eCommerce: Global Market Development

WTO Raised Trade Volume Forecasts for 2024: What It Means for eCommerce

WTO raised positive expectations for trade volume growth in the holiday season. Here is what that means for eCommerce.

Article by Nadine Koutsou-Wehling | October 16, 2024Download

Coming soon

Share

WTO Raises Rate Forecast: Key Insights

WTO Expects Higher Growth Rates: The World Trade Organization (WTO) raised its forecast for trade in goods from 2.6% to 2.7%. eCommerce is closely linked to global trade in goods.

Regional Developments: Europe is currently in a weaker position with lower investment spending, but a recovery is expected soon. Trade between China and the U.S. is low due to rising tariffs, so sellers are finding alternative routes.

The World Trade Organization (WTO) recently adjusted its forecast for the expected recovery in world trade this year, as central banks have lowered their key interest rates and inflation has fallen. Since both events tend to lower the price level and thus increase household spending, trade in goods is expected to increase accordingly.

The holiday season is particularly busy, and for some companies, the fourth quarter of each year determines their annual sales. WTO revised its forecast for trade in goods from 2.6% to 2.7%. While this is a small increase, the revision highlights a path of recovery from the -1.1% slump in 2023.

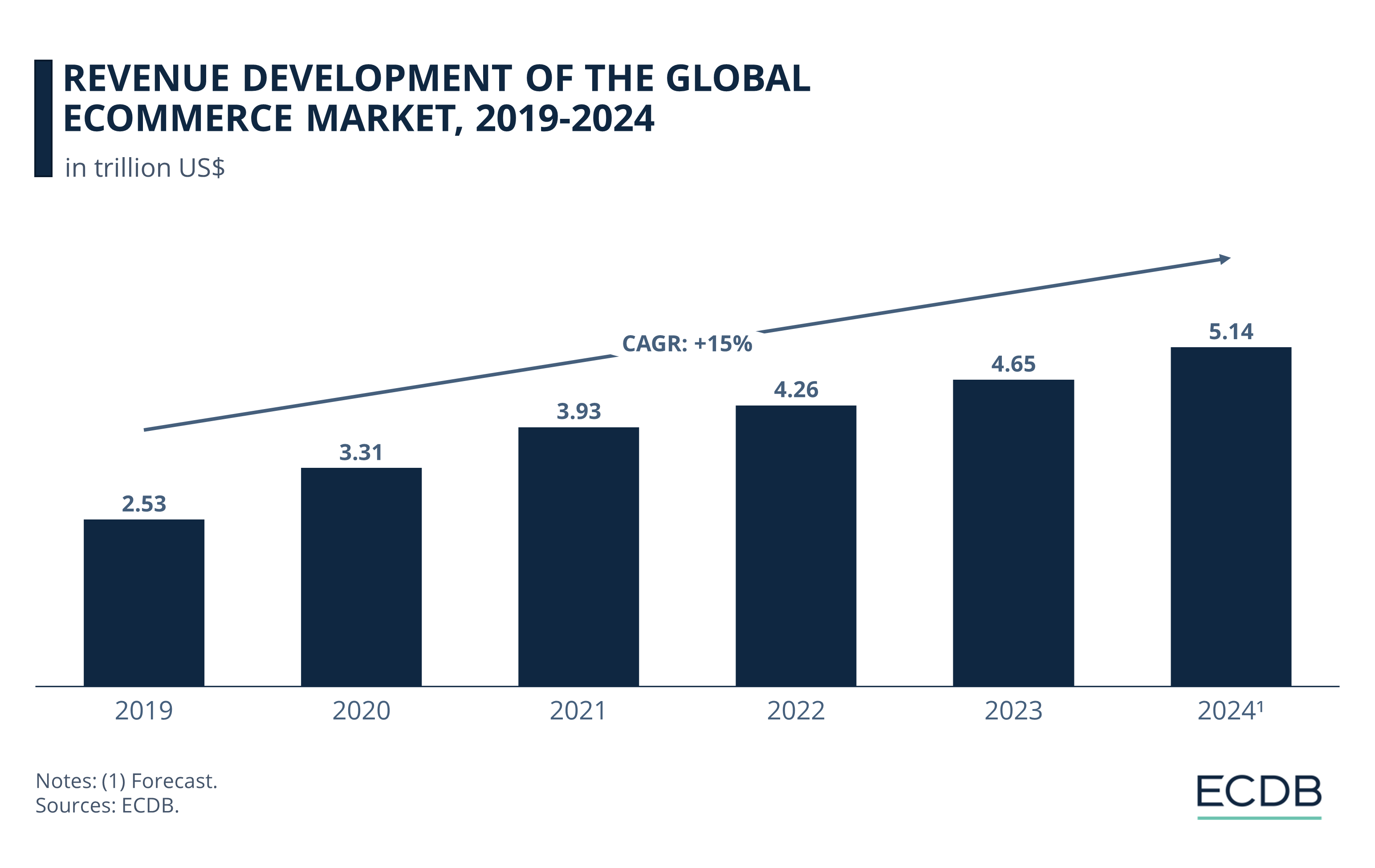

Global eCommerce Market Revenues to Surpass US$5 Trillion by 2025

In 2024, the online share of eCommerce in the total retail market is 17.9%. It is expected to grow in the coming years, from 19.6% in 2025 to 20.5% in 2026. Thus, an increase in the total global trade volume has a positive impact on eCommerce.

From 2020 to 2025, global eCommerce market revenues are projected to grow from US$3.3 trillion to US$5.1 trillion. Online trade, like overall trade, has experienced ups and downs due to decreasing restrictions and supply chain disruptions.

At the same time that WTO raised its growth forecast for the holiday season, the agency lowered its 2025 forecast from 3.3% to 3%. Given the dynamic nature of global trade, these rates are subject to adjustment as conditions evolve.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

Regional Developments

Currently, however, Europe is the weakest part of the global economy, due to high interest rates that reduce investment spending. With a more investment-friendly climate in the form of lower interest rates, WTO expects a slow recovery in 2025.

WTO also noted that trade between the U.S. and China is growing more slowly than comparable trade relationships. At the same time, China's exports to Vietnam and Mexico have increased, as have imports from those countries to the U.S. WTO concludes that while the redirection changes the flow of the supply chain, it does not negatively affect the overall volume of trade. The increase in the share of imports from more countries is expected to play a more significant role.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Older Consumers Drive Growth in the Chinese eCommerce Market

Older Consumers Drive Growth in the Chinese eCommerce Market

Deep Dive

Online Shopping in China: Where Chinese Consumers Shop Online

Online Shopping in China: Where Chinese Consumers Shop Online

Deep Dive

Google Launches Its First Cross-Border eCommerce Acceleration Center in China

Google Launches Its First Cross-Border eCommerce Acceleration Center in China

Deep Dive

Temu Revenue: Does Temu Really Lose US$30 per Order?

Temu Revenue: Does Temu Really Lose US$30 per Order?

Deep Dive

American Apparel & Footwear Association (AAFA) Calls Out Social Commerce Platforms for Counterfeiting

American Apparel & Footwear Association (AAFA) Calls Out Social Commerce Platforms for Counterfeiting

Back to main topics