eCommerce: Pandemic Market Development

Health Care Products: Hand Sanitizer Grew Highest During the Pandemic

Health products were high in demand during the pandemic and eCommerce provided a way for consumers to receive their products while avoiding crowds. Learn about the categories that performed best in top eCommerce markets.

Article by Nadine Koutsou-Wehling | June 11, 2024Download

Coming soon

Share

Health Care Products eCommerce: Key Insights

Hand Sanitizers Surged Particularly: Across all countries in this study, Germany, France, the U.S., the UK and Japan, hand sanitizers saw explosive growth with CAGRs (2019-2021) around 120%.

National Regulations and Digital Maturity: The pandemic fast-tracked eCommerce sales of health care products worldwide, while the extent to which growth took place depends on factors like maturity of the market's digital infrastructure, pandemic safety measures and regulations, and consumer willingness to purchase products online.

UK and U.S. Saw Highest Growth: Online health care providers, which include specialized stores such as online pharmacies, were most developed in the UK and U.S. already before the pandemic started.

The online strategies of large drugstore chains certainly also contributed.

The Covid-19 pandemic was a driving force of global eCommerce growth. Supply shortages occurred because consumers purchased products in bulk in anticipation of an impending crisis. We suggested that for health care products in particular, several factors contributed to their growth: They include national healthcare systems, digital maturity, varying governmental approaches to enforcing lockdowns, and consumer willingness to buy products online.

Examining the case of five core eCommerce markets (The U.S., the UK, Germany, France, and Japan), see which health care products grew highest and what factors accounted for their different development.

Health Care Products: Growth Factors

Across all countries observed in this analysis, the exceptionally high compound annual growth rate (CAGR) in online sales of hand sanitizers stands out. Public health agencies around the world identified hand sanitizers as a necessary precaution to reduce infections by keeping hands clean.

The COVID-19 pandemic also drastically shifted the landscape of healthcare systems. Telehealth services became more prevalent as in-person visits plummeted due to the public health crisis. The transition was most notable in rural areas where access to healthcare services tends to be more limited. The pandemic created the urgent need to apply new technologies, which include remote patient monitoring and electronic medical record systems, to keep track of patients' health status.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

Among the USA, the UK, Germany, France and Japan, where did online health care products grow highest in the pandemic?

1. USA

Hand sanitizers and other disinfectants played a leading role in the early days of the pandemic, when shoppers flocked to supermarkets and drugstores to prepare for store closures. As consumers encountered empty shelves in brick-and-mortar stores, online channels became a viable alternative for many seeking to stock up on products they deemed essential to face the health crisis.

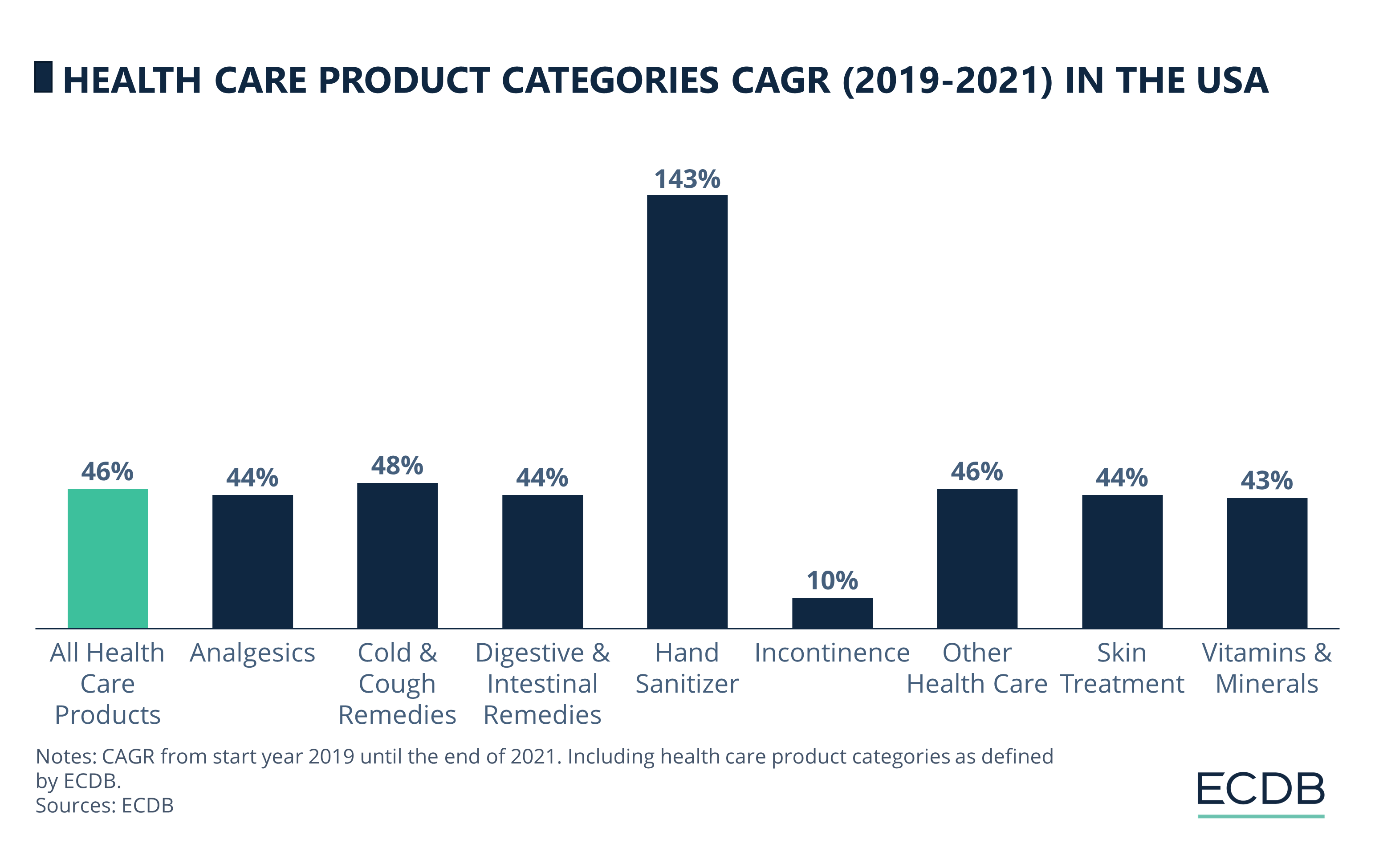

The U.S. eCommerce market was particularly suited to face the surge in online orders of essential healthcare products. The whole category grew by an annual average of 46% during the pandemic:

Most Health Care Products in the U.S. had CAGRs around the average, ranging from 43% for vitamins & minerals to 48% for cold & cough remedies.

However, the annual growth of the fringe product groups was more extreme in the U.S. For instance, hand sanitizers grew at a CAGR (2019-2021) of 143%.

Incontinence products saw the slowest increase, at an annual increase of 10%.

Presumably, a contributing factor for steep growth of health care products eCommerce in the U.S. is the prevalence of telehealth services. This determines whether consumers were accustomed to making in-person visits or whether there was already high consumer adoption of online channels in the pre-pandemic period.

Popular U.S. online pharmacies with a long-standing online presence are walgreens.com, cvs.com and riteaid.com.

Another market were these factors played a role is the following:

2. United Kingdom

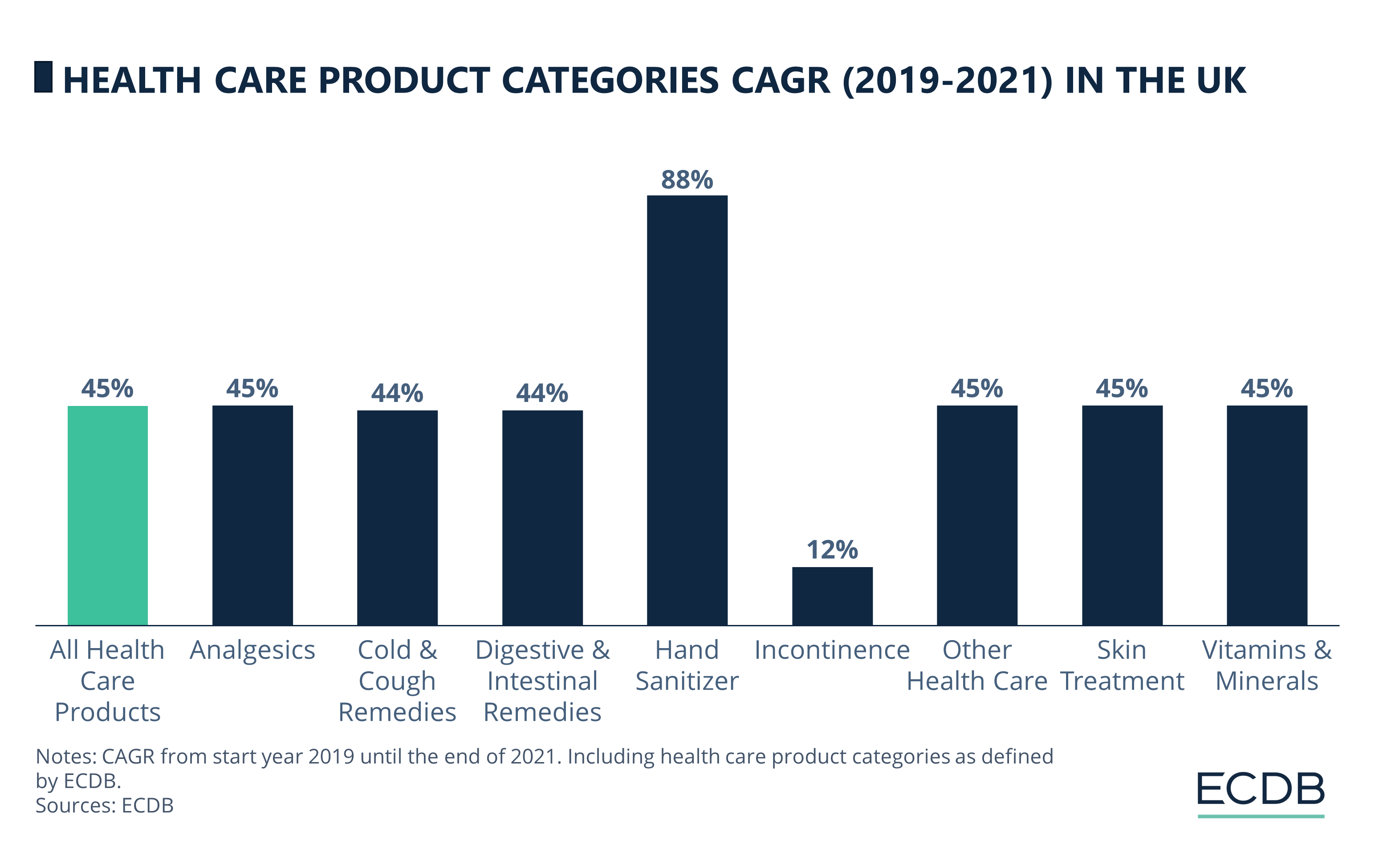

Close behind the USA is the UK, where health care product growth was just one percentage point lower, at 45%:

Once again, hand sanitizers grew steepest in the UK, but its CAGR (2019-2021) remained lower than in the U.S., with a rate of 88%.

The other subcategories remained around the average of 45%, with rates a little higher than in the U.S.

Incontinence products saw the slowest increase, with a compound annual growth of 12%.

The U.S. and UK were two of the few countries that had already established online pharmaceutical sales channels at the onset of the pandemic, something that not many other countries had done to the same extent at such an early stage. In the UK, leading online pharmacies are pharmacy2u.co.uk, lloydspharmacy.com and chemist-4-u.com.

3. Japan

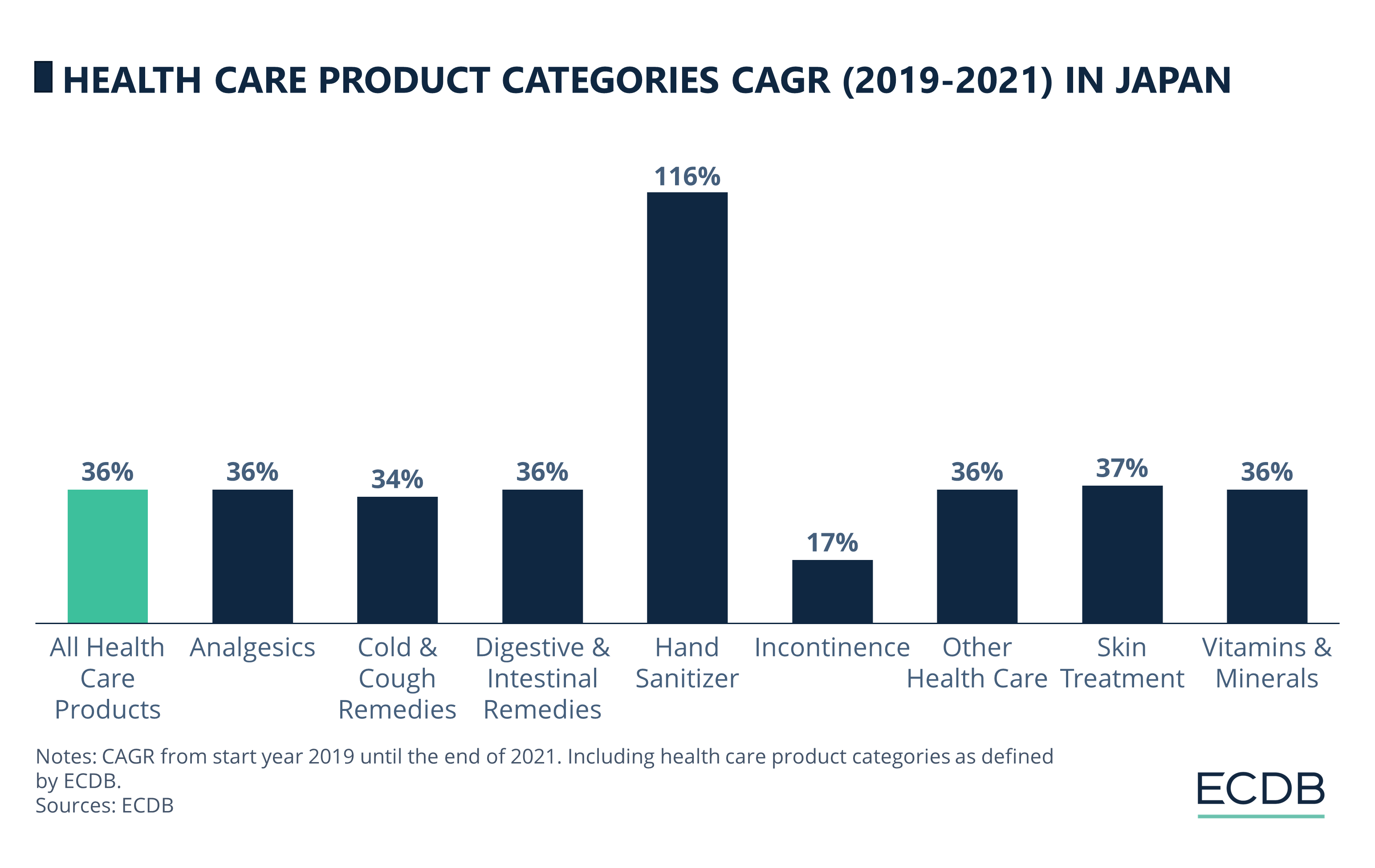

Japan's overall health care market grew by an average of more than one third its initial value each year from 2019 to 2021.

But the same patterns emerge as for the previous two markets.

Hand sanitizers grew significantly faster than the other product groups with a CAGR of 116%.

Incontinence products online sales rose slower than the others with a CAGR of 17%.

All other categories performed around the market average, with a maximum difference of two percentage points.

While Japan's eCommerce infrastructure did not have the extensive telehealth opportunities in place like the previous two markets on this list, its overall health care products growth in eCommerce was moderately high. Reasons for this are found in Japan's individual case: The government did not impose regulations that were as strict as other countries, which meant that it was quite common for Japanese workers to continue commuting to their workplace. Stocking up on medicine may have thus become a safeguard against infections.

Because to this day, specialist online pharmacies are quite insignificant in Japanese eCommerce, it is most likely consumers ordered these products from generalist retailers, such as Amazon or Yodobashi.

Another factor is expected to be consumer willingness to buy healthcare products online. This is what affected the following market on the list:

4. France

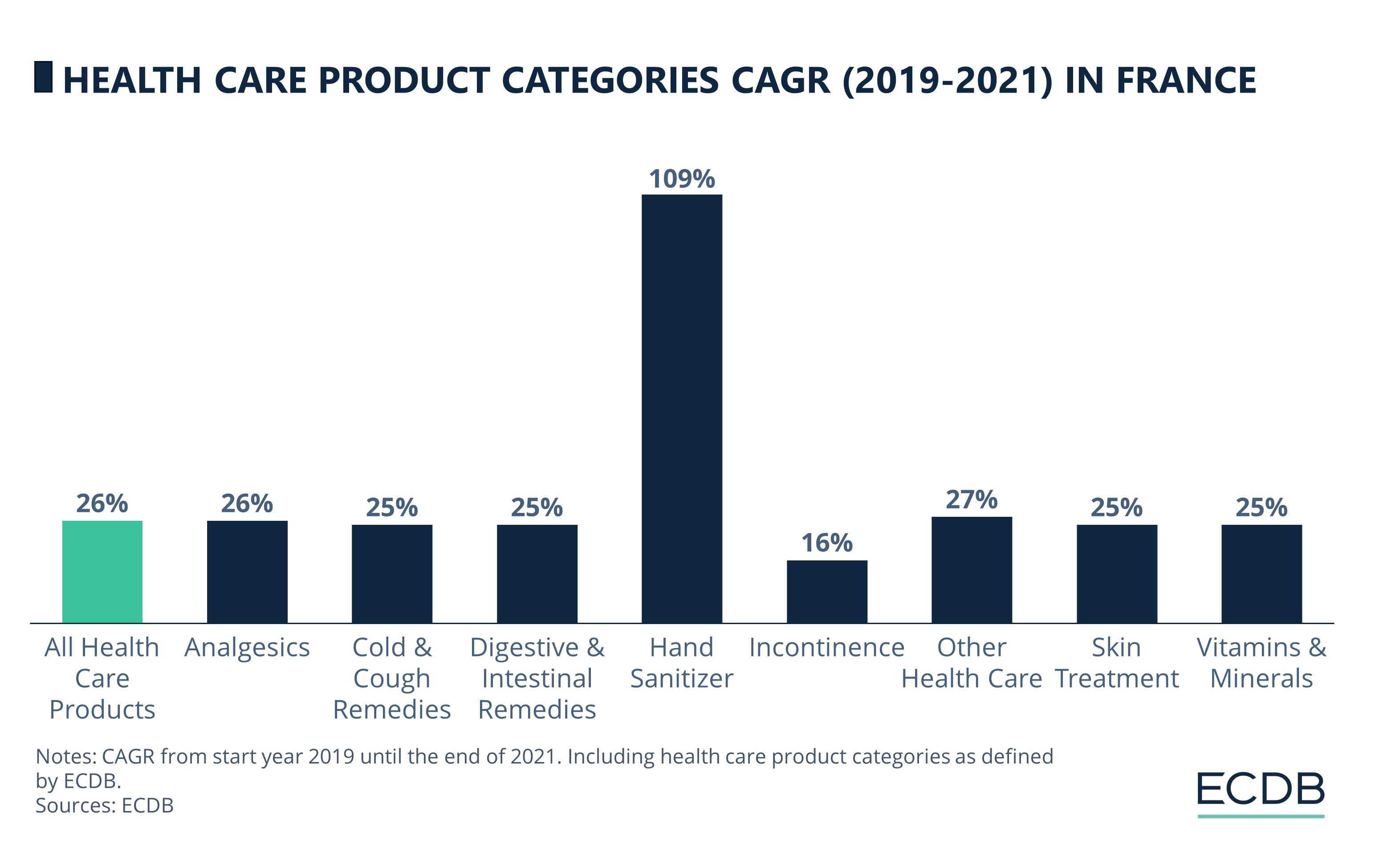

In France, a combination of insufficient digital infrastructure for health care online products and low consumer willingness to purchase these products via eCommerce played a role:

France had a CAGR (2019-2021) of 26% for all Health Care Products, while the “Other” category grew at a slightly above-average rate of 27% per year. Other health care includes products such as nutritional foods, dietary supplements, bandages, first aid, condoms, feminine hygiene, and biometric monitors.

Analgesics, or pain relievers, had the same growth rate as the average market, while all other products had percentages slightly below the average.

Hand sanitizers grew at a much higher CAGR (2019-2021) of 109%.

Despite the high eCommerce growth of hand sanitizers, French consumers are highly used to purchasing their health products in a nearby drugstore or pharmacy. Accordingly, online pharmacies do not really lead the way in French eCommerce.

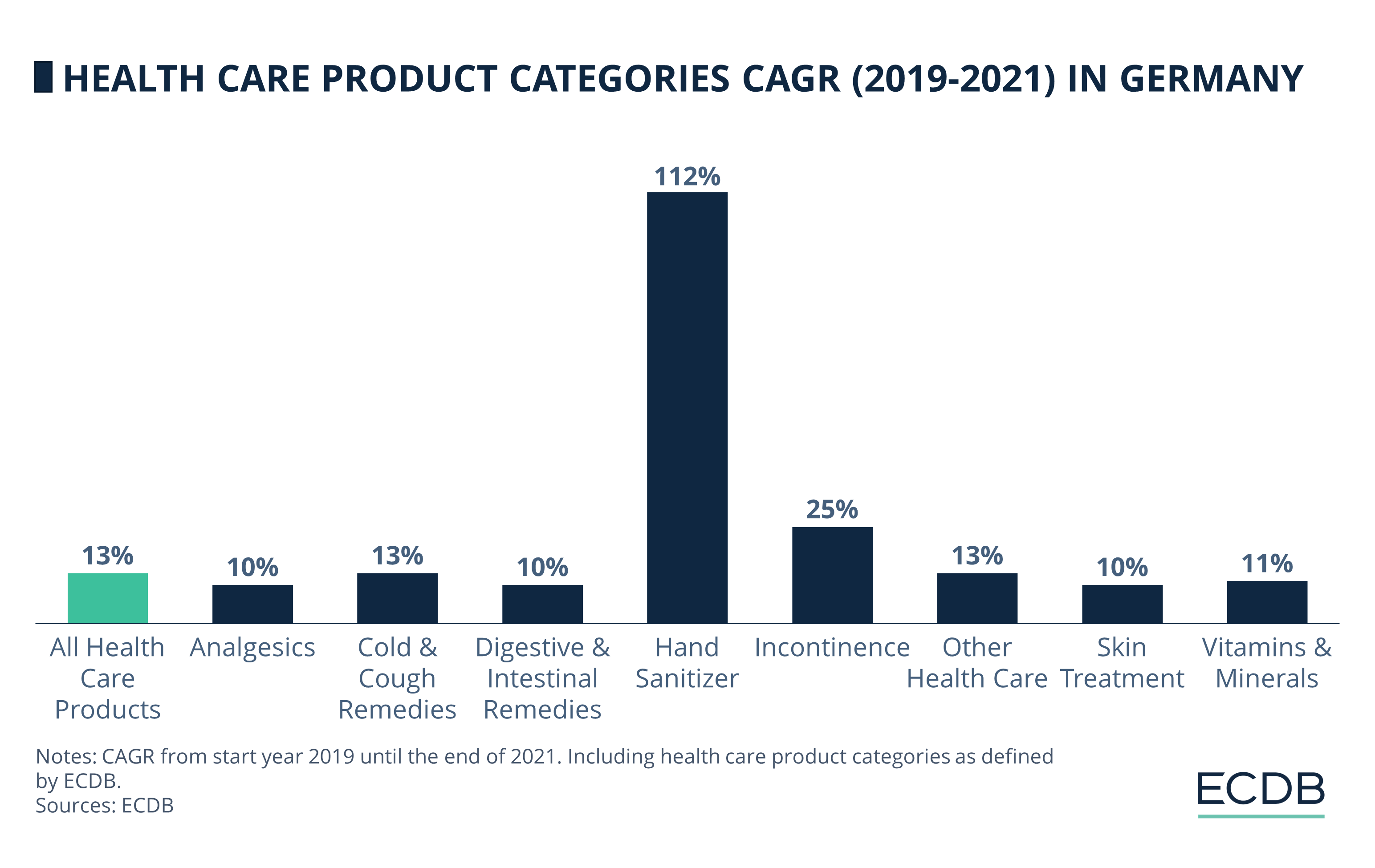

5. Germany

Germany's online health care products growth was significantly below that of the other four countries.

While most of the other categories at this level are around average, this time it is analgesics, digestive & intestinal remedies, and skin treatment that had the lowest CAGR between 2019 and 2021 at 10%.

Incontinence products were sold online at an above-average rate of 25% per year.

Most notably, hand sanitizers stand out, with a CAGR (2019-2021) of 112%.

Interestingly, Germany is nowadays a highly profitable market for online pharmacies and health care products. But the surge of online net sales for health care providers started relatively late, around 2022 and 2023. Before, the infrastructure was not sufficiently in place and consumer awareness was low. Today, however, online pharmacies like shop-apotheke.com and docmorris.de generate high revenues, ranking among global lists of top pharmacies.

Pandemic Health Care Products: Wrap-Up

A detailed analysis of online sales growth data for Health Care Products in the U.S., UK, France, Germany, and Japan shows that hand sanitizers are the clear winners in all countries, with annual growth rates averaging around 100%. Reasons for this include that hand sanitizer usage was encouraged institutionally in all countries, and that disrupted supply chains resulted in empty store shelves, which increased online demand.

Overall, the U.S. market for Health Care Products saw the steepest growth between 2019 and 2021, closely followed by the UK. Analyses pinpoint the reason for this in the developed infrastructure and substantial provider base of online pharmacies in both countries. Japan and France saw moderate development in online sales of health care products, while Germany had the lowest growth rates. Compared to the total online market, only the U.S. and the UK saw very high growth of health care products, but overall, online sales were positive in all countries observed during the pandemic period.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Deep Dive

What Exactly Are In-Game or In-App Purchases?

What Exactly Are In-Game or In-App Purchases?

Deep Dive

AI in eCommerce: Better Deals, Greater Precision, and Easier Targeting

AI in eCommerce: Better Deals, Greater Precision, and Easier Targeting

Back to main topics