eCommerce: Online Food Delivery Insights

Online Food Delivery: Market Development, Top Online Stores & Revenue

The global online food delivery market is facing a slowdown in growth, but the market is still evolving. Learn more about the top stores and their sales revenues.

April 18, 2024Download

Coming soon

Share

Online Food Delivery: Key Insights

Expanding Online Food Delivery Market: By 2028, the global online food delivery market is projected to reach a valuation of US$1.79 trillion, with significant shifts in the rankings of countries. Notably, India is anticipated to become the third largest market by 2026.

Increased Revenue from Grocery Delivery: Grocery delivery services report a higher Average Revenue Per User (ARPU) compared to meal delivery services. This difference is primarily attributed to the bulk nature of grocery purchases versus the smaller, more frequent orders typical of meal deliveries.

Global Presence of Uber Eats: In the fiercely competitive online food delivery sector, Uber Eats has broadened its global reach through strategic acquisitions and partnerships. Despite Uber Eats' international expansion, local enterprises continue to lead in regions such as North America and Asia, where market dynamics show considerable regional variation.

Online Food Delivery: Global Market to Reach US$1.65 Trillion by 2027

Data from Statista Market Insights shows that the global online food delivery market is estimated to have hit the US$1 trillion mark in 2023. With a CAGR (2024-2028) of 10%, the projected volume will expand further to reach US$1.79 trillion by 2028.

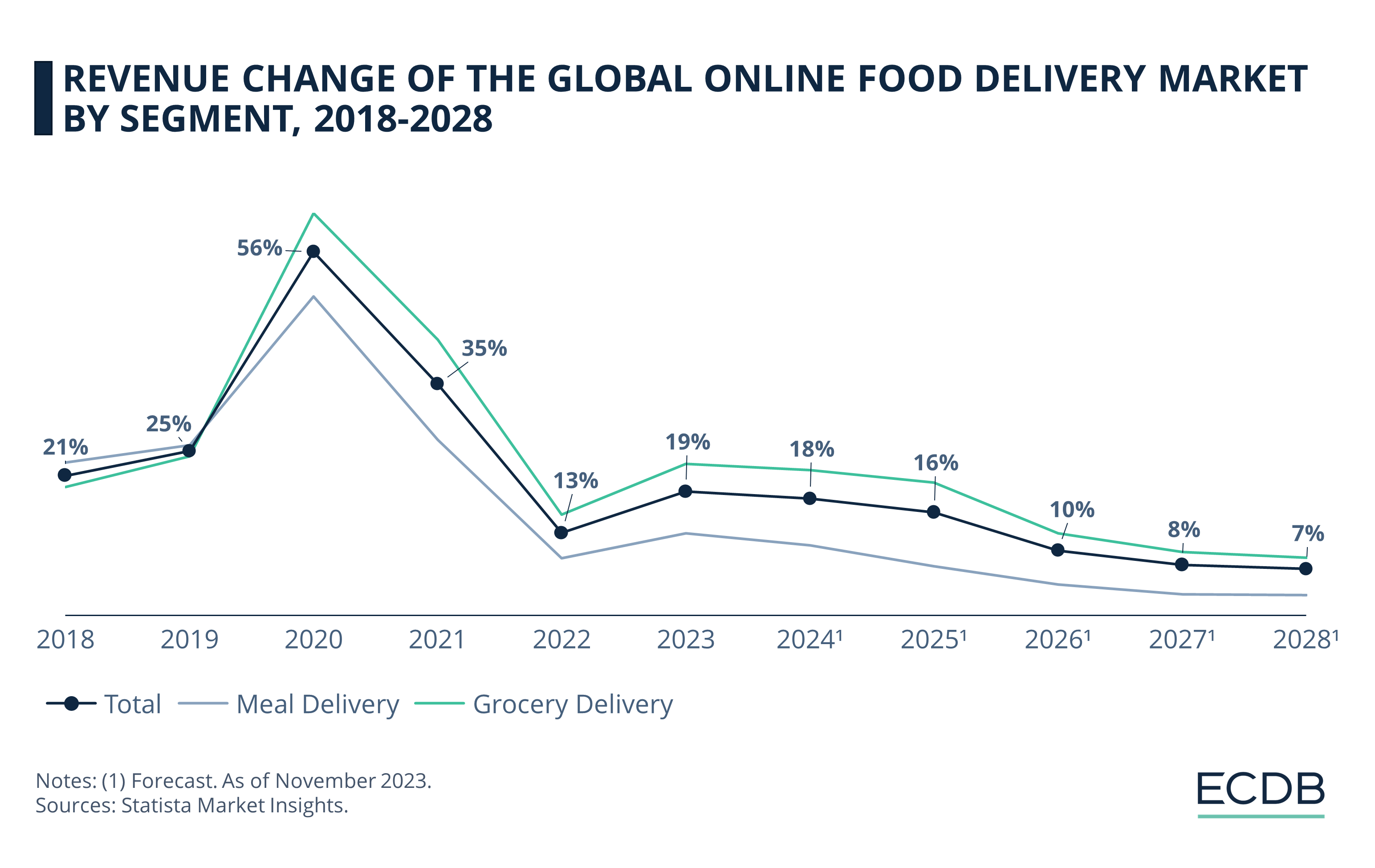

The market has exhibited a significant shift in revenue growth over the years. In 2019, total market growth was an impressive 25%. Propelled by the increased demand for online deliveries amid the pandemic, 2020 saw a remarkable surge in growth, hitting 56%.

Since that peak, the growth rate has moderated, with 2022 recording a modest growth of 13%. Looking ahead, forecasts show a continued positive trend but at a decelerating pace. Despite last year’s estimated recovery at 19%, market growth for 2024 is projected to be slightly lower at 18%. Until 2027, market growth is projected to slow further down, hitting as low as 7%, suggesting a maturing market.

Throughout this period, growth rates for the submarkets of Grocery Delivery and Meal Delivery remain in proximity to the total market figures, indicating that these segments are integral to the overall health and trajectory of the industry.

Online Food Delivery in India: Third Largest Market by 2026

Looking at the ranking of the top 5 global online food delivery markets by revenue, we see shifting dynamics in the years to come.

China is projected to consistently hold the top position through 2028, showcasing its dominance in the industry. Similarly, the U.S. is expected to maintain the second position, reflecting a steady and robust market.

Some shifts are observed in the rankings of other countries. The United Kingdom, ranked fourth last year, is predicted to climb to the third position this year and sustain it until 2026, when it will be replaced by India. On that note, India and South Korea are anticipated to exhibit fluctuations in their rankings, indicating a dynamic competition between these markets.

In particular, the projections for India show a significant upward movement, rising from the fifth position by 2024 to the third position by 2026, highlighting its potential for significant growth and development in the coming years. South Korea, on the other hand, is estimated to lose its dominance in the market, dropping from third place last year to fifth place in 2025.

Grocery Delivery: ARPU Exceeds Meal Delivery

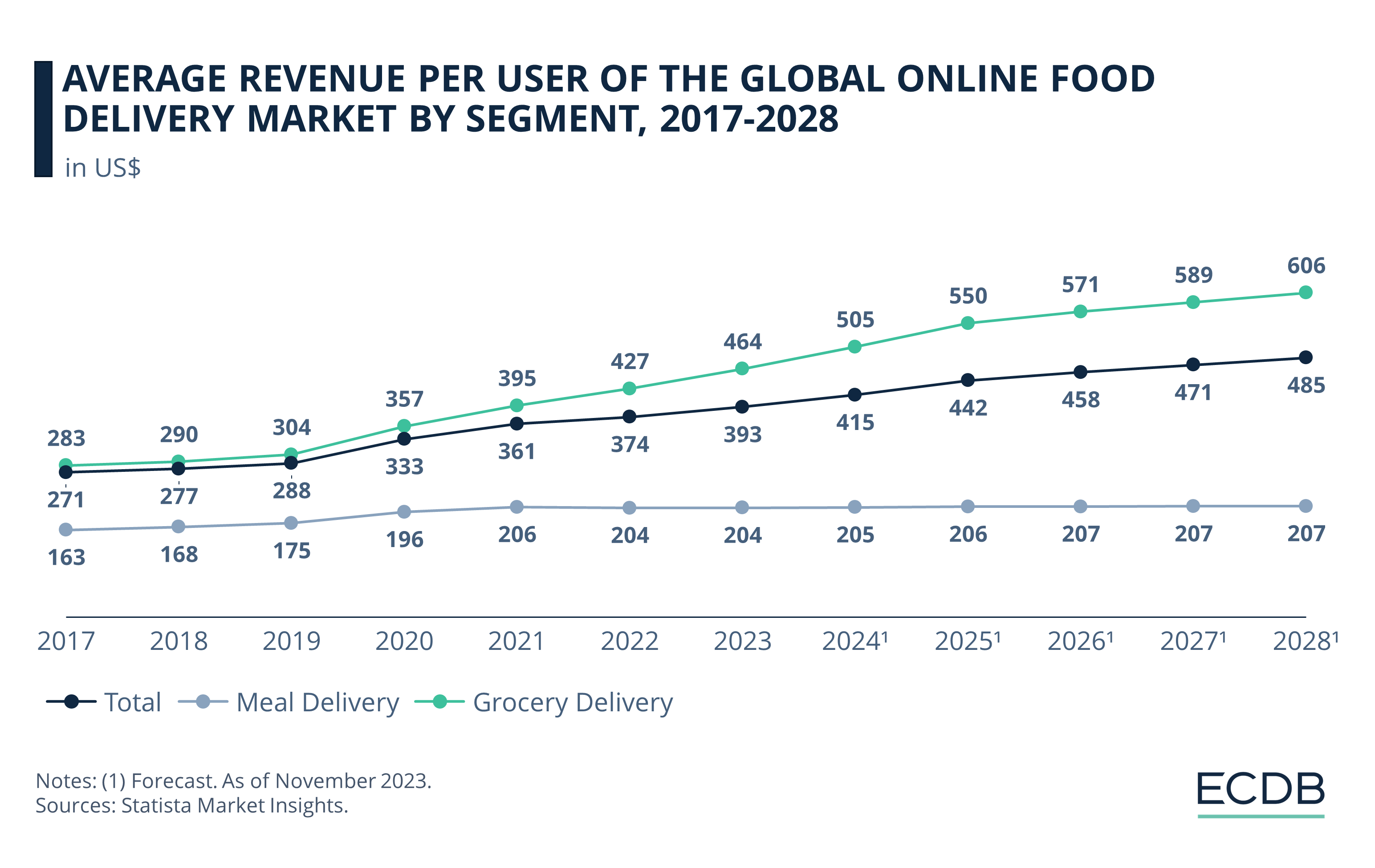

Further data from Statista shows a clear trend in the Average Revenue Per User (ARPU) of the global online food delivery market segments.

From 2017 to 2028, there is a persistent and widening gap between the ARPU in the Grocery Delivery and Meal Delivery submarkets. The former is expected to consistently record higher ARPU values compared to the latter, with this difference increasing over time.

One reason for this gap could be attributed to the nature of purchases in each submarket. Grocery deliveries typically consist of bulk purchases, encompassing a variety of items, contributing to a higher ARPU. In contrast, meal deliveries are generally smaller, more frequent transactions, resulting in a lower ARPU.

In terms of the total market trend, there’s a steady increase in ARPU, reflecting the overall growth and adoption of online food delivery services. The continual rise suggests an increasing consumer reliance on these services for both meal and grocery deliveries, marking a positive trajectory for the industry’s revenue outlook.

Top Online Food Delivery Companies by Region

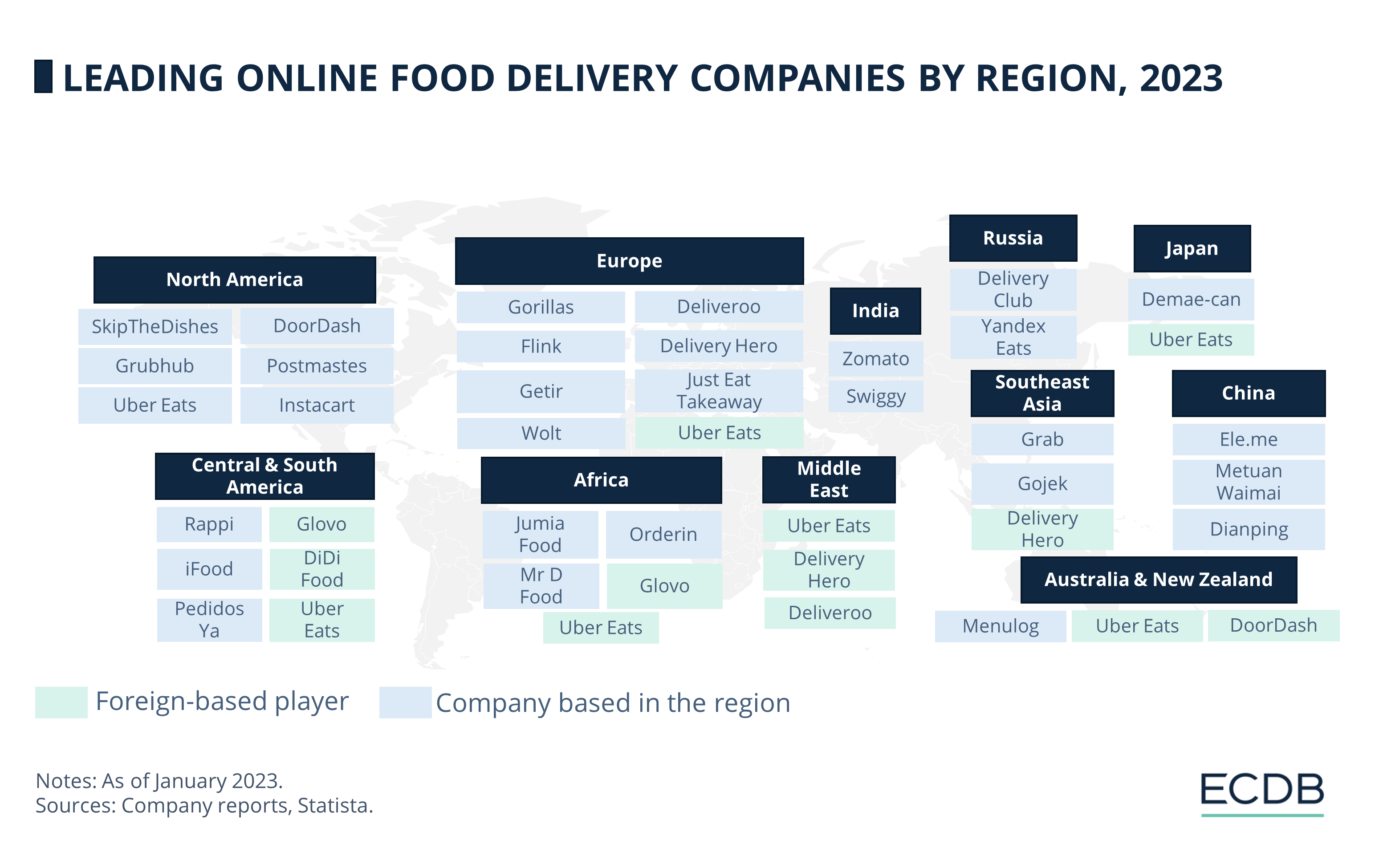

Within the online food delivery landscape, which has become ever more competitive, several companies are looking to establish their footing. A quick look at the leading players operating across the world shows that Uber Eats has made global gains and marked its presence almost unanimously in different regions.

Uber Eats: Strategic Acquisitions and Partnerships

The platform's strategic acquisitions, including Cornershop in 2019, Postmates in 2020, and Drizly in 2021, have broadened its scope beyond restaurant meals. In 2022, Uber Eats expanded its services by forging alliances with grocery retailers and quick commerce firms, notably announcing a significant partnership with Getir, a leader in instant grocery delivery in Europe.

Reflecting the innovative spirit of the sector, Uber Eats has also ventured into the cannabis eCommerce space, following a collaboration between Leafly and UberEats in Toronto. This venture offers customers the convenience of delivery with in-depth information on cannabis varieties and user feedback.

Other players are fighting to stake their claims in the market as well, to varying degrees of success.

Local Companies Dominate North America and Asia Food Delivery

In North America, local players clearly control the field. This includes SkipTheDishes, Grubhub, Uber Eats, DoorDash, Postmates and Instacart. Their popularity with local consumers is successfully gatekeeping foreign-based companies from foraying into the region in any meaningful way.

In contrast, the market is entirely dominated by foreign players in the Middle East: Uber Eats, Delivery Hero and Deliveroo enjoy the customers’ attention in the absence of any significant local rivals.

Nevertheless, a comparative pattern of regional companies predominating can be seen in India (Zomato, Swiggy), China (Ele.me, Meituan Waimai, Dianping) and Russia (Delivery Club, Yandex Eats). In Europe, too, native companies such as Gorillas, Flink and Getir are preferred, with the only exception of Uber Eats also operating in the region.

In Africa, Southeast Asia and Japan, while foreign companies like Uber Eats, Delivery Hero and Glovo are active, regional companies outnumber them. In contrast, in Central and South America, as well as Australia and New Zealand, the market is split nearly evenly between regional and foreign companies, hinting that local players may need to level up their game if they want to beat international competitors and divert customers’ loyalty towards themselves.

As the worldwide eCommerce market changes in the coming years, it remains to be seen whether the biggest players in the food delivery business will continue to consolidate their position and edge out smaller actors, or whether regional companies will be able to gain traction and increase their market share.

Sources: Statista, Leafly, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Uber Eats Grocery 2024: Market Analysis, Target Demographic, Forecast

Uber Eats Grocery 2024: Market Analysis, Target Demographic, Forecast

Deep Dive

Digital Grocery 2024: What’s New at Amazon, Getir, Walmart & Target

Digital Grocery 2024: What’s New at Amazon, Getir, Walmart & Target

Deep Dive

Top Quick Commerce Providers in Germany 2023: Flink, Gorillas & More

Top Quick Commerce Providers in Germany 2023: Flink, Gorillas & More

Back to main topics