eCommerce: Meituan

Meituan Reports Strong Revenue and Profit Growth in the Second Quarter

China's economy is currently facing some economic challenges, with a high rate of deflation leading to low prices and discounted products. Meituan has managed to profit from this and is reporting strong revenues for Q2 – what's behind this development?

Article by Antonia Tönnies | August 29, 2024Download

Coming soon

Share

Meituan Revenue: Key Insights

Strong Revenue Growth: Meituan reported a 21% increase in second-quarter revenue to 82 billion yuan, driven by strategic investments.

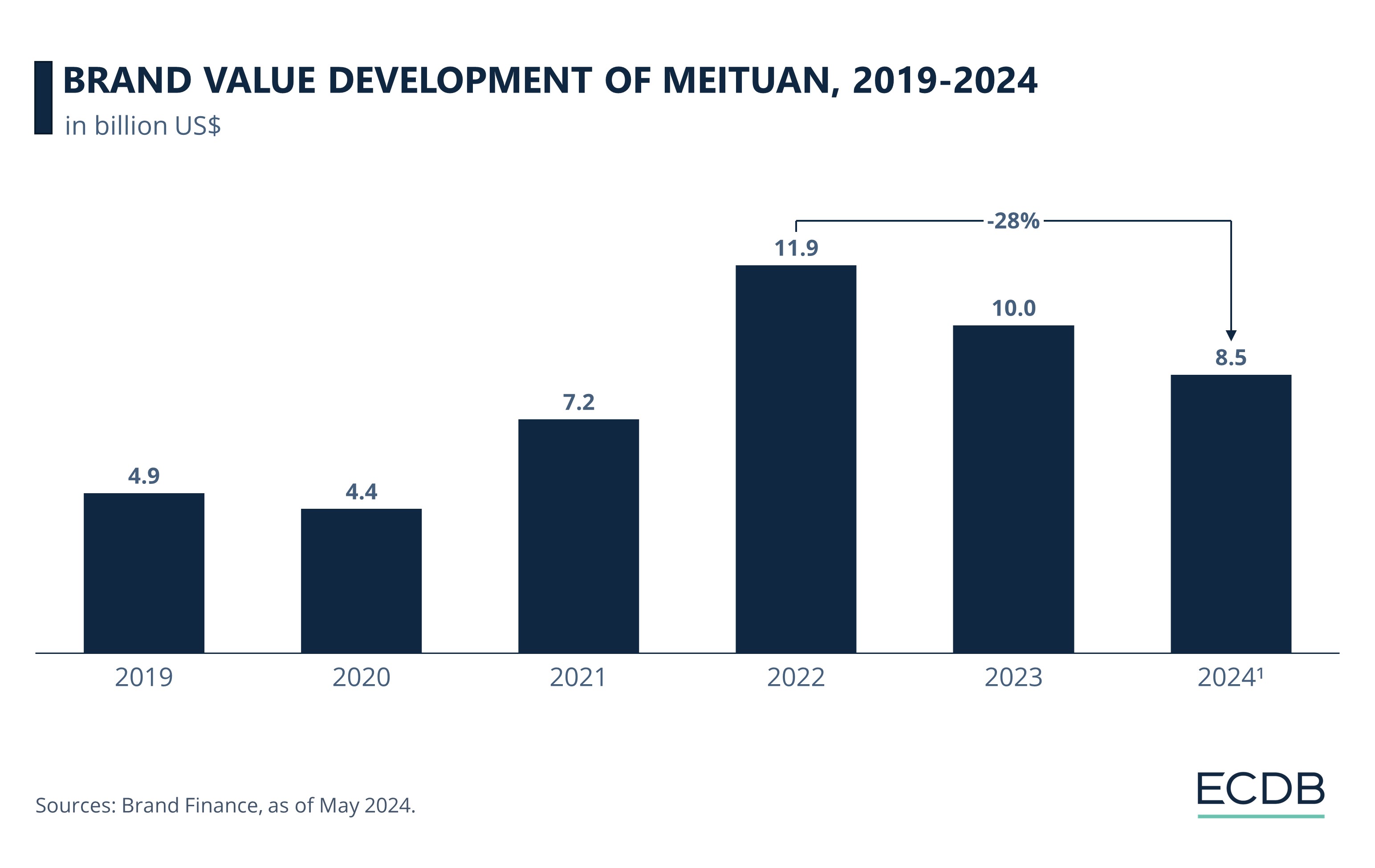

Declining Brand Value: Despite financial growth, Meituan's brand value declined from a peak of US$11.9 billion in 2022 to a projected US$10 billion in 2023.

Expanding Product Range: Meituan expanded its product offerings through partnerships with major brands like Midea and LEGO, diversifying beyond food delivery to attract a broader customer base.

Meituan, China’s largest on-demand service provider, reported a robust 21% increase in second-quarter revenue, reaching 82 billion yuan (US$11.5 billion). The company also saw a significant profit surge, with earnings in Q2 jumping by 142% from 4.7 billion yuan (US$660 billion) to 11 billion yuan (US$1.5 billion).

This growth was driven by strategic investments in the company and Meituan Instashopping, delivering goods within hours. The company has thus strengthened its competitive edge against rivals such as Alibaba's Ele.me and ByteDance's Douyin – we provide you the details.

Brand Value Declines as Meituan's

Revenue Rises

Meituan attributed the increase to operational improvements and an increased focus on "value-for-money" offerings. The core local commerce segment, comprising food delivery, hotel and travel bookings, and merchant marketing services, saw revenue increase by 18.5% to 60.7 billion yuan (US$8.5 billion). Looking at the development of Meituan's brand value, the picture is less rosy:

Between 2019 and 2022, the company's brand value soared by 142%, from US$4.9 billion to US$11.9 billion.

After peaking in 2022, the value began to decline from US$11.9 billion to US$10 billion.

In 2024, Brand Finance identified a further decline to US$8.5 billion for the Meituan brand.

In addition, Meituan's Hong Kong-listed shares fell by 3.2% to HK$102.8 (US$13.8) ahead of the earnings announcement. This comes amid internal restructuring efforts to streamline operations and consolidate its software and hardware businesses under a new unit, and to rebrand its overseas business as Keeta.

Meituan Revenue: From Food Delivery

to All-Rounder

In a strategic move to expand its product offerings, Meituan recently partnered with home appliance giant Midea, as well as brands such as LEGO, Apple resellers, Mars, Decathlon, and Suning.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

This strategy aims to diversify Meituan's product range and convert food delivery users into broader buyers within its ecosystem.

Sources: South China Morning Post, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Wayfair’s Shopping Way Day: Analysis & Market Insights

Wayfair’s Shopping Way Day: Analysis & Market Insights

Deep Dive

Inside Apple Revenue: Latest Sales Figures and Key Insights

Inside Apple Revenue: Latest Sales Figures and Key Insights

Back to main topics