Not So Friendly Fraud: When Customers Defraud Businesses

May 24, 2023

Cybersource’s 2022 Global Fraud and Payments survey asked merchants about their experiences with fraud attacks. Interestingly, it’s not just professional fraudsters in organized crime who are committing fraudulent purchases and payment schemes. Legitimate customers are also known to take advantage of obliging company policies to get a deal on their purchases.

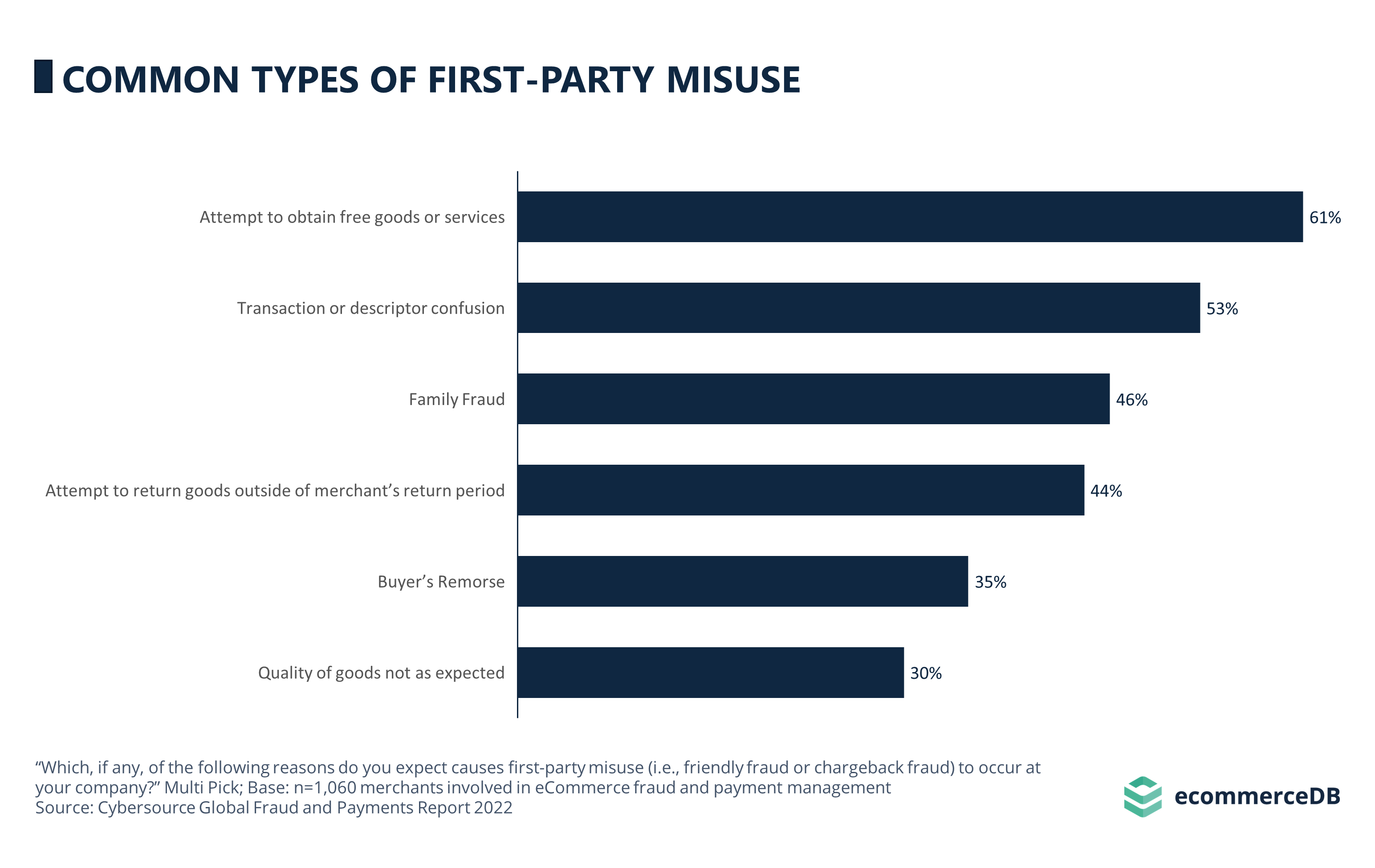

The chart below shows the reasons for Friendly Fraud (or First-Party Misuse). According to the Cybersource report, merchants believe that First-Party Misuse accounts for 16% of all fraudulent activity worldwide. At the same time, 32% of merchants responding to the survey said that they had experienced this type of fraud in their organization.

Common Reasons for Chargeback Requests

When asked what merchants think causes First-Party Misuse, 61% cited malicious intent. This means that merchants believe that these customers are requesting a chargeback to receive free goods and services.

In addition to intentionally fraudulent chargeback requests from customers, there are also cases of genuine misunderstanding. 53% of merchants report that confusion over transactions or product descriptions is another reason customers file chargebacks. For example, if someone orders a product that doesn’t match the description on the website, it’s the merchant’s responsibility to reimburse the customer. Another case that falls into this category is when customers lose track of their transactions and mistakenly believe an incorrect charge has been made. This category shows that mistakes can happen on both the customer and merchant side, so taking steps to prevent misunderstandings regarding product descriptions or the origin of transactions can go a long way toward preventing massive chargebacks.

Another common type of Friendly Fraud is Family Fraud. 46% of merchants reported encountering this subset of First-Party Misuse. Family Fraud occurs when the cardholder’s family or household members make purchases using the cardholder’s payment credentials. When the authorized cardholder subsequently disagrees with the purchase and requests a chargeback, it’s called Family Fraud.

The fourth most common subtype of Friendly Fraud occurs when customers try to return products outside of the merchant’s return period. 44% of survey respondents chose this category. This can be due to a lack of information about a company’s return policy, but it can also be the fault of customers who aren’t paying enough attention. One way to avoid late returns is to communicate more clearly so that customers are aware of return deadlines.

More than a third of merchants (35%) suspect that Buyer’s Remorse is the reason for chargebacks they have received. Buyer’s Remorse is a widely known concept that describes post-purchase concerns about a product. Regret can be caused by both emotional and practical concerns. While emotional reasons for Buyer’s Remorse include buying products on impulse or being influenced by advertising and other marketing tactics that go beyond rational reasoning, practical concerns arise because of the high price of a product, or because clients realize that they won’t use the product after all.

The last reason for Friendly Fraud that merchants reported is quality concerns, named by 30% of respondents to the Cybersource survey. Unlike Buyer’s Remorse, this time it’s product quality that fails to satisfy customers because of exaggerated or missing product descriptions on websites, or because marketing has created unrealistic expectations of the product’s quality. Providing accurate information about a product that sets realistic expectations for potential customers can help reduce chargebacks due to quality concerns.

Customer Is Not Always at Fault - What Can You Do to Prevent First-Party Fraud?

First-Party Misuse or Friendly Fraud is not an uncommon occurrence for merchants in eCommerce. Whether intentional or not, consumer chargebacks can have significant financial and reputational impacts on businesses. To mitigate the risk of fraudulent chargebacks, businesses should establish clear and consistent policies that outline their expectations for customers. This includes providing detailed information about products and transactions, as well as clear policies for returns and refunds. By creating a transparent and trustworthy environment, companies can reduce the likelihood that customers will misuse their policies.

Sources:

Related insights

Article

Online Car Selling & Buying: Revenues, Forecast, Top Marketplaces & Trends

Online Car Selling & Buying: Revenues, Forecast, Top Marketplaces & Trends

Article

Fashion ReCommerce in the UK: Top Categories, Generational Attitudes, Leading Shops

Fashion ReCommerce in the UK: Top Categories, Generational Attitudes, Leading Shops

Article

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Zalando, Otto & About You: Revenue, Market Growth, Business Strategies

Article

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Online Shopping vs. In-Store Shopping in Europe: eCommerce Recovers After Post-Pandemic Dip

Article

eCommerce in Indonesia: Market to Reach US$100 Billion Soon

eCommerce in Indonesia: Market to Reach US$100 Billion Soon

Back to main topics