Food Delivery App Downloads Decline in 2022 After the COVID Boost

Article by Cihan Uzunoglu | May 16, 2023

Download

Coming soon

Share

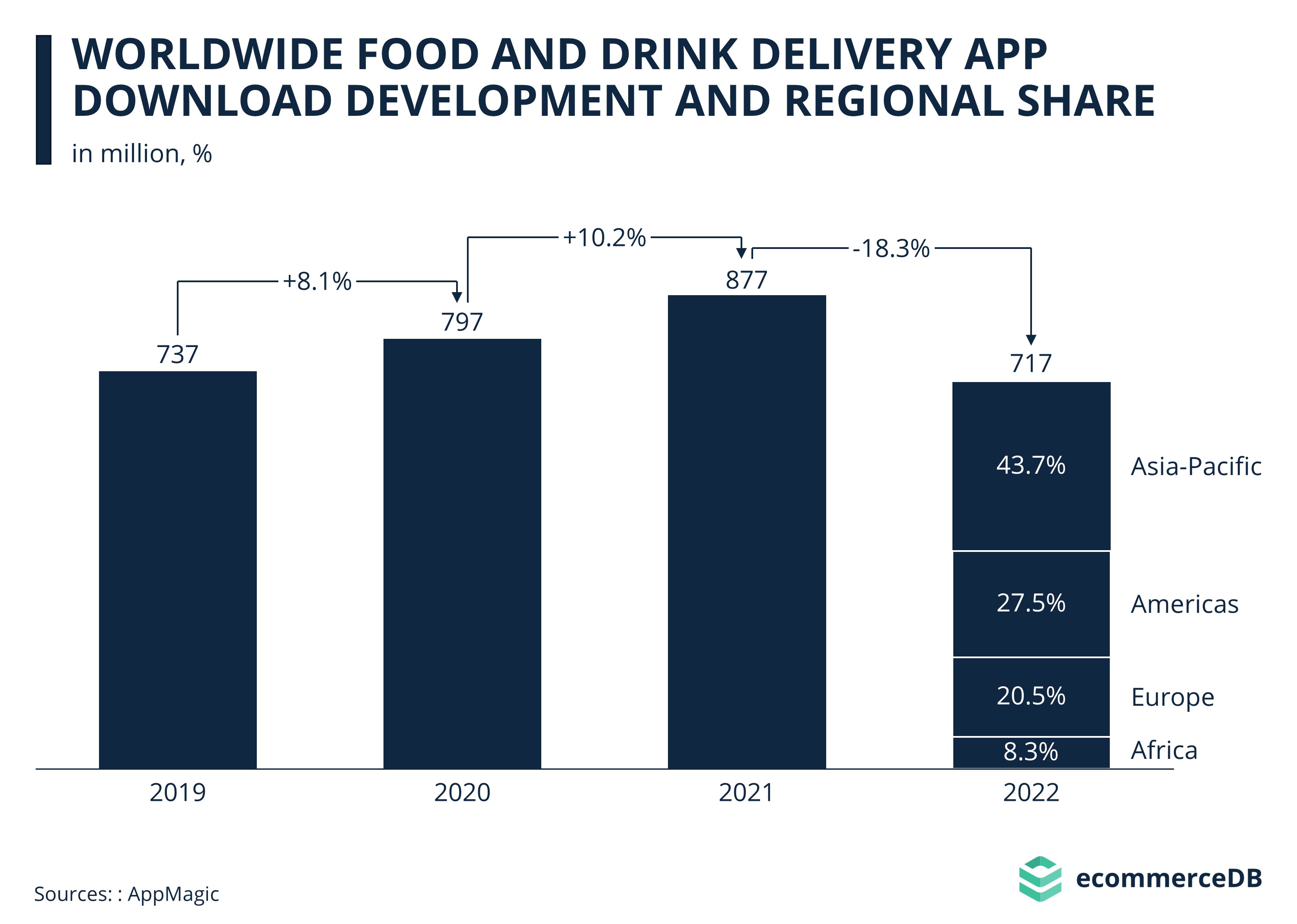

Food and drinks have long been among the smaller segments of the global eCommerce market – and they still are: With combined global eCommerce revenues of US$480 billion in 2022, the market segment food and drinks can still not compete with segments like electronics (US$760 billion), fashion (US$849 billion) or toys, hobby & DIY (US$700 billion), according to Statista Digital Market Insights. However, the Covid-19 pandemic led to an unprecedented boost in revenues from online grocery sales, resulting in YoY growth rates of 44% for beverages and as much as 56% for food in the first pandemic year 2020, and similarly high double-digit growth in 2021. In 2022, when other segments registered declining online revenues, the groceries segments were able to stay on the growth tracks. Together with meal delivery, the online groceries market is a strongly app-focused business, serving customers in a quick and convenient way. Accordingly, the popularity of delivery apps in the food and drinks segment also rose remarkably over the pandemic years:

As the demand for online meal and grocery delivery surged from 2020 through 2021, the global number of app downloads in the segment rose as well, from a total of 737 million in pre-pandemic 2019 to 877 million in 2021. This corresponds to an absolute growth of 19% between 2019 and 2021. When comparing year-on-year growth, it turns out that 2021 was even a little stronger than 2020, with a year-on-year download growth of 10% (8% in 2020). 2022 then saw a significant decrease in the global number of food and drink delivery app downloads of -18% to 717 million. On the one hand, this reflects the general slowdown that eCommerce in general, and the food segments in particular, experienced in 2022. Global eCommerce revenues stagnated while order volumes went down. On the other hand, a slowdown in app downloads is also to a certain extent logical – as a download is a one-time event, once a majority of people have an app installed, the number of downloads must go down – and the decline in download numbers does not say anything about the use of the apps. A look at the regional breakdown of the download figures reveals that all analyzed regions experienced a decline – both app-savvy regions like Asia-Pacific and emerging regions like Africa. Asia-Pacific and the Americas were responsible for the bulk of food and drink delivery app downloads in 2022 – accounting for seven out of ten app downloads globally. With -25% respectively -19%, the two regions also registered the strongest year-on-year decline. The region with the smallest decline is Europe. With 155 million in 2021 and 153 million in 2022, the number of downloads of food and drink delivery apps remained almost stable in Europe.

Related insights

Article

Video Games Market in 2024: Market Revenues, Segments, Regions & Top Companies

Video Games Market in 2024: Market Revenues, Segments, Regions & Top Companies

Article

Top Amazon Rivals: The Tech Giant’s Biggest Competition

Top Amazon Rivals: The Tech Giant’s Biggest Competition

Article

Top 10 Online Stores in the U.S: Amazon Sold More Than All Other Top 5 Stores Combined

Top 10 Online Stores in the U.S: Amazon Sold More Than All Other Top 5 Stores Combined

Article

Prada & Prada Beauty Analysis: Business Model and Global Net Sale

Prada & Prada Beauty Analysis: Business Model and Global Net Sale

Article

UK Fashion Market: Brands ASOS and Boohoo Under Scrutiny For Greenwashing

UK Fashion Market: Brands ASOS and Boohoo Under Scrutiny For Greenwashing

Back to main topics