U.S. Meal and Grocery Delivery Users Doubled Between 2017 and 2022

Article by Cihan Uzunoglu | June 07, 2023

According to Statista Digital Market Insights and ecommerceDB, the U.S. eCommerce market will pass the US$1 trillion revenue mark in 2023. This makes the United States the second largest eCommerce market in the world, beaten only by China, and leaving third-placed Japan way behind, with more than five times as high a total market revenue. The same is true when looking at a related digital market: online food delivery. Statista Market Insights expects the U.S. online food delivery market to reach a total volume of US$270 billion in 2023, which secures the United States second rank in global comparison also in the online food delivery market. And the food delivery market is not yet as saturated as the eCommerce market. Year-on-year growth rates of around 23% are expected for the upcoming years, while eCommerce in the U.S. is projected to grow by less than 20% annually. During the corona pandemic online food delivery was among the top profiteers. The U.S. market grew by 53% in 2020 and 28% in 2021. The market did not only grow revenue-wise, but also attracted a remarkable amount of new customers in the course of the pandemic, and user numbers continue to grow:

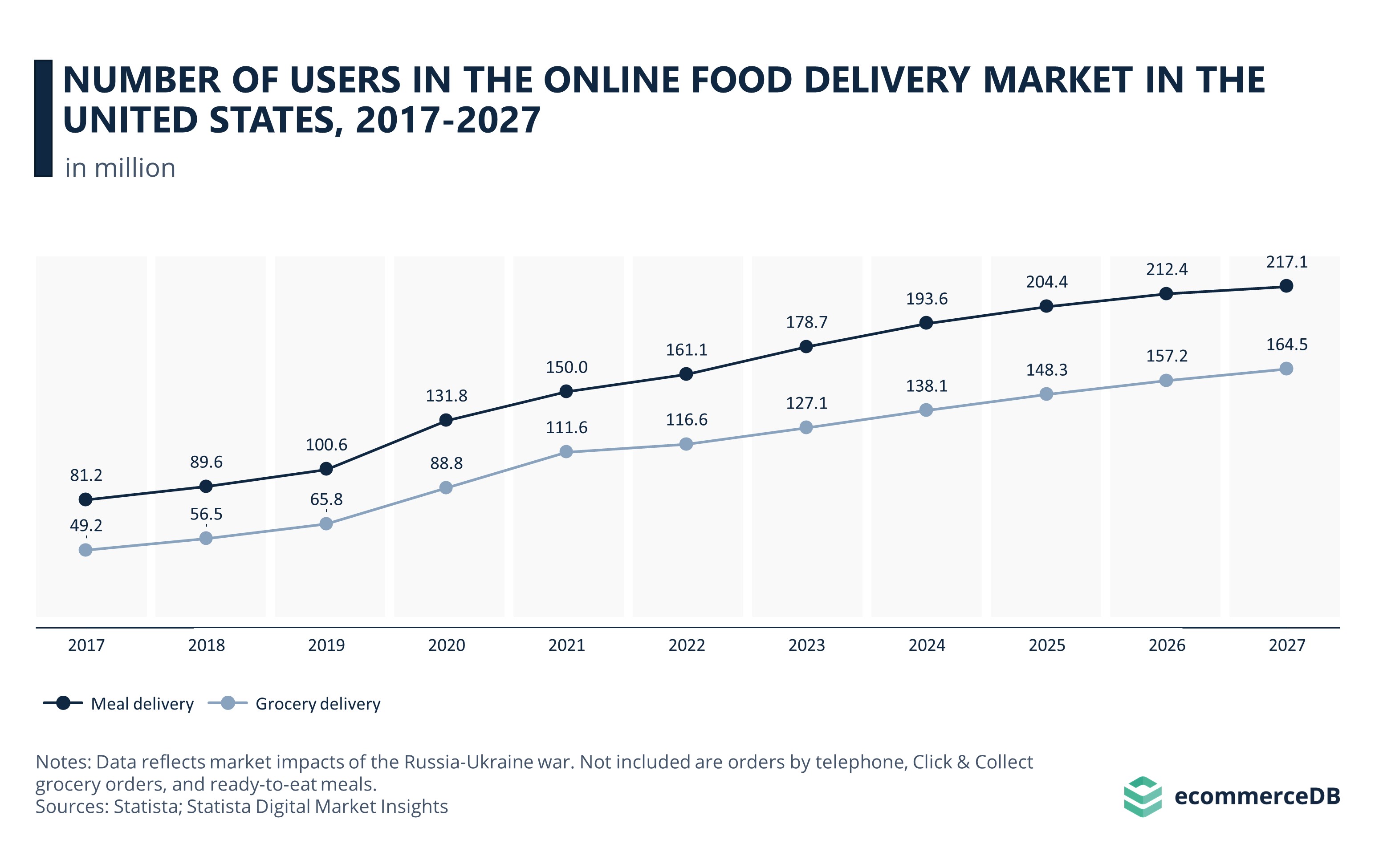

Both segments in the online food delivery market have attracted an increasing number of users over the past years, with a special impetus in the pandemic years. Both segments registered a year-on-year increase in user numbers of more than 30% between pre-pandemic 2019 and the first corona year 2020. Between 2017 and 2022, user numbers in the meal delivery market almost doubled from 81.2 million to 161.1 million. The user numbers in the grocery delivery segment increased even stronger, by 137% from 49.2 million in 2017 to a total of 116.6 million in 2022. Both segments will increase their user numbers further. Although the user numbers in the grocery delivery segment will generally increase faster, total user numbers will remain below the meal delivery user numbers. While meal delivery will pass the 200 million user mark by 2025, grocery delivery will continue to count less than 200 million users through 2027. Grocery delivery, however, beats meal delivery in a different aspect: revenues. Although the total user numbers were lower, grocery delivery generated 2022 revenues of US$141 billion in the United States, as opposed to US$76 billion produced by the meal delivery segment. Moreover, revenue growth is also higher in the grocery segment, which also results in an increasing average revenue per user.

Related insights

Article

Video Games Market in 2024: Market Revenues, Segments, Regions & Top Companies

Video Games Market in 2024: Market Revenues, Segments, Regions & Top Companies

Article

Top Amazon Rivals: The Tech Giant’s Biggest Competition

Top Amazon Rivals: The Tech Giant’s Biggest Competition

Article

Top 10 Online Stores in the U.S: Amazon Sold More Than All Other Top 5 Stores Combined

Top 10 Online Stores in the U.S: Amazon Sold More Than All Other Top 5 Stores Combined

Article

Prada & Prada Beauty Analysis: Business Model and Global Net Sale

Prada & Prada Beauty Analysis: Business Model and Global Net Sale

Article

UK Fashion Market: Brands ASOS and Boohoo Under Scrutiny For Greenwashing

UK Fashion Market: Brands ASOS and Boohoo Under Scrutiny For Greenwashing

Back to main topics