ECOMMERCE: HEALTHCARE

Healthcare eCommerce in the United States: Market Size, Top Stores, Consumer Behavior by Generation

Whether it’s a doorstep delivery of medicines or a remote doctor consultation – online healthcare is growing. In 2023, the U.S. healthcare eCommerce market made over US$22 billion in revenues. Discover its market development, top online stores, and generational preferences for using digital medical services.

Article by Nashra Fatima | June 11, 2024Download

Coming soon

Share

Healthcare eCommerce in the United States: Key Insights

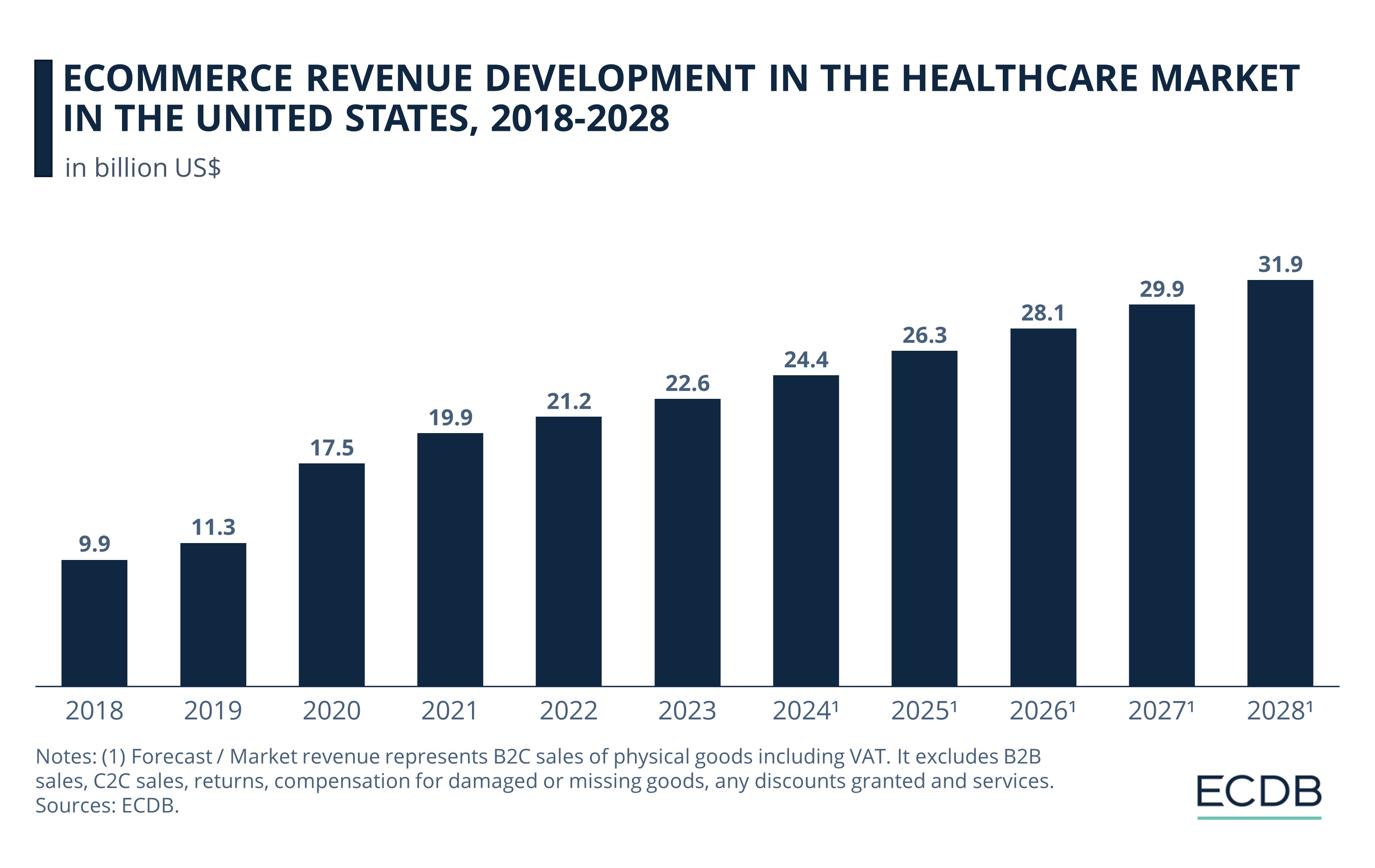

Market development: The U.S. healthcare eCommerce market surged during the pandemic. Revenues reached US$17.5 billion with an annual growth rate of 55%. In 2023, revenues stand at US$22.6 billion.

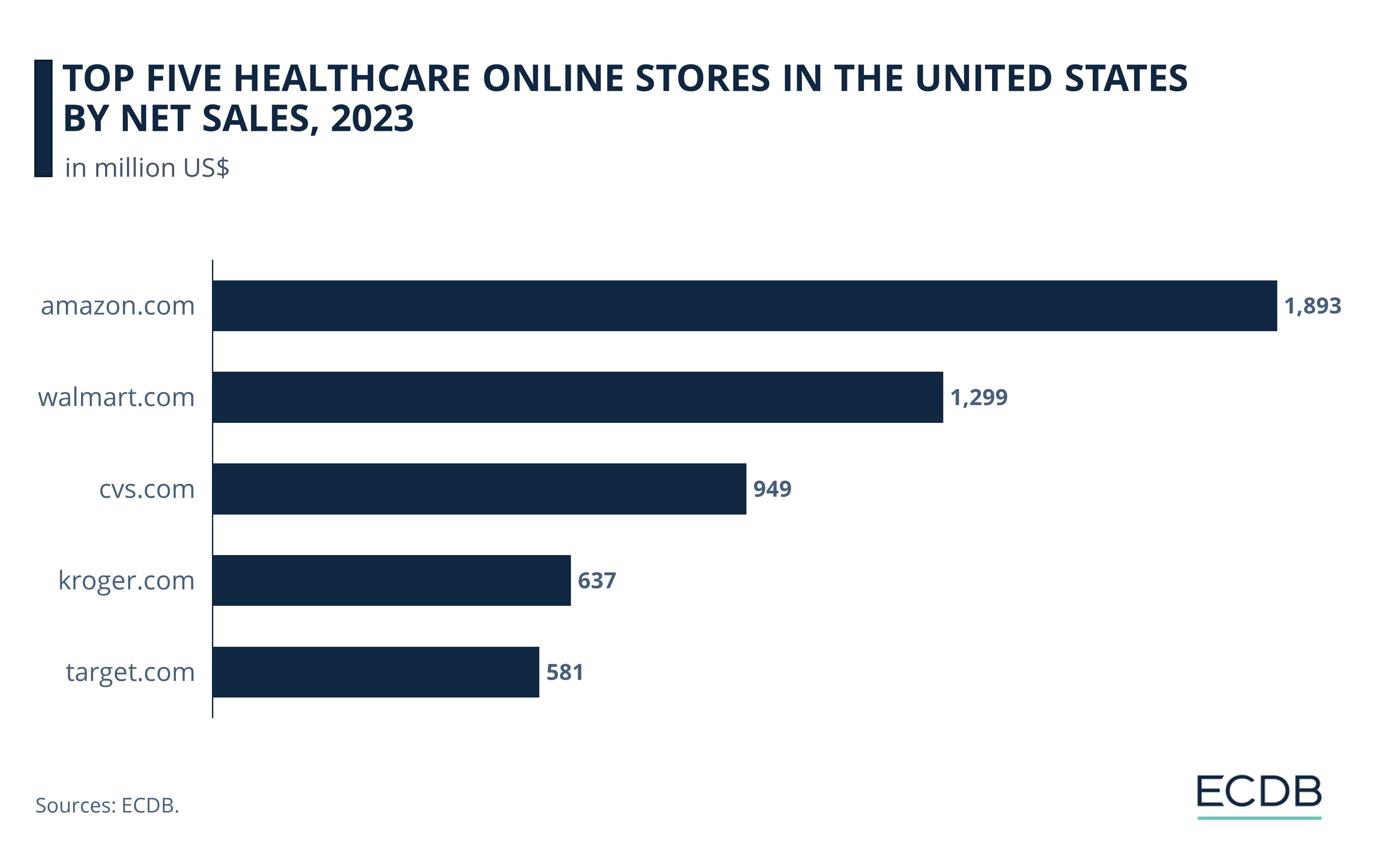

Top stores: Amazon.com is the leading store for healthcare eCommerce, with revenues of nearly US$2 billion in 2023. It is followed by Walmart.com, at US$1.3 billion, and CVS.com with US$950 million.

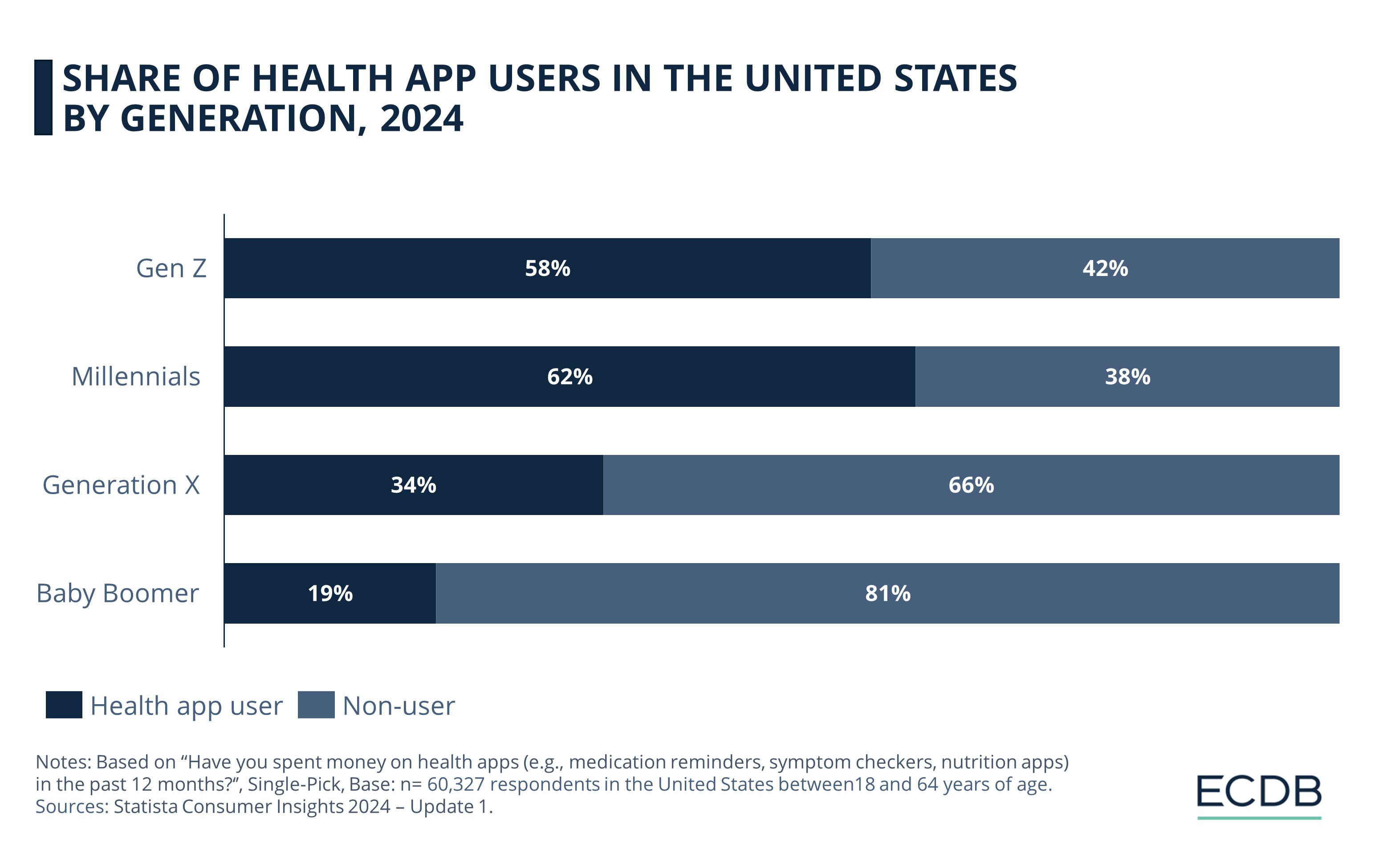

Generational preferences for health app usage: U.S. Millennials take the lead, with 62% of them having spent money on a health app in the past year, compared to only 18% of Boomers.

Visiting a doctor online is not as unusual today as it was some years ago.

Whether it is buying medicines from an online pharmacy, an online consultation, or tracking one’s glucose level on a device – all contribute to the growing field of healthcare eCommerce.

How has the healthcare eCommerce market developed in the United States? What are the top stores? And how does consumer preference for using medical services online differ from generation to generation? Find out in this article.

What is Healthcare eCommerce?

Also known as eHealth, healthcare eCommerce refers to the use of and transaction for healthcare goods and services online.

This includes activities such as online purchase of medicines and medical devices, remote consultations, telemedicine, electronic health record management, and using digital medical apps.

For this article, we extend ECDB’s scope, under which only retail of physical products is considered, to also discuss consumer preference for digital medical services usage.

Latest Trends in Healthcare eCommerce

Automation: Technology is being used to automate administrative tasks and diagnostics. Software helps manage medical records, schedule appointments, and bill and track payments. AI and machine learning help examine patient data, identify abnormalities in test results, and provide more precise treatment recommendations.

Digital healthcare platforms: Telehealth mobile apps or online platforms allow healthcare providers to connect with their patients online. Telemedicine apps can collect health data and allow online sharing of prescriptions, lab results, and treatment plans.

Wearable technologies: Devices such as fitness trackers, smartwatches, glucose meters and blood pressure monitors are some examples of wearable medical devices. Their usage helps track a patient’s health in real time and allows health providers to make timely interventions.

Healthcare eCommerce Market Size in the United States, 2018-2028

In the U.S., healthcare is the second-largest subcategory within Care Products, accounting for over a quarter of the market in 2024. Personal Care takes the biggest share at 64%, while Household Care is smaller at 10%.

Online use of healthcare eCommerce surged during the pandemic, instigating a process of market expansion that continues until now. Revenues from 2018 onwards show consistent growth. Only retail of physical goods is considered.

Look at the development of healthcare eCommerce in the U.S.:

The yearly growth rate was a modest 13% in 2019. But in 2020, when the pandemic hit, the market grew exponentially. Revenues shot up to US$11.3 billion, with a year-on-year increase of 55%.

The pandemic boost continued the following year, but the rate of growth mellowed out. In 2021, revenues reached US$17.5 billion at a moderate yearly increase of 14%.

When the pandemic effect dissipated, several eCommerce markets showed a downturn. However, healthcare eCommerce in the United States demonstrated resilience. Maintaining the upward trend, revenues grew by 6% and 7% in 2022 and 2023 respectively. This year, revenues are expected to reach US$24.4 billion.

The developments suggest that consumers have accepted using eCommerce to meet their healthcare needs. According to ECDB projections, the healthcare eCommerce market will keep growing in the U.S. At a compound annual growth rate (CAGR 2024-2028) of 6.9%, the market volume will likely cross US$31 billion by 2028.

Top 5 Healthcare eCommerce Stores in the United States

The healthcare eCommerce industry gained traction during the pandemic. This was also the time that major players like Walmart forayed deeper into the market by offering comprehensive health services.

Today, established players in the field and beyond compete for market shares, with many big names including Amazon featuring in the top list. The data below shows the leading stores’ national sales in healthcare.

In 2023, the top five healthcare eCommerce stores in the United States were:

1. Amazon.com

Amazon towers over other healthcare eCommerce stores, generating revenues worth US$1.89 billion in 2023. That is nearly 10% of the entire market.

Amazon accelerated digital transformation in healthcare retail. Its services include Amazon Pharmacy, which provides doorstep delivery of over the counter (OTC) and prescription medicines, and the dedicated Amazon Clinic app, which connects patients with online doctors.

While partnerships and acquisitions further boost its market dominance, healthcare is a minor focus for Amazon, accounting for only 1.1% of its net sales in 2023.

2. Walmart.com

With a revenue of US$1.3 billion, Walmart.com is the second biggest U.S. healthcare online store. Healthcare products made 2% of its net sales in 2023.

Walmart’s online pharmacies sell and refill prescription, vaccines, pet vaccines, and prescription glasses under its Vision Center. Other health services include tests, birth control prescriptions, and health insurance.

3. CVS.com

Cvs.com stands third with revenue of US$950 million in 2023. The store focuses on Care Products and derives 60% of its net sales from healthcare products. It is the only store on our top five list owned by a health company, CVS Pharmacy Inc.

Cvs.com’s services include prescription management, eyecare, and virtual care. Customers can also book online appointments for in-home health evaluation, vaccines and tests, and primary care for older adults.

4. Kroger.com

Ranked fourth, Kroger.com’s revenue was US$600 million in 2023. The all-round online store has Grocery as its main category, with healthcare accounting for 10% of its net sales.

The health services offered by Kroger.com include prescription management, and online scheduling of vaccines, and clinic appointments. In addition, customers can book virtual visits for issues like allergy testing, sexual and reproductive care, preventive care, and telenutrition.

5. Target.com

With revenue of US$500 million, Target.com is the fifth largest healthcare eCommerce store in the U.S. It is operated by Target Corporation. Healthcare made up only 3% of its net sales in 2023.

Target.com’s focus is on selling healthcare products, including prescription drugs, supplements, first aid, nutrition, and eyecare, among others.

Which Generations Are Using Health Apps in the United States?

Digitalization has disrupted the healthcare industry. Some of its most visible manifestations include health apps, wearables, and telemedicine.

From a global perspective, the United States has the fourth largest share of health app users at 47%, as of 2022. However, the usage of health apps differs widely from generation to generation.

Here is the share of health app users in the United States, according to generation:

1. Gen Z

More than half of Gen Z (58%) respondents have spent money on a health app in the last year. In contrast, a smaller 42% said that they have not done the same. Motivating factors include on-demand medical service, speed, and personalization.

2. Millennials

As the first digital natives, Millennials demonstrate the highest use of health apps, including purchases, out of all generations. 62% of them have spent money on a health app, with the share who has not done so the smallest at 38%.

3. Generation X

34% of Gen X respondents made purchases on a health app in the past year, while a larger 66% did not, indicating this generation’s disinclination towards using e-health.

4. Baby Boomers

At just 19%, Baby Boomers are the smallest group out of all generational cohorts to have spent on a health app. The share of those who made no health app purchases is very high, at 81%.

Healthcare eCommerce in the United States: Closing Remarks

eCommerce in healthcare is paving the way for improved patient care. Many healthcare retailers are now selling medicines online. Medical practitioners are also adopting digital technologies, such as mobile apps and platforms, to offer comprehensive care.

But the healthcare field can be unpredictable. For instance, Walmart recently announced that it is shutting down its 51 health centers and virtual care centers across the United States, citing an unsustainable model. This suggests that the market can be tricky to navigate, even for established retail giants.

The industry must also contend with barriers. Patient privacy and data protection are major concerns that necessitate stringent safety measures. Legal compliance frameworks for digital health and pharma sales may also differ from state to state. Such factors make healthcare eCommerce a challenging and competitive market.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Back to main topics