Fashion Marketplace Comparison

Shein’s Third-Party Share Is Expected to Approach 18% This Year

Shein Marketplace launched in 2023 and the share of third-party sales to Shein's total GMV is already higher than that of some competitors. Here are the details.

Article by Nadine Koutsou-Wehling | March 10, 2025

Who hasn’t heard of Shein by now? Shein is the ultra-fast fashion retailer that has been in the news for challenging its established rivals with a novel supply chain model that responds to consumer demand quicker than the traditional process. In 2023, Shein updated its business model to include a marketplace, meaning it also sells products from third-party (3P) sellers on its online platform.

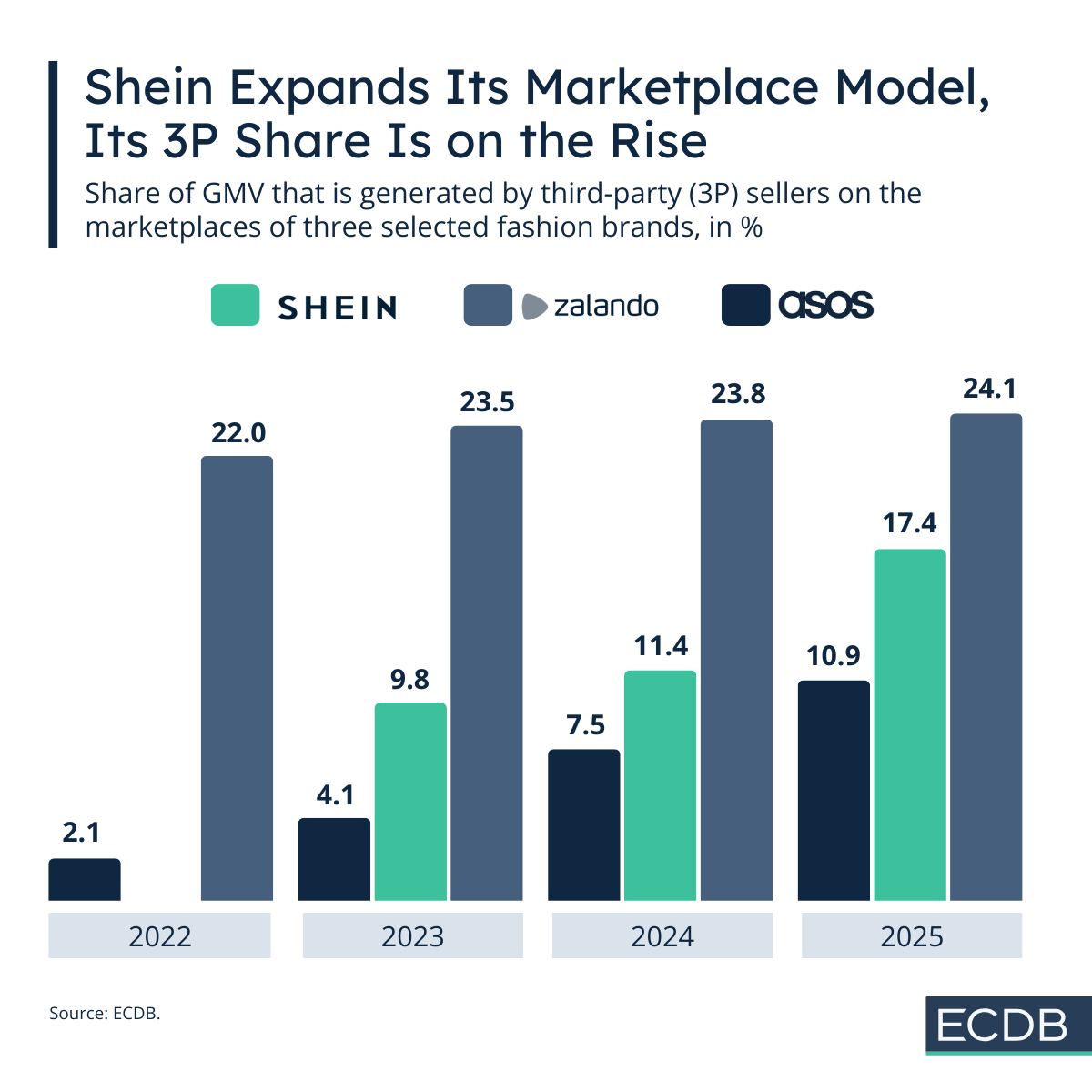

Shein’s marketplace model has taken off, as evidenced by the rapid growth of its 3P GMV share. Here is how its performance compares to other fashion marketplaces with similar concepts.

Shein’s 3P GMV Share Experienced Fast Growth

Shein Marketplace was launched in 2023, a move that is common in the eCommerce industry as third-party sales expand the range of products retailers can offer to their audiences. The move came at a time when competitors to Shein’s pricing model were emerging to take away its considerable market share. The most notable of these rivals is Temu, with which Shein has been locked in a back-and-forth legal battle for several years.

Since the inception of Shein’s marketplace model, its third-party share of GMV has grown rapidly. It started at a remarkable 9.8% in 2023 and increased to 17.4% in 2025. This means that 17.4% of all revenues generated on the platform come from the sale of third-party goods.

Comparing 3P's share to Temu's will not yield fruitful results, as Temu operates in a pure marketplace model, meaning that 100% of its merchandise has its origin in third-party sellers. But there are other retailers in the online fashion industry that serve as a more useful comparison to Shein.

Zalando Has a Higher 3P Share Than Shein, But Shein’s Absolute Numbers Determine Its Lead

In terms of the 3P percentage, Shein falls in between Zalando and Asos. Zalando's marketplace business has been running for longer, since 2018, and has since developed into a 3P business, accounting for 24.1% of GMV in 2025. Zalando's 3P share is therefore higher than Shein's, but Zalando's rise has been flatter than Shein's because the marketplace started earlier.

If you have been following fashion news over the past few years, you know that Asos has been struggling for some time. Differentiation from competing platforms with similar styles and lower prices has put Asos under pressure. Asos' marketplace model has been around longer than Shein's and Zalando's, but it still generates the lowest share of the three. In 2025, 10.9% of Asos' GMV was generated by 3P sales. Shein's share is already higher than Asos' since the first year, which shows that Asos' 3P sales don't contribute much to its total GMV.

Then there is the absolute number to consider. Shein is a dynamic company with a steep growth path in recent years, its GMV was US$60.3 billion in 2024. Both Zalando and Asos are much smaller than that, Zalando with a GMV of US$14.0 billion and ASOS with US$4.4 billion in 2024. Shein's rapidly growing 3P share gains further weight with these numbers. At US$6.9 billion in 2024, it significantly outperforms both Zalando and ASOS, with the former at US$3.3 billion and the latter at US$330.5 million.

If one thing is clear, it is that Shein is outpacing its rivals in the fashion industry by virtue of its already massive scale. Shein's latest move mirrors its rivals, Temu and AliExpress — but it hasn’t outpaced them yet.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Ocado.com’s Success Driven by High AOV and Connections to Grocers

Ocado.com’s Success Driven by High AOV and Connections to Grocers

Deep Dive

Can Luxury Fashion Sold on Online Marketplaces Remain Successful?

Can Luxury Fashion Sold on Online Marketplaces Remain Successful?

Deep Dive

TikTok Shop Launched in Germany, France and Italy - What's to Be Expected Next?

TikTok Shop Launched in Germany, France and Italy - What's to Be Expected Next?

Deep Dive

Love Your Pet: Chewy.com Prevails Over Petsmart.com and Petco.com

Love Your Pet: Chewy.com Prevails Over Petsmart.com and Petco.com

Deep Dive

After Zalando's Takeover of About You: How That Affects German eCommerce

After Zalando's Takeover of About You: How That Affects German eCommerce

Back to main topics