Online Hot Drinks Market in the United States

Download

Coming soon

Share

The COVID-19 pandemic has reshaped countless sectors and trends, including eCommerce. The online hot drinks market, in particular, has enjoyed elevated growth rates in many countries. The United States, the second biggest eCommerce market globally, is one of the countries where this growth was most pronounced. Amidst the shifting routines and lifestyles, the U.S. online hot drinks market has surged, experiencing a transformative boost.

As workplaces transitioned to homes and physical cafes shuttered their doors, Americans turned towards digital platforms to satisfy their cravings. With a blend of necessity and convenience, the virtual marketplace for hot drinks has transcended its conventional bounds. According to a 2021 survey, more than half (54%) of coffee drinkers who work from home in the U.S. said that they drank more coffee. While 31% of the respondents didn’t have any change in their coffee consumption, 15% reported drinking less coffee.

Representing 93% of the U.S. online hot drinks market revenue in 2022, the online coffee market is the largest sub-market of the online hot drinks market. In order to have a better understanding of the topic, let’s have a look at the growth trajectory of the online hot drinks market in the U.S. first, how it relates to the overall eCommerce growth of the country, and then dive into its sub-markets – namely, coffee, tea and cocoa.

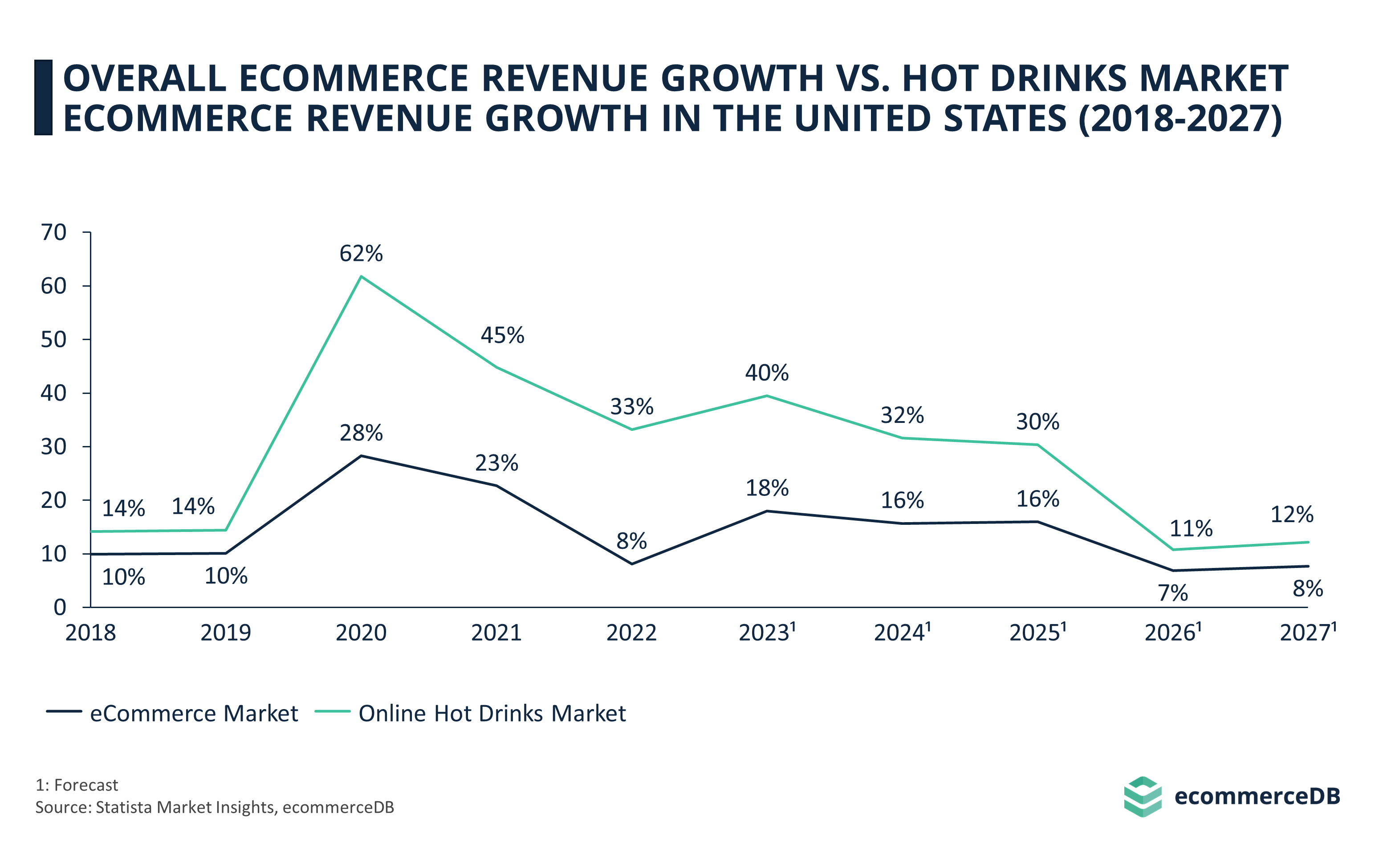

Online Hot Drinks Market in the U.S. Grew by 62% in 2020

Going into the pandemic with US$1.96 billion revenue at 14% growth in 2019, the U.S. online hot drinks market was worth US$3.17 billion by the end of 2020 with 62% growth achieved that year. Though the market’s expansion slowed down in 2021, it still grew by 45%, a level that’s well above the pre-pandemic figures. As for last year, the market hit US$6.13 billion with an annual growth of 33%. Despite projections indicating a substantial 40% expansion of the U.S. online hot drinks sector by the end of 2023, taking earnings to an estimated US$8.55 billion, the pace of growth in the subsequent years is expected to slow down. The market is forecasted to have 32% and 30% growth for 2024 and 2025 respectively, however, this rate goes down to 11% and 12% for the following two years.

For full context, it is key to understand that over the past five years, the online hot drinks market in the U.S. has outpaced the growth of the general eCommerce sector. Though the gap between the two growth rates was only 4 percentage points in the 2018 – 2019 period, it went as high as 34 percentage points in 2020. Since then, the gap has been closing and it is expected to go back to the pre-pandemic level in 2026.

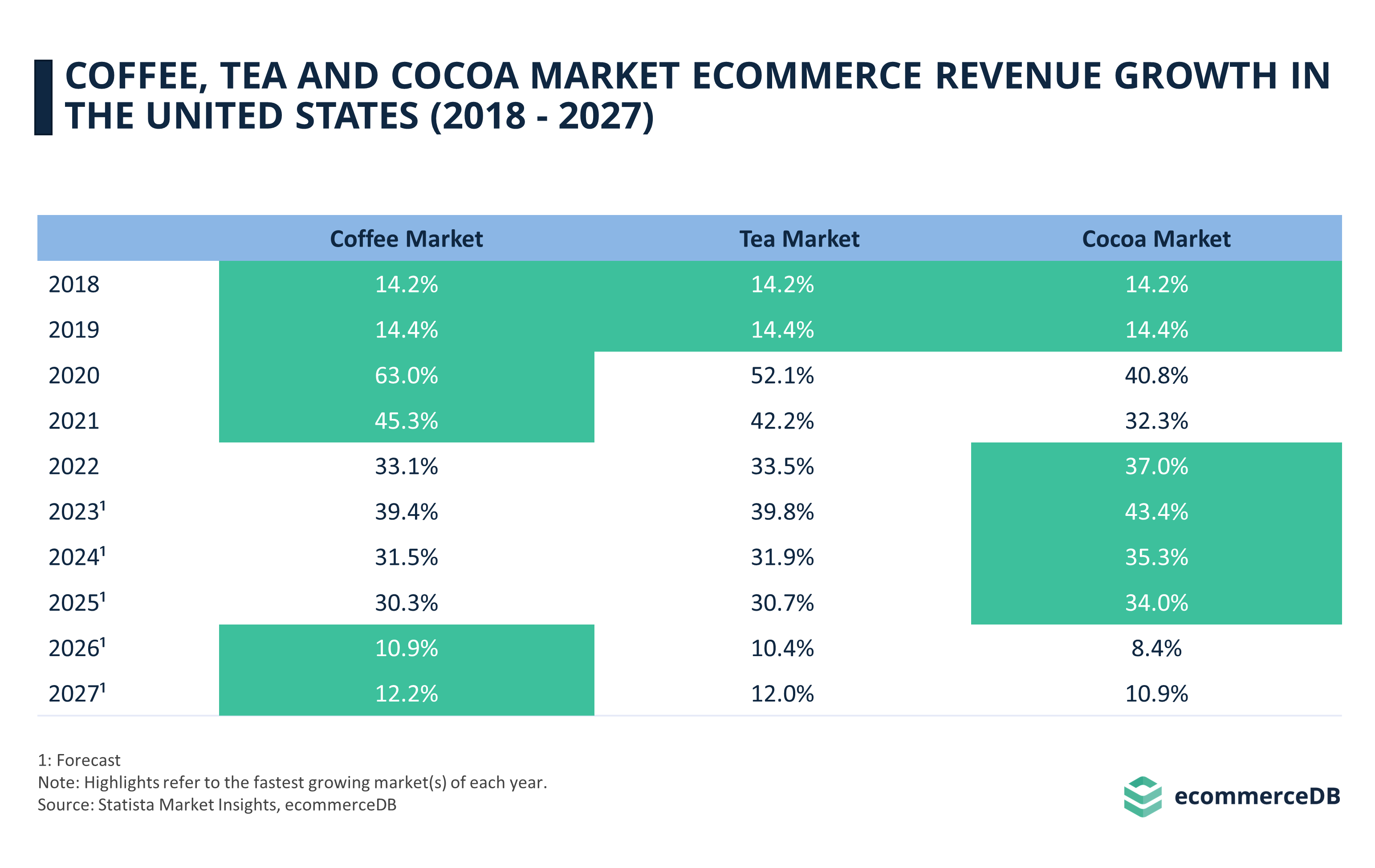

Coffee, Tea and Cocoa Markets

As mentioned before, the U.S. online coffee market is the largest sub-market of the online hot drinks market. Parallelly, the market’s growth pattern has been very close to the online hot drinks market’s. The online tea market, which is the second biggest hot drinks sub-market, reached 52% growth in 2020 – a 38 percentage point jump over 2019’s growth. Similar to the online coffee market, the online tea market’s growth also decreased in the following years, going down to 42% in 2021, and 33% in 2022. Although the online cocoa market’s growth spurt was not as impressive as the other sub-markets' (41% in 2020, and 32% in 2021), it actually grew at a higher rate than the others in 2022 with 37%, staying well above the pre-pandemic level (14% growth in 2019).

Looking ahead, the anticipated 2023 growth for each sub-market varies between 39% and 43%. While the calculated growth rates for 2024 and 2025 are in the range of 30% to 35%, those for 2026 and 2027 remain at 8-12%. As it was the case last year, in the next three years, too, the U.S. online Cocoa market is expected to have the highest growth among all online hot drinks sub-markets. From 2026 on, though, the online coffee market takes back the lead in growth.

Cocoa Takes the Lead in Growth Until 2026

The COVID-19 pandemic brought about transformative shifts in consumer behavior in the United States, leading to a surge in the online hot drinks market. As lifestyles adjusted to accommodate more home-based activities, the market experienced phenomenal growth, significantly outpacing the general eCommerce sector. In relation to this, the coffee sub-market particularly benefited from a notable increase in consumption among home-based workers. It's important to note, though, that while the growth trend has been robust, projections suggest a gradual slowing down, with the growth rate gap between the hot drinks market and the general eCommerce sector expected to go down to the pre-pandemic level by 2026.

Taking a closer look at the sub-markets, the online coffee sector continues to mirror the broader market's trajectory, while the tea and cocoa sectors follow suit. Interestingly, the cocoa market, which had initially experienced slower growth, surged ahead in 2022. While the cocoa market is anticipated to spearhead growth over the next three years, projections predict the coffee market reclaiming its position of dominance from 2026 onwards. Thus, the dynamics of the online hot drinks market in the United States continue to evolve, underscoring the pivotal role of changing consumer behaviors in shaping market trends.

Sources: ecommerceDB, Statista Market Insights, Statista Consumer Insights

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics