Online Shopping Events: Way Day

Wayfair’s Shopping Way Day: Analysis & Market Insights

As 2024 comes slowly to an end, the U.S. company Wayfair kicked off the holiday shopping season with their famous Way Day. How has the company and its online stores developed? What are Wayfair's goals for the years ahead?

Article by Antonia Tönnies | October 15, 2024Download

Coming soon

Share

Wayfair’s Shopping Way Day: Key Insights

Extended Way Day: Wayfair prolonged its Way Day event until October 9th, offering up to 80% discounts and 24-hour flash deals to boost Q4 eCommerce sales ahead of the holiday season.

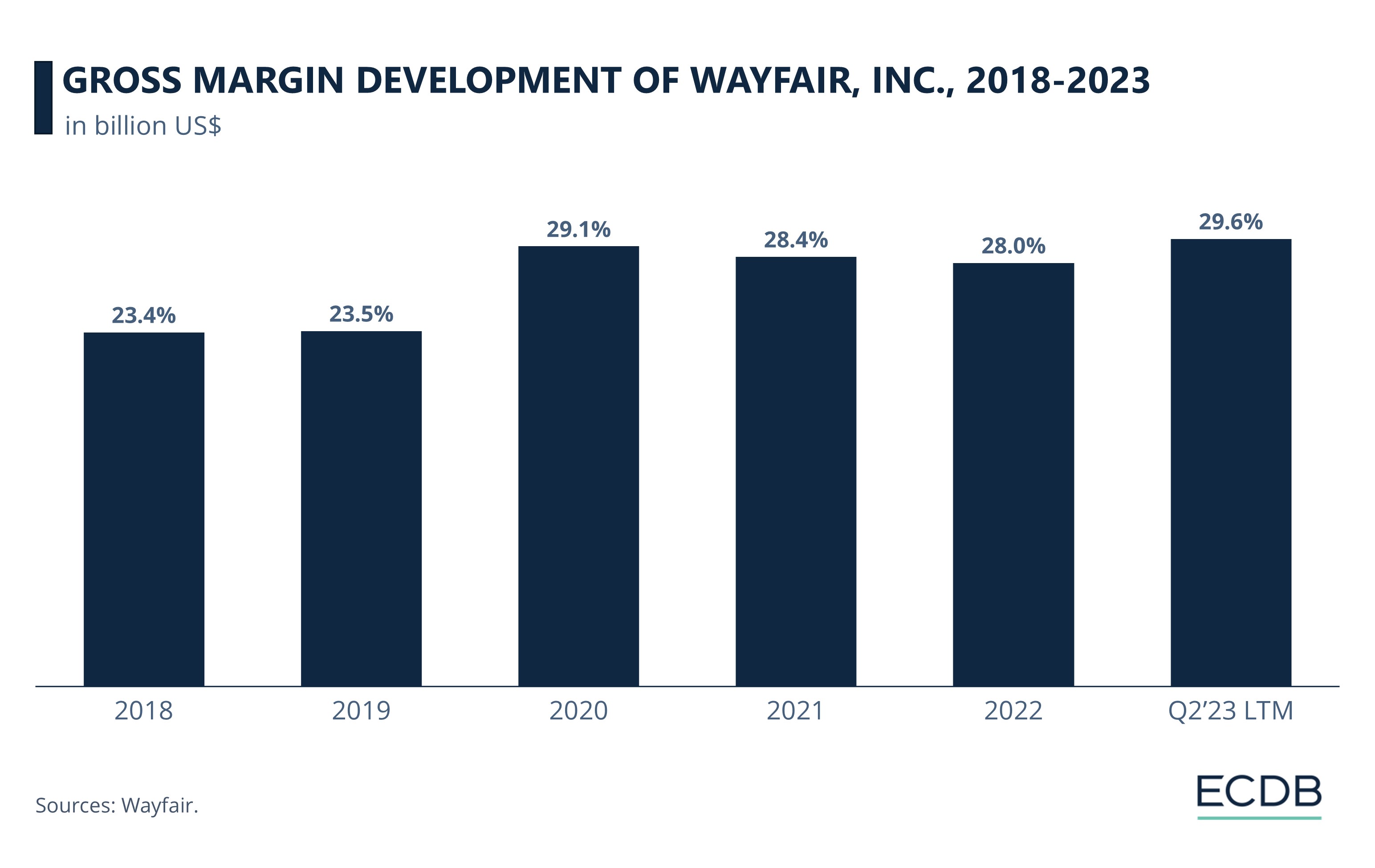

Gross Margin Improvement: Wayfair has successfully increased its gross margin, rising from 23.5% in 2019 to 29.6% in 2023, showcasing effective cost management and profitability enhancements.

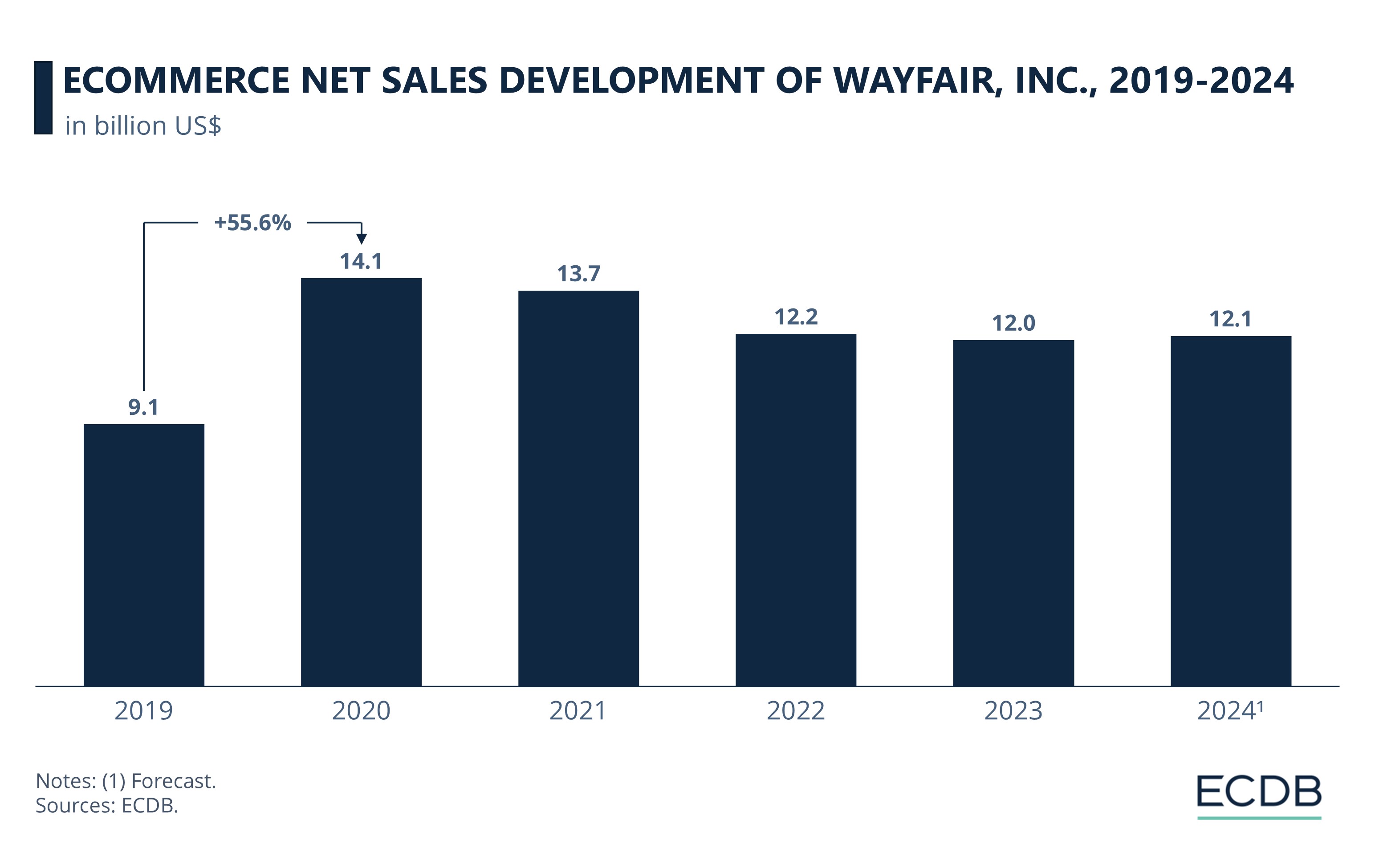

Revenues between Decline and Stabilization: After declining since the peak of the pandemic in 2020, Wayfair's revenue decline is expected to stabilize in 2023, with a slight growth forecast of 1.2%.

Focused Brand Positioning: The company’s brand strategy spans across luxury, mass-market, and economy segments, addressing distinct income groups to capture a wide range of consumer demand and create brand-specific loyalty.

Wayfair's special shopping event, Way Day, is over, but the next online shopping event is already waiting as the holiday season approaches. These eCommerce events are crucial when it comes to the performance of Wayfair, Inc., one of the largest U.S. furniture & homeware companies, and one of the most valuable U.S. eCommerce companies.

But what exactly is Way Day? What impact does this event have on Wayfair's eCommerce net sales? Find out about the U.S. company's latest developments in eCommerce.

Wayfair’s Shopping Way Day: Holiday Shoppers on the Hunt for Discounts

This year’s Way Day started a bit earlier than the previous year on the 5th of October 2024 instead of the 25th of October back in 2023. Promoted as one of the biggest sales of the U.S. company Wayfair, the online store surprised this year its customers by extending the special shopping event.

Normally set for two days, this year’s Way Day has been prolonged until the 9th of October exclusively in the United States. During those days, items across product categories like furniture & homeware, kitchen, as well as electronics were available with discounts up to 80% combined with 24-hour flash deals and deals of the day.

All in all, this annual shopping event is timed just a few months before the holiday season. The first holiday shoppers may have used this sale to buy their first gifts on the cheap. For the company, this online shopping event is crucial to push eCommerce net sales in Q4 before the end of the year.

As Wayfair wraps up another successful Way Day, the company continues to focus on long-term growth and profitability. A deeper look into Wayfair’s progress was provided during the Wayfair Investor Day 2023, where key developments in the company’s financial performance and strategic direction were discussed.

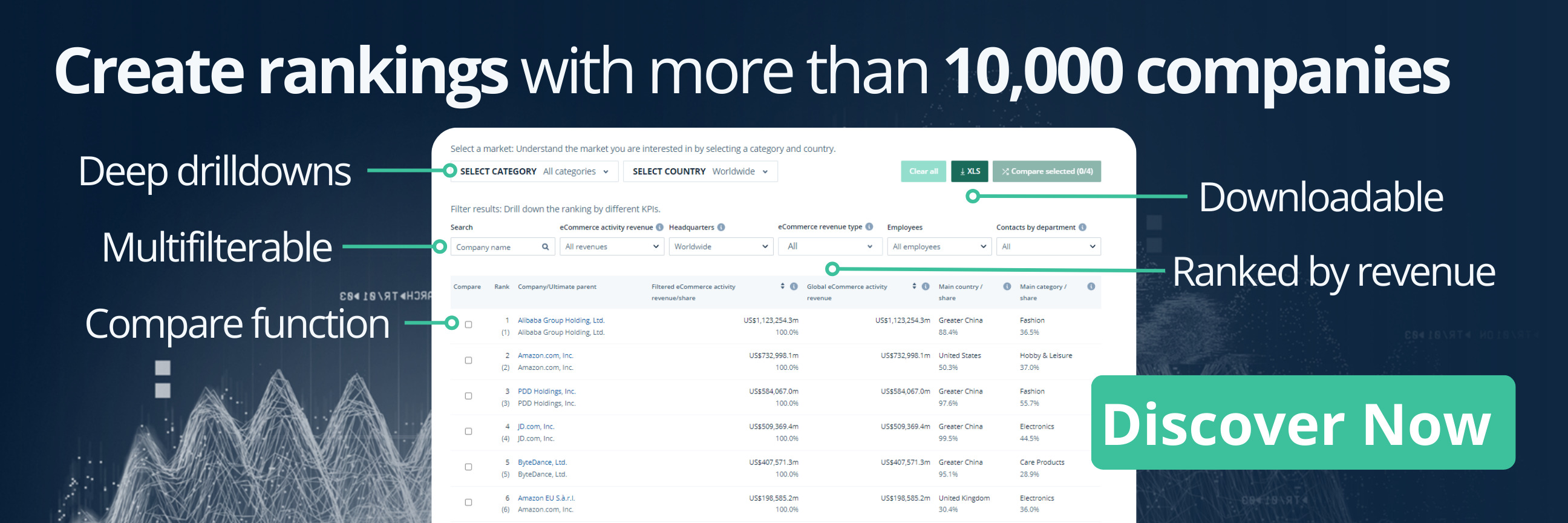

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

Wayfair Progress in Profitability

In August 2023, Wayfair hosted its very first investor day, the Wayfair Investor Day 2023. This event is designed to give investors and analysts a deeper insight into the company, with a strong focus on the customers’ point of view.

One important key takeaway of this special event is Wayfair’s latest profitability achievements. The expansion of gross margins through logistics, supplier services, wholesale economics and merchandising mix is starting to pay off.

Gross margin essentially measures how much money an eCommerce business retains from each dollar of sales after covering the direct costs of producing and delivering its products. A growing gross margin in eCommerce indicates that the business is efficient at managing costs relative to sales – as in Wayfair's case:

Before the eCommerce boom, Wayfair's gross margin ranged from 23% to 24%. It changed with the surge from 23.5% in 2019 to 29.1% in 2020.

After 2020, it declined, albeit minimally, moving from 28.4% in 2021 to 28% in 2022.

The latest data for 2023, namely Q2'23 LTM (last 12 months), shows a new growth in gross margin, reaching 29.6%.

Not only did the U.S. company improve its profitability over the past year, but its eCommerce sales also saw some positive changes.

Financial Performance of the Company, Wayfair, Inc.

Of the approximately US$800 billion total addressable market (TAM) in which Wayfair operates in 2023, a quarter is generated online, according to Wayfair. Going forward, the company expects about half of the addressable opportunity to be online, while the other half will be offline.

At the Wayfair Investor Day 2023, the company announced a CAGR of 32% between 2014-2022, but since 2020, revenue has been declining year over year, as confirmed by the ECDB data:

The company's revenue soared 55.6% between 2019 (US$9.1 billion) and 2020 (US$14.1 billion), thanks to the eCommerce COVID-19 boom.

After 2020, revenue declined each year until it reached US$12 billion in 2023. The sharpest decline, 10.9%, occurred between 2021 (US$13.7 billion) and 2022 (US$12.2 billion).

According to ECDB's analysts, Wayfair's revenue downtrend could end this year with an annual growth of 1.2%, resulting in revenues of US$12.2 billion.

By investing in partnerships (e.g., with Kelly Clarkson) and social media marketing on Pinterest and TikTok, the U.S. company aims to "unlock significant growth opportunities." But Wayfair's products play the most important role.

What Does Wayfair Sell?

The company primarily sells products from the category furniture & homeware (46.2%), of which 30.7% are from the sub-category furniture. Additionally, Wayfair offers products from the DIY (31.3%), electronics (19.8%) and hobby & leisure (2.8%) categories.

Wayfair's brand portfolio covers three different segments: luxury, mass and economy. According to the most recent investor day, the economy segment centers on customers with a household income of US$60,000 and below. Meanwhile, the mass segment encompasses customers with a household income of US$60,000 to US$175,000, whereas the luxury segment covers those with a household income above US$175,000.

The luxury segment consists mainly of brands such as Perigold and Allmodern. The brand Birch Lane is aimed at the upper end of the mass segment and the bottom end of the luxury segment. The store named after the company targets customers from all sectors, just like Joss & Main.

Wayfair’s Shopping Way Day: Closing Thoughts

After a downward trend, Wayfair's revenues could begin to grow again in 2024, albeit at just over 1%. Investments in partnerships and social media presence, as well as logistics, supplier services, wholesale economics and merchandising appear to be bearing fruit.

This is also reflected in the gross margin: Despite negative sales trends over the past three years, the company has managed to improve its profitability, which is particularly evident when looking at the development of the gross margin.

Special online shopping events such as Way Day may have contributed to this development. But while Way Day is over, the fourth quarter and the holiday shopping season are just beginning. With only one Cyber Monday and one Black Friday left before Christmas, the question begins to arise: Do I have all the gifts I need for the holidays?

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Inside Apple Revenue: Latest Sales Figures and Key Insights

Inside Apple Revenue: Latest Sales Figures and Key Insights

Deep Dive

Yoox Net-a-Porter Is Sold to Mytheresa by Richemont: What the Acquisition Means for the Online Luxury Brands

Yoox Net-a-Porter Is Sold to Mytheresa by Richemont: What the Acquisition Means for the Online Luxury Brands

Back to main topics