eCommerce: Shipment Providers

FedEx Expands Chinese eCommerce Delivery Service to U.S. and Europe

FedEx expands its International Connect Plus service to include destinations in Europe and the U.S., having been formerly only available in the Asia-Pacific region. The move is expected to significantly reduce current delivery times.

Article by Nadine Koutsou-Wehling | August 07, 2024

FedEx Expands International Service: Key Insights

Expanding FedEx International Connect Plus: Formerly just available within the Asia-Pacific region, FedEx now offers a delivery service for Chinese sellers to include destinations in Europe and the U.S. to arrive in 2-3 business days.

Growing Demand for Chinese Products: Pioneered by Shein and Temu, larger retailers in the U.S. and Europe are following the strategy to source a growing number of low-cost products from Chinese factories. The FedEx service will help significantly reduce delivery times.

FedEx is expanding its cross-border service for eCommerce merchants in China, Hong Kong and Japan to encompass destinations in the U.S. and Europe. The service, called FedEx International Connect Plus (FICP), has been widely available to sellers within the Asia-Pacific region, typically delivering packages within 2-3 business days. The expansion of destinations to Europe and the U.S. would significantly reduce current delivery times.

Growing Cross-Border Demand for Products Sourced in China

The new expansion move responds to the growing cross-border demand for shipments in China to be delivered to European and U.S. markets, which has been driven on a larger scale by players like Temu and Shein. Now that Amazon has announced the launch of a discount segment on its own platform, demand for products from China to the U.S. and Europe is likely going to increase further.

FedEx’s Service Would Reduce Delivery Times

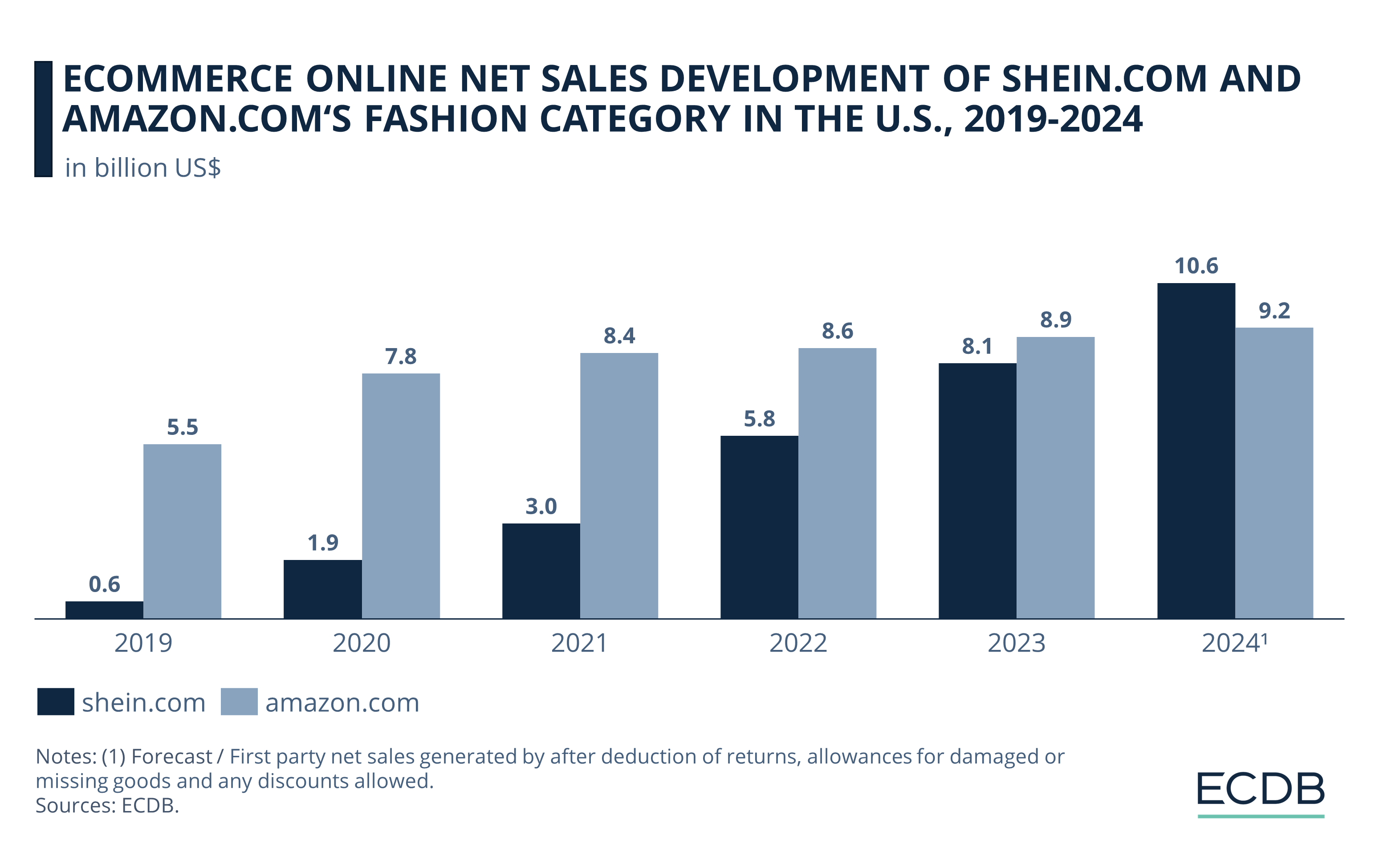

Initially, Amazon stated that delivery times would range from 9 to 11 days, a period that is expected to be significantly reduced with the expansion of FedEx's service. Amazon's decision to introduce the discount segment is consistent with Shein's success in global markets, as evidenced by Shein’s expected lead over Amazon in U.S. fashion eCommerce.

Amazon’s move comes at a time when its market leadership is being chipped by low-cost competitors with a strategy that leverages the C2M model and factories in China to undercut most other manufacturers’ prices. Shein is one of the most prominent examples. Temu is another retailer with a comparable strategy. While longer delivery times have so far been a downside of ordering from these providers, the new FedEx service could turn this aspect into a competitive advantage.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

Sources: FedEx: 1 2 – Parcel and Postal Technology – Reuters – Supply Chain Dive

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics