Consumer Responses to Inflation in Germany: An Examination of Household Income and Size

Article by Nadine Koutsou-Wehling | May 30, 2023

Inflation rates in Europe are at levels last seen in the 1970s. The causes are thought to be post-pandemic aftershocks in supply chains and the war in Ukraine, which have disrupted the supply of goods and services. This, combined with increased demand due to the recovery of the post-pandemic labor market, has created a shortage effect that is driving up prices and affecting consumer purchasing power.

Because of its relevance to consumers across Europe, Statista asked online shoppers in Germany how inflation has affected their shopping habits. In addition to previous insights on respondent demographics, we conducted further analysis on the impact of household net income and household size on changes in purchasing behavior due to inflation.

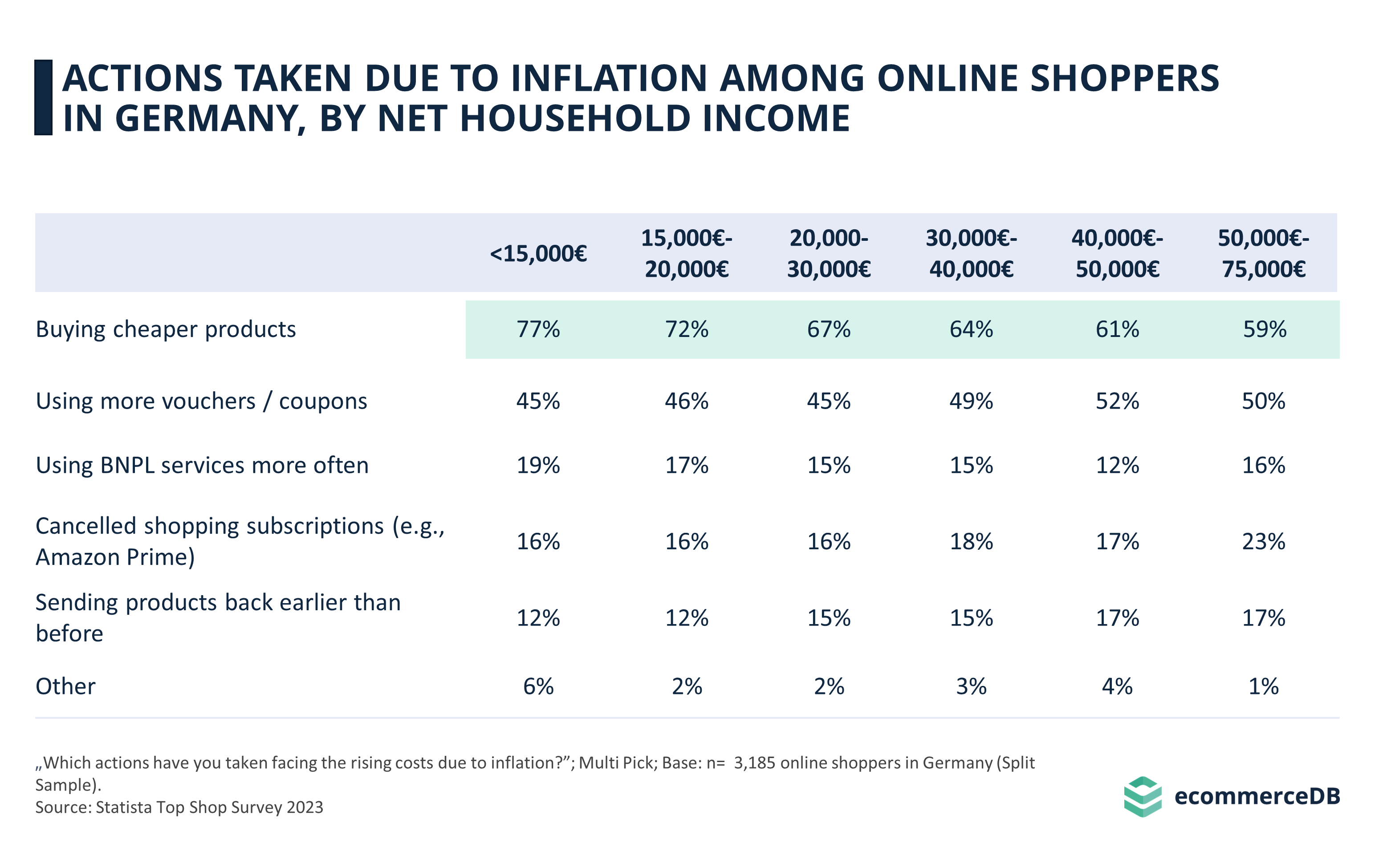

The Lower the Household Income, the More Likely One Is to Buy Cheaper Products and Use Buy Now, Pay Later Services

Beyond buying fewer products due to inflation, which we examined in more detail here, this article discusses the actions that consumers in Germany took in the face of rising prices.

Overall, most consumers reported buying cheaper products, and this response remains the most chosen across all net household income levels. Income is negatively correlated with the propensity to buy cheaper products, meaning that the lower the household income, the more likely respondents are to buy products at lower prices in the face of inflation.

At 77%, online shoppers living in households with a net income below €15,000 are more likely to buy cheaper products than those living in households with a net income above €50,000. The latter said they buy cheaper products less often, with 59%.

Buying less or cheaper products is not the only way consumers cope with the effects of inflation: while the use of vouchers or coupons is similarly popular across all income groups (around 50%), lower-income households are slightly more likely to use BNPL (buy now, pay later) services.

However, the correlation for the BNPL variable is not straightforward either, as the highest income group has the third largest share at 16%.

Along with measures aimed at reducing the immediate weight of purchases, online shoppers also dealt with rising costs by eliminating recurrent charges. This is evidenced by the reaction of cancelling shopping subscriptions, which is positively correlated with net household income.

Users living in households with a net income of up to €30,000 cancel their shopping subscriptions at a rate of 16%, as do 18% of users in households with a net income between €30,000 and €40,000. While this rate decreases slightly for online shoppers with a net household income of up to €50,000, the highest income bracket is the most likely to cancel their subscriptions at 23%.

Linear regression analysis shows that buying cheaper products is the most statistically significant, as it is the only variable with a p-value below 0.05. Household income accounts for 1.4% of the variance in buying cheaper products, giving it a moderate explanatory power.

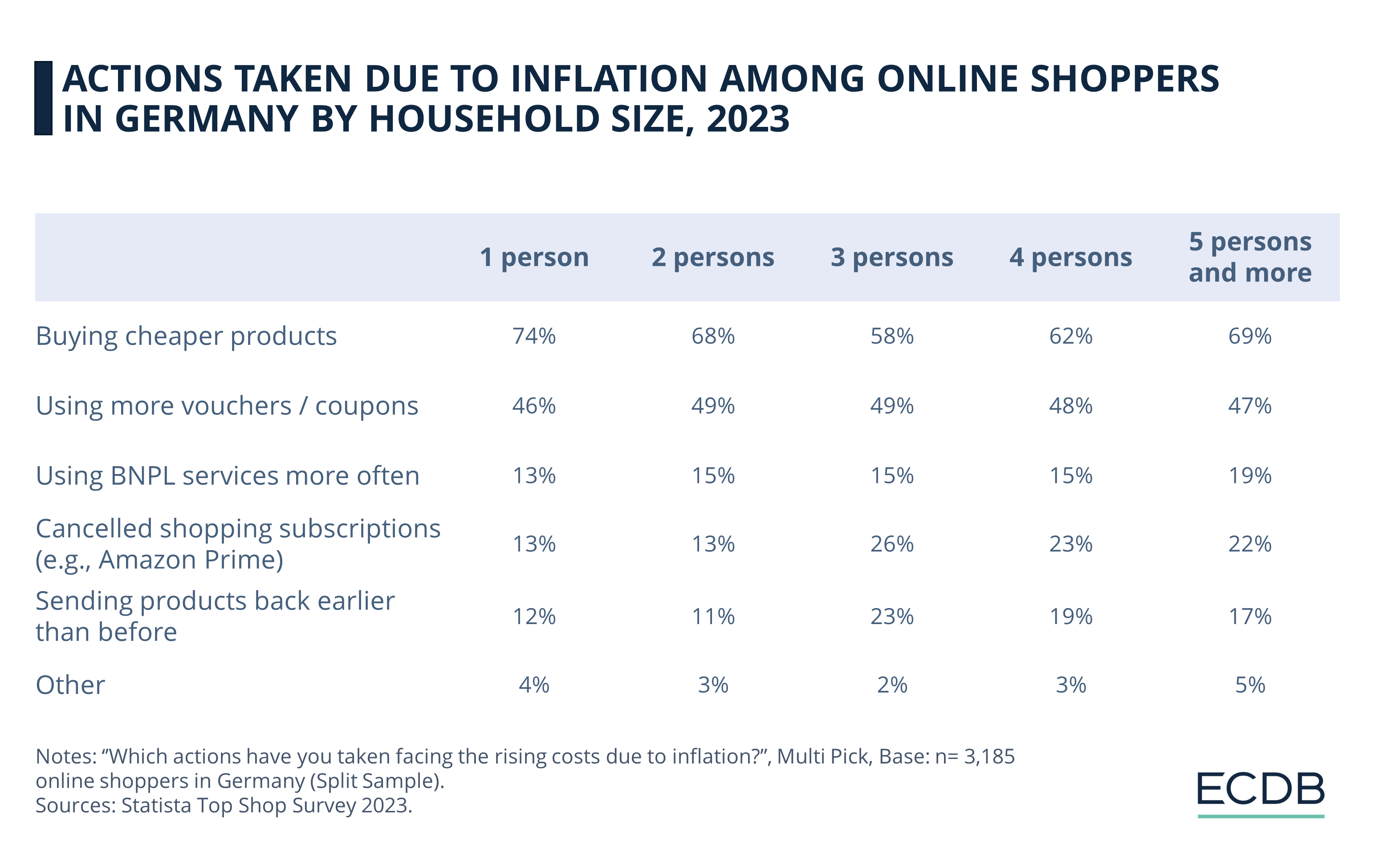

Buying Cheaper Products Is Negatively Correlated With Household Size, the Remaining Responses Produce Different Results

When it comes to household size, the two most common responses remain. There is a negative, but not consistent, correlation between household size and the propensity to buy cheaper products. 74% of users in 1-person households said they did, while 69% of online shoppers who live in households with 5 or more members agreed, followed by 68% of users in 2-person households. Members of 4-person households (62%) are more likely to engage in this activity than those of 3-person households (58%).

While the use of more vouchers does not vary significantly with household size, the remaining three responses are more or less positively correlated with the number of people living in a household.

More specifically, users living in households with 5 or more members tend to use BNPL services the most (19%), while households with 2 to 4 members use it at 15%. Online shoppers in single-person households are the least inclined to use it, at 13%.

Members of 3-person households are most likely to cancel their shopping subscriptions (26%) and return products sooner (23%). Looking at users in other household sizes, those with more members are more likely to take these actions than those with fewer members.

Correlations between household size and all responses except for coupons and BNPL services were found to be significant. Returning products has the highest explanatory power with an R² of 1.6%, followed by cheaper products and cancelling subscriptions, where household size accounts for 0.8% of the variance. It should be noted, however, that there are other factors that contribute to a clearer picture of why consumers feel compelled to take a particular action.

Users Across all Income Levels and Household Sizes Are Most Likely to Buy Cheaper Products and Use Vouchers, While Other Responses Are More Demographically Driven

Statista’s 2023 survey shows that consumers across all income groups and household sizes prefer to buy cheaper products and use vouchers when faced with rising prices due to inflation.

However, patterns emerged when examining the correlations between the responses and the two demographic variables. On the one hand, users with a lower net household income are more inclined to choose lower-priced products and use BNPL services. On the other hand, online shoppers with a higher net household income are more likely to cancel shopping subscriptions and return products earlier.

The size of the household in which users live also affects their purchasing behavior in the face of inflation. More precisely, online shoppers in single-person households tend to buy cheaper products more than those with more household members. The larger the household, the more likely members are to use BNPL. Households with 3 members are most likely to use vouchers, cancel their shopping subscriptions, and return products earlier.

Sources

Related insights

Article

Fashion ReCommerce in the UK: Top Categories, Generational Attitudes, Leading Shops

Fashion ReCommerce in the UK: Top Categories, Generational Attitudes, Leading Shops

Article

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Article

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Article

eCommerce in Indonesia: Market to Reach US$100 Billion Soon

eCommerce in Indonesia: Market to Reach US$100 Billion Soon

Article

Who Is the Average walmart.com Shopper? Customer Base, Purchase Drivers & Consumer Insights

Who Is the Average walmart.com Shopper? Customer Base, Purchase Drivers & Consumer Insights

Back to main topics