Find eCommerce Data: Shopping Events

Cyber Week 2023 in Europe: Data on Online Sales, Consumer Trends & Products

Cyber Week 2023 was an international event that offered online discounts on consumer products, benefiting merchants with increased sales and heightened awareness. How did this event fare in Europe? We have the data on online sales and consumer trends.

Article by Nadine Koutsou-Wehling | January 22, 2024

Cyber Week in Europe: Key Insights

Market Estimates Focus on Relative Numbers: Market analysts calculate that Cyber Week online sales in Europe grew between 7% and 8% year-over-year. Compared to the ECDB's annual European market growth of 5%, this means that Cyber Week outperformed the overall market by 2 percentage points.

Inflation and Consumer Spending: While inflation decreased in 2023, consumer willingness to participate in Cyber Week increased. Overall, this leads to a growth in net consumer demand during this period, which contradicts reports of declining user interest in these holiday shopping events.

Regional Differences in Europe: Germany and the UK are the most lucrative markets for Cyber Week in terms of consumer participation, average spend and average number of orders. Other markets show more diverse preferences.

Cyber Week is a shopping event that takes place at the end of November. It offers deep discounts to shoppers around the world and an opportunity for merchants to increase sales. Coinciding with the holiday season, Cyber Week sales are ideal for gift purchases.

Our previous analysis focused on a recap of Cyber Week in the United States. But how did the event play out in Europe? In addition to sales trends and consumer participation, learn about the differences between European markets, which product categories sold the most, and related consumer trends.

Cyber Week Online Sales Outpaced the European Market

The exact number of Cyber Week sales for 2023 is hard to come by. Market analyses primarily focus on the relative changes that took place from year to year, rather than aggregating the exact sales figures for each European country.

The two most prominent figures found among analysts are a year-over-year increase of 7% by Foxintelligence and 8% by Salesforce. Plotting this fairly accurate range against the information in our ECDB database, which depicts a 5% annual increase in the market in question, we conclude that Cyber Week sales outgrew the overall market in Europe by two to three percentage points.

Cyber Week Europe 2023 & Amazon

Several factors impacted consumer spending patterns during Cyber Week 2023. In particular, the simultaneous occurrence of Amazon Prime Day in October, which preceded Cyber Week, posed a challenge. Although limited to Prime members, the close timing of these events may have negatively impacted consumer spending. Foxintelligence's market research supports this notion, revealing a 23% year-over-year increase in sales during Prime Day in October, as opposed to the more modest 7% growth seen during Cyber Week.

Additionally, macroeconomic indicators, such as the substantial decrease in inflation from 2022 to 2023, impacted consumer spending. This decline resulted in lower prices, ultimately enhancing consumer purchasing power. With reduced inflation, consumers could afford more goods for their money. Furthermore, the lower inflation rates in the Eurozone (at around 3%) indicated that the 7% growth in value sales during Cyber Week stemmed from increased consumer spending, rather than price hikes.

Another factor contributing to rising sales during Cyber Week in Europe has to do with increased consumer participation.

More Online Shoppers Participated in Cyber Week 2023

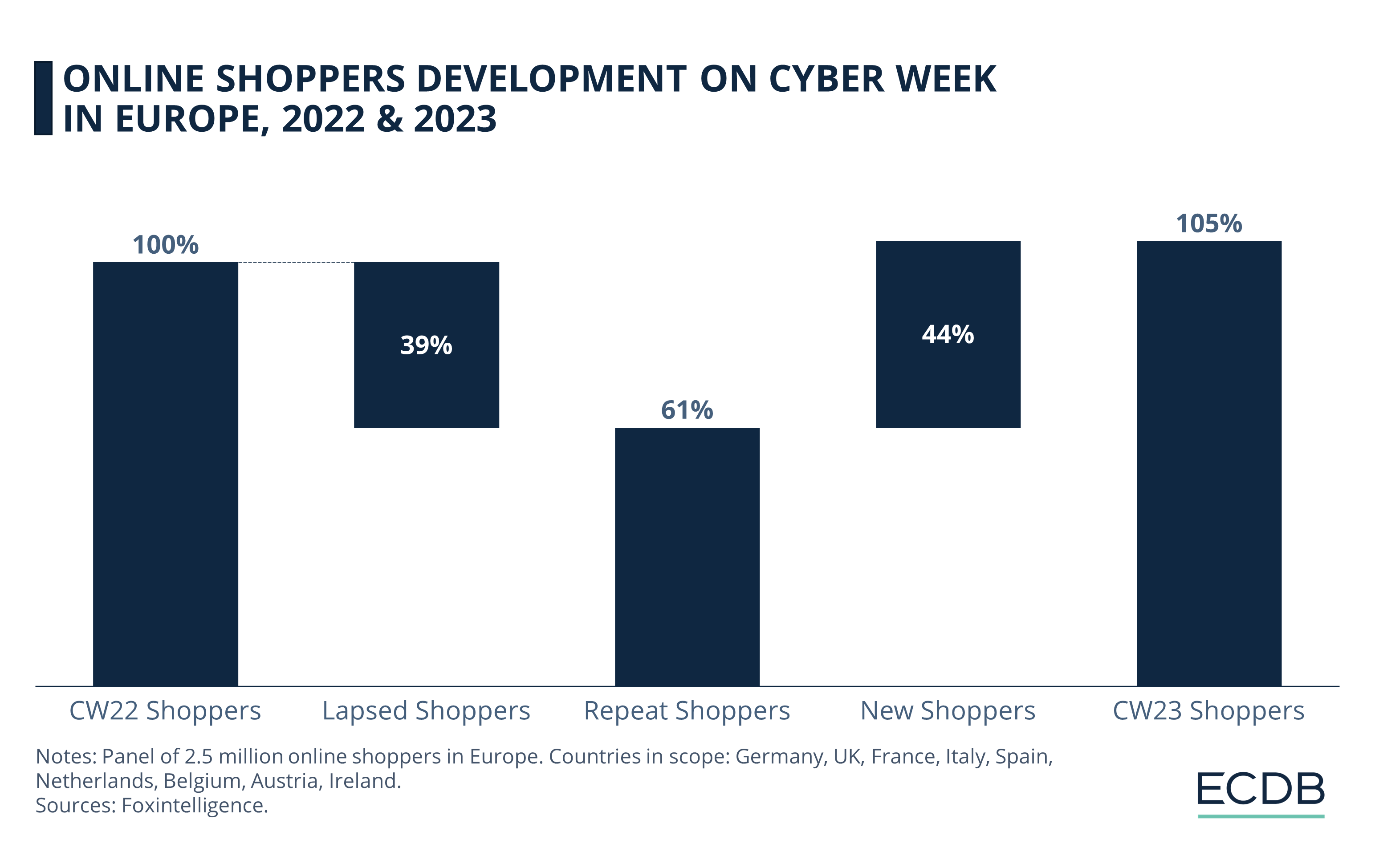

Foxintelligence conducted a comparative analysis of Cyber Week participation between 2022 and 2023. Starting with the baseline of shoppers in 2022 (100%), 39% of those shoppers did not participate in 2023, resulting in a 61% repeat purchase rate during Cyber Week in 2023.

In addition, 44% of new shoppers who did not purchase during Cyber Week in 2022 participated in 2023. This ultimately resulted in a total online shopper participation rate of 105% during Cyber Week 2023.

The fact that 5% more online shoppers made purchases during Cyber Week, coupled with Foxintelligence's calculation of a 2% increase in overall consumer spending, contributed to a 7% growth in value added during Cyber Week 2023 compared to the previous year.

Interestingly, this suggests that despite some skepticism about the Week’s relevance, consumers in Europe continued to engage in holiday shopping during this period and took advantage of discounts for their personal shopping needs.

Cyber Week 2023: Highest Average Participation in Europe

Measuring consumer willingness to partake in Cyber Week over time shows us the overall user sentiment towards the shopping event. With recent reports and social media posts calling attention to misleading discounts, it is clear that some retailers are resorting to artificially inflating base prices to create the illusion of higher discounts than they are actually offering.

Despite this, consumer participation increased during Cyber Week. Foxintelligence's data underscores this trend:

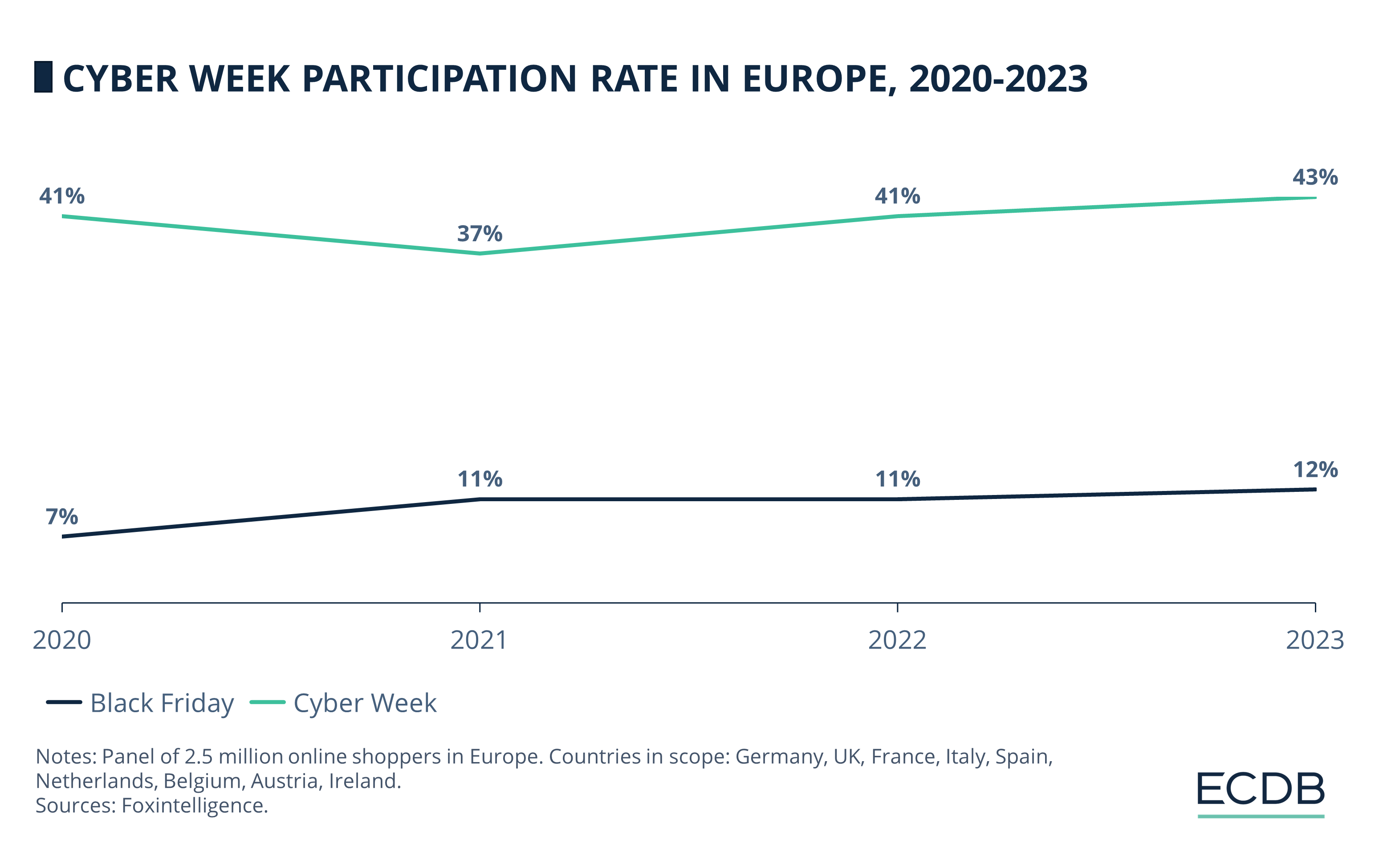

Consumer data from online shoppers in Europe shows that Cyber Week participation dropped from 41% in 2020 to 37% in 2021.But Black Friday participation increased from 7% in 2020 to 11% in 2021.

During lockdowns, when many people didn't have jobs and money was locked, lots of shoppers didn't care about discounts. They didn't buy holiday gifts or non-essential products.

After 2021, however, Cyber Week participation in Europe increased again. This is particularly evident in the 4-percentage point increase in 2022, resulting in an overall share of 41%.

Accordingly, participation rates during Cyber Week 2023 reached new heights following the pandemic. With 43% of online shoppers in Europe participating, this represents an increase of 2 percentage points year-over-year and an increase of 6 percentage points since 2021. Black Friday itself also saw a slight increase year-on-year, and an overall growth of 5 percentage points since 2020.

Highest Sales in Germany and the UK

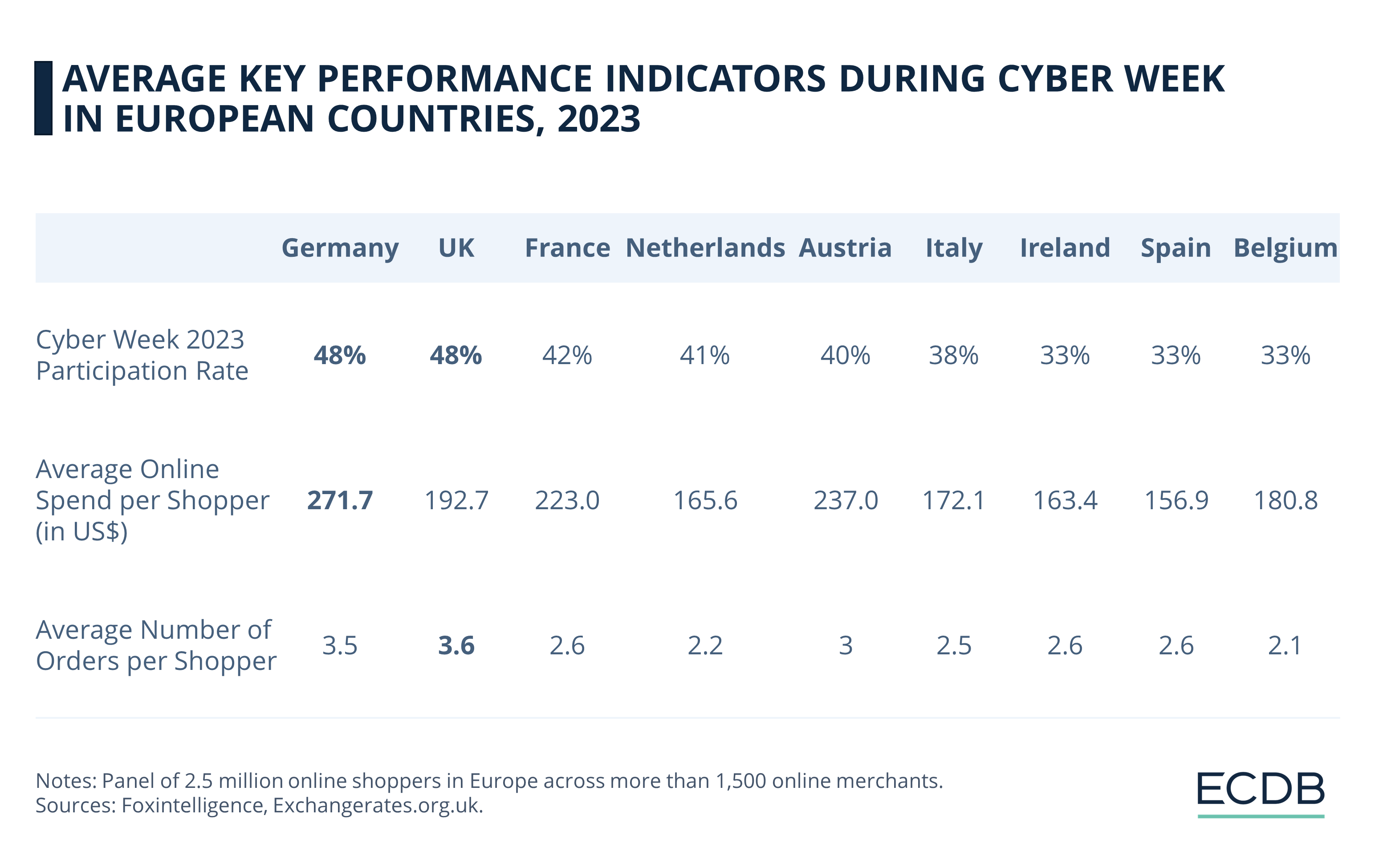

An analysis of key performance indicators (KPIs) across European countries shows that the most lucrative markets for Cyber Week 2023 were Germany and the UK:

Not only does Germany have the highest participation rate at 48% of online shoppers (tied with the UK), it also has the highest average spend per online shopper at US$271.7. This is followed by Austria (US$237) and France (US$223).

However, the UK leads in the average number of orders placed by each shopper during Cyber Week 2023, at 3.6. Germany is next at 3.5, followed by Austria at 3.

Ireland, Spain and Belgium have the lowest participation rates with 33% each. However, Belgium has a relatively high average spend per online shopper (US$180.8) with a lower average number of orders (2.1). Consumers in Ireland and Spain are willing to order more (2.6 each), albeit at a lower total spend: Online shoppers in Ireland have an average online spend of US$163.4, while shoppers in Spain indicate the lowest average online spend at US$156.9.

It is natural that on a continent such as Europe, different countries have different economic conditions, consumer sentiments and shopping habits. This statement also plays a role when it comes to the most popular product categories during Cyber Week 2023 in Europe.

Fashion and Electronics Sold Best During 2023 Cyber Week in Europe

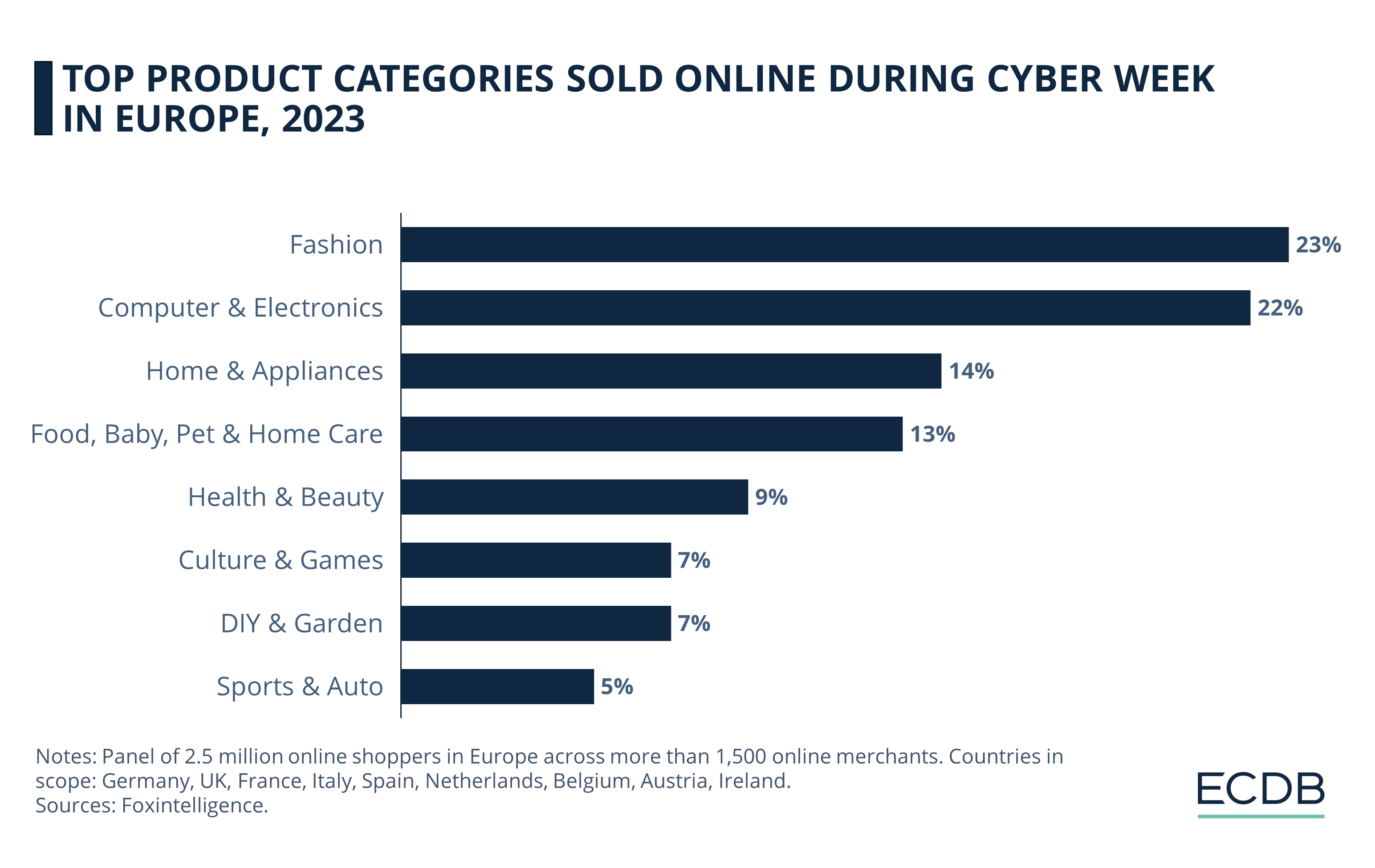

Looking first at the average value of popular product categories among the European countries observed, one can see that fashion and electronics are leading the way:

23% of products purchased by consumers in Europe during Cyber Week belonged to the fashion category. Close behind was electronics, which accounted for 22% of product categories sold during the period.

On a country-by-country basis, fashion was sold best in Belgium and Ireland (27% each), while France had the lowest share of fashion sales at 18%. For electronics, Spain was the market where this category sold best during Cyber Week at 30%, while Ireland and the UK had the lowest shares at 17% each.

Home and Appliances: Most Sold in Germany

Moving down the rankings, we see that home and appliances accounted for 14% of Cyber Week sales, followed by food, baby and pet products, as well as home care at 13%.

In terms of countries where home and appliances performed best, Germany had the highest rate (17%), while France and Austria both reached a 16% share. At the lower end of the spectrum for home and appliances sales are the Netherlands (11%) and Spain, Belgium, and Ireland at 13%.

The range for food, baby, pet and home care is more diverse, reaching from 22% in the Netherlands and 20% in France, down to 6% in Austria and 7% in Germany.

Ireland Is the Most Lucrative Market for Health and Beauty Products

Health and beauty products accounted for an average of 9% of sales in Europe, with Ireland being the strongest market (11%) and France the weakest (6%).

At the bottom of the list is culture and games, tied for last place with DIY and garden products at 7% of sales. Finally, sports and auto ranked last with 5%.

For culture and games, Germany, Austria, and Italy had the highest share of sales at 8% each. On the other hand, France and Ireland saw the lowest sales share in this category, at 6%. Similarly, Austria and Germany ranked best for DIY and Garden (9% each), while the opposite holds true for the Netherlands (4%) and Ireland (5%).

The worst performing category overall was sports and auto, which was sold best in Germany (7%), with the Netherlands coming in last with only 2% of total sales.

ECDB: Find Out About Our Company

Cyber Week 2023 in Europe: ECDB Thoughts

Consumer spending patterns and preferences during Cyber Week are as diverse as the European market itself. Cyber Week 2023 can be considered a success, as it achieved a 7% year-on-year sales increase, surpassing the European market's overall annual online sales growth by 2 percentage points.

Despite growing skepticism about the credibility of discounts, which some retailers manipulate to make price reductions appear larger than they are, consumer participation increased after the pandemic. This suggests that there is a continued interest among consumers in these shopping events.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics