eCommerce: Market Insights

Digitization of Small and Medium Businesses in Spain: eCommerce, Cloud Computing, Social Media

How integrated is eCommerce in Spain's economy? The majority of businesses in the country are small and medium enterprises, how digitized are they? Here is how Spain compares to the EU average.

Article by Patrick Nowak | October 14, 2024Download

Coming soon

Share

Spanish SME Digitization: Key Insights

High SME Penetration: SMEs account for 99% of Spain's economy, or 2.8 million businesses. Despite their significance for Spain's labor market, SME productivity is lower than that of larger firms.

Average Digital Integration in EU Average: While 75% of Spanish SMEs have a web presence, only a third engage in eCommerce. Spain is in line with the EU average in digital growth, but lags in big data utilization and eCommerce.

National Program: The Digital Spain 2026 initiative targets digital progress in SMEs through measures such as funding, human resources development, and digital literacy workshops. The government aims to improve Spain's global position in eCommerce and strengthen economic resilience.

Spain was one of the countries that were particularly hit by the economic crisis in the early 2010s. Nowadays, the country has proven resilient to the financial hardships it has suffered. Especially eCommerce is growing in Spain, with international investments supporting the growth of online marketplaces where consumers can place orders.

Social commerce is also popular in Spain and contributes to the growth of the digital market. But Spain's economy is largely shaped by small and medium enterprises (SMEs). SMEs constitute 99% of Spain's economy. During the pandemic, the Spanish government funded digitization programs like many other countries in the world. The "Digital Spain 2026" initiative aligns with the "EU Digital Compass 2030". It addresses economic facets from infrastructure and digital literacy to business digitization.

Let's see how far the digitization of Spanish SMEs has come.

Small and Medium Enterprises in Spain

SMEs, or small and medium enterprises, are defined as companies with fewer than 250 employees and annual revenue of less than €50 million. This category includes micro-enterprises (fewer than 10 employees), small enterprises (10-49 employees), and medium-sized enterprises (50-249 employees).

In Spain, SMEs account for 99% of active businesses, or about 2.8 million in total, considerably higher than the EU average of 67%. SMEs generate 60-61% of the country's value added and employ 72% of the Spanish workforce. However, in terms of productivity, they contribute less value per person compared to larger companies, a trend that mirrors the EU average.

It shows that Spanish SMEs are in dire need of improvement in their business strategies and sales. But the Spanish government has already identified one factor that will help them make progress: Digitization.

Spanish SMEs With a Website: Below EU Average

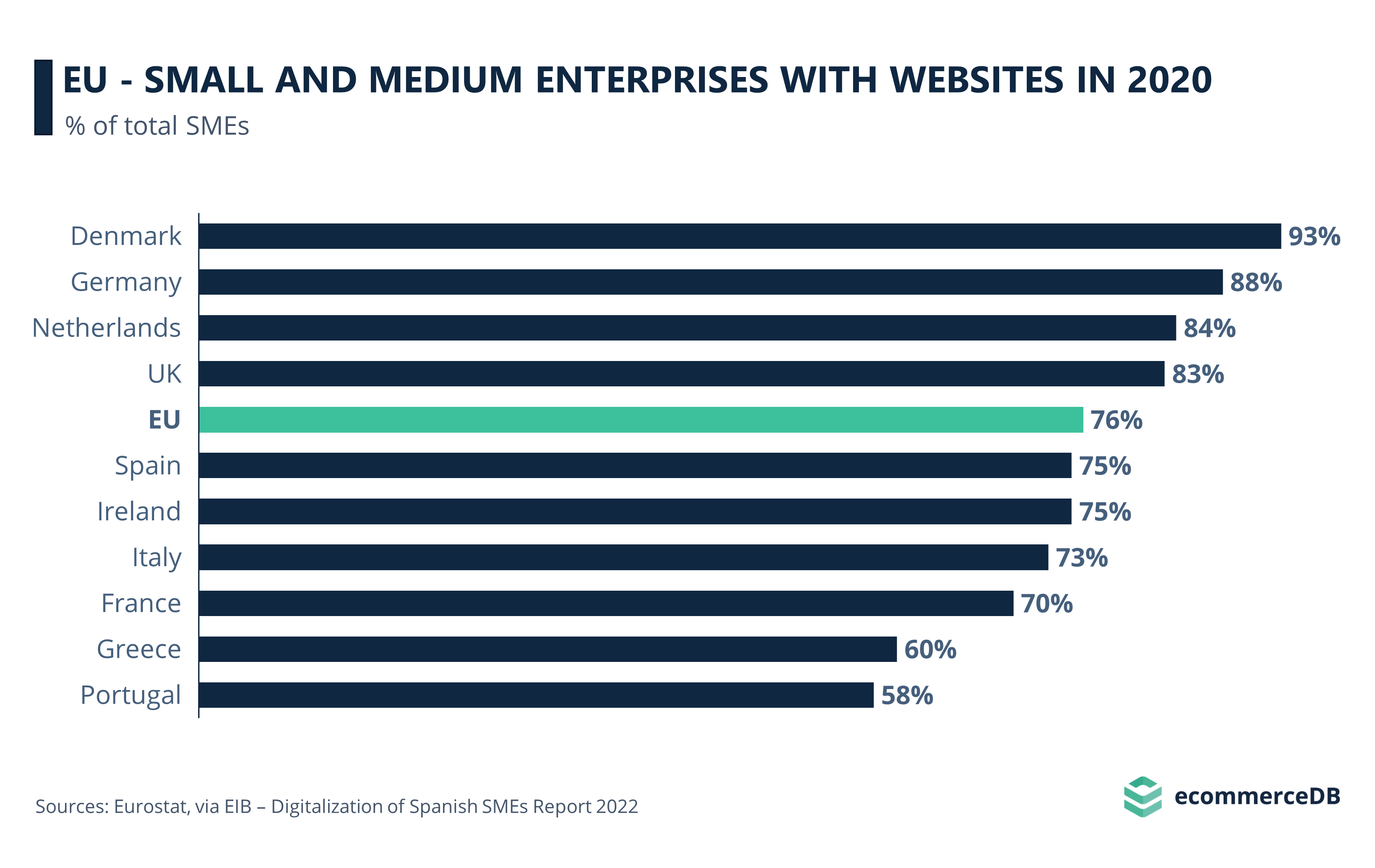

Eurostat shows the share of SMEs in the EU that have a web presence. While this does not imply that companies are also engaged in eCommerce, it measures how digitally inclined SMEs are. It also allows for cross-country comparisons.

The graph shows us that Spain is positioned around the EU average (76%), with 75% of Spanish SMEs having a website in 2020. It is at the same level as Ireland and just ahead of Italy. The UK (83%), the Netherlands (84%), Germany (88%), and Denmark (93%) are at the top of the list.

Why Is a Website Helping Businesses Compete?

A website helps customers learn more about a business they are considering engaging with. Especially when competing with well-established large corporations, having a curated, professional online storefront can make all the difference to customers.

In addition, websites are seen as a prerequisite of eCommerce, another aspect where Spanish SMEs need to improve.

One Third of Spanish SMEs Sell Online

Across all indicators, Spain is in 9th place in the DESI 2022 ranking, which measures countries’ overall digital development, including digital public services (where Spain ranks 7th), internet connectivity (where Spain scores 3rd), and digital human capital, which includes the digital skills of the population and ICT (Information and Communication Technology) professionals (where Spain ranks 12th).

Business Intelligence: Our rankings, updated regularly with fresh data, offer valuable insights to boost your performance. Which stores and companies are the leaders in eCommerce? What categories are generating the most sales? Explore our detailed rankings for companies, stores, and marketplaces.

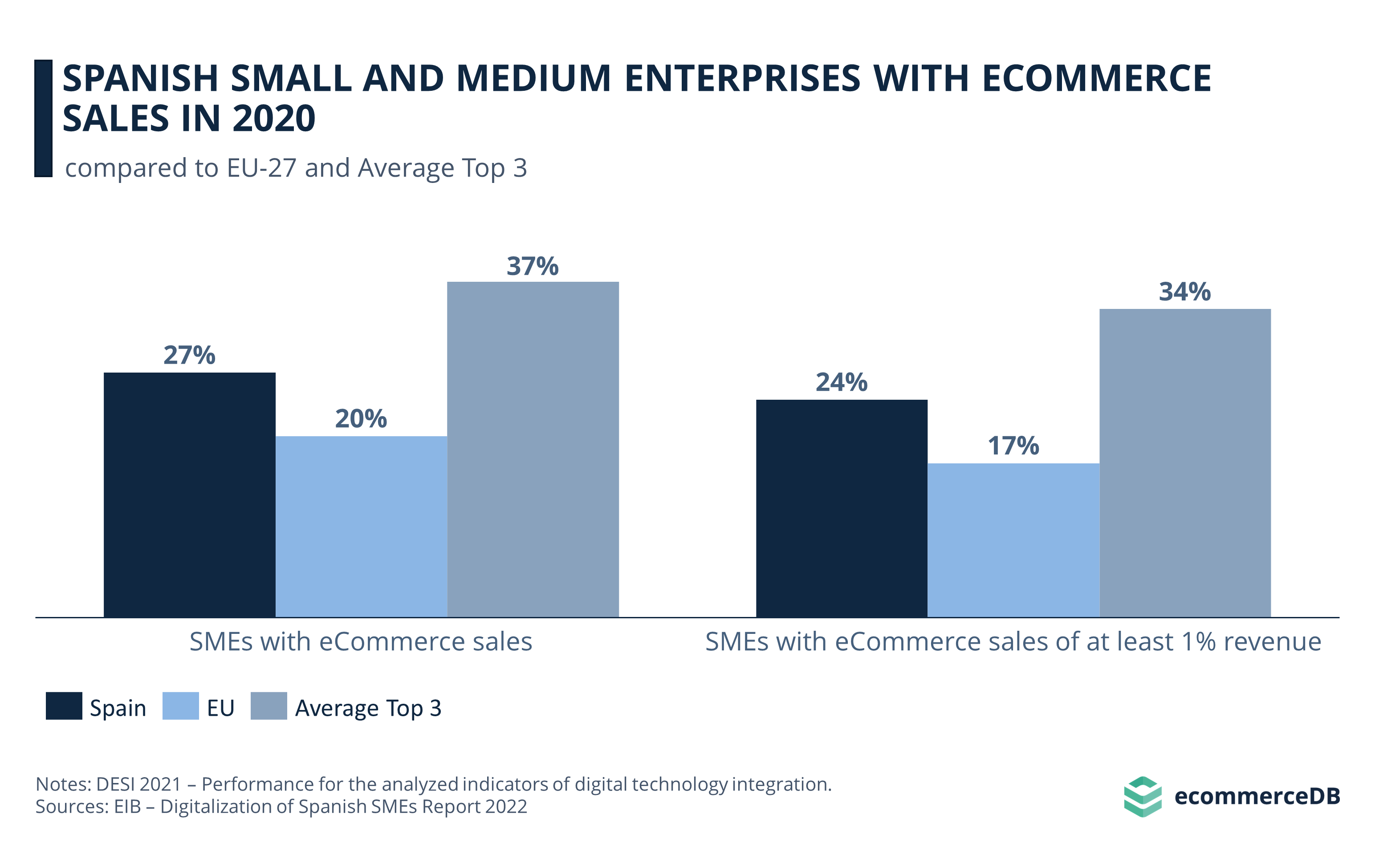

Spain good ranking indicates that the country is performing adequately in all dimensions compared to the EU average. The same is true for eCommerce sales by SMEs, where Spain’s figure is 11 percentage points above the EU-27 average. But Spain lags behind the average of the top 3 digital economies¹.

Given the outstanding proportion of SMEs in Spain, a comprehensive eCommerce development initiative could help Spain improve its standing in the global eCommerce market and boost cross-border trade. As digital is here to stay, this would help the country’s economic progress and increase SME productivity, taking some of the wind out of the sales of larger companies.

But how far along are Spanish companies in implementing digital technologies in their daily business? Let’s take a look.

Spanish Enterprises Have Basic Digital Integration, but Lack Efficiency

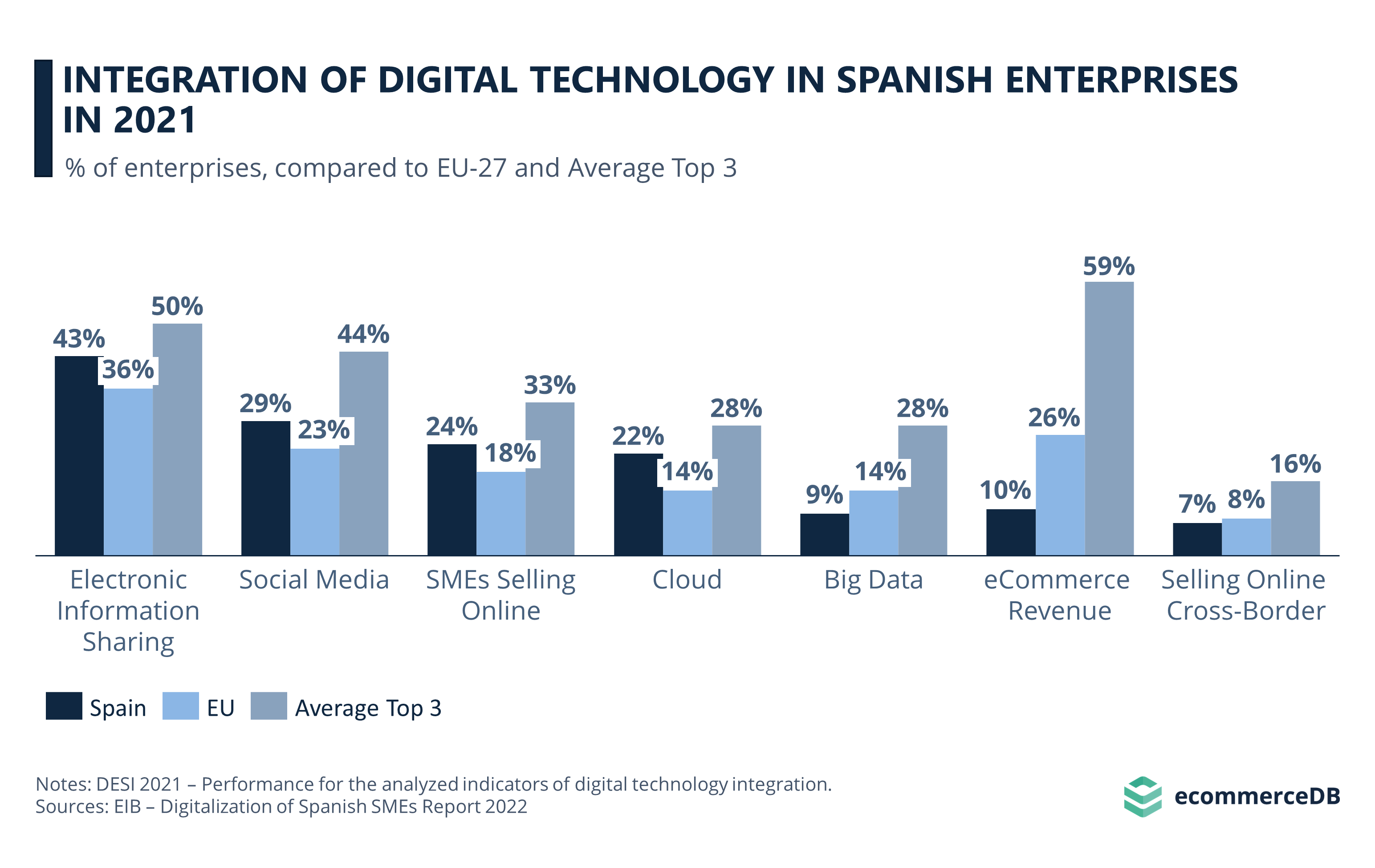

The European Commission shows how digitally integrated all Spanish enterprises are – remember that 99% of them are SMEs. The report shows that Spain is above the EU average in the electronic exchange of information (via email, intranet, or digital platforms), the use of social media, and the proportion of SMEs selling products online.

On the other hand, Spain lags behind the average in the use of big data, which increases efficiency and improves strategic planning, as well as eCommerce revenues and the use of cloud computing to store data on a centralized platform. It is on one level with the EU in selling cross-border.

The shortcomings of Spanish companies are mainly related to issues of efficiency and entry into the national and international eCommerce market.

Big data and eCommerce are closely linked, as eCommerce activities help to collect valuable consumer data, improve inventory management and measure the effectiveness of marketing strategies. In addition, a developed national eCommerce market with a large number of SMEs participating can help increase cross-border trade, further stimulating the national economy.

Digital Spain 2026: SME Digitization Plan

The Spanish government has integrated a digital development plan for SMEs that runs from 2021 to 2025. As part of the Digital Spain initiative, the 14 sub-measures aim at the basic digitization of SMEs, the improvement of digital chain management, the promotion of innovation and the strategic support of digitization in all economic sectors.

As human resources and financial support are the main areas of improvement for the digital economy in Spain, the program focuses on providing grants and workshops. By incentivizing Spanish SMEs to become more involved in eCommerce, the government hopes to reduce inefficiencies and ultimately improve the country’s structural economic insecurities.

SMEs in Spain: Closing Remarks

Spain's economy is on its way to becoming more digital. Foreign investment is further strengthening the role of eCommerce in the country. While SMEs account for almost the entire pool of businesses in the market, they can benefit from selling their products on online marketplaces to reach a wider audience. This is how Pinduoduo became successful in its domestic market of China.

The success of social commerce in Spain can provide further opportunities for growth. Online businesses looking to thrive in Spain should consider the region's level of digitization and consumer preferences for online shopping to adapt their approach to sell successfully in the market.

Footnote: 1: The top three countries vary per statistic variable, referring to the three countries with the higher/better statistic in each case.

Sources: Digital Spain – EIB – EU Digital Compass – IBM

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics