ECOMMERCE: TOP PRODUCT CATEGORIES

What Are the Fastest Growing Product Categories in UK’s Online Market?

In UK eCommerce, product categories with the highest revenues are not the best performers from a growth perspective. So, which categories are making waves in the online market, thanks to their impressive growth numbers? Find out.

Article by Nashra Fatima | June 12, 2024Download

Coming soon

Share

Top Categories in the United Kingdom: Key Insights

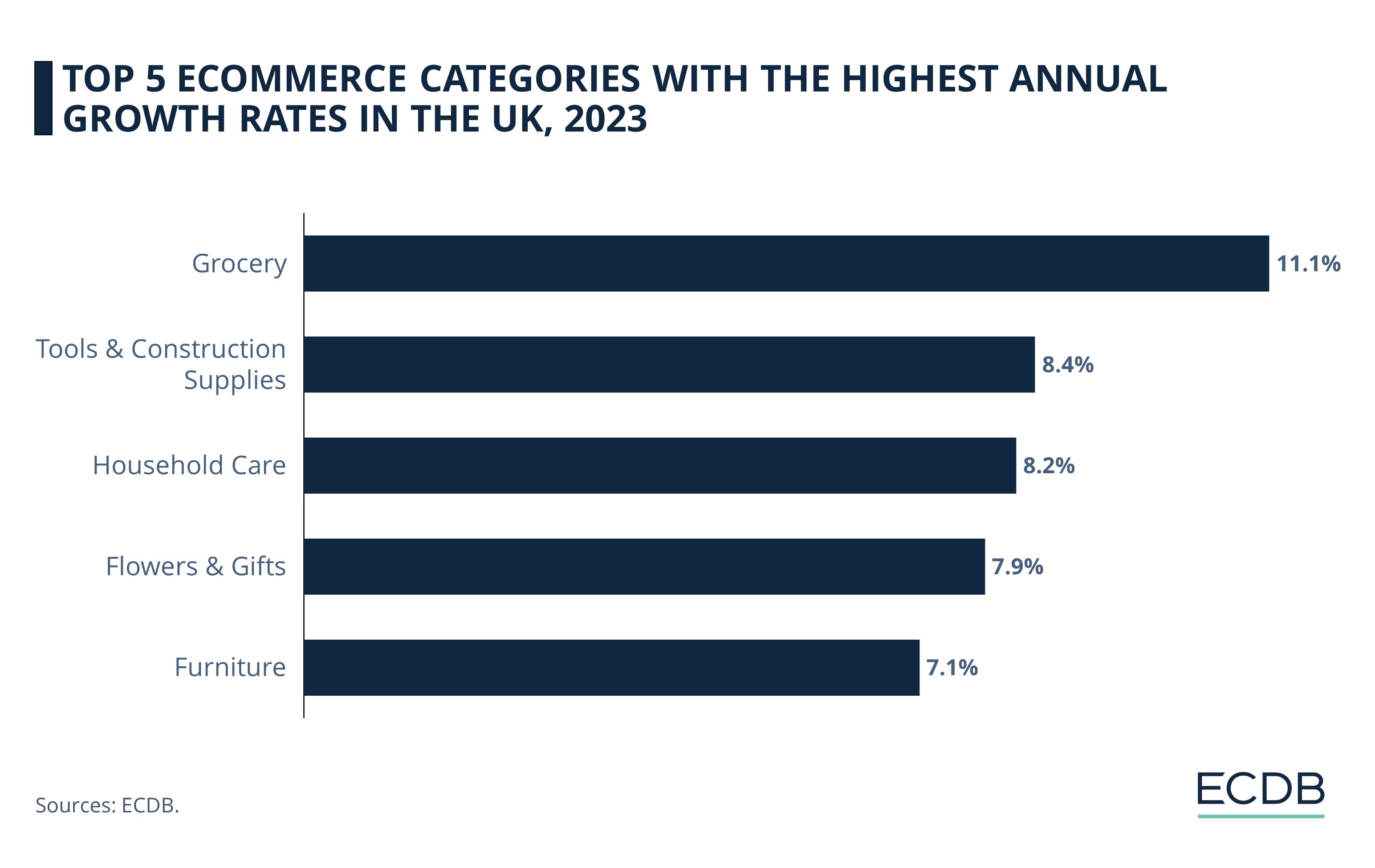

Grocery on Top: The grocery segment is accelerating in the UK. It had the highest growth out of all categories in 2023, at 11.1%.

Middle-Ranking Categories: Tools & construction supplies stand second, with 8.4%. Household care (8.2%) is third, flowers & gifts (7.9%) is fourth, and furniture (7.1%) is fifth.

Market Outlook: All top 5 product categories are forecast to perform strongly until 2028. However, some will grow faster (grocery, 11%) than others (flowers & gifts, 6%).

Data-driven insights into a product category’s performance empower eCommerce businesses. Knowing what’s selling online – and conversely, what’s not selling – helps stores devise successful marketing and sales strategies.

Our ECDB data reveals the performance of various product categories in UK eCommerce in 2023. We analyze the categories that grew the most last year and discuss how they are expected to perform in the future.

Online Categories in the UK: Grocery Grew Highest in 2023

Per ECDB’s latest data, in 2023, the categories that saw the highest year-on-year growth in the UK online market are:

Grocery had the highest year-on-year growth in the UK, at 11.1%.

Tool & Construction Supplies, part of DIY, is second, with a growth of 8.4%.

Household Care, under care products, is third with a yearly increase of 8.2%.

Flowers & Gifts, part of hobby & leisure, is fourth with an annual revenue growth of 7.9%.

Furniture, from furniture & homeware, is fifth, with a 7.1% growth.

Have these categories shown consistently positive performances in the past? Are they expected to deliver in the future?

1. Grocery (11.1%)

Ever received your online grocery order in less than an hour? It’s not a one-off phenomenon anymore, with grocery companies fighting it out for speedier door-step deliveries, accelerating qCommerce globally.

In the UK, grocery eCommerce emerged as the fastest-growing category in 2023. Its sub-markets include food (67%) and beverages (33%), both of which are expanding individually as well – food slightly faster (11% vs 10.5%).

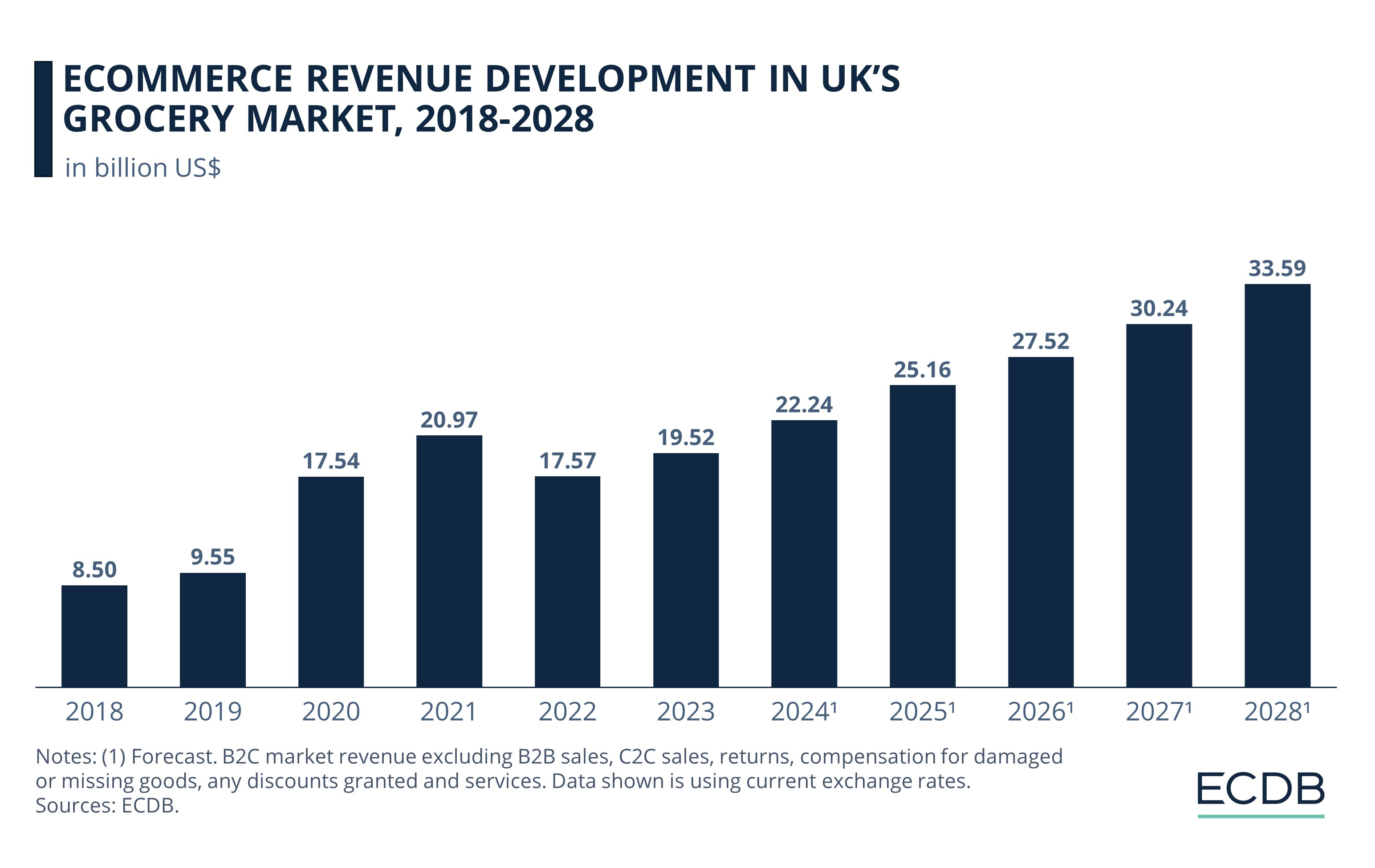

ECDB data shows the category’s overall performance:

Between 2018 and 2019, the market was growing, but slowly. The pandemic pushed grocery eCommerce into the limelight like never before. Growth skyrocketed in 2020 – a yearly increase of 84% put revenues at US$17.5 billion.

Although sales had crossed US$20 billion in 2021, the progress was cut short when the market contracted in 2022. A return to in-store shopping, combined with punishing inflation, decreased order frequency and restrained growth.

The market showed an impressive recovery of 11.1% in 2023. Taking significant strides, revenues will likely reach the highest yet figure of US$22.2 billion in 2024.

In 2023, the top online store for grocery in the UK was Tesco.com, with US$4.2 billion in revenues. Sainsbury.co.uk followed, with US$3.8 billion. Ocado.com was third, with US$1.6 billion. Morrisons.com and Asda.com are smaller players, with sales of around US$1 billion each.

The trend of digital grocery is neither about to perish nor slow down anytime soon. UK’s online grocery market is projected to grow at a compound annual growth rate (CAGR 2024-2028) of 10.9% – the highest among our top five list – with its revenues likely to cross US$33.5 billion by 2028.

2. Tools and Construction Supplies (8.4%)

From hardware store visits and flea market rummages, tools & constructions supplies enthusiasts are turning towards online shops for their buying needs.

A sub-market of the DIY segment, tools & construction supplies accounted for over half (57%) of the market in 2023. Other sub-segments are vehicle parts (22.5%) and garden (20.6%).

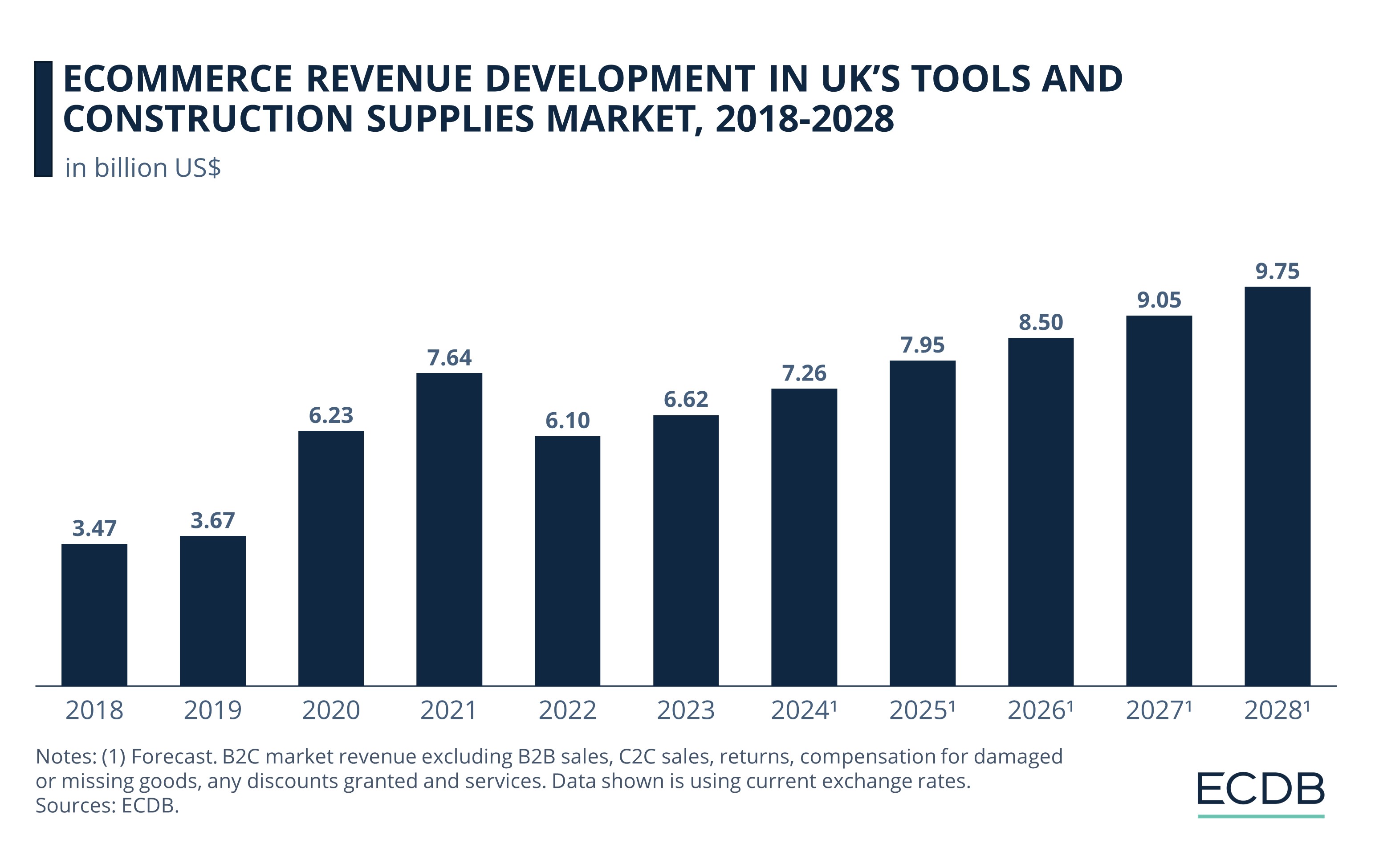

ECDB data drills down into the category’s past and future performance:

Pre-pandemic, the market was growing, but at a slow pace. In 2019, revenues stood at US$3.67 billion.

Home-bound consumers started to actively buy tools & construction supplies online in 2020, driving an increase of 70% in 2020. Revenues hit a high of US$7.6 billion by 2021. Discretionary spending was high during this period, balancing out the impact of supply chain challenges.

After a regression in 2022, the online market showed a moderate recovery in 2023. Revenues are predicted to hit US$7.3 billion this year. However, this is still below the 2021 mark.

UK’s top performing online store for tools & construction supplies in 2023 was Screwfix.com, generating US$1.64 billion. Amazon.co.uk is second, with US$960 million. Wickes.co.uk, Diy.com, and Victorianplumbing.co.uk follow, with revenues of around US$300 million each.

The online market for tools & construction supplies is expected to reach US$9.6 billion in revenues by 2028, at an estimated compound annual growth (CAGR 2024-2028) of 7.6%.

3. Household Care (8.2%)

For people who discover they have run out of detergent right when it’s laundry time, the household care online market is probably a godsend. Rising demand for quick and painless delivery of everyday items spur the category’s growth.

As the smallest sub-market within the care products category, household care made up approximately 10% of its total revenues in the UK in 2023. Its sub-categories include detergents (53%), cleaning equipment (33%), and other household care (15%).

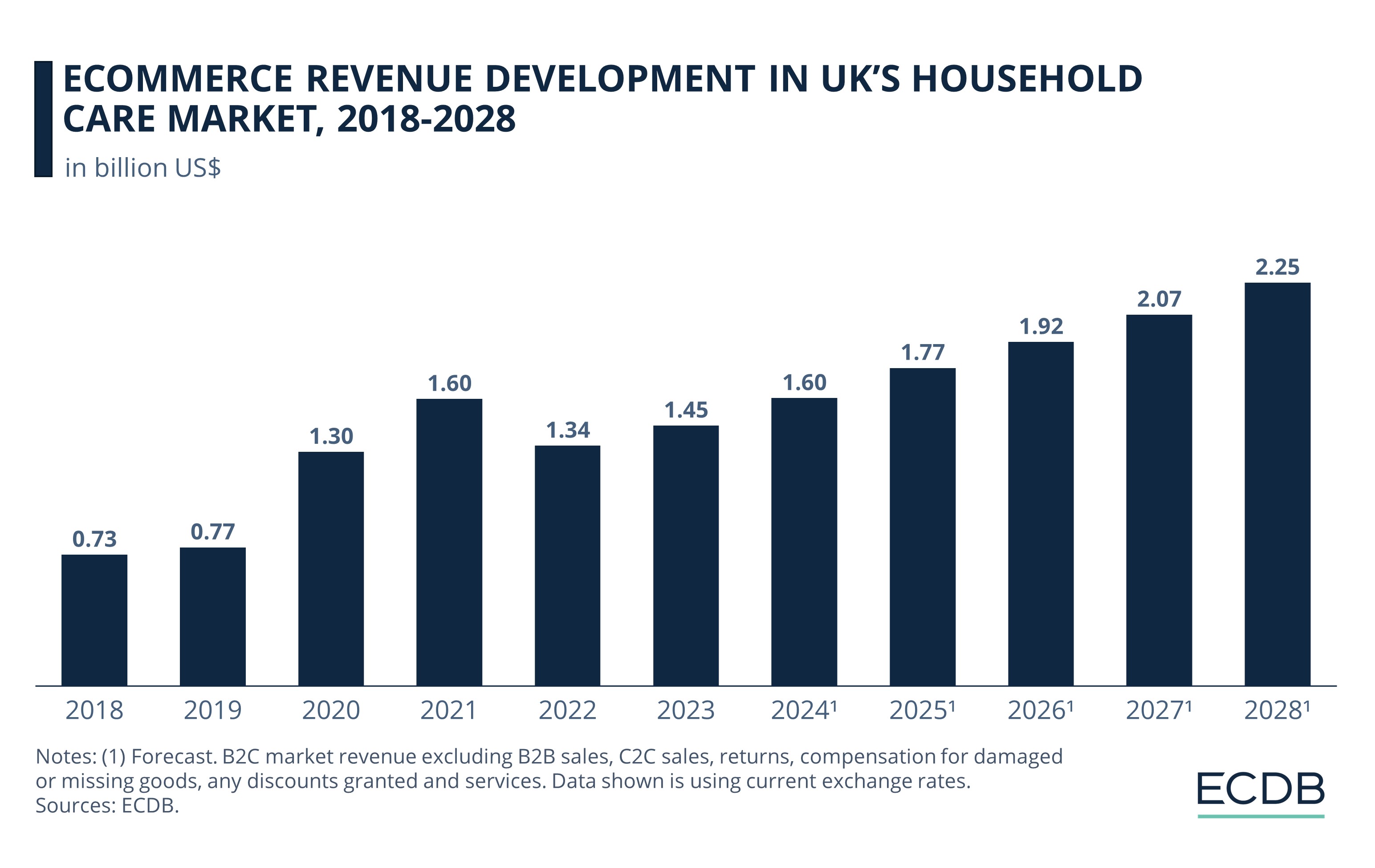

Revenues for household care are back on a growth path, after a decline seen two years ago:

With revenues of US $770 million in 2019, online household care used to be a smaller market.

When the Covid virus threat emerged, people began to panic buy and stockpile household care items, particularly cleaning products. This drove revenues by 69% in 2020. By 2021, revenues hit US$1.6 billion, although the growth rate had subsided to 22.6%.

The resumption of in-store shopping negatively impacted household care eCommerce, which declined by 16% in 2022. But recovery took place in 2023. This year, revenues are likely to reach the pandemic high of US$1.6 billion once more.

The online market for household care is not very concentrated, with the top five players generating comparable revenues in 2023. Amazon.co.uk was the leading store, with revenues worth US$210 million. Asda.com and Sainsury.co.uk were next, with around US$190 million each. Ocado.com was fourth, with US$180 million, while Morrisons.com was fifth, with a smaller US$100 million.

With an expected compound annual growth (CAGR 2024-2028) of 8.8%, revenues for household care in UK ecommerce will likely reach us$2.25 billion by 2028.

4. Flowers & Gifts (7.9%)

The online flowers & gifts market is blossoming. Convenience, personalization, and variety all matter, with online shops offering a broader assortment of products than the florist around the corner. AI tools on websites help consumers find the right gift for every occasion: Just answer a few questions (about the recipient, the occasion, and their preferences or personality) and virtual assistants deliver product suggestions in real time. Not only is this suitable for people who usually struggle with gifting ideas, but it drives website engagement and store revenues.

As a sub-segment of the hobby & leisure category, flowers & gifts accounted for 6.7% of its total revenues in 2023. In comparison, the largest segment, media, had shares of 30%.

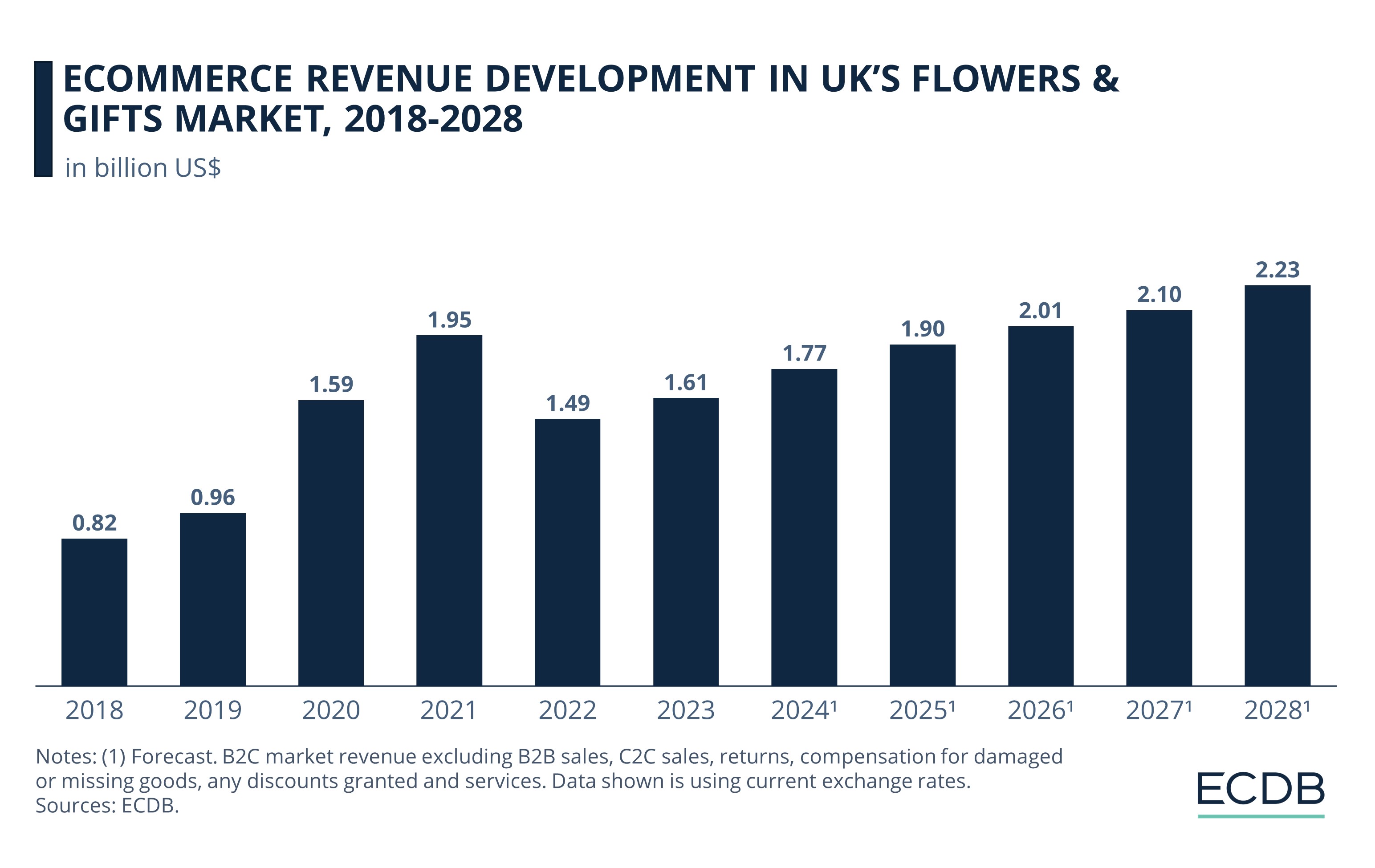

Although still small, flowers & gifts is a growing sub-market in UK ecommerce, with online revenues predicted to increase steadily until 2028.

Flowers & gifts eCommerce was expanding in 2018. A yearly increase of 17% put revenues close to US$1 billion in 2019.

But the real surge in the industry happened during the pandemic, like other categories. Revenues hit US$1.6 billion in 2020, with an annual growth of 65%. In 2021, growth was small but notable at 22.6%.

After a year of decline (-24%), a moderate upswing in the market took place in 2023. Revenues increased to US$1.6 billion. The market is forecast to keep expanding, with revenues reaching US$1.77 billion in 2024.

The top online retailer in the Flowers & Gifts online market by far is Moonpig.com, with revenues of US$240 million. Next.co.uk and Asda.com are next, with revenues ranging between US$120 and US$140 billion. Marksandspencer.com and Interflora.co.uk are behind, with revenues between US$73 and US$89 million.

The expected compound annual growth rate (CAGR 2024-2028) for flowers & gifts is modest, at 6%, with revenues likely to reach US$2.2 billion by 2028.

5. Furniture (7.1%)

The “view in your room” button has made life easier for many a furniture shopper. With stores like IKEA enabling customers to see what a couch looks like in their personal space even before buying, it’s no wonder the online market for furniture is thriving.

Part of the larger Furniture & Homeware category, furniture generated 54.2% of its revenues in the UK in 2023. Its sub-segments include home & living, kitchen & bath, home office & workplace furniture, outdoor furniture, and other. Home & living accounted for half of the market revenues.

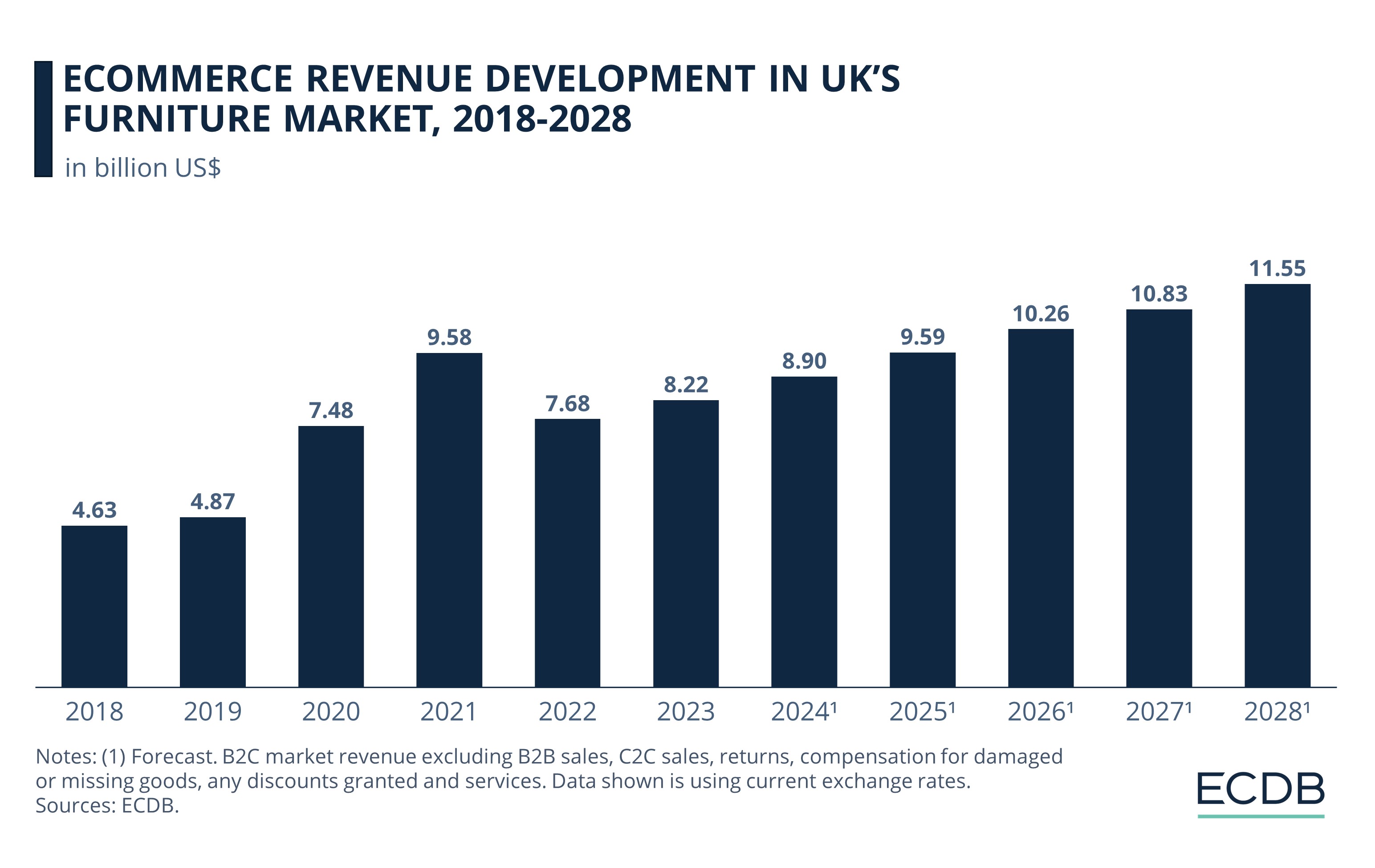

The current and projected performance of furniture in UK eCommerce is:

From a small revenue increase of 5.3% in 2019, the furniture market grew by leaps and bounds in 2020. Building on a 54% jump in 2020, the market expanded further in 2021, reaching revenues of US$9.6 billion.

The post-pandemic downturn had an impact, with revenues dipping by nearly 20% in 2022. A moderate recovery followed in 2023, but revenues were still below the peak pandemic level.

Technological integration and consumer acceptance for online furniture shopping is positively shaping the market. Growth will continue, with revenues expected to hit US$8.2 billion in 2024.

UK’s top performing online store for furniture in 2023 was Ikea.com, with revenues of US$464 million. Dunelm.com was second, with US$422 million, followed by Argos.co.uk at $395 million. Next.co.uk and Amazon.co.uk rounded off the top five, with revenues between US$258 and US$270 million.

The furniture eCommerce market in the UK is projected to reach US$11.5 billion in revenue by 2028, at a compound annual growth rate (CAGR 2024-2028) of 6.7%.

Top Categories in UK eCommerce: Closing Remarks

The strong performance and positive outlook of categories like grocery indicate that people will keep shopping for their daily essentials online, not only in the UK but also worldwide. As the cloud of inflation slowly lifts, online shoppers are also likely to spend more on non-essential or discretionary purchases, thus driving the growth of markets including tools & construction supplies, flowers & gifts, and furniture.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Largest Product Categories in German eCommerce: Fashion Tops the List

Largest Product Categories in German eCommerce: Fashion Tops the List

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Deep Dive

Walmart Expands Pet Care Services

Walmart Expands Pet Care Services

Deep Dive

eCommerce in the United States: Best Product Categories

eCommerce in the United States: Best Product Categories

Back to main topics