eCommerce: Store Innovations

Amazon Rival Grabango Shutters Due to Lack of Funding for Cashierless Technology

Grabango worked with Aldi and Giant Eagle to bring contactless checkout into grocery retail. As Amazon's biggest rival in that field, it now opted out of the game. Here is why.

Article by Nadine Koutsou-Wehling | October 11, 2024

Cashierless Checkout Startup Grabango: Key Insights

Grabango Failed to Secure Funding: The startup launched in 2016, when the investment frenzy for cashierless technology began. Since then, a growing number of startups have struggled to secure funding for new ventures.

Amazon Remains the Leading Player: Amazon's secure financial footing gives it more freedom to try innovations that startups typically don't have. While the Just Walk Out (JWO) technology is being rolled out in public places, Amazon is not exempt from challenges.

Grabango is a venture-backed startup that was working to beat Amazon in the race for cashierless checkout technology. But Grabango has now been forced to shut down, as the startup was unable to raise enough funding to continue operations.

Grabango was founded in 2016, around the same time that Amazon introduced the concept of contactless checkout for its Amazon Go stores. The first Amazon Go store opened in 2018, while Grabango has been working with other grocery competitors such as Aldi and Giant Eagle.

Tough Investment Climate Since 2022

According to CNBC, Grabango raised over US$73 million, with its most significant funding round in 2021. Since then, the venture capital market for innovative startups has seen fewer and fewer funds go through. Grabango was able to raise US$39 million in June 2021 and has announced a planned IPO. But investment has been harder to come by because of a climate that discourages spending, fueled by inflation and economic uncertainty.

Since 2022, only a few venture-backed companies have debuted on the U.S. stock market. Analysts conclude that the days of easy venture backing are over, and startups are more exposed to rivalries and financial losses. Other startups in the cashierless technology sector include AiFi and Trigo.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

Amazon Sets the Stage, Again

The largest player in the field is Amazon, however. The eCommerce giant has set the stage for cashierless technology, bringing a glimpse of the future to grocery shopping. While the technology has been tested and is available in public venues such as stadiums, arenas, conference centers, and airports across the U.S., some challenges remain.

These include privacy concerns, the accuracy and functionality of the technology, and whether the overall costs are worth the potential benefits. All of these issues likely contributed to Amazon's decision to scale back the technology in its Amazon Go and Whole Foods stores.

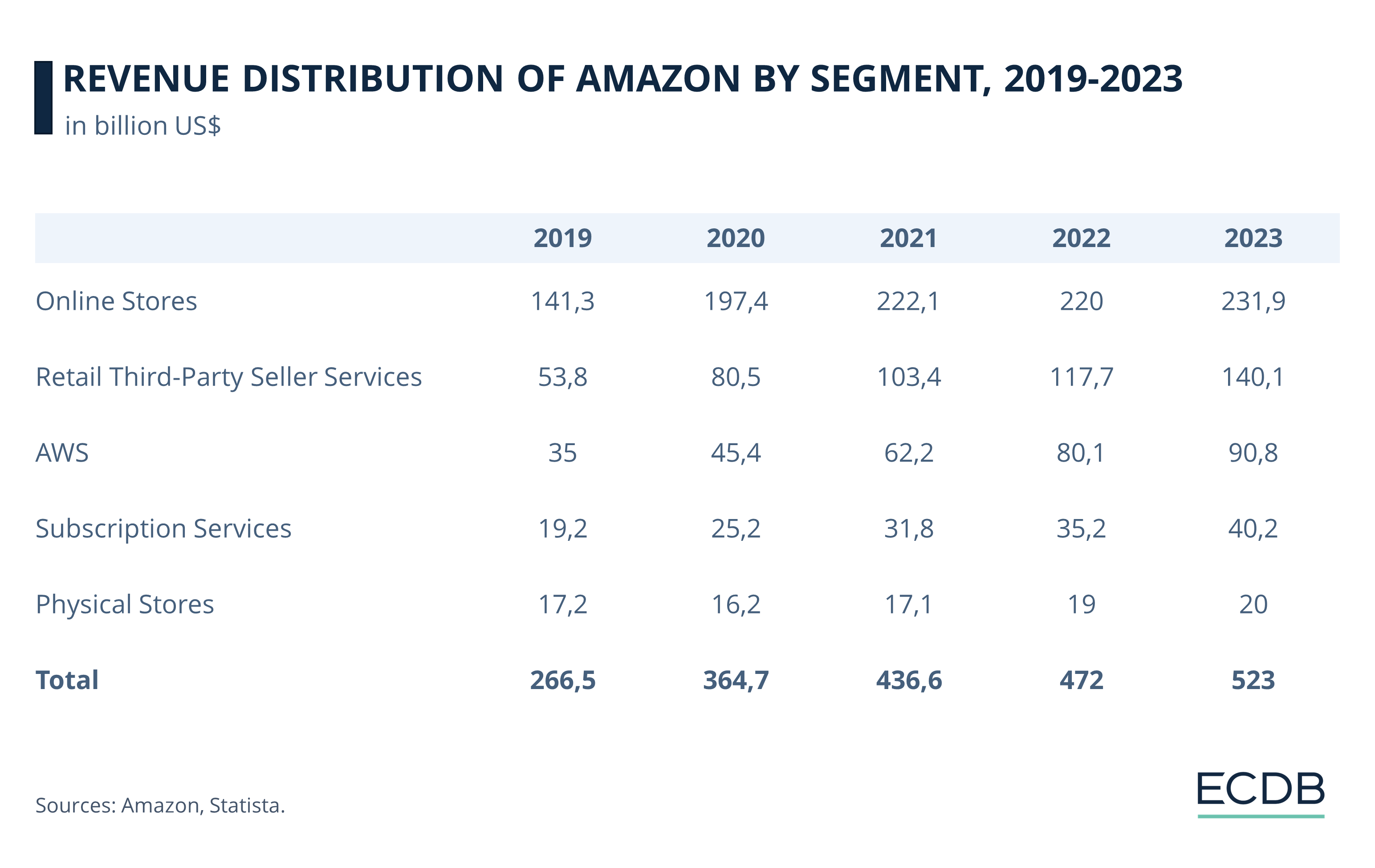

Physical stores account for only a small portion of Amazon's total revenue. In 2023, revenue from physical stores was US$20 billion. Cashierless technology was seen as a differentiator for Amazon's physical store network. Now, however, the Just Walk Out technology is being implemented in other locations. The company has also moved the JWO unit into its cloud computing division.

Amazon's deep pockets allow it to try out new store concepts more freely than startups, which are more dependent on consistent backing. It is a safe bet that cashierless checkout will become the standard in the future. The new industry is going to continue expanding, the question is only which of the many contenders get to participate.

Sources: CNBC: 1 2 – European Data Protection Supervisor – The Spoon

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics