eCommerce: Furniture & Homeware Market

XXXLutz: Online Sales, Store Development & Market Competition

XXXLutz Group operates over 370 brick-and-mortar stores across Europe and dominates digitally via xxxlutz.de. Online Sales, Store Development & Market Competition: ECDB provides the data.

May 27, 2024Download

Coming soon

Share

XXXLutz Group Development: Key Insights

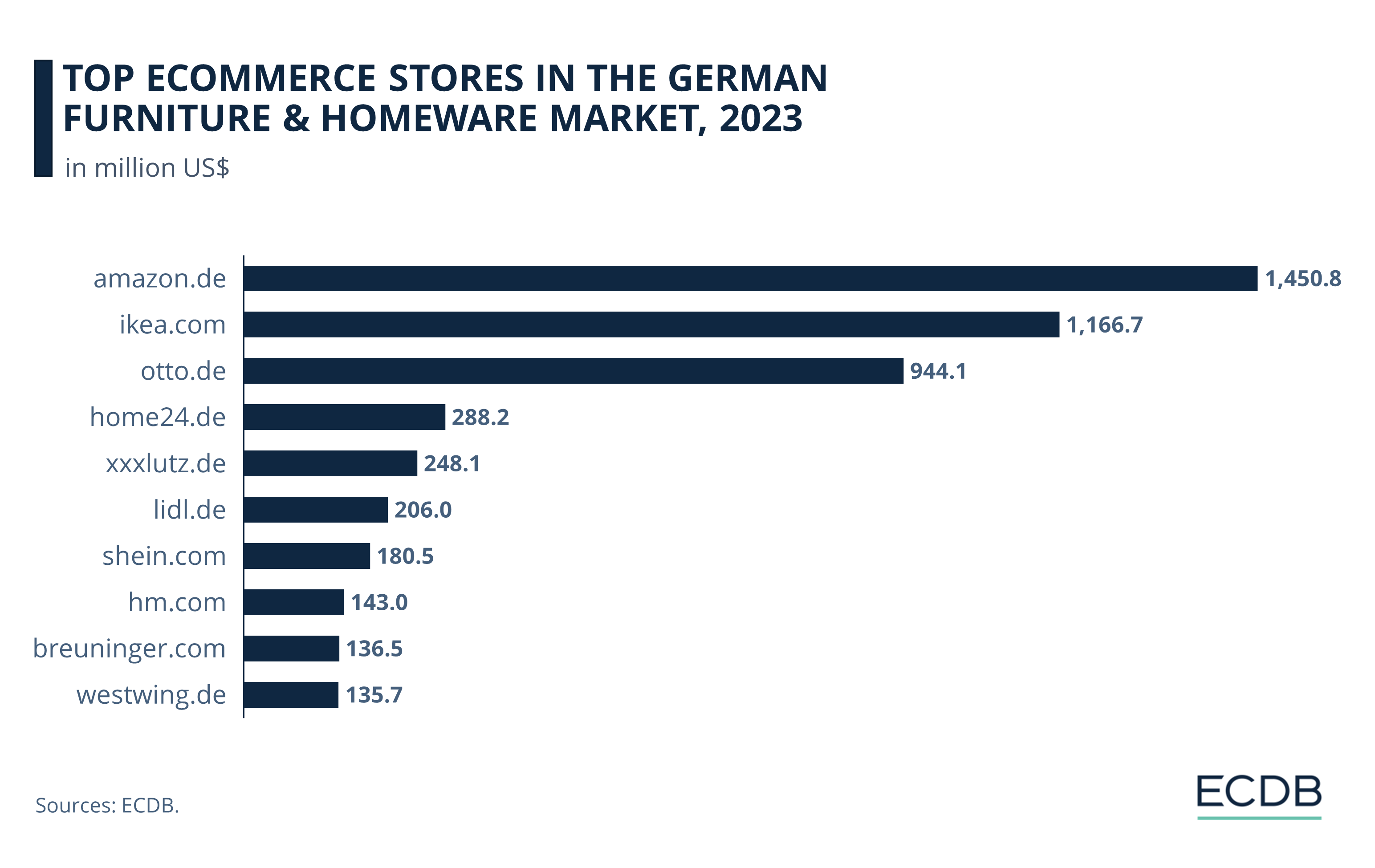

Core Focus: The majority of xxxlutz.de's revenue comes from its Furniture & Homeware sales, accounting for 88% of its total sales. It stands out in Germany's competitive online market for these categories, trailing only behind industry heavyweights like Amazon.de, Ikea.com, and Otto.de.

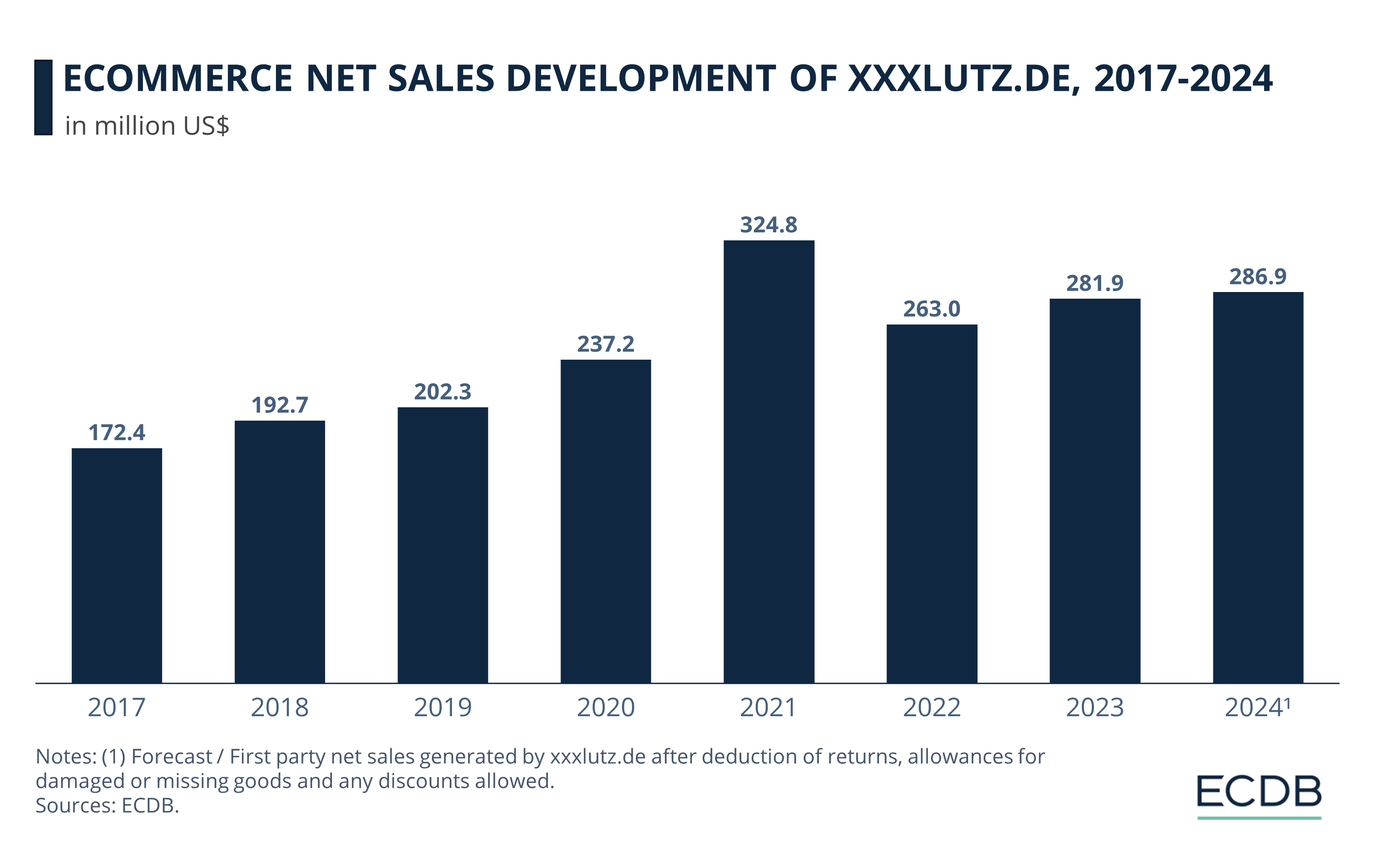

Bouncing Back: Following a 19% decrease in sales in 2022, xxxlutz.de experienced a modest recovery with a 7% sales increase in 2023. Projections indicate a steady, though small, rise in revenue through 2024.

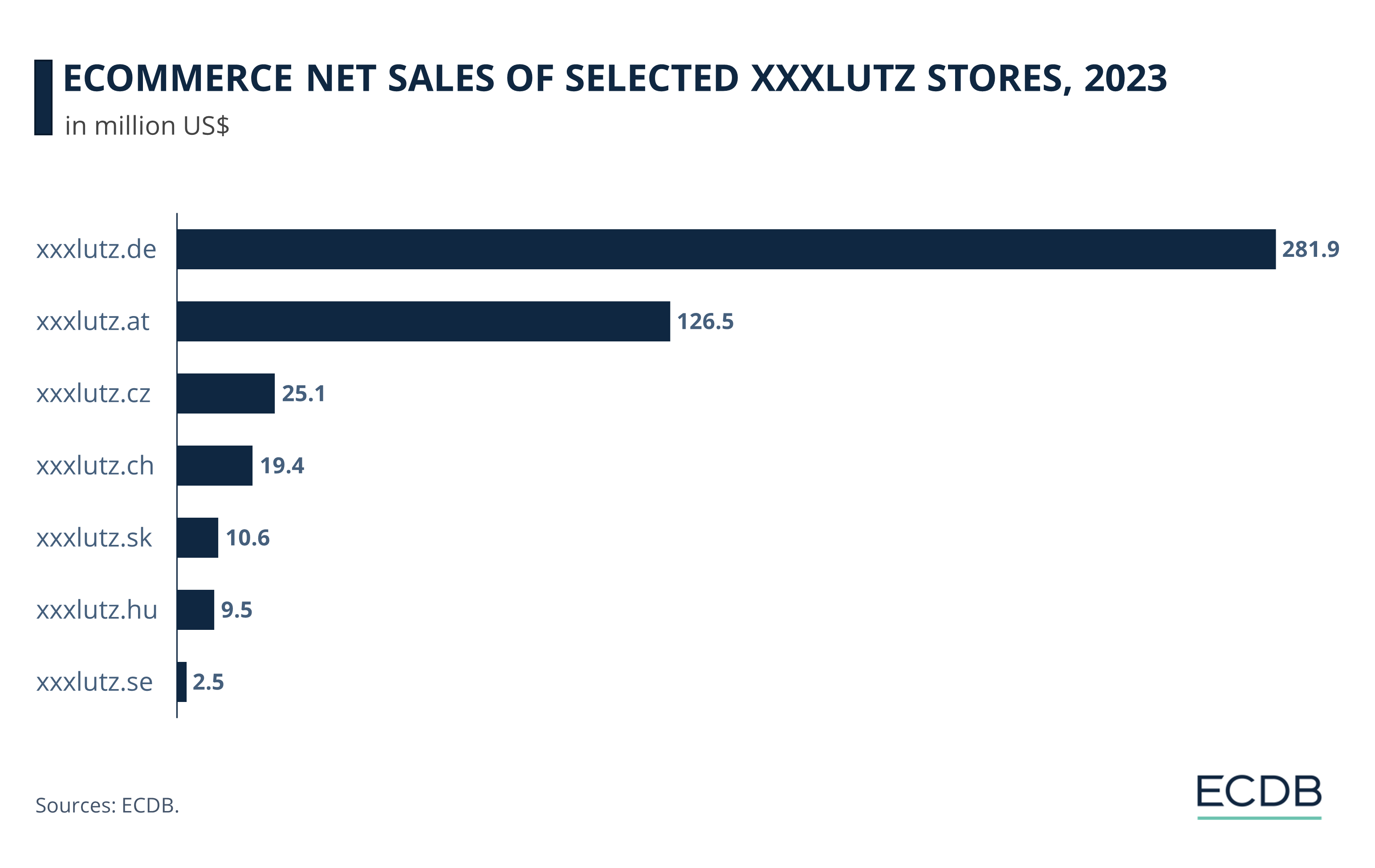

Digital Leadership: Xxxlutz.de is the standout performer within the XXXLutz Group's online stores, generating US$281 million in net sales in 2023. This figure not only surpasses the sales from its other sites but also underscores the German platform's pivotal contribution to the group's overall digital strategy.

In 1945, Austria gave birth to what would eventually become one of the world's largest furniture retailers — XXXLutz Group. This commercial powerhouse has made a name for itself not just in traditional brick-and-mortar shops but also in the digital realm, especially through its Germany-focused eCommerce platform.

Specializing predominantly in Furniture & Homeware, most of xxxlutz.de’s sales revenue is generated domestically. The strength of the XXXLutz Group, however, extends far beyond its digital platforms.

With more than 370 physical stores spread across 13 European countries and employing over 26,000 people, the group's wide-reaching presence has undoubtedly contributed to the success of its online ventures. This physical network has given the company a firm foundation, providing an advantageous position in both traditional and digital retail sectors.

One key strategy that underscores XXXLutz's commitment to digital expansion is its recent acquisition of eCommerce platform home24. This move not only fortified home24's market position but also solidified XXXLutz’s own influence in the home and living retail sector. The acquisition was a clear signal of the company’s ambition to not just participate in the digital marketplace but to lead it.

XXXLutz: Main Product Categories &

Market Ranking

A look at xxxlutz.de's revenue streams reveals an unequivocal focus on the Furniture & Homeware category, accounting for 88% of net sales. Within this focus, Furniture represents a significant 63%, and Homeware makes up 25%. The remaining 12% is sourced from Electronics, Fashion, and Hobby & Leisure segments.

As per our 2023 numbers, the top online stores in Germany for Furniture & Homeware are led by Amazon.de with sales reaching US$1.45 billion, followed by Ikea.com at US$1.16 billion, and Otto.de with US$944 million. Among these, xxxlutz.de also made its mark, securing a notable position with US$248 million in sales. Other key players in the market include home24.de, lidl.de, shein.com, hm.com, breuninger.com, and westwing.de.

XXXLutz.de: Slow Recovery After 2022's Dip

Over the past years, xxxlutz.de has experienced noteworthy revenue shifts. The company's sales figures have predominantly shown an upward trajectory. From 2017’s US$172.4 million, the online store’s revenue exhibited considerable growth, particularly between 2020 and 2021 (37%).

However, the journey hasn't been without its bumps. In 2022, xxxlutz.de reported a dip in net sales to US$263 million, down from the previous year's impressive US$324.8 million, representing a 19% decline.

Making a modest recovery in sales last year (7.2%, reaching US$281.9), our forecast for the online store this year point to a stabilization and another modest upswing in earnings. Revenue is projected to increase to US$286.9 by the end of 2024, still remaining above pre-pandemic levels.

German XXXLutz Online Store Dwarfs Others

As we conclude our look at XXXLutz, it's essential to highlight the central role played by the company's German domain, xxxlutz.de, in its overall digital agenda.

Among the online stores we're taking into consideration, the German platform has marked itself as the undisputed leader, boasting US$281.9 million in net sales for 2023. This revenue far outpaces the Austrian platform, xxxlutz.at, which reported US$126.5 million, as well as other domains such as xxxlutz.cz and xxxlutz.ch, which tallied more modest sales.

2022's dip in net sales for xxxlutz.de should serve as a reminder that even a top name in the sector has room for self-assessment and strategy re-calibration. But with forecasts pointing towards stabilization and moderate growth in 2024, xxxlutz.de is set to regain its stride. As it does, the domain's performance will undoubtedly continue to inform the broader strategies of XXXLutz Group.

Sources: pressetext, home24, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Wayfair Launches Paid Loyalty Program Wayfair Rewards

Wayfair Launches Paid Loyalty Program Wayfair Rewards

Deep Dive

Largest Product Categories in German eCommerce: Fashion Tops the List

Largest Product Categories in German eCommerce: Fashion Tops the List

Deep Dive

Online Furniture & Homeware Market in Germany: Top Stores & Market Revenue

Online Furniture & Homeware Market in Germany: Top Stores & Market Revenue

Deep Dive

What Are the Fastest Growing Product Categories in UK’s Online Market?

What Are the Fastest Growing Product Categories in UK’s Online Market?

Back to main topics