eCommerce: Fashion Market Europe

How Zalando, About You, Zara and H&M React To Temu

About You, Zalando, H&M, and Inditex are reacting to the disruptive market entry of low-cost competitors Temu and Shein. While About You and Zalando follow strategies contrary to each other, H&M and Inditex found a middle course.

Article by Nadine Koutsou-Wehling | July 11, 2024Download

Coming soon

Share

Temu and Shein Against Fashion in Europe: Key Insights

Disruptive Market Entry: The highly innovative C2M model has several advantages that allow new entrants to disrupt incumbents in European markets: By producing small batches to gauge consumer interest and basing further production on demand, companies can offer more styles, avoid overstocking, and reduce supply chain costs.

About You Aligns Itself With New Production Model: About You announced an adaptation to Temu's and Shein's model, but with European and Turkish factories instead of Chinese operations.

Zalando Contrasts With an Emphasis on Quality: Instead of competing directly with the low-cost model, Zalando seeks to differentiate its platform by offering higher-quality products. An in-house logistics fulfillment service called ZEOS is developing a proprietary and comprehensive supply chain network across Europe.

Inditex and H&M Combine Both Ways: Fashion conglomerates with a larger brand portfolio differentiate each brand by pursuing both low-cost and high-quality approaches across the board.

Fashion eCommerce in Europe is experiencing profound market changes: New competitors offer lower costs and faster trend changes, snatching consumers away from incumbents. The emerging retailers are pure-play online retailers of Asian origin, notably Shein and Temu.

Their low prices and high assortment make established retailers in Europe pale in comparison. Can the likes of Zara, H&M, Zalando and About You hope to compete with these low-cost rivals?

Recent developments show that About You is already planning to implement the C2M (consumer-to-manufacturer) model in its own operations, while Zalando is trying to differentiate itself with a high-quality approach. Which path is more likely to lead to sustainable success? And what are other retailers doing? Find out here.

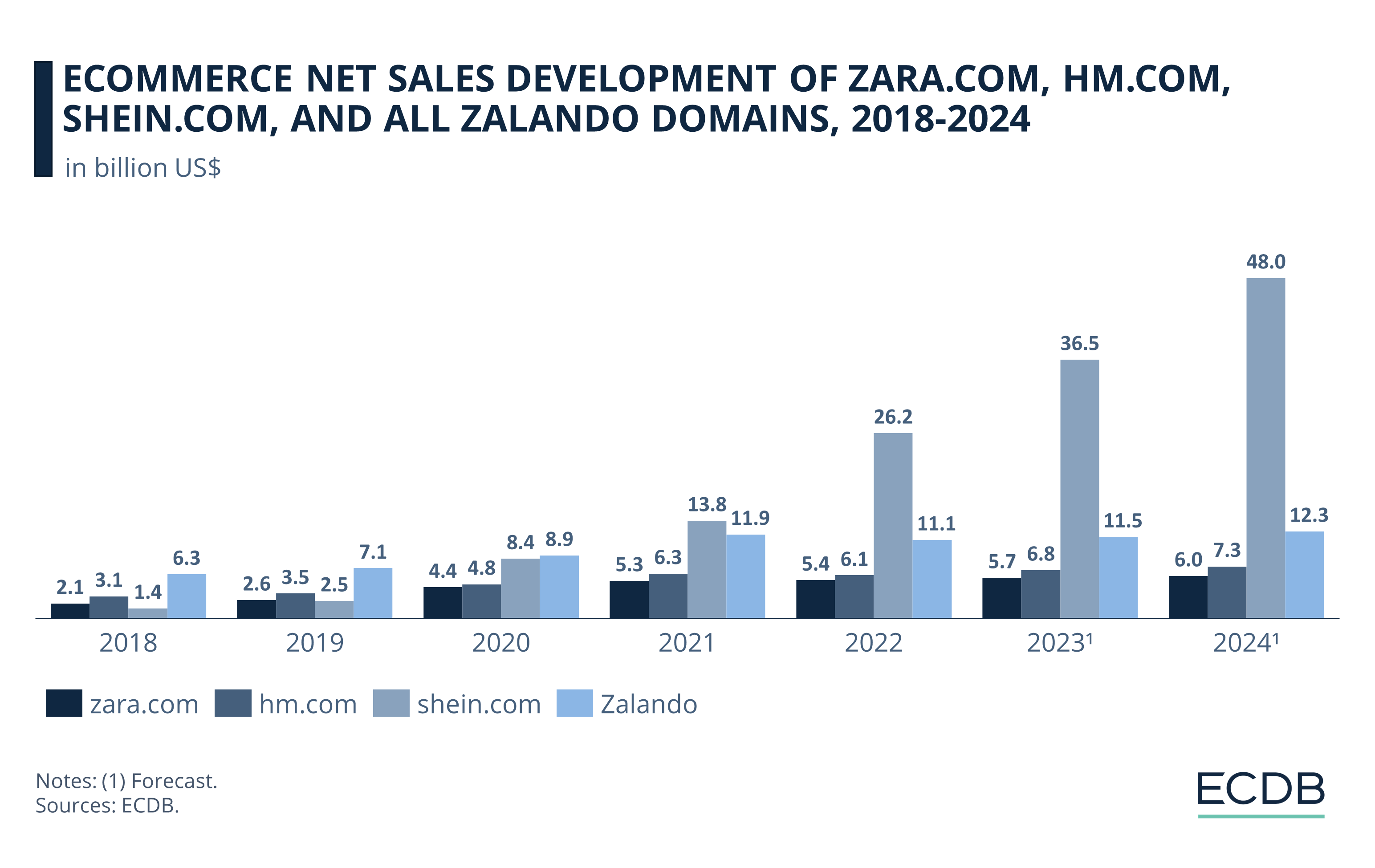

Zara, H&M, Zalando and Shein: Net Sales Development

Shein's entry into the European market has already created a shake-up that has incumbents rethinking their strategy. See how Shein is outpacing the others in terms of net sales development:

Established fashion retailers are facing trouble. Because Shein and Temu undercut the prices and turnaround time of fast fashion retailers in Europe, ultra-fast fashion has become the new thing.

Shein's explosive growth over recent years and Temu's rise trigger reactions among European fashion retailers. Two real life examples, About You and Zalando, are following opposing paths.

1. About You: Beating Temu and Shein at Their Own Game?

About You CEO Tarek Müller recently announced an adaptation of Temu’s and Shein’s C2M model. But instead of sourcing from manufacturing facilities in China, About You plans to use factories in Europe and Turkey.

There are benefits and drawbacks to this move:

Benefits of Adopting a C2M Strategy in Fashion

A consumer-to-manufacturer model cuts out the intermediary by leveraging immediate-feedback technology. It reduces operational costs and avoids warehousing issues.

Enables price competition: Local sourcing and demand-driven production lowers costs by reducing delivery distance and associated costs. It allows About You to compete on price with the likes of Temu and Shein.

Improves operational efficiency: Starting with small production batches allows for better gauging of consumer interest. This method is more environmentally friendly and supports trend-driven production with less risk and waste.

Reduces excess inventory: On-demand production minimizes overstock and waste.

Helps bring the fashion industry to a new standard: A strategy focused on minimizing excess inventory while maintaining trend-led production, when adopted by a major player, can encourage others to follow suit.

Drawbacks of Adopting a C2M Strategy in Fashion

But the move also has its risks, particularly in regards to quality control.

Continued distribution of low-quality products: The risk of persisting with inferior product quality remains. Consumers are still incentivized to easily discard items or never wear them, which does not promote product value.

Takes a long time to set up and refine: Establishing and perfecting this strategy requires significant time and effort, and it also demands costly investments.

Does not imply a solution for a sustainable return strategy: In fashion eCommerce, which has the highest returns, cheap production often makes it more profitable to contribute to landfills than to redistribute.

About You's direct competitor, Zalando, is responding to the new market dynamics in a different way.

2. Zalando: Improving Quality and Supply Chain Services

Rather than joining the ranks of Shein, Temu or TikTok Shop, Zalando is driving a differentiation strategy. This means that the Berlin-based fashion retailer has announced to integrate more products of higher quality on its platform and also move into the luxury segment. At the same time, Zalando is tackling the supply chain conundrum through economies of scale by introducing ZEOS, its own-brand logistics fulfillment service.

When contrasted with About You's move, other pros and cons come up:

Benefits of Focusing on Higher-Margin Products and Quality Control

Zalando is releasing ZEOS to any retailer willing to take advantage of the service, regardless of brand affiliations.

An overall higher value is placed on products, improving Zalando’s reputation: The integration of higher quality and luxury products enhances Zalando's brand image by offering items that last longer and provide greater customer satisfaction. This helps build customer trust.

The shared logistics network is a win-win solution for participating retailers: ZEOS provides fulfillment services. This reduces costs and improves delivery times for the retailers, while providing Zalando with additional revenue and a more integrated network.

Makes returns easier and more feasible: Having its own logistics network makes the returns process more efficient and sustainable.

Offers a true differentiation against low-cost rivals: By focusing on quality and luxury, Zalando sets itself apart from budget-focused competitors like Shein, Temu, and TikTok Shop.

Drawbacks of Focusing on Higher-Margin Products and Quality Control

The main downside of higher prices is that it will turn off certain consumer segments that are either not willing or able to pay more for products.

Higher price points will alienate consumers with lower income: The focus on higher-end and luxury products may alienate budget-conscious shoppers and reduce the overall customer base.

Fulfillment services are dependent on a stable order situation: Economic downturns can disrupt order volumes, making the fulfillment service less reliable and potentially less profitable than a C2M model.

While it is not possible to predict with certainty which solution will prove more effective, other retailers in the game try to swerve a definite answer by applying both.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

3. Inditex and H&M: Brand Diversification as an Alternate Solution

The H&M Group and Inditex, with its flagship Zara, are also under pressure to act: They see their market shares shrinking in the face of new competition that undercuts them on price and outperforms them on frequency and quantity of assortment.

Interestingly, both conglomerates are using a brand diversification strategy to take advantage of both the low-cost and high-value assortments in their portfolios.

H&M brands like COS, & Other Stories and Arket are targeted at the more affluent consumer, while Sellpy and Afound focus on a reCommerce strategy. H&M itself is being restructured to include more products from higher-margin retailers, as well as the affordable styles consumers are used to.

Inditex is taking the same route: The Spanish conglomerate diversified its brand portfolio to target different market segments effectively. Zara, including Zara Home, and Massimo Dutti focus on higher-end quality and designs at slightly higher price points, while Bershka, Stradivarius, and Pull&Bear target younger, budget-conscious shoppers.

Which strategy will prove most effective in the end? An approach must suit the overall brand identity instead of following a one-size-fits-all strategy. It does not hurt, however, to incorporate innovations and trends as they serve one's marketing purpose. Exemplary of it is the live commerce trend in China, which is breaking into Europe with larger platforms like TikTok.

Temu and Shein in Europe:

Closing Remarks

The impact of Temu’s and Shein’s meteoric rise leaves European fashion retailers scrambling to adjust their approach. However, the reactions differ from one retailer to the next:

About You aims to beat Temu and Shein at their own game with a home-grown C2M Made in Europe strategy. Zalando is taking the opposite path, promoting quality and its own logistics fulfillment network with participating retailers.

Fashion conglomerates with a larger brand portfolio take the safe route by pursuing both approaches at once: Through brand diversification, H&M Group and Inditex operate both low-cost alternatives and higher-margin offerings at the same time.

Despite the widespread criticism of each approach, it is exciting to see how incumbents are adapting to market dynamics. Ultimately, it is up to consumers to decide which offer resonates most with them.

Sources: CNBC – Handelsblatt

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

Back to main topics