eCommerce: Market Insights

eCommerce in Pakistan 2023: Market Revenue, Online Share, and Top Payment Methods

The online market in Pakistan is growing but it is yet to mature. The populous nation – with an expanding middle class and increasing internet coverage – presents an unrealized opportunity for eCommerce growth.

January 31, 2024

Pakistan eCommerce Market: Key Insights

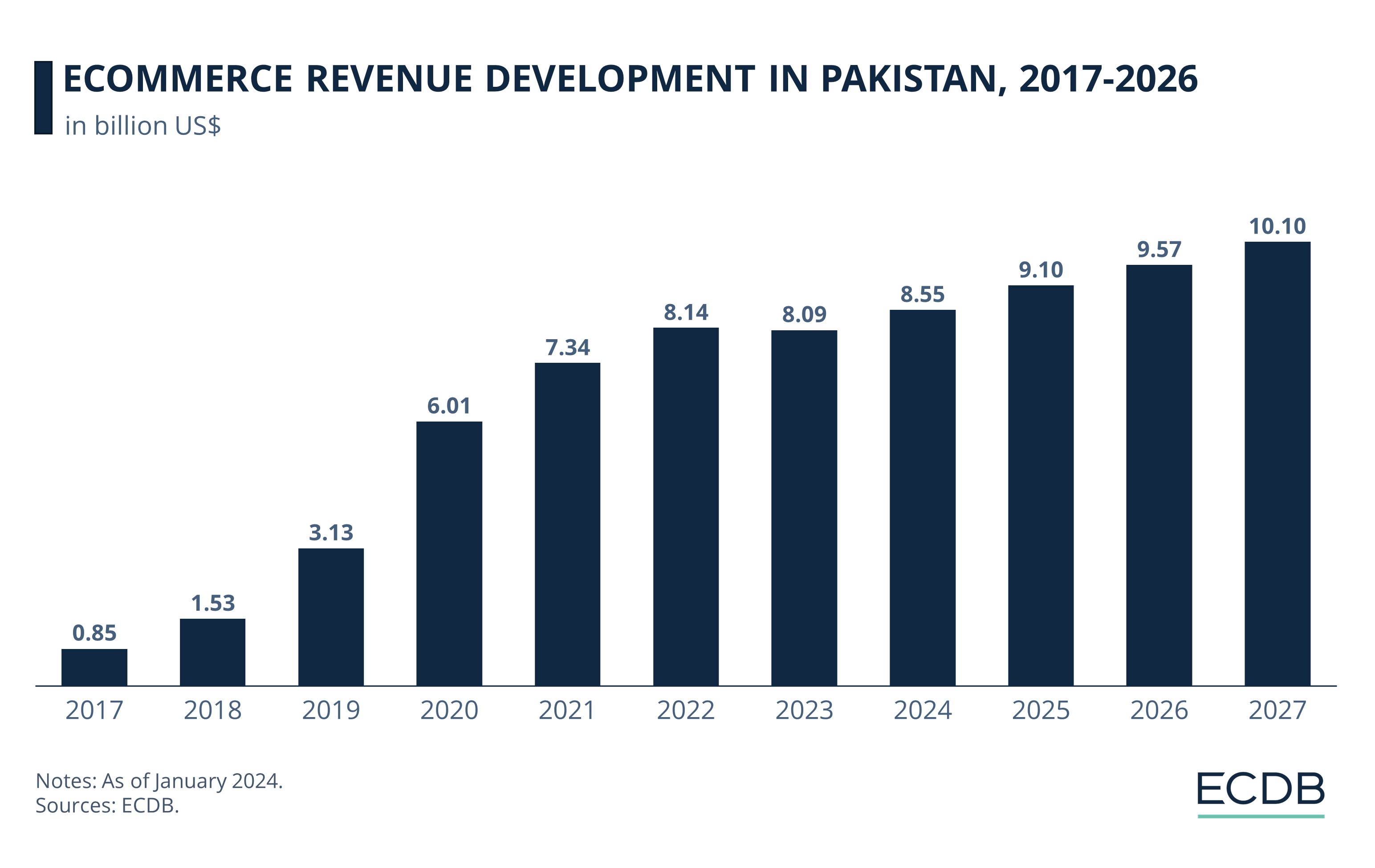

eCommerce Revenue Development: The online market in Pakistan is expected to grow at a CAGR (2023-2027) of 5.7%. Revenue will hit US$10.1 billion by 2027.

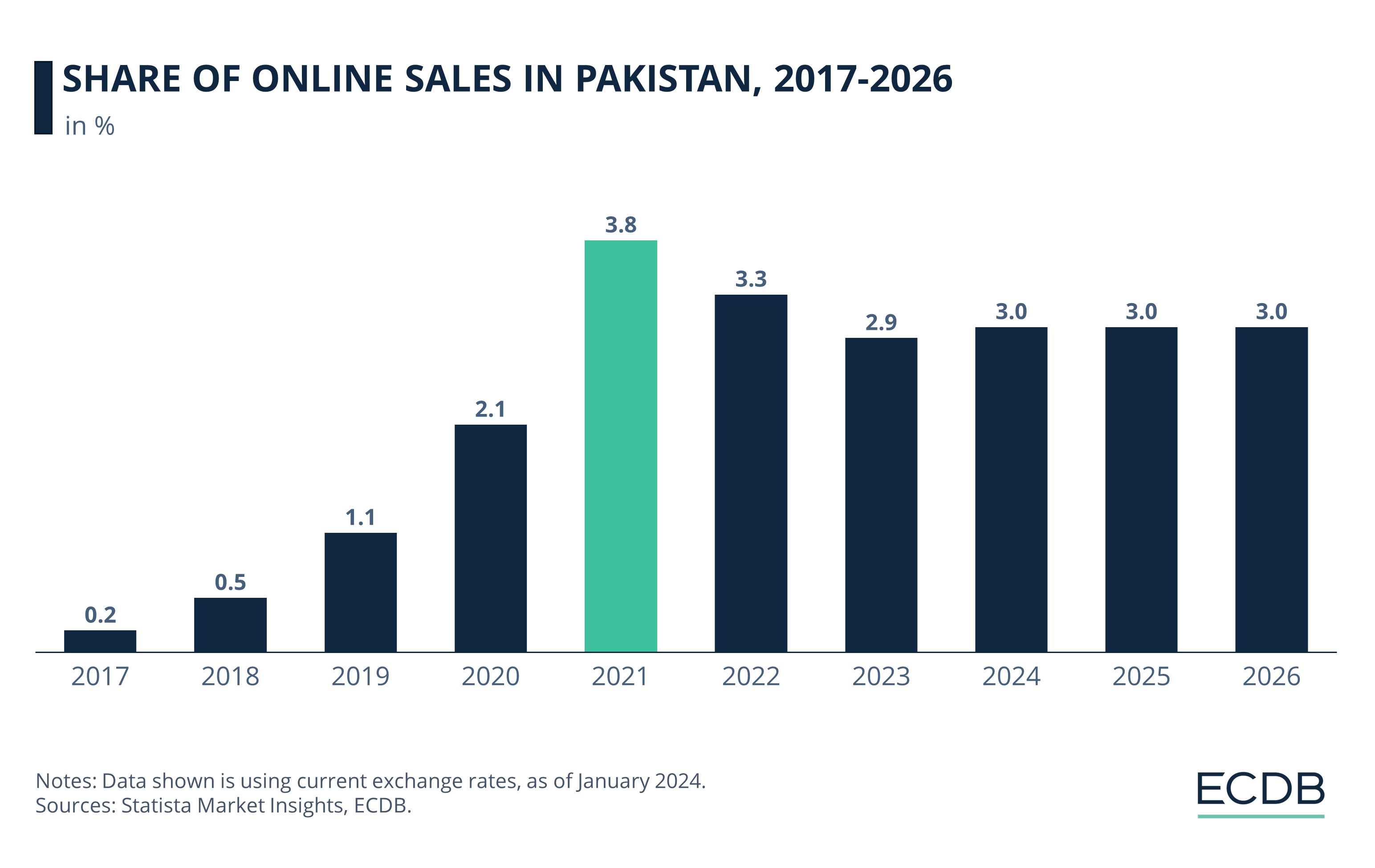

Online market share: Even with increasing eCommerce sales, the online market share is relatively small and will remain so in the coming years. Presently, online sales make up less than 3% of the country’s total retail sales.

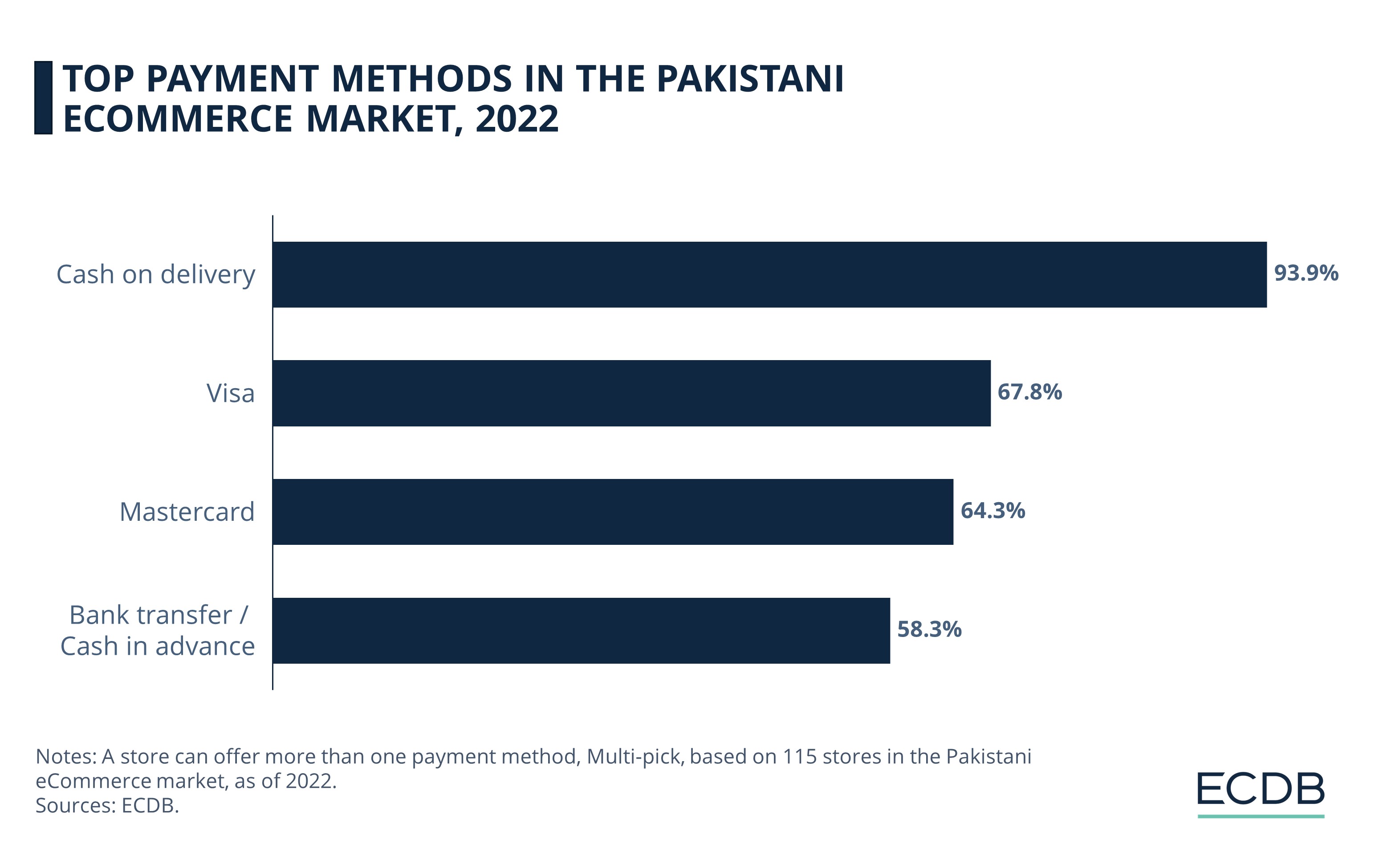

Preferred payment methods: By and large, Pakistani consumers have not switched to digital payment channels. Cash on delivery is the predominant method of payment used by Pakistani online shoppers, followed by Visa and Mastercard.

Pakistan is the 36th largest market for eCommerce globally. Online sales picked up pace in the country during the pandemic. Since then, the eCommerce market in Pakistan has continued to grow.

How has Pakistan’s eCommerce revenue and online market share developed? Which payment methods do online shoppers in Pakistan prefer using? ECDB provides answers.

Market Volume: Pakistan’s eCommerce Revenue to Hit US$10.1 Billion by 2027

Following a surge of growth during the pandemic, Pakistan’s online retail industry registered a slight dip in 2023.

Earlier, the online market had followed an upward trend between 2018 and 2019 as well, when eCommerce revenue more than doubled. When the pandemic hit in 2020, it only boosted the online market’s momentum.

In this period, revenue rocketed by over 93%: from US$3.13 billion in 2019 to US$6.01 billion in 2020. This development happened during the pandemic period when online sales underwent a global increase. Like consumers elsewhere, Pakistanis saw online platforms as safer alternatives to brick-and-mortar stores, many of which shuttered down amidst lockdowns.

Even as pandemic mandates gradually loosened and stores reopened in the next two years, eCommerce in Pakistan continued to expand. Revenue increased steadily until 2022, followed by a slight decline in 2023. The national climate of economic and political instability, accompanied by inflation and cutbacks on retail spending, likely contributed to this negative growth.

eCommerce in Pakistan is expected to grow at a compound annual growth rate (CAGR 2023-2027) of 5.7%.

However, in the upcoming period - between 2024 and 2027 - the eCommerce market in Pakistan is anticipated to speed up, despite sluggish economic recovery. Revenue is projected to grow at a compound annual growth rate (2023-2027) of 5.7%. In absolute terms, the market volume of eCommerce in Pakistan will likely reach US$10.1 billion by 2027.

Interested in exploring ECDB’s data on national eCommerce markets?

eCommerce Market Share in Pakistan: Online Sales Share Jumped in 2021

In 2023, online sales make up a modest 2.9% of total retail sales in Pakistan.

According to ECDB data, the share of online sales saw an unprecedented increase in 2021. In this year, online sales made up 3.8% of the total retail volume, up from a much smaller 2.1% in 2020.

In this year, the government also took measures to promote eCommerce. Under the Digital Pakistan Policy, the aim was to boost eCommerce activity by facilitating payment service providers and operators. This is in line with comparative digital models launched in neighboring countries to improve digital infrastructure, digital literacy, as well as digital services including eCommerce.

The impetus did not lead to impressive results, however, possibly due to government shuffle and political turmoil. Consequently, both 2022 and 2023 saw the online market share diminishing.

In the coming years, even as absolute online sales will likely increase, the proportion of online sales to total retail volume in Pakistan is expected to remain small but stable at 3%.

Payment Methods in Pakistan eCommerce: Cash on Delivery Top Option

In terms of payment methods, the eCommerce market in Pakistan is fragmented, where no single payment service provider dominates. Cash on delivery emerges as the prevalent method used by online shoppers.

As of 2022, nearly 94% of transactions for online orders were completed through cash on delivery.

On the other hand, the use of electronic or digital fund transfers for online orders is comparatively limited. 68% of transactions are done through Visa card and 64% through Mastercard. They are followed by bank transfer or cash in advance at 58%.

Pakistan has a predominantly cash-based economy. Factors such as low banking coverage, lack of trust in digital payments, poor connectivity, and high cost of transactions mean that it can be challenging to lure consumers away from the traditional cash on delivery method.

For instance, the online banking penetration in Pakistan is projected at just 3.8% in 2024. Thus, by offering cash on delivery as a payment method, eCommerce businesses can cater to populations who do not have bank accounts or trust in online payments.

At the same time, payment flexibility in Pakistan’s eCommerce is slowly improving. In 2021, the State Bank of Pakistan launched an indigenous digital payment system called Raast to facilitate affordable small-value retail payments. The use of mobile wallets like Easypaisa and JazzCash is also projected to rise significantly in the upcoming years.

Moreover, internet penetration is set to increase from 25.6% in 2023 to 38.8% in 2028. Although this rate is lower than regional counterparts, it can be a significant factor – alongside eCommerce-friendly state initiatives, introduction of diverse payment methods, and a larger consumer shift towards online shopping – to help expand the country’s eCommerce market.

Concluding Remarks

Pakistan is the fifth most populous country in the world. According to McKinsey, it has one of the fastest growing middle classes and a young population. As a substantial segment of internet-savvy consumers with stronger purchasing power emerges, it positions Pakistan as an eCommerce market with an immense potential waiting to be tapped.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics