eCommerce: Grocery Market

Grocery Retailers Face Online Channel Profitability Challenge

Ordering groceries online is another addition to our lives brought on by the pandemic. But how sustainable and profitable is this business?

Article by Cihan Uzunoglu | August 07, 2024Download

Coming soon

Share

Challenges in Online Grocery Profitability: Key Insights

Labor Challenges: The surge in online grocery sales during COVID-19 has led to a 125% increase in labor requirements compared to traditional shopping, posing profitability difficulties for grocery retailers.

Continued Investment: Despite staffing shortages and rising wages, grocery retailers continue to invest in labor-intensive online services, with the online grocery market share projected to grow to 8.3% by 2028.

Strategies for Profitability: To improve online grocery profitability, retailers should enhance efficiency, invest in automation technologies, optimize delivery models, personalize shopping experiences, and implement sustainable practices like recyclable packaging and optimized delivery routes.

Online grocery shopping has surged with the COVID-19 pandemic, becoming one of the fastest growing categories in eCommerce, but it remains a costly and labor-intensive endeavor for retailers. Managing this growing yet unprofitable channel is a significant concern for grocery stores.

Grocery retailers are grappling with how to handle the growing online channel, which is popular among a segment of their customers but remains highly unprofitable. Let's look at ways to turn this around based on recent research.

A Popular and Growing Channel

According to U.S. Census Bureau data, online retail sales jumped from 12% in Q1 2020 to 18% in Q2 2020, with much of this growth in grocery. However, the online grocery sales growth brought by the COVID-19 also came with challenges.

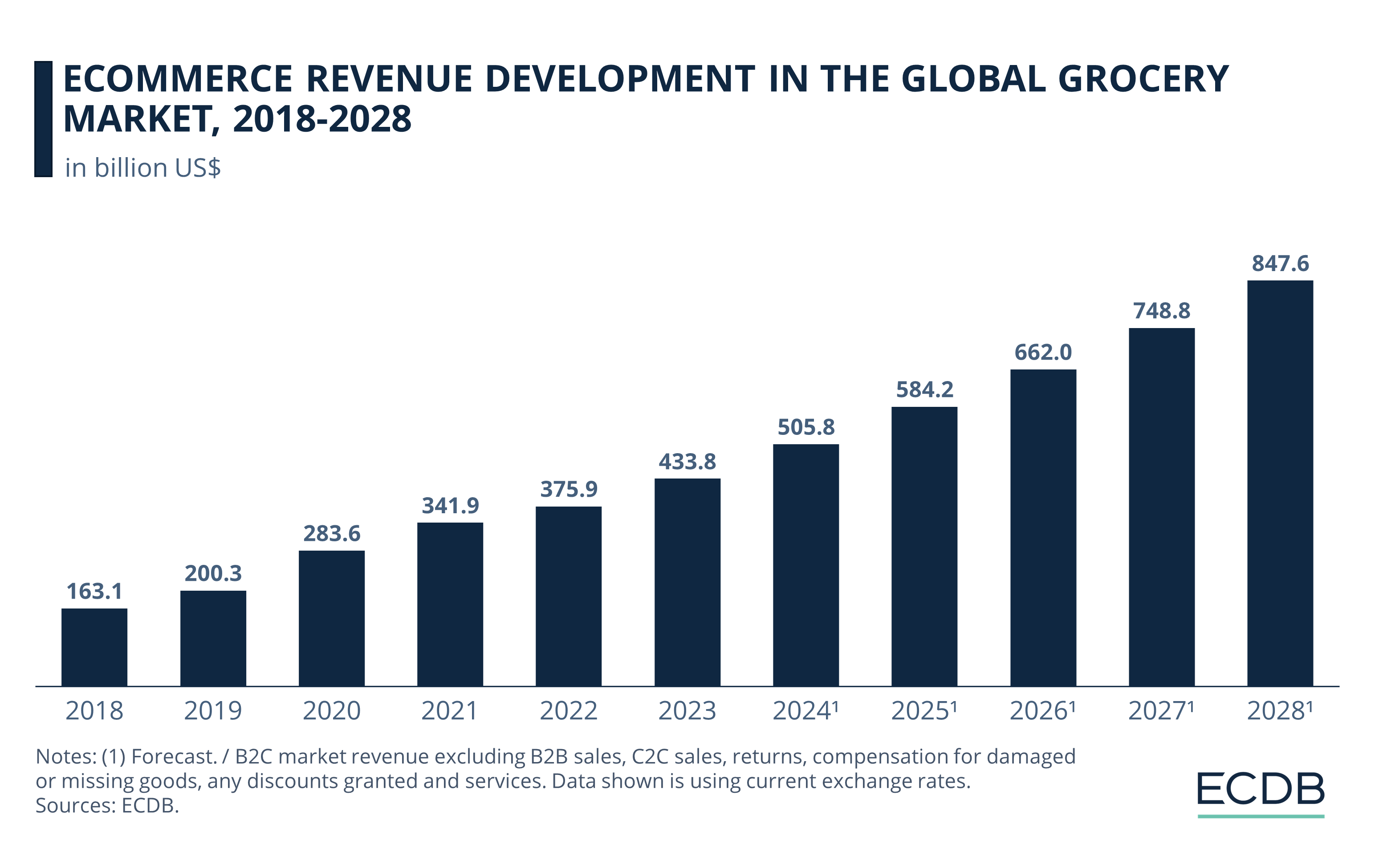

Valued at US$200 billion before the pandemic, the online grocery market grew by 41% in 2020 and reached US$283 billion. The market closed last year at US$433 billion and is forecast to break the US$500 billion mark this year.

A study showed online grocery requires 125% more labor than traditional shopping due to double-handling: moving products onto shelves and then picking and delivering them. Grocery retailers now face the challenge of managing this low-margin yet growing channel.

An Unsustainable Approach

Grocery retailers globally are struggling with staffing shortages and rising wage bills. Despite these challenges, they continue to invest in labor-intensive online grocery services.

We expect that the online share of the total grocery market will grow in the close future:

While this share was 2.7% in 2019, it increased to 4.7% by the end of 2021.

After falling to 4.4% the following year, the online share picked up again and closed 2023 at 4.8%.

Our forecasts show that this share will reach 5.5% by the end of this year and 8.3% by 2028.

A study with West Monroe Partners revealed that different delivery modes significantly impact labor requirements, with home delivery from store sales floors needing the most additional time (37.4 minutes) compared to the base case of 30 minutes for in-store shopping.

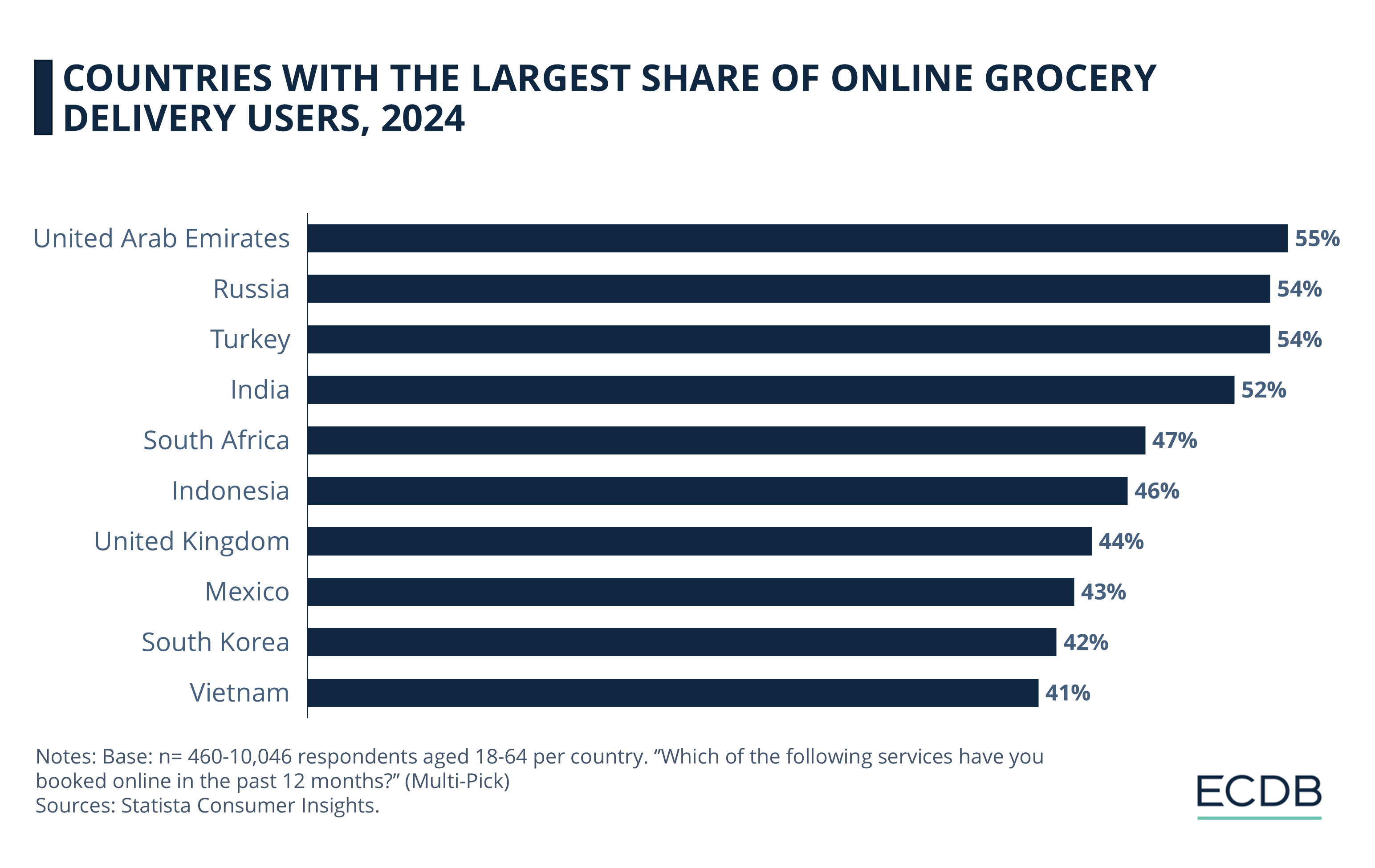

Among the top countries with the largest share of online grocery delivery users, the UAE, Russia, Turkey and India lead the way, with the majority of respondents in these countries using the service.

Traditional in-store customers are effectively subsidizing online grocery services, as retailers rarely charge for the additional labor involved in order preparation and delivery. This model is unsustainable as wage rates continue to rise.

How to Improve Online Grocery Profitability

To address the profitability issues of the online grocery channel, retailers need to adopt new strategies that can balance customer convenience with operational efficiency.

1. Enhancing Online Efficiency

Walmart’s Market Fulfillment Centers (MFCs) collocate with hub stores, enhancing efficiency for curbside pickup by leveraging automation and economies of scale, which significantly reduce labor costs and increase profitability.

2. Leveraging Technology and Automation

Investing in advanced technologies such as automated warehouses and robotic picking systems can speed up order fulfillment, minimize errors, and lower operational costs.

3. Optimizing Delivery Models

Retailers can partner with third-party delivery services and utilize gig economy workers to manage peak times, while offering various delivery options like scheduled deliveries or subscriptions to spread out workload.

4. Personalizing Online Shopping Experiences

Using data analytics for personalized recommendations and targeted promotions can create a more engaging shopping experience, driving customer loyalty and increasing average order value.

5. Implementing Sustainable Practices

Integrating eco-friendly practices such as recyclable packaging and optimized delivery routes can attract environmentally conscious consumers and differentiate the retailer in a competitive market.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

Future of Online Grocery and Quick Commerce: Closing Thoughts

The online grocery and quick commerce sectors have grown rapidly, driven by the pandemic. Getir's retreat to Turkey and Uber Eats' steady growth highlight the challenges of profitability and scalability.

In the next 5 to 10 years, market consolidation will arguably favor established players like Amazon, Walmart, and Uber Eats, which benefit from diversified offerings and strong infrastructure. In this context, regional differences and consumer preferences will shape which providers succeed.

The pandemic has cemented the popularity of online grocery shopping, and its growth is expected to continue, adapting to changing consumer demands and technological advances.

Sources: Harvard Business Review, U.S. Census Bureau, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Keeta in Saudi Arabia: Meituan to Expand Online Food Delivery Market

Keeta in Saudi Arabia: Meituan to Expand Online Food Delivery Market

Deep Dive

Online Grocery Prices in the United States See Record Drop

Online Grocery Prices in the United States See Record Drop

Deep Dive

Meituan Reports Strong Revenue and Profit Growth in the Second Quarter

Meituan Reports Strong Revenue and Profit Growth in the Second Quarter

Deep Dive

Jow Interview: Unique Approach in Quick Commerce, Growth & Challenges

Jow Interview: Unique Approach in Quick Commerce, Growth & Challenges

Deep Dive

Delivery Hero Leads the Booming Food Delivery Sector

Delivery Hero Leads the Booming Food Delivery Sector

Back to main topics