eCommerce: UK Electronic Market

Currys' Decline Attracts Potential Buyers: JD.com Shows Interest in European Market

eCommerce giant JD.com shows interest in acquiring the struggling tech retailer Currys as part of its strategy to enter the European market.

Article by Lukas Görlitz | February 22, 2024Download

Coming soon

Share

Currys' Decline Attracts Potential Buyers: Key Insights

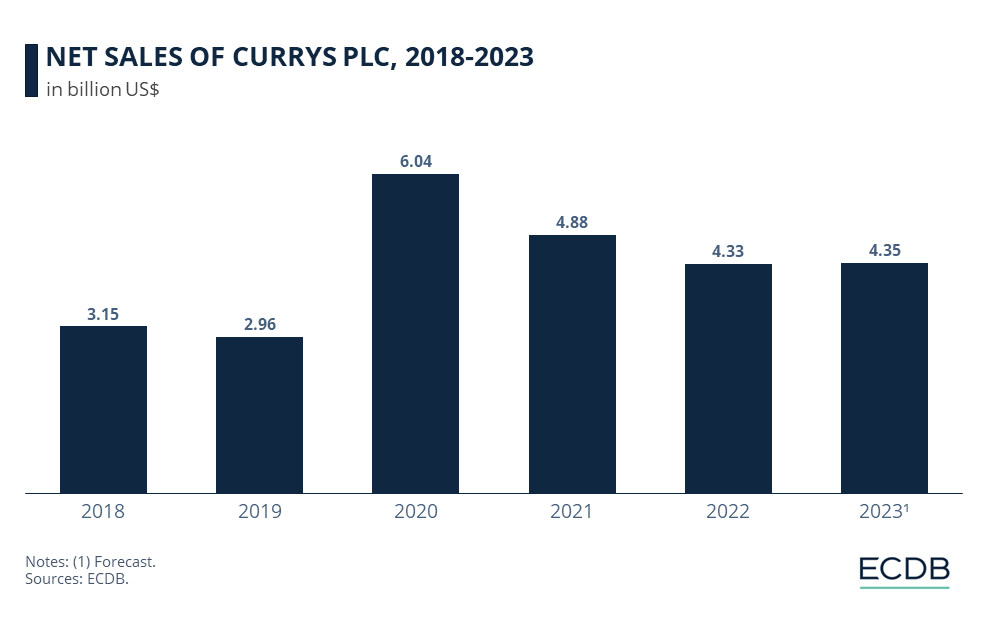

Currys' Challenges: Currys experienced stock value declines and sales fluctuations as the net sales dropped from US$6 billion in 2020 to US$4.3 billion in 2022. The recently selling of its Greek subsidiary aimed to improve financial performance.

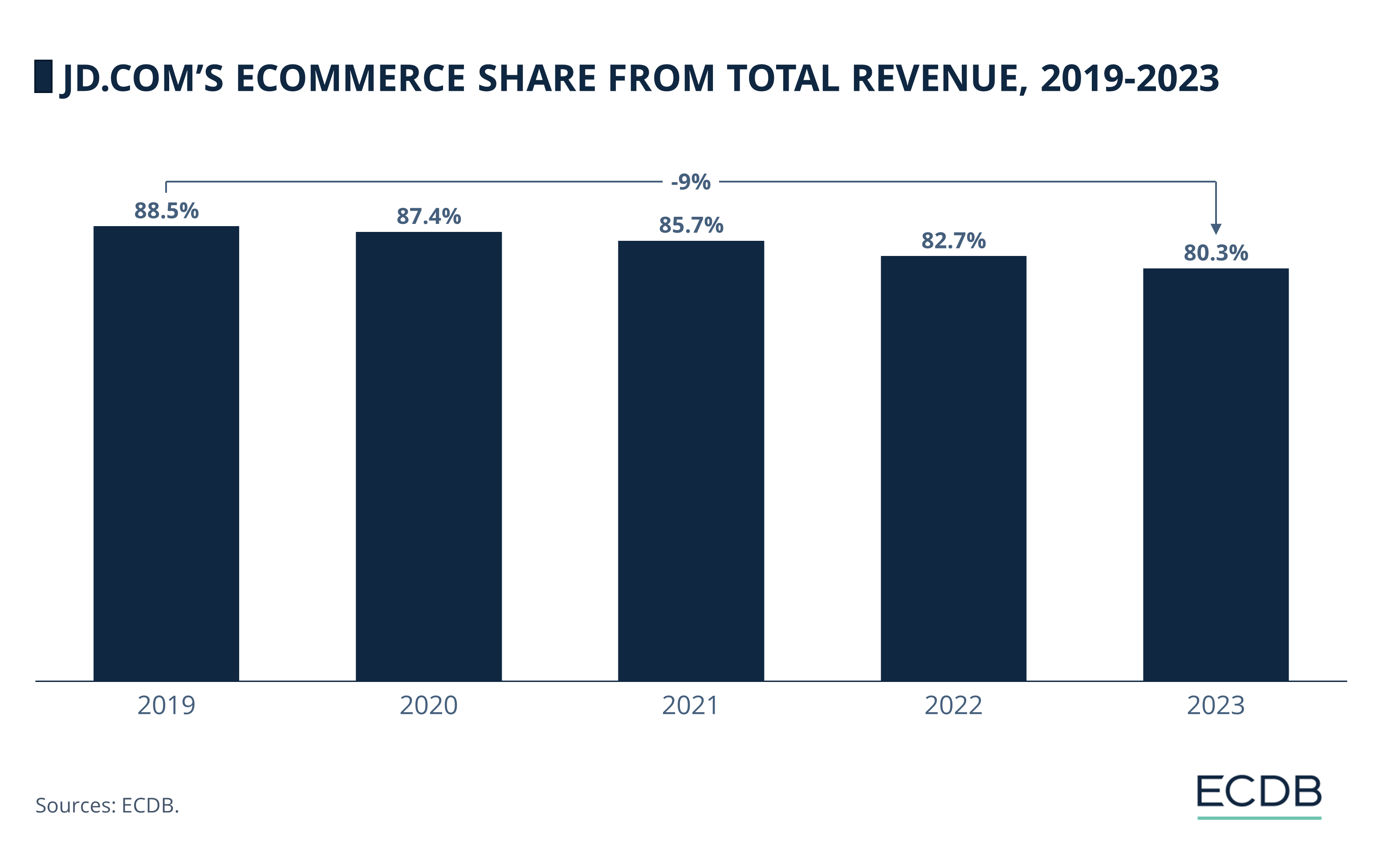

JD.com's Strategy Change: JD.com's interest in Currys suggests a move beyond online retail, as JD.coms numbers of its online revenue share dropped in recent years. With a focus on physical stores and European expansion, JD.com aims to diversify its operations and increase market presence.

Bidding Competition: JD.com is not without competition in the race for Currys. U.S.-based Elliot Advisers placed a bid of US$883 million but was rejected by tech retailer.

The low valuation of Currys in recent years has triggered interest from competitors in taking over. One of them: The Chinese tech giant JD.com. The Chinese-based company is one of the biggest eCommerce players. It owns the second-largest online store in the world by revenue. Now, JD.com is in the running for Currys, a UK technology retailer with a focus on brick-and-mortar stores.

Following the news of JD.com's involvement, Currys' stock jumped by 38% to 65 pence. Prior to this increase, its shares had lost 54% of their value over the last two years. But JD.com is not without competition, Elliot Advisors is also in the race of buying Currys. The investment management company from the U.S. made a bid of US$883 million, but it was rejected by Currys.

Curry Tackles Own Problems

Currys has struggled to grow over the last two years due to the high inflation that has compromised incomes in the UK. Despite a big improvement in the first pandemic year, the last couple of years have been difficult for the company.

Currys' net sales have fluctuated in recent years. In 2018 and 2019, net sales reached $3.15 billion and $3 billion respectively, but in 2020, the company saw a 103.9 percent burst to $6 billion. Since then, the company's sales decreased every year, falling to US$4.9 billion in 2021 and US$4.3 billion in 2022.

"As a group, we're focused on maintaining our encouraging momentum in the UK and Ireland and getting the Nordics back on track."

– Alex Baldock, CEO, Currys plc

In last November, the company announced the sale of its Greek subsidiary Kotsovolos for US$214 million. "As a group, we're focused on maintaining our encouraging momentum in the UK and Ireland and getting the Nordics back on track," said CEO Alex Baldock to the announcement of the sale. The sale expected to improve shareholder returns and give the company more flexibility.

JD.com Testing Brick-and-Mortar?

Currys is only generating one third of its total sales through online channels. If JD.com were to acquire Currys, it would mark a significant shift for the company. While JD.com has traditionally been an online-focused business, it has recently begun to expand into physical retail. In 2018, JD.com generated 90.1% of its income through online sales. By 2023, this figure had decreased to 80.3%.

By the end of 2023, there were already speculations that JD.com was interested in buying Ceconomy, the parent company of the German-based retailers Media Markt and Saturn. This shows JD.com's willingness to invest more in brick-and-mortar stores and European markets.

Just recently, JD.com announced a partnership with a UK-based parcel delivery company to help British sellers to auction their products in the Chinese market. This highlights JD.com's interest in further establishing itself in the UK market.

JD.com’s bid for Currys: Closing Remarks

JD.com is testing its possibilities in the European market. The eCommerce giant recently showed interest in the German tech company Ceconomy and are now looking to acquire Currys. This would mean a significant change in its access to the European market and a shift to more in-store businesses.

One goal for the Chinese eCommerce player may be to enhance Currys' online business, which could potentially benefit from the online expertise of the Chinese eCommerce giant. This may help the company improve its net sales and overcome its slump in recent years.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

Online Shopping in China: Where Chinese Consumers Shop Online

Online Shopping in China: Where Chinese Consumers Shop Online

Deep Dive

Alibaba, Pinduoduo, JD.com Prepare For Singles’ Day Shopping Festival

Alibaba, Pinduoduo, JD.com Prepare For Singles’ Day Shopping Festival

Deep Dive

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

Deep Dive

China's eCommerce Market Shifts Focus to Offline Channels

China's eCommerce Market Shifts Focus to Offline Channels

Back to main topics