Fashion Week Insight Topic

Can Luxury Fashion Sold on Online Marketplaces Remain Successful?

The concept of online marketplaces for luxury fashion was born at Paris Fashion Week, which kicks off again today. We discuss why the business model is plagued by a series of contradictions.

Article by Nadine Koutsou-Wehling | March 03, 2025

Paris Fashion Week starts today, where luxury fashion brands present the most coveted styles to a global audience every half year. But times have changed and so have luxury sales: Case in point are online marketplaces for luxury fashion that sell authenticated products at prices lower than the market average.

Fun fact, the idea for online marketplace Farfetch was conceived at Paris Fashion Week in the early 2000s. But the marketplace has lived through turbulent years recently and has now arrived at a place of stagnation.

Is this a development that is to be expected for that business model? Or are online marketplaces for luxury fashion fulfilling a consumer need that guarantees them business despite challenges?

Growth Is Slowing for Established Luxury Marketplaces

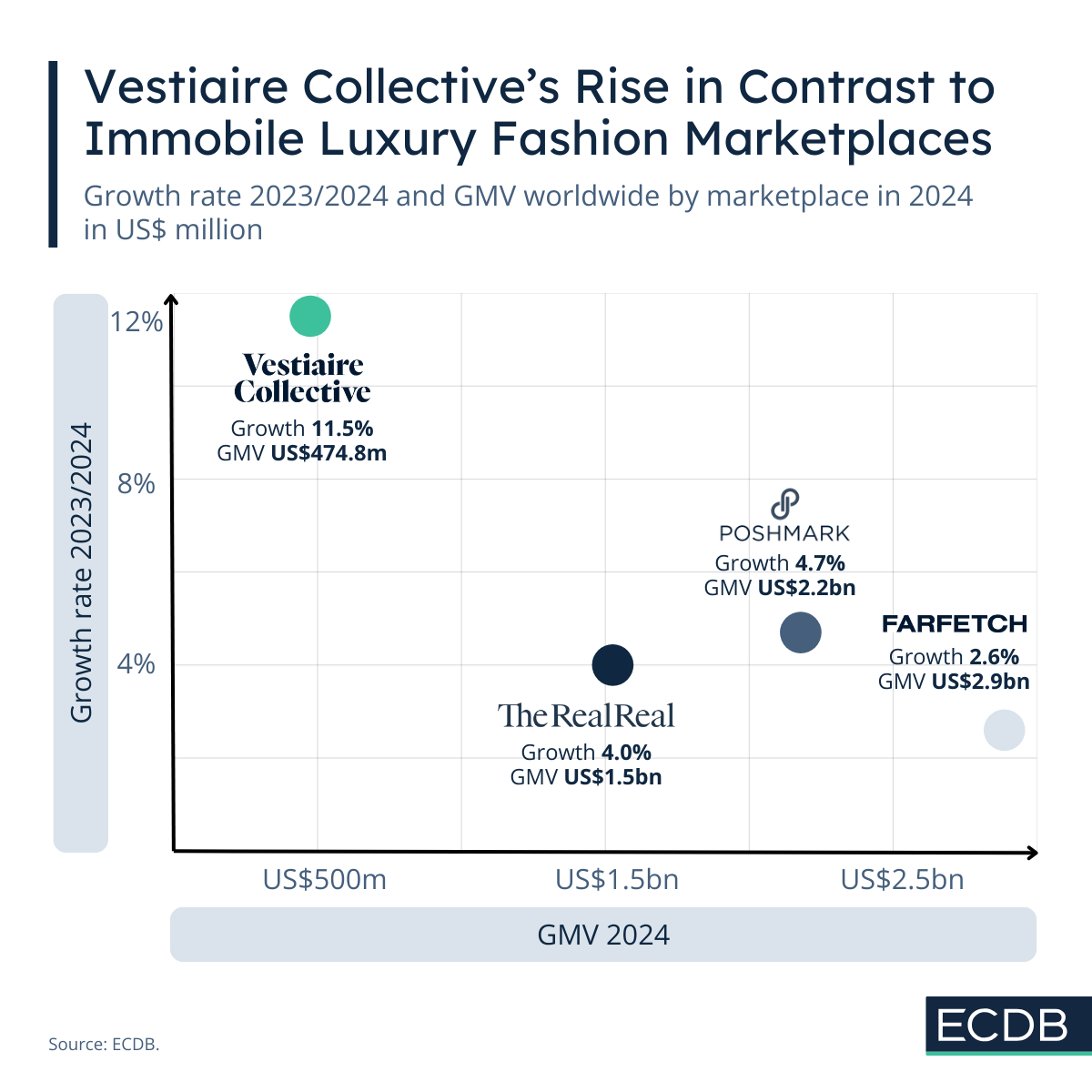

Larger players grow slower while smaller ones grow faster, not an unusual sight so far. But the turbulent history of some of these marketplaces, together with expert doubts about the viability of the business model, put to question how severe the currently stagnating GMV numbers are.

A closer look at the development shows that Farfetch is the marketplace with the highest GMV in 2024 (US$2.9 billion) and the lowest growth rate (2.6%), in contrast to Vestiaire Collective with the highest growth rate (11.5%) and lowest GMV (US$474.8 million).

The other two marketplaces in our depiction, Poshmark and The RealReal, are more like Farfetch in GMV and growth speed but they nonetheless do not exactly fall into a linear pattern. Poshmark grew at a rate of 4.7% from 2023 to 2024 to reach a GMV of US$2.2 billion and The RealReal generated US$1.5 billion in 2024 with a growth rate of 4.0%.

The billions of dollars transacted on these marketplaces each year suggest successful operations, but that alone does not imply profitability. Especially online luxury marketplaces have high costs due to the implied authentication processes which necessitate labor and time.

Acquisitions in Recent Years Spur Doubtful Prospects

A look at the Financials section on the respective ECDB Company Pages confirms that neither Poshmark, nor Farfetch, nor The RealReal had positive operating profit or net income in the last years available for analysis. These bleak financials contributed to why Farfetch and Poshmark were acquired by the largest South Korean eCommerce companies, Coupang and Naver, respectively.

The acquisitions themselves were highly disputed. Analysts are still not in agreement as to whether that development will help or harm luxury marketplaces, given that Coupang and Naver do not have an origin in the luxury industry and may therefore misconstrue the whole concept of the platforms.

Because essentially, this is what the discussion boils down to: Does the commodification of luxury products oppose their appeal by diluting exclusivity?

Online Luxury Marketplaces Aim Somewhere in the Middle

It is difficult to answer with a clear yes or no. On the one hand, consumers who want to spend less on a luxury purchase benefit from the more affordable offers on luxury online marketplaces, while sellers can reach wider audiences or profit from selling their personal items. The recent rise of Vestiaire Collective is indicative of a business concept of this kind with growth potential.

On the other hand, the exclusivity aspect is a hallmark of luxury products, which includes the tactile experience and store interactions. Online luxury marketplaces aim somewhere in between the regular consumer who is never or rarely willing to spend US$5k on a sequin-covered slip and the highly affluent user who immerses themselves in the full luxury experience when buying the products. Farfetch’s complex acquisition history of recent years and the slowing down of the other marketplaces show how falling somewhere in the middle is a struggling feat among the high-performing marketplaces with low-cost appeal.

The RealReal has at least found a way to cut costs by using AI and machine learning authentication of products. Its platform has seen higher engagement in recent months due to savings-minded consumers who want to support the market and spare their purse by buying secondhand.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

TikTok Shop Launched in Germany, France and Italy - What's to Be Expected Next?

TikTok Shop Launched in Germany, France and Italy - What's to Be Expected Next?

Deep Dive

Love Your Pet: Chewy.com Prevails Over Petsmart.com and Petco.com

Love Your Pet: Chewy.com Prevails Over Petsmart.com and Petco.com

Deep Dive

After Zalando's Takeover of About You: How That Affects German eCommerce

After Zalando's Takeover of About You: How That Affects German eCommerce

Deep Dive

Watching the Super Bowl? Here Is the eCommerce Strategy of the Top Football Merch Retailer Fanatics

Watching the Super Bowl? Here Is the eCommerce Strategy of the Top Football Merch Retailer Fanatics

Deep Dive

ByteDance on the Fast Track With a High Level of Revenue and Strong Growth

ByteDance on the Fast Track With a High Level of Revenue and Strong Growth

Back to main topics