eCommerce: Car Parts

RockAuto Business Analysis: Net Sales & Online Car Parts Market in the U.S.

How has RockAuto's business grown, and what does the future hold for the online car parts market in the U.S.? Find the answers in our detailed analysis.

Article by Cihan Uzunoglu | August 21, 2024

RockAuto Business Analysis: Key Insights

RockAuto’s Steady Growth: RockAuto.com has consistently expanded its online sales, with a strong focus on the U.S. market, and is projected to reach $193 million in eCommerce revenue by 2024.

Expanding U.S. Market: The U.S. online car parts market is experiencing rapid growth, with eCommerce share expected to climb to 24% by 2028 and total sales projected to reach nearly US$40 billion.

Rising Competition: Specialist online stores like Carparts.com and Advanceautoparts.com currently lead the market, but their dominance is under increasing pressure from retail giants like Amazon, whose growing market share is leading to revenue declines for these specialty merchants.

Shopping for cars and car parts online has become second nature for many, but not all eCommerce sites look the part. Take rockauto.com, for example—owned by RockAuto, LLC, it resembles a catalog pulled straight from a parts store terminal rather than a sleek, modern web store.

Yet, despite this throwback appearance, RockAuto has thrived, riding a wave of increased demand for car parts, particularly during the pandemic. What’s driving this growth? And how does RockAuto, a seemingly old-school player, fit into the fast-changing world of online car parts sales? Let’s dive into the details to find out.

RockAuto.com Online Store

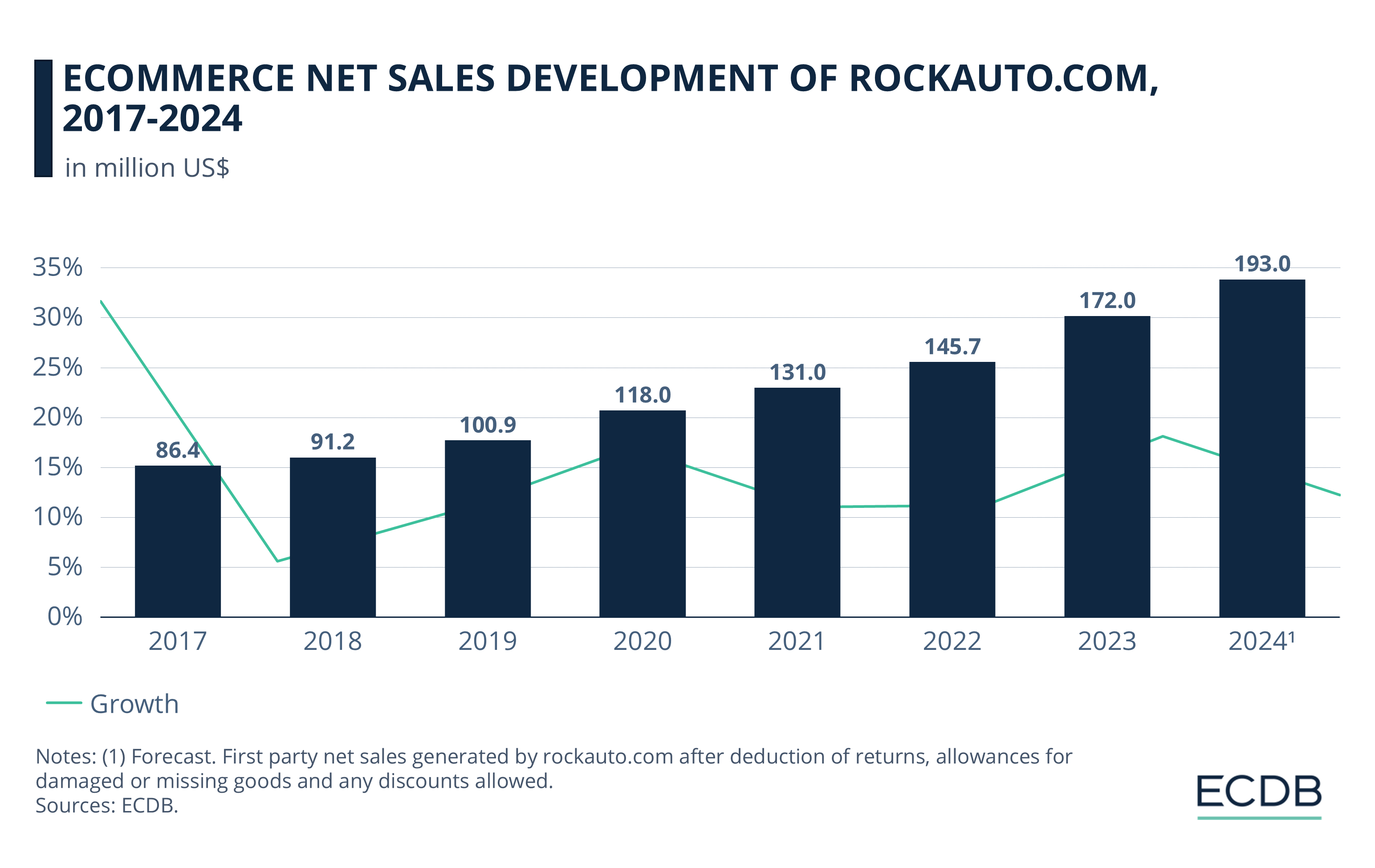

Net Sales Development

Rockauto.com has shown consistent growth in its online sales from 2017 to 2024. The data reflects the company’s ability to capitalize on the increasing demand for auto parts, particularly during the pandemic, with a strong upward trajectory forecasted through 2024:

Rockauto.com’s eCommerce revenue grew from US$86.4 million in 2017 to US$91.2 million in 2018.

By 2019, sales had reached US$100.9 million, reflecting steady growth.

The pandemic year of 2020 saw a significant rise, with revenue jumping to US$118 million.

This growth trend continued, with sales hitting US$145.7 million in 2022.

By 2023, rockauto.com’s eCommerce revenue had surged to US$172 million, with 2024 expected to reach US$193 million.

Born and raised in the U.S., the online store doesn't look too far to make business.

Top Markets of RockAuto.com

The online store's revenue distribution by country underscores its strong reliance on the U.S. market, with significant contributions from North American neighbors and a smaller international presence:

In 2023, the United States dominated Rockauto.com's online sales, accounting for a substantial 82.9% of total eCommerce revenue.

Canada followed as the second-largest market, contributing 12.3% of sales.

Mexico represented a smaller but notable share, with 3.2% of revenue coming from this market.

The remaining 1.5% of sales were distributed across the rest of the world, indicating Rockauto.com's more limited international footprint beyond North America.

Beyond RockAuto, let's also take a look at the overall online car parts market in the U.S. How has the market revenue developed and what has the pandemic’s effect on the sector?

Online Car Parts Market in the U.S.

The online car parts market in the U.S. has evolved rapidly, driven by changing consumer behavior and significant market disruptions. As the supply chain issues of recent years have pushed vehicle owners to keep their cars longer, the demand for replacement parts has risen.

The average age of vehicles on American roads has hit an all-time high of 12.2 years, increasing the need for maintenance and repairs. This trend has played directly into the hands of online retailers like Rockauto.com.

Quarter of Car Parts in the U.S. to Be Sold Online Soon

Consumers are increasingly turning to online platforms to find the parts they need. The appeal is straightforward: online shopping offers convenience, a wide selection, and often better prices compared to traditional brick-and-mortar stores. As online purchasing becomes more common – even if it occasionally comes with unexpected tipping prompt – the trend is clear:

While the online share of the overall auto parts market in the U.S. was 9.3% in 2017, it reached 9.7% by the end of 2019.

The pandemic also boosted online usage in this market: by 2020, the online share of the market was 12%.

It continued to rise, reaching 16.2% by the end of last year, and we expect it to reach 24% by 2028. This means that in just a few years, a quarter of all auto parts sold in the country will be sold through online channels.

The growing popularity of buying car parts online is also about the ability to comparison shop and access a broader range of products than what’s typically available in physical stores. Online platforms have effectively tapped into this demand by offering extensive inventories, detailed product information, and customer reviews, making it easier for consumers to find the right part at the right price.

Online Sales Will Reach US$40 Billion in a Few Years

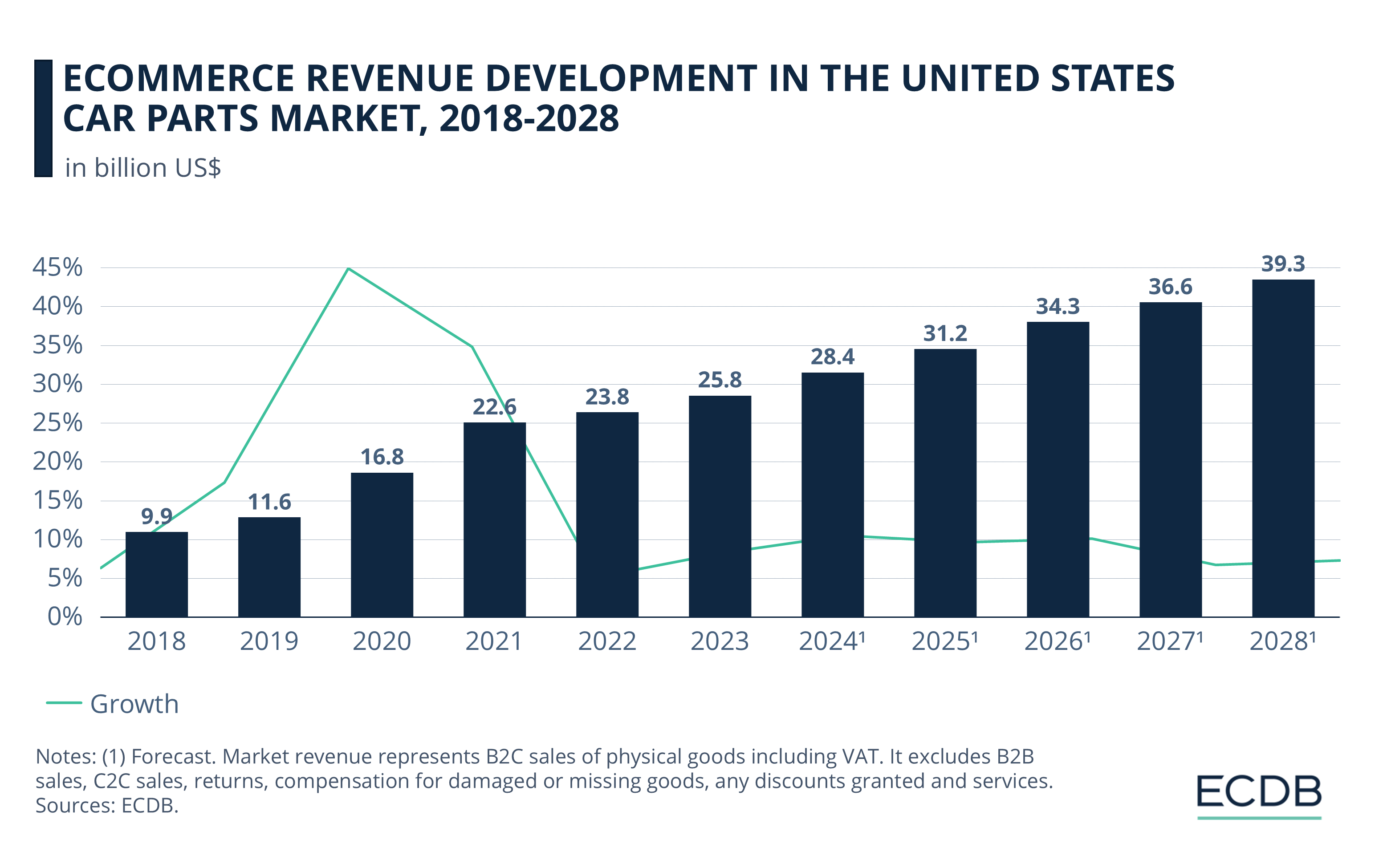

The U.S. car parts market has experienced substantial growth in eCommerce revenue over the past decade, with the trend expected to continue through 2028:

In 2018, the market generated US$9.87 billion in revenue, which grew to US$11.58 billion by 2019.

The onset of the pandemic in 2020 led to a sharp increase (45% growth), with revenue surging to US$16.79 billion.

This growth trajectory continued in 2021, reaching US$22.63 billion, and further to US$23.79 billion in 2022.

By 2023, the market had expanded to US$25.75 billion.

Looking forward, 2024’s revenue is forecasted to rise to US$28.44 billion, while the forecast for 2028 suggests the market will reach US$39.26 billion.

Top Car Parts Online Stores in the U.S.

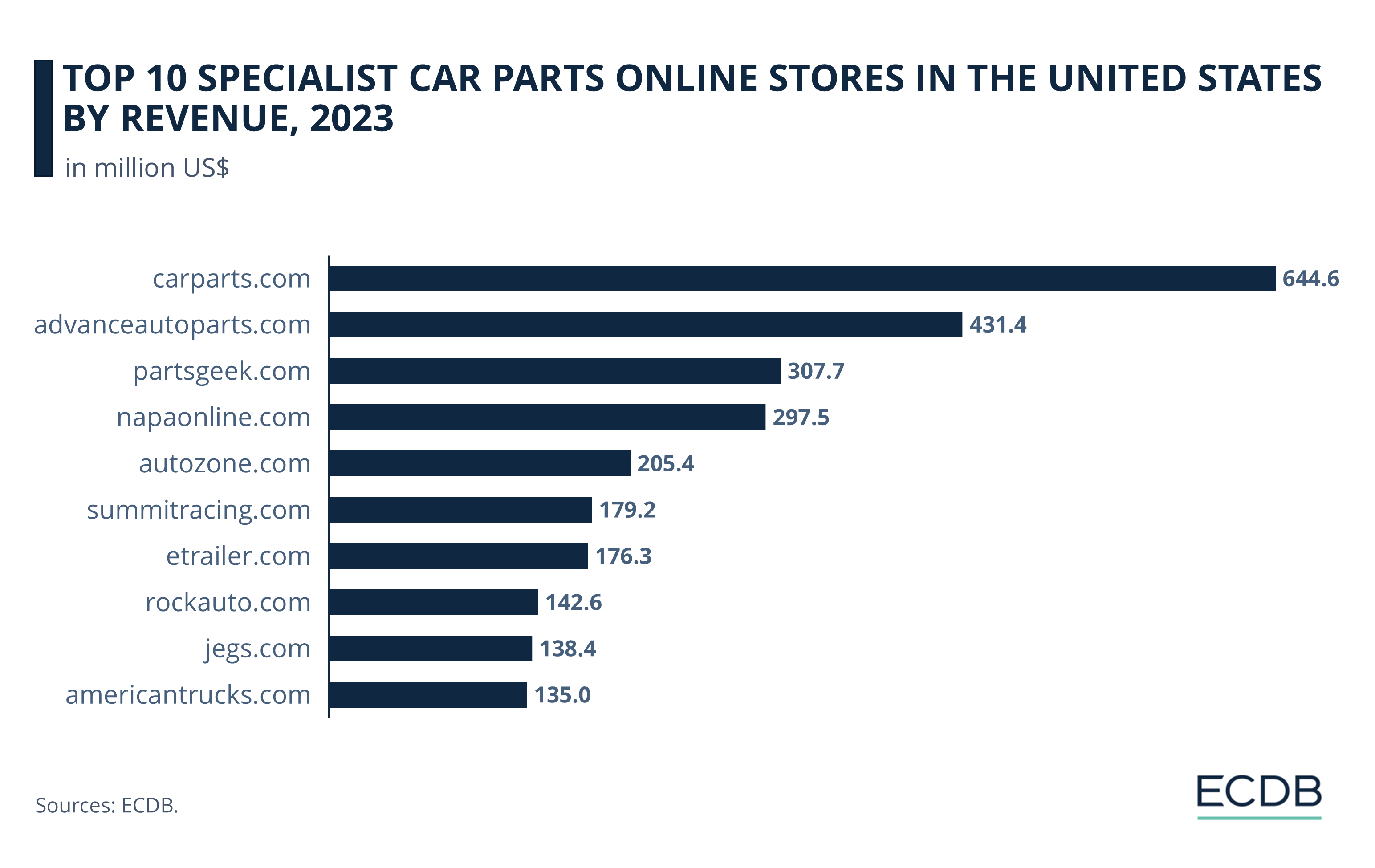

In the U.S. car parts market, a few specialist online stores have emerged as clear leaders, with distinct tiers separating the top performers. The rankings for 2023 highlight the significant revenue differences among these players:

Carparts.com dominates the market, standing in a tier of its own with a revenue of US$644.6 million.

Advanceautoparts.com follows, also in its own tier, as the second-largest player with US$431.4 million in revenue.

Partsgeek.com and napaonline.com form the next tier, with revenues of US$307.7 million and US$297.5 million, respectively.

The remaining stores, including autozone.com (US$205.4 million), summitracing.com (US$179.2 million), etrailer.com (US$176.3 million), rockauto.com (US$142.6 million), jegs.com (US$138.4 million), and americantrucks.com (US$135 million), make up the final tier.

While this is the landscape of specialist online stores, the view changes quite a bit when we include retail giants like Amazon.

Online Marketplaces Disrupt Specialty Car Parts Retailers

While specialist online stores dominate specific niches, the broader landscape shifts when retail giants like Amazon enter the picture: Amazon’s market share in car parts sales has grown significantly, reaching 12.1% in Q4 2023, up from 11.1% the previous year.

This growth is impacting specialty merchants, with CarParts.com reporting a 5% decline in net sales in Q1 2024 and a net loss of $6.5 million. Even established players like Advance Auto Parts are seeing drops in comparable store sales.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

eBay is also expanding its car parts business, enhancing listings with fitment data, which has driven a double-digit increase in conversion rates, further eroding the market share of traditional car parts retailers.

RockAuto Business Analysis: Closing Thoughts

The online car parts market is set to continue its growth, driven by the direct-to-consumer model, which offers lower prices and greater supply chain control. Companies like RockAuto.com have thrived by meeting consumer demands for affordability and reliability.

As the market evolves, the rise of electric vehicles (EV) will be a key factor. Although EVs have fewer parts, the need for essential components remains. The market's ability to adapt by including more EV-specific parts will determine its relevance in the next decade. If these trends hold, we expect that the market’s popularity can be expected to last well into the future.

Sources: The News Wheel, The Drive, The Daily Dot, PYMNTS, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

Back to main topics