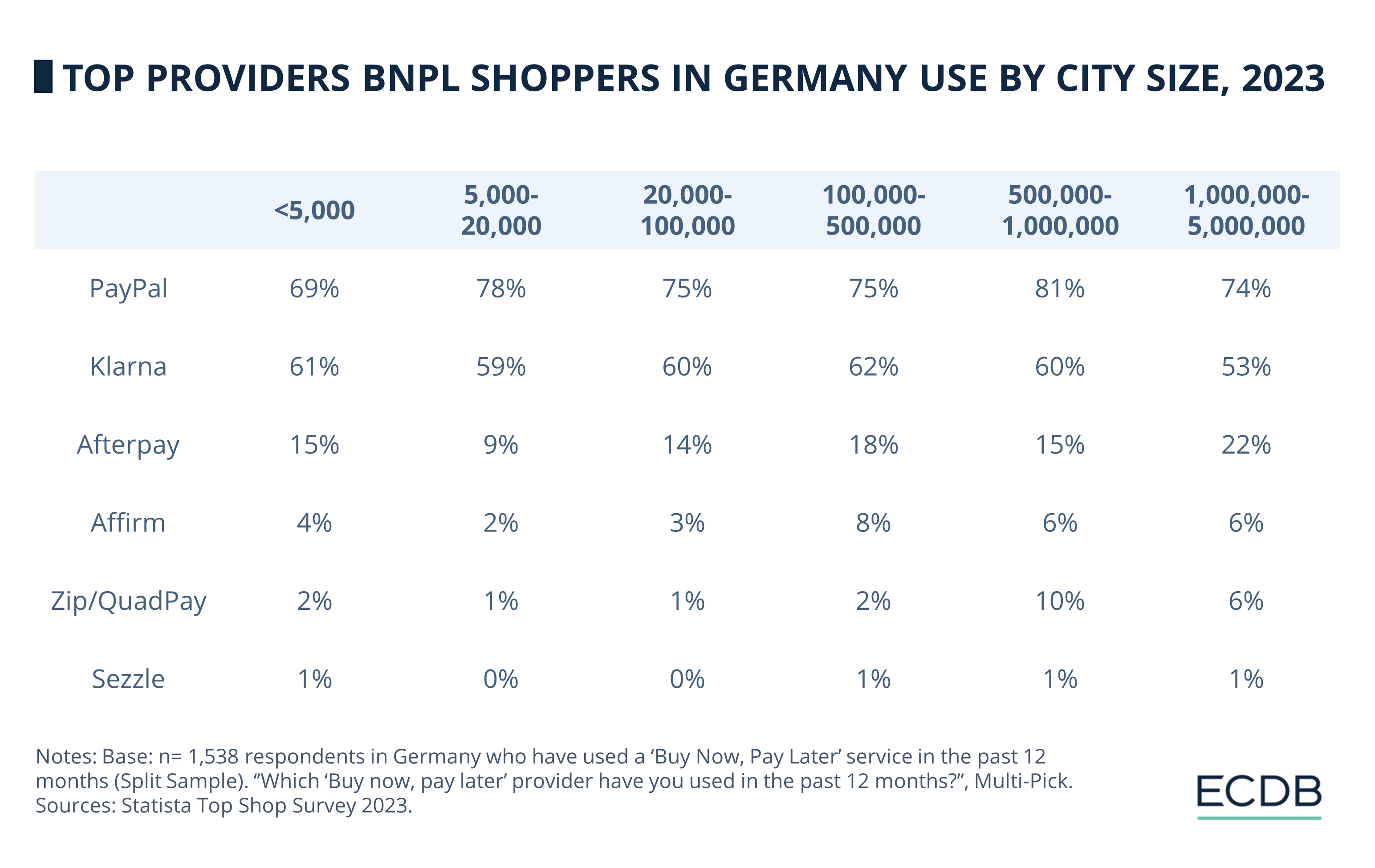

Less Popular Providers Are More Popular in Larger Cities

Digging through the survey results, we see that PayPal is the strongest in cities with 500,000 to 1,000,000 inhabitants. Another comparison reveals that Klarna is less used in very large cities with more than 1,000,000 inhabitants, while Afterpay is used a lot in those large cities with 22%, compared to cities with different numbers of inhabitants. This is potentially interesting from a marketing perspective, among others, as both providers focus on female users.

Less popular BNPL providers tend to be more widely used in larger cities. While Affirm was increasingly named in cities with more than 100,000 inhabitants, Zip/QuadPay was especially used in cities with more than 500,000 inhabitants.

Buy Now, Pay Later in Germany:

Closing Thoughts

The forecasted 14% growth in BNPL transactions in Germany for this year reflects the rising importance of flexible payment options among consumers. This growth not only highlights Germany's key role in the European BNPL scene but also emphasizes the impact of services like Klarna, which has been a game-changer since its introduction.

The ongoing challenge for BNPL providers will be to adapt to changing consumer preferences, ensuring they remain relevant in a competitive landscape where choice and convenience are paramount.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Deep Dive

Payment Options Matter: Retailers Face A Persistent Challenge With Shopping Cart Abandonment

Payment Options Matter: Retailers Face A Persistent Challenge With Shopping Cart Abandonment

Deep Dive

Poland’s eCommerce Trends 2023: Market Share, Payment Methods & Amazon

Poland’s eCommerce Trends 2023: Market Share, Payment Methods & Amazon

Deep Dive

Buy Now, Pay Later (BNPL) Explained: What Is It & How Does It Work?

Buy Now, Pay Later (BNPL) Explained: What Is It & How Does It Work?

Deep Dive

Buy Now, Pay Later (BNPL) in the U.S: Top Providers, Market Analysis & Consumer Behavior

Buy Now, Pay Later (BNPL) in the U.S: Top Providers, Market Analysis & Consumer Behavior

Back to main topics