eCommerce: Consumer Favorites

Online Shopping in China: Where Chinese Consumers Shop Online

eCommerce marketplaces tend to reach most consumers in China, but what about online stores? Which providers take the lead in the market?

Article by Nadine Koutsou-Wehling | October 18, 2024Download

Coming soon

Share

Online Shopping in China: Key Insights

Online Stores Less Used Than Marketplaces: eCommerce marketplaces reach most consumers in China, while online stores are less prevalent.

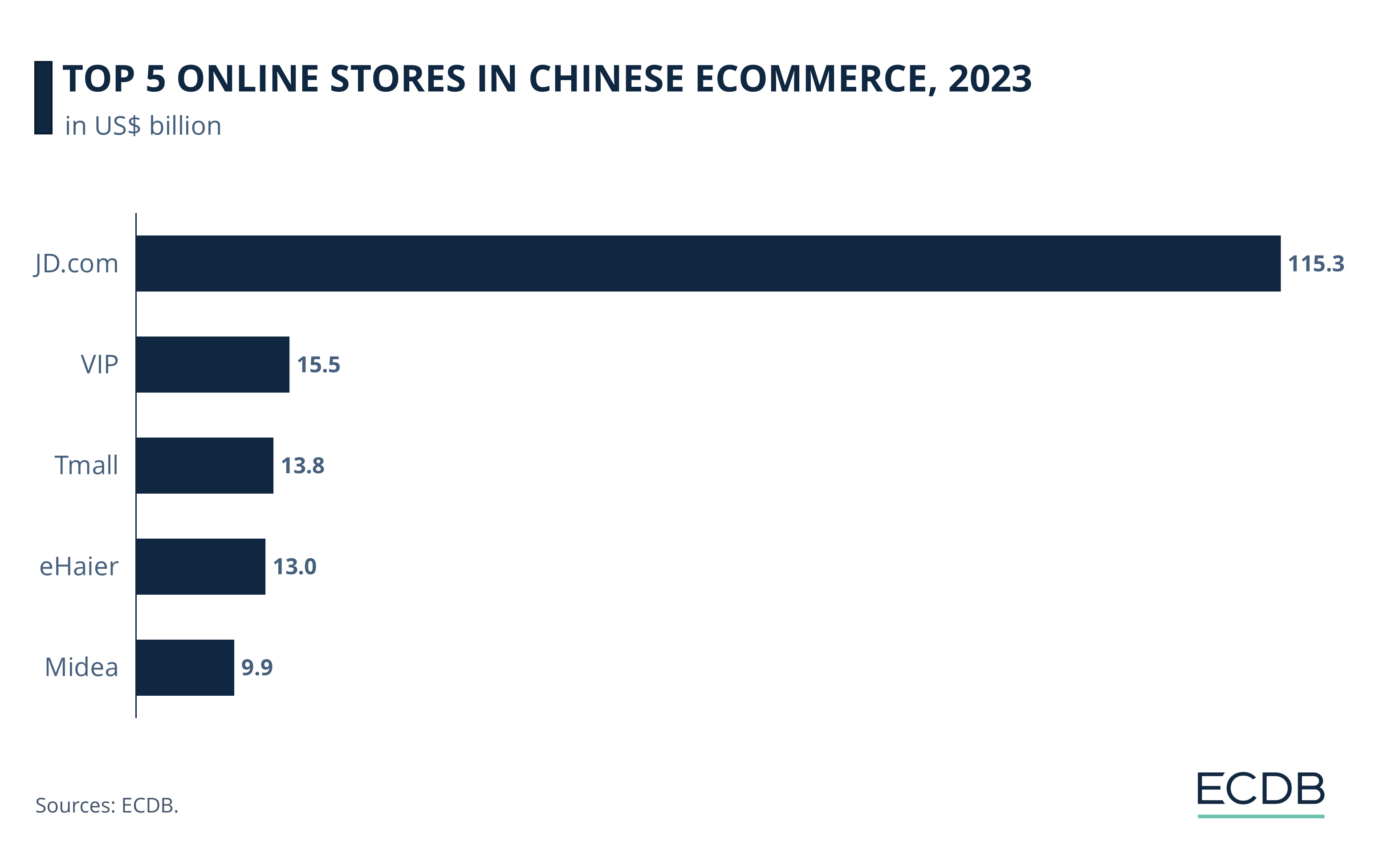

JD.com Is the Number One Online Store: JD.com towers over the other online stores in terms of eCommerce net sales. It made US$115 billion in 2023.

Success Strategies: Other players in the top five include Vip.com, Tmall, eHaier and Midea. Each has its own methods for succeeding in Chinese eCommerce.

China sets eCommerce trends. Its development and online integration of the economy make China the world’s largest eCommerce market. The Chinese eCommerce market is projected to reach US$2.03 trillion in 2024, which means that it is comparable to Amazon's market cap. Household names in China such as Alibaba (AliExpress.com) and Pinduoduo (temu.com) are also becoming known on the global stage.

While the topic of Chinese eCommerce marketplaces is quite common, top online stores are less often discussed. Why is that? And which online stores do Chinese consumers buy from?

The Role of eCommerce Stores in China

Unlike marketplaces, online stores sell their own branded goods. Online store providers act as sellers themselves, while marketplace providers offer sellers the platform and infrastructure to distribute their products.

In China, marketplaces tend to reach the most consumers. This is one of the main reasons why merchants offer their products on eCommerce marketplaces, because of the wider reach. It is also easier, cheaper and more likely to enter Chinese eCommerce as a newcomer or niche player. Because marketplace providers have the structures in place, market entry for sellers is faster and requires less preparation.

But online stores have their own advantages: Merchants retain control over their operations to set their own service policies, web design and customer data. Selling through their own online store typically means merchants pay lower transaction costs, and they have the flexibility and freedom to introduce new products and manage inventory as brands see fit.

One is not inherently better than the other, it depends on the merchant's characteristics and goals. In general, merchants who want to sell quickly and at a lower cost tend to join marketplaces, while brands with more resources and eCommerce experience may benefit from an online store.

Here are the online stores that maintain highest revenues in China.

Online Shopping in China: JD.com Is China’s Number One Online Store

China is the largest market for eCommerce in the world, with sales exceeding US$2 trillion this year. Being such a huge country with a large population (1.4 billion) and high Internet penetration (73.1%), China offers ideal conditions for eCommerce growth.

Here are the online stores with the highest sales in China.

JD.com leads the way, with revenues of US$115.3 billion in 2023.

VIP is the second largest online store in the country. Its revenues of US$15.5 billion are far beyond the first place.

Alibaba’s Tmall ranks third, with US$13.8 billion online sales in 2023.

Fourth place is eHaier, with US$13 billion.

Midea follows with US$9.9 billion eCommerce net sales in 2023.

What are the reasons for consumers to shop at these stores? Here is more about each online store.

1. JD.com

JD or Jingdong started out as a niche retailer of magneto-optical discs. It expanded to sell other electronic devices or home appliances online. Today, JD.com sells all kinds of products online.

JD.com operates the largest online store and second largest marketplace in China. Together with Alibaba and PDD Holdings, JD.com belongs to the trinity of eCommerce leaders in the market. With years of leveraging economies of scale and experience in eCommerce, JD.com now operates an efficient logistics system, including fully automated warehousing and its own fleet of autonomous delivery vehicles.

The company invests in research & development with a particular focus on smart logistics, supply chain efficiency, as well as AI and VR. JD.com also has a stake in the next business on this list, Vipshop.

2. VIP.com

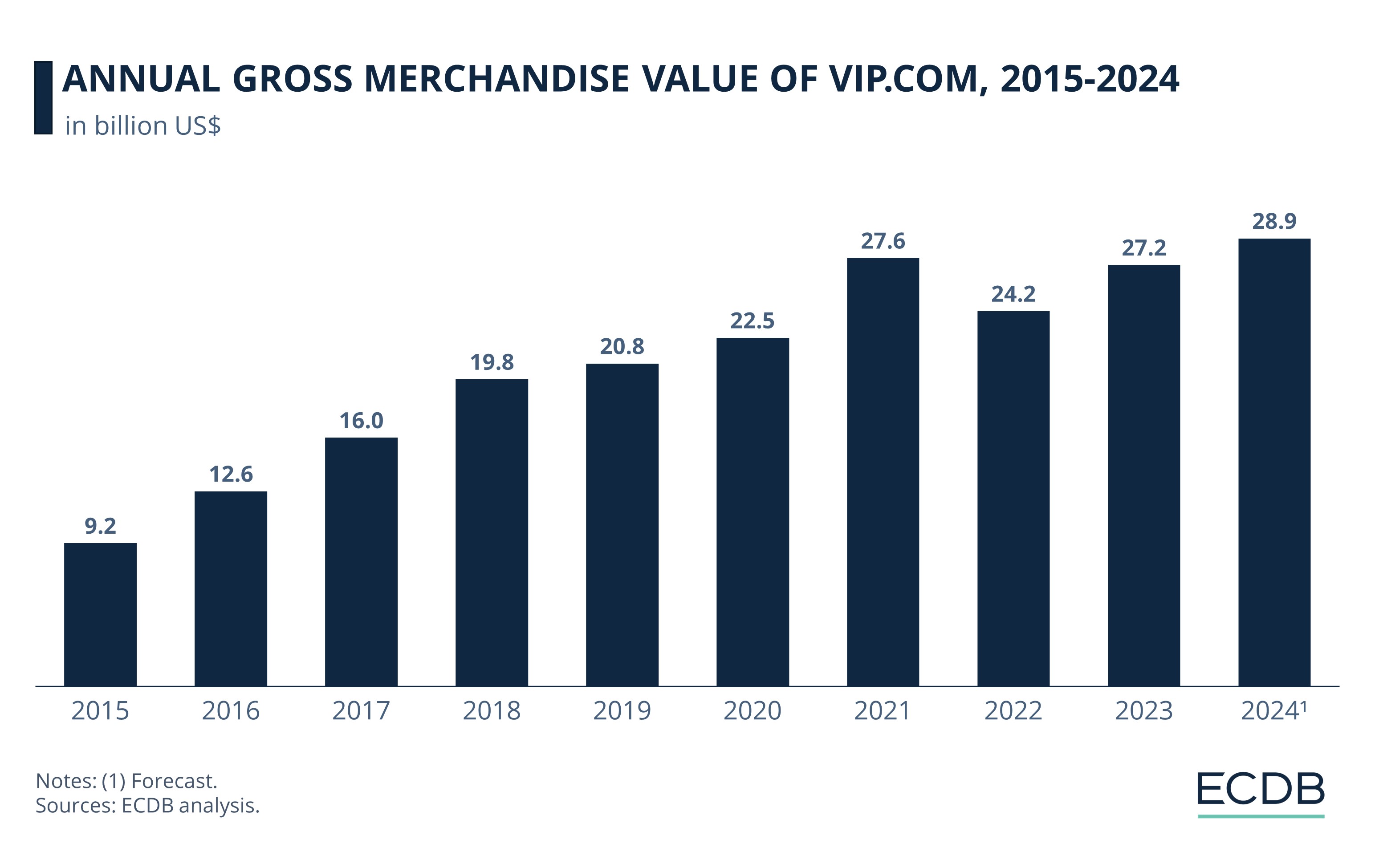

VIP.com, operated by Guangzhou VIP Information Technology Ltd., has established itself in the discount market. Guangzhou VIP Information Technology Ltd. has been operating in China for 14 years, but has recently faced challenges: Its latest quarterly results show a 42% drop in profit and a decline in active users, which has negatively impacted its stock price.

Vipshop, which buys excess inventory and sells it at a discount, has been profitable since 2013. This is particularly noteworthy given the competitive nature of the fashion eCommerce market. When Vipshop was founded in 2008, it was the first company to use such a business model to connect users with excess inventory. In the years following its initial rise, Vipshop faced competition from many other smaller players such as Fclub, Jumei, Mogujie and Juanpi. Most of them are no longer in business.

VIP.com is still the leader in discount fashion, but it is facing a new generation of competitors, including Aikucun from Shanghai and Haoyiku from Hangzhou. But Vipshop also competes with Alibaba and Pinduoduo, which have market share in virtually all relevant eCommerce product categories.

Speaking of Alibaba, how is Tmall doing?

3. Tmall

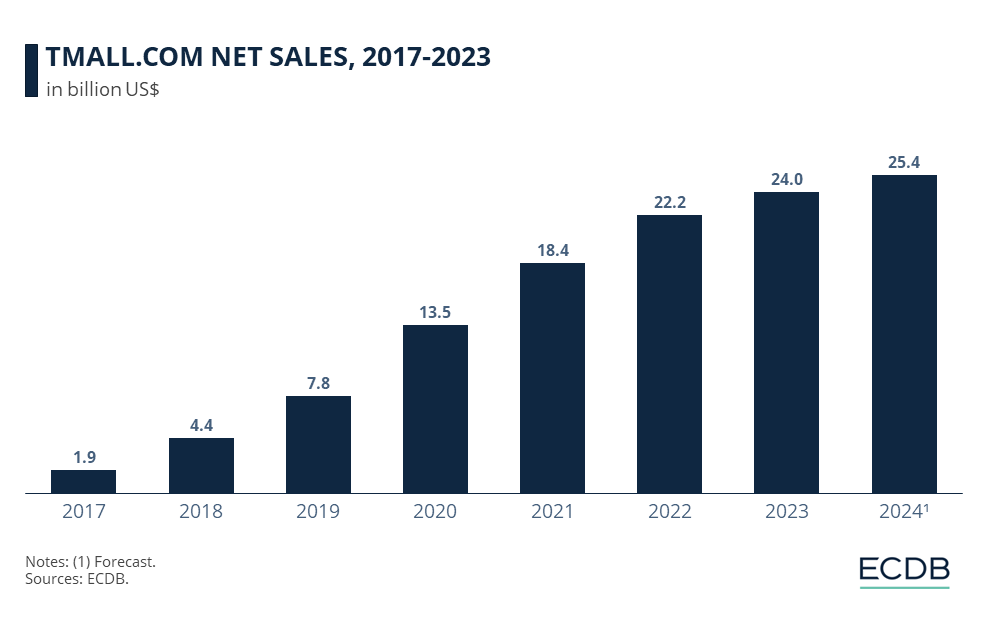

Tmall was launched by Alibaba in 2008, which was an era of mass prosperity in China. Tmall was created to cover the high-income segment of the consumer base that Taobao did not reach. With Alibaba’s capital backing, Tmall became one of the leading online stores in China.

Today, Tmall ranks third among the top online stores in China, with revenues of US$13.8 billion in 2023. Since the pandemic, the platform has maintained a stable level of sales growth, and currently generates revenues of around US$14 billion.

For Alibaba, China commerce retail accounts for 46% of total revenue. Typical of large conglomerates, Alibaba has diversified its revenue streams to include cloud computing, logistics, entertainment media, and more.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

Tmall is known for its wide range of products. The next spot has a narrower product focus.

4. eHaier

Haier started from being a refrigerator manufacturer to selling electrical appliances online to the whole country. The company is noteworthy because it is structured in ecosystems that are made up of micro-enterprises (ME), each with its own goal. Across the organization, these hubs work together to meet customer demands. In this way, Haier is known for its innovative approach and relevance in the industry.

Haier also launches its own home appliance collections. These are based on the latest technology, including IoT (Internet of Things), which means that appliances communicate with each other. In China, Haier operates the fourth largest online store. It generated $13 billion in 2023, and sales are growing.

Another home appliance company, Midea, ranks fifth.

5. Midea

Midea has been producing home appliances since the early 1980s. Today, the company is a leading retailer of home appliances, with online sales approaching US$10 billion this year.

A little behind eHaier, Midea's strategy is very similar to that of its direct competitor. Both companies emphasize product innovation and invest in research and development in relevant industries.

Along with Haier and Gree Electric Appliances, Midea is one of the top 3 home appliance manufacturers, which is highly concentrated in terms of the market capitalization of the top 10. Like Haier, Midea is doing well in the market as both companies are increasing their sales.

Where Chinese Consumers Shop Online: Key Insights

Marketplaces are most typically used for online shopping in China, but there are also online stores the consumers like to buy from. JD.com is the largest online store in terms of 2023 revenues. Further behind, it is followed by VIP, Tmall, eHaier and Midea.

Sources: Denison – eTail Asia – Jingdaily – SCMP – The Bamboo Works – Wipo.int – Yicai Global

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Tinaba Partners with Alipay+ to Launch European Super App

Tinaba Partners with Alipay+ to Launch European Super App

Deep Dive

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Back to main topics