eCommerce: Payment Providers

Visa and Mastercard: Click-to-Pay Feature to Simplify the Payment Process

Visa and Mastercard are introducing a "click-to-pay" service that streamlines the online payment process. Find out what this launch is all about.

Article by Nadine Koutsou-Wehling | September 20, 2024

Click-to-Pay by Visa and Mastercard: Key Insights

Widespread Launch by the End of 2024: Already available in select markets and with specific merchants, Visa and Mastercard are preparing for a broader rollout by the end of the year. Click-to-pay is reducing steps in the payments process to facilitate online purchases.

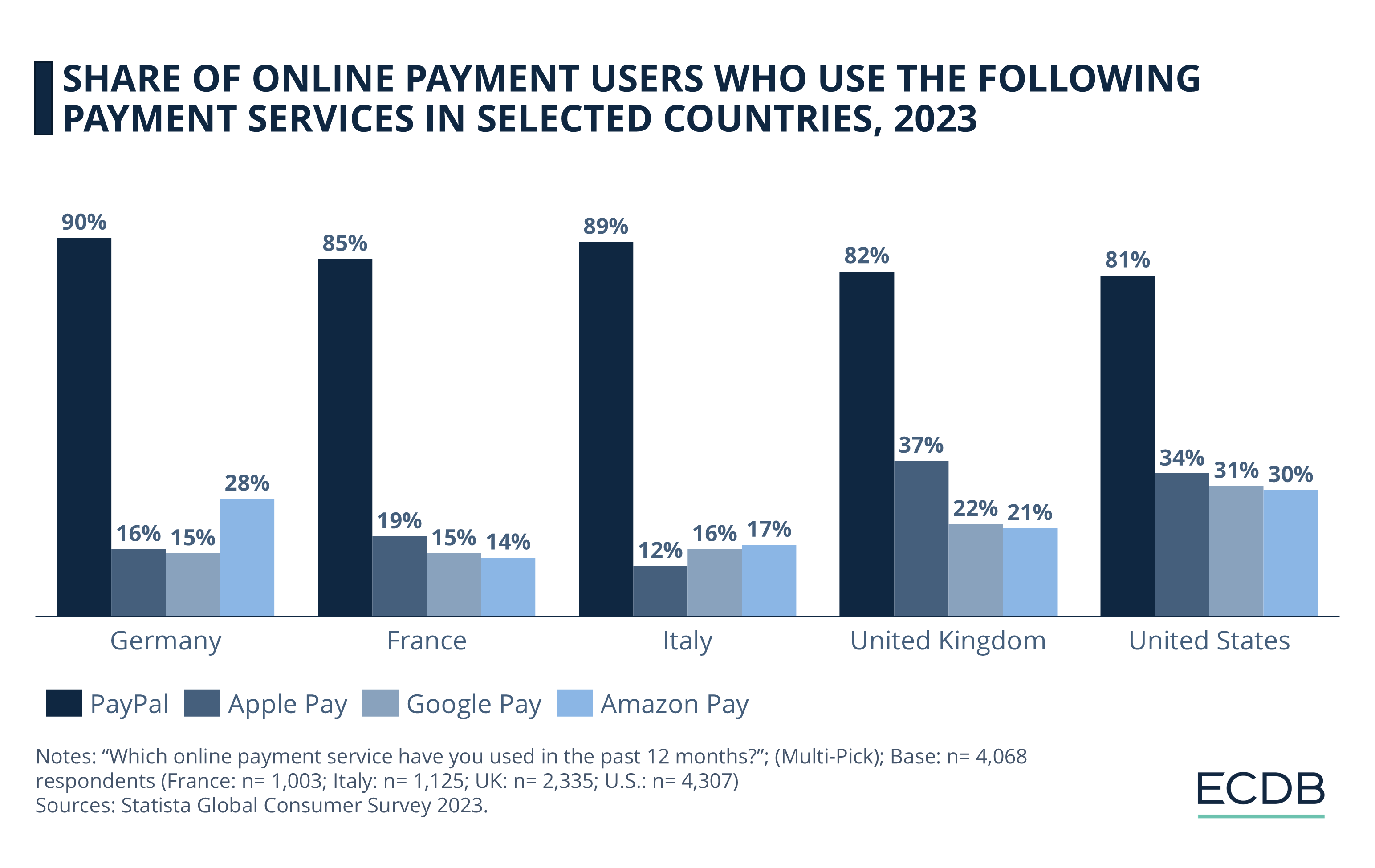

Increase of PayPal and eWallet Usage: Because PayPal has significantly streamlined the payments process in eCommerce and is widely used by consumers across markets, the new credit card service click-to-pay is a likely reaction.

Visa and Mastercard are making it easier to buy online with "click-to-pay," which allows consumers to pay without entering card numbers and verification codes. The new service lets consumers access payment data by entering their email address and receiving a one-time code on a preferred device. By creating a profile, users can shortcut the payment process with payment information securely stored. Multiple cards can be accessed within a profile.

The launch is expected to be completed by the end of this year in selected markets and merchants that accept the service. It is a strategic decision by these international online payment leaders to solidify their dominant position in global eCommerce, given the success of eWallets such as PayPal and others.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

Two Market Leaders Defend Their Position

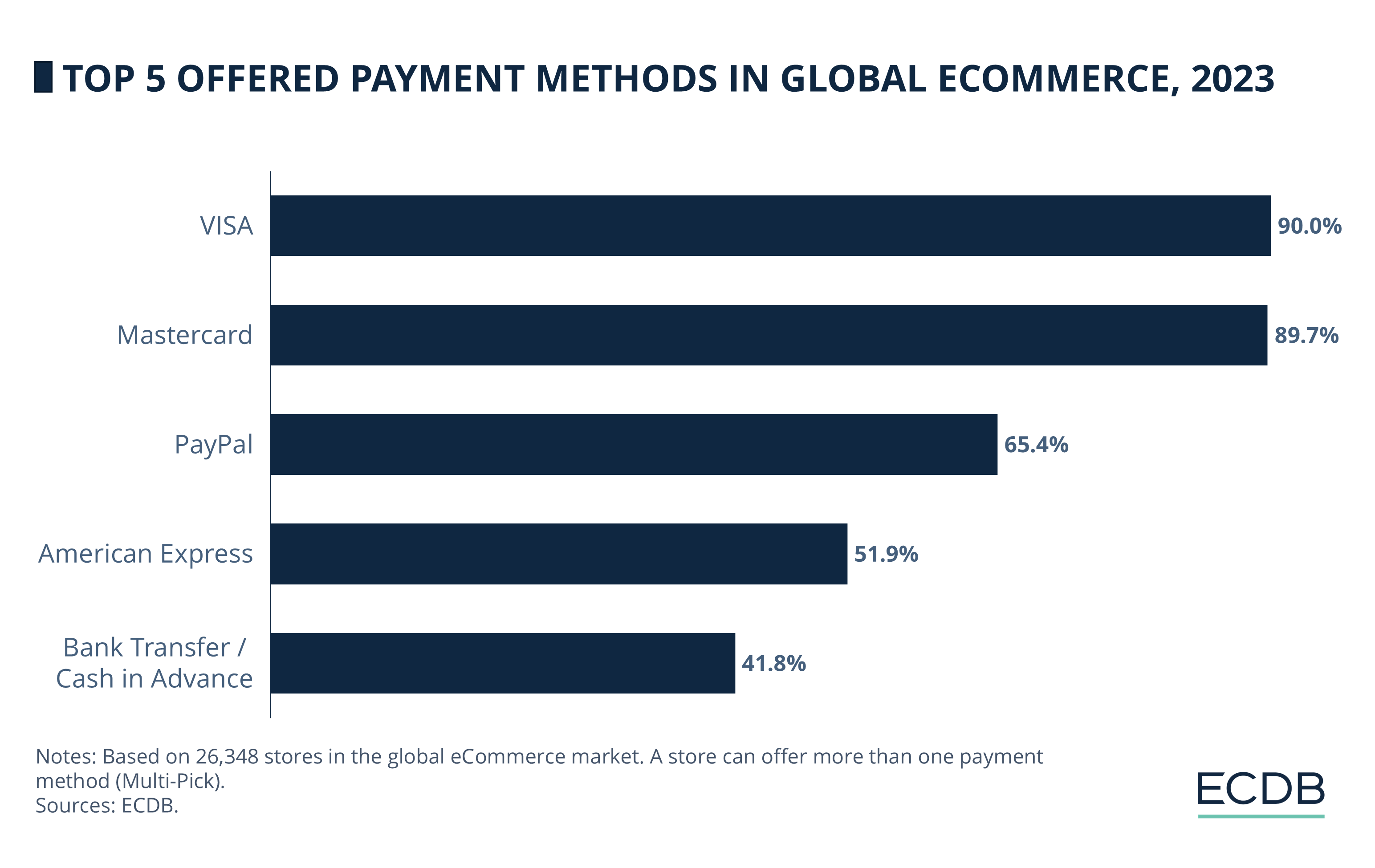

According to proprietary ECDB data, VISA and Mastercard are the most widely accepted payment methods in global eCommerce:

VISA leads by a small margin: VISA is only slightly more frequently offered by merchants, 90% to be exact. In comparison, Mastercard has an acceptance rate of 89.7%.

PayPal closes the gap: In third place is PayPal, the most popular eWallet provider. It is offered by 65.4% of online stores worldwide.

Fourth and fifth ranks: American Express is in fourth place, used by 51.9%, followed by bank transfer at 41.8%.

While Visa and Mastercard are still far ahead of PayPal in third place, it is undeniable that PayPal offers consumers a payment convenience that is second to none. Other major players, such as Apple Pay and Amazon Payment, have also launched their own consumer eWallets, but they are nowhere near as popular as PayPal.

With the introduction of click-to-pay, credit card providers are starting to play defense. It remains to be seen whether users will abandon PayPal in favor of this new service. It is more likely that they continue to use multiple providers.

Click-to-Pay Service: Wrap-Up

Convenience is key in eCommerce, and reducing complexities in the payment process usually means an increase of conversion rates. While this is beneficial for merchants, consumers may need extra reassurance for the security of the new payment feature.

Sources: Mastercard – Stern – Visa

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics