Ecommerce: Product Return

Online Purchase Returns in the United States 2023: Product Categories by Gender and Generation

Which products do different genders and generations of online shoppers in the United States return the most? Find out data-backed answers about product return rates by gender and generation in this article.

Article by Nashra Fatima | February 13, 2024

Online Purchase Returns in the United States 2023: Key Insights

Product returns in the United States: The percentage of product returns by category in the U.S. depends on the gender and generation of the shopper.

Product returns by gender: Compared to females, American males are more comfortable returning products that they buy online in every category except for clothing. It is a tie between the two genders when it comes to returning clothes – the category with the highest return rate.

Product returns by generation: Out of different generational cohorts, Millennials take the lead in returning products that they purchase online. This hints at the ease with which they have come to navigate the eCommerce ecosystem, where they do not hesitate to return products that they bought online

As customers become increasingly familiar with eCommerce platforms, they may also become less hesitant to use the product return option.

However, the return rates of products bought online in the U.S. vary according to the gender and generation of the shopper, according to Statista Consumer Insights.

What are the differences between return rates in different product categories, depending on the shoppers’ gender and generation? We analyze the variations with the latest data.

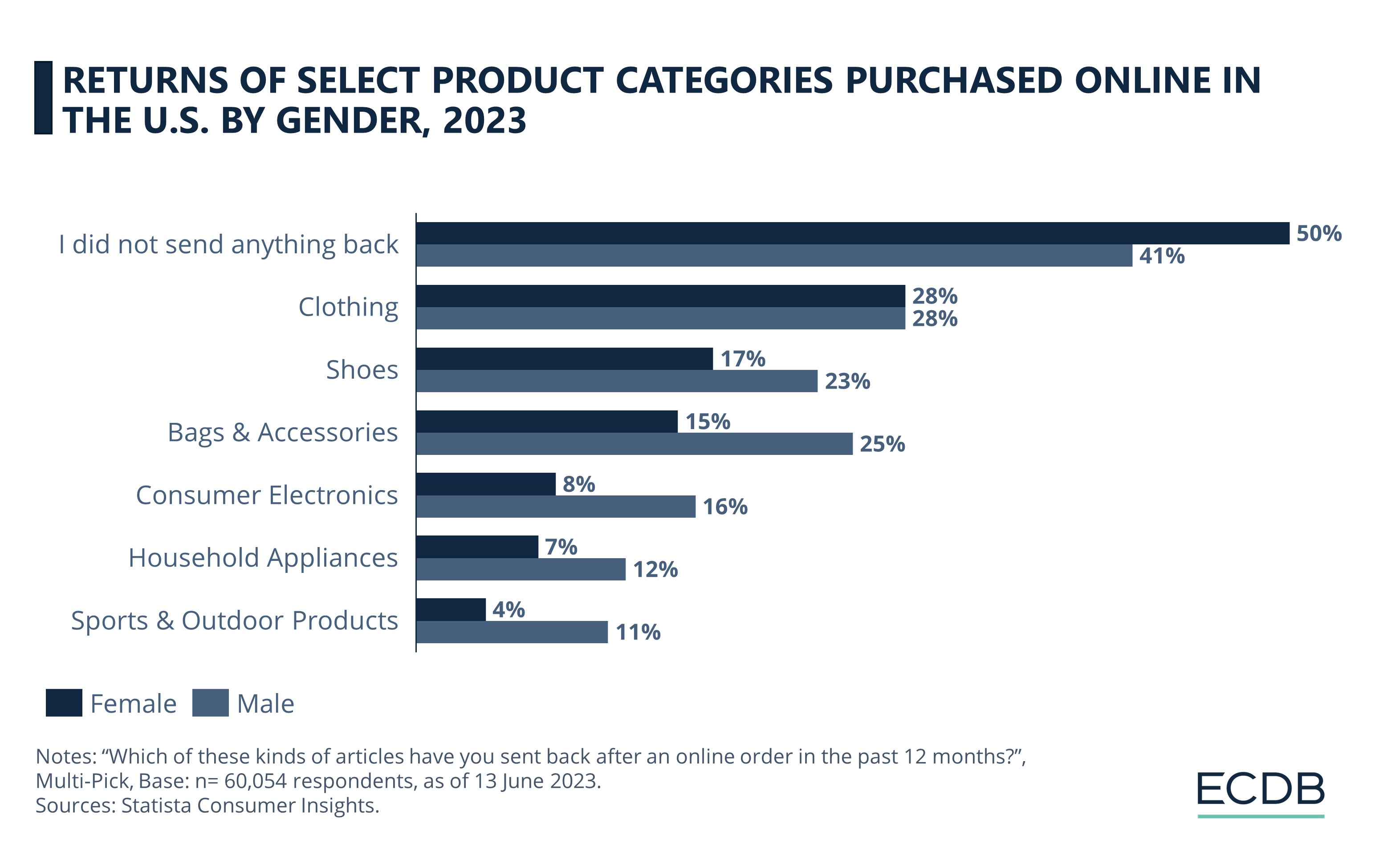

Product Returns in the U.S. by Gender: Males Outpace Female Shoppers in Returning Products

The percentage of males in the U.S. who return products bought online exceeds that of females in nearly every category.

For instance, 16% males returned Consumer Electronics , which is double the percentage of females (8%). This is likely because males tend to be more likely than females to purchase consumer electronics online. A similar pattern of product returns can be discerned in other categories such as DIY & Garden, Sports & Outdoor, and Stationery & Hobby Supplies.

Clothing remains the category with the highest return rate, but here, the share of male and female returns is the same at 28%. However, males again overtake females visibly in returning Bags & Accessories (25% vs 15%) and Shoes (23% vs 17%).

A larger share of women (50%) than men (41%) said they did not send anything back in the past year, showing they are less likely than male shoppers to return products that they buy online.

Product Returns by Generation

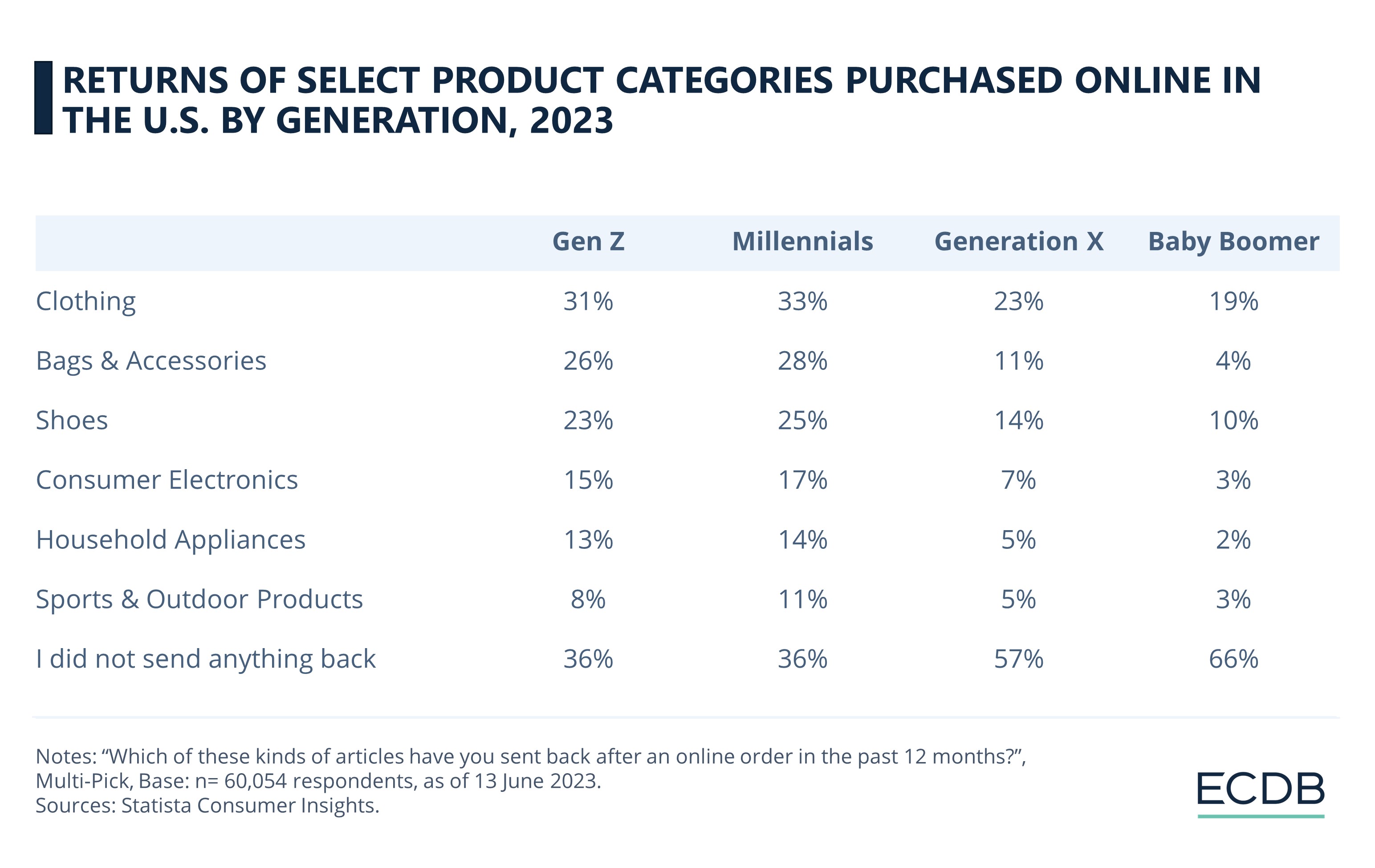

In terms of generation, younger shoppers in the U.S. are responsible for returning more products than their older counterparts.

Amongst the generational cohorts under study, 66% of Boomers and 57% of Generation X said that they did not send anything back; this means that the percentage of Boomer and Generation X shoppers who returned products that they bought online stands at 34% and 43% respectively.

In contrast, the percentage for both Millennials and Gen Z who sent products back stands at a comparable high of 64% each. This suggests that shoppers from younger generations are more likely to return products that they purchase online than those from the older generations.

In terms of category, the most returns for every generation occurred in Clothing, for which the share of returns by Millennials (33%) slightly exceeds that of Gen Z (31%). In comparison, only 23% of Generation X and 19% of Boomers returned clothing. In other categories, the patterns of return for the four generations remain comparable.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics