Ecommerce: Multichannel shopping

Multichannel eCommerce Strategies in the U.S. 2023: Consumer Behavior by Gender and Generation

How are online shoppers across the U.S. using multichannel service offering in eCommerce? Learn the difference in attitude towards multichannel shopping according to shoppers' gender and generation.

Article by Nashra Fatima | February 13, 2024Download

Coming soon

Share

Multichannel eCommerce Strategies in the U.S.: Key Insights

Trends in multichannel service: Options that enable people to gather information, like online product search and store locators, find approval across gender and generation divisions. More complex channel mixing, however, is determined by the shopper’s gender as well as generation.

Active users of multichannel service: Younger shoppers, particularly those from the Millennial generation, are more likely to adopt multichannel shopping than others. In terms of gender, men appear more open to the practice than women.

The future of multichannel retail: Physical stores remain an important touchpoint for customers of all ages and genders. A unified omnichannel retail strategy that integrates the digital and physical elements of shopping may be a smart way forward for businesses.

The transition from brick-and-mortar to online retail continues across major global markets. But even as consumers adopt eCommerce, they mix and match online and offline channels to customize their shopping experience.

In the United States, the usage of multiple channels for shopping depends on the gender and generation of the shopper, according to Statista Consumer Insights.

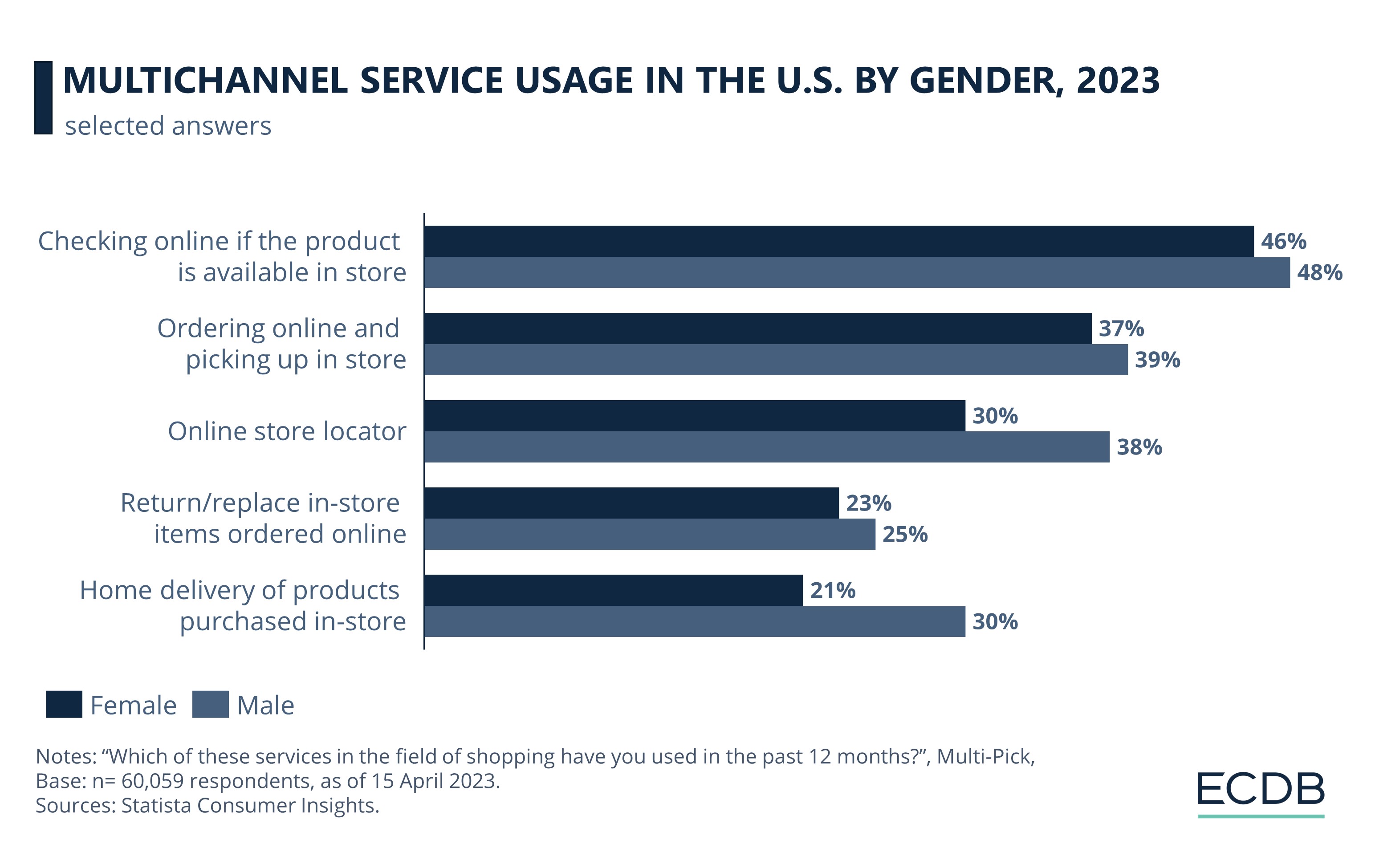

Multichannel Usage by Gender: Male Shoppers More Active

Both male and female online shoppers appear to be comfortable integrating offline channels into their online buying journey. But data suggests that males are more active than females in combining online and offline channels.

Nearly half the respondents from both genders – 46% women and 48% men – go online to check whether a product is available in store, indicating that online search before purchase has become a common practice for consumers regardless of their gender.

In another fusing of the physical and digital in shopping, ordering online and picking up the purchase in stores is also popular amongst both genders, with men (39%) preferring it only slightly more than women (37%).

However, gender difference in multichannel shopping becomes apparent in practices like home delivery of products purchased in stores, with 30% males taking this option over 21% females.

Using an online store locator is also more popular amongst males, with 38% of them using it compared to 30% females. Buying in store and returning by mail shows a similar pattern, with 18% males following this practice as opposed to 10% females.

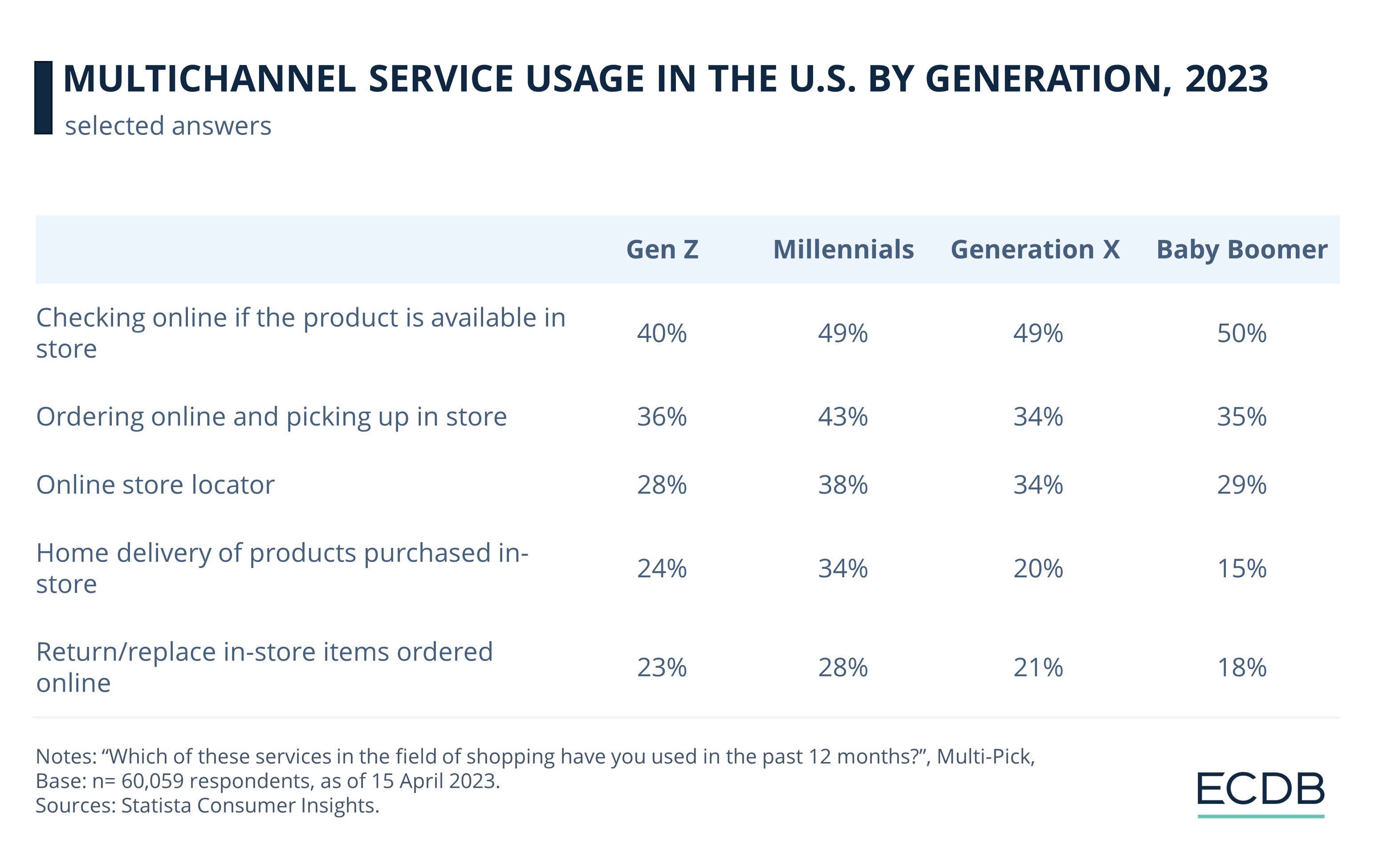

Millennials Ahead of Others in Using Multiple Channels for Shopping

Multichannel service usage also correlates with the shopper’s generation. Out of all generational cohorts under study, Millennials display the most ease using hybrid buying methods.

Only one practice – checking online for a product’s availability in store – increases linearly with the shopper’s age: 47% Gen Z, 49% Millennials and Generation X, and 50% Boomers adopt it.

In most other instances, Millennials emerge as the savviest multichannel shoppers, outpacing their older as well as younger counterparts.

For example, 43% of Millennials ordered products online and picked them up in store as opposed to 36% Gen Z, 34% Generation X, and 35% Boomer shoppers.

Similarly, while 34% of Millennials opted for home delivery of products purchased in the store, the percentage of Gen Z, Generation X, and Boomer for the same stands at comparatively low 24%, 20%, and 15% respectively.

Generally, larger shares of older shoppers preferred single-channel shopping. For example, only 9% Generation X and 3% Boomers bought products in store and returned them by mail as compared to 16% of Gen Z and 20% of Millennials.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics