eCommerce: Market Insights

Largest Product Categories in German eCommerce: Fashion Tops the List

Germany is one of the markets with the highest eCommerce revenues in the world, and 2023 was a successful year for selling products online. Find out which categories generated the most revenue in 2023.

October 15, 2024Download

Coming soon

Share

Largest Product Categories in German eCommerce:

Key Insights

Fashion Leads, but Competition Grows: Fashion remains the largest eCommerce segment in Germany, generating revenues of US$26.9 billion in 2023. Meanwhile, sectors like hobby & leisure and electronics are increasingly competitive.

Electronics and Hobby & Leisure on the Rise: Hobby & leisure (at US$26.2 billion) and electronics (at US$23.1 billion) are among the top 3 product categories, expected to outpace fashion in the coming years.

Strong Future Growth Across Sectors: From groceries to DIY, Germany’s eCommerce categories are projected to grow steadily, with CAGRs ranging from 4.2% in DIY to 12.6% in groceries, showing a robust recovery and future potential.

The German eCommerce market ranks as the sixth largest eCommerce market in the world, with revenues of US$108 billion in 2023. The seven major product categories driving the German eCommerce market are as unique as Germany itself.

In 2023, fashion eCommerce keeps on being the largest product category by revenue in Germany, but other markets are closing in and creating competition. What are these eCommerce product categories? How has eCommerce in Germany developed in the past?

Top Product Categories in Germany: Fashion Remains in Leading Position

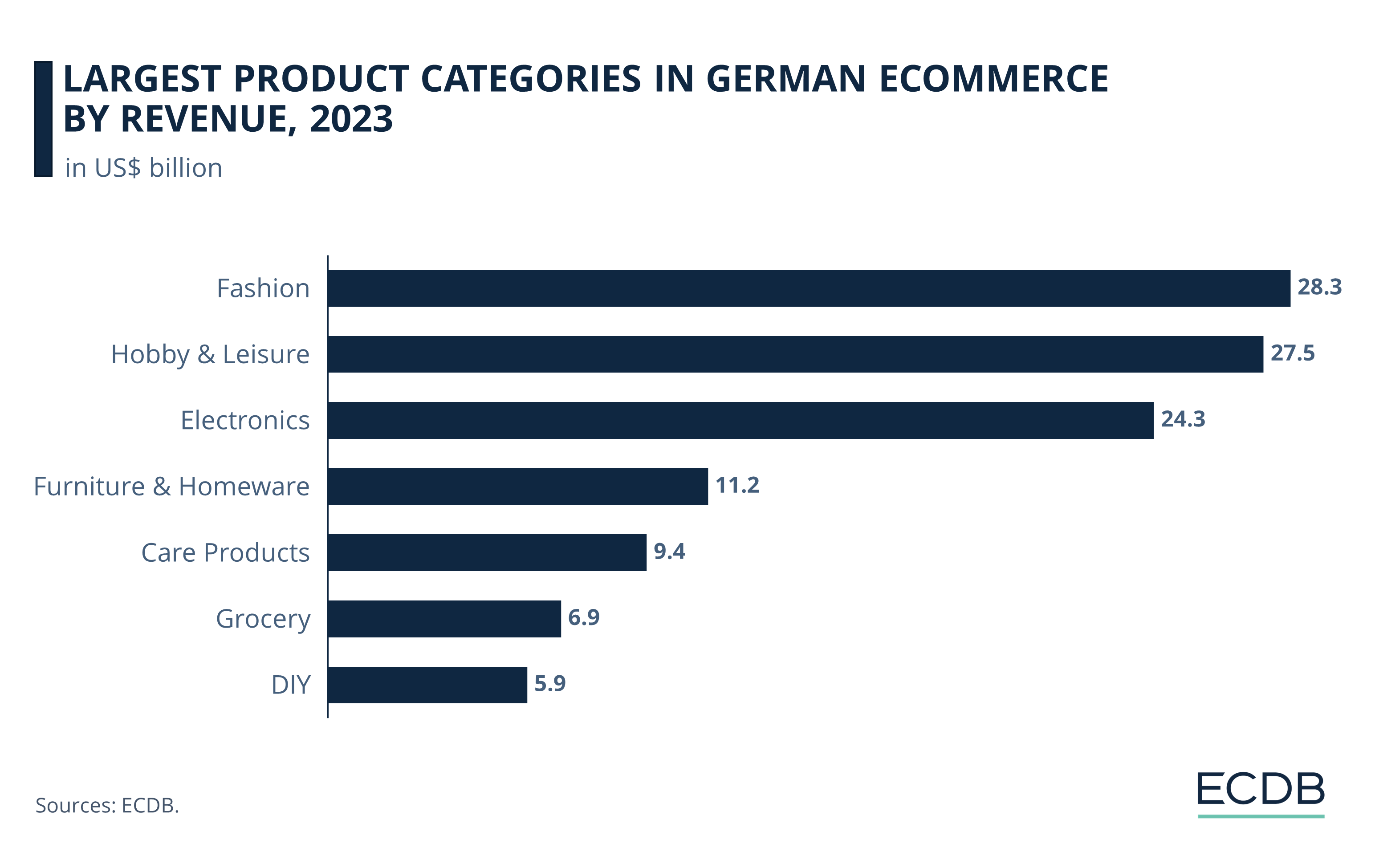

ECDB distinguishes seven main categories in the eCommerce sector: fashion, electronics, grocery, care products, furniture & homeware, hobby & leisure, and DIY. Depending on the eCommerce market and country, the categorical performance can differ:

In 2023, the main product categories fashion, hobby & leisure, and electronics ranked first with similarly strong revenue performance.

They are followed by furniture & homeware together with care products.

At the bottom of the ranking come the eCommerce product categories grocery and DIY.

How have these product categories developed in the past? What can we expect from them in the future?

1. Fashion

In the German eCommerce industry, fashion is the top-selling product category. Not only that, but in 2023, the German fashion market generated US$26.9 billion in revenue, ranking fourth in the world, just behind the United Kingdom's US$40.7 billion. The largest share of this (71.3%) is accounted for by the apparel sub-category.

After peaking in 2021 (US$32 billion), eCommerce revenue declined by 17.3% in 2022. But the market appears to be stabilizing again, with a projected CAGR of 0.8% from 2024 to 2028. Subsequently, this might also have a positive impact on the leading fashion online stores, such as zalando.de and otto.de, which reached revenues of US$2.5 billion and US$1.5 billion in 2023, respectively.

2. Hobby & Leisure

The second largest eCommerce sector in Germany is the hobby & leisure category, with revenues of US$26.2 billion in 2023. This puts Germany in third place globally, just behind the United States (US$203.6 billion) and China (US$128.6 billion). The market includes products from sub-categories such as smoking supplies, pet supplies, and media.

Thanks to the pandemic, the hobby & leisure market peaked at US$28.9 billion in 2021. The following year, the market experienced a major decline of 12.4%, reaching revenues of US$25.3 billion in 2022. Now, the market appears to be stabilizing as it started to increase again in 2023 with an annual growth rate of 3.4%. Looking ahead, ECDB expects the online sector to grow at a CAGR of 3.5% between 2024 and 2028.

3. Electronics

In third place stands the electronics eCommerce product category, which reached revenues of US$23.1 billion in 2023. From a global perspective, the German market ranks fifth between the electronics market of the United Kingdom (US$23.7 billion) and India (US$21.9 billion). The largest online stores in the German electronics market include amazon.de, mediamarkt.de, and apple.com.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

The electronics market also saw a notable uptick in revenue during the pandemic. In 2021, the sector peaked at US$25.6 billion, after which it dropped by 14.2% to US$21.9 billion in 2022. Since last year, the German electronics market shows signs of recovery, growing by 5.1%. Over the next four years (2024 to 2028), the market is expected to continue growing at a CAGR of 5.1%.

4. Furniture & Homeware

The fourth-largest product category in Germany falls further behind: With less than half of electronics eCommerce sales, Furniture & Housewares comes next, with sales of US$10.6 billion in 2023. The German furniture & homeware market positions worldwide in sixth position, behind South Korea (US$11.6 billion), and before India (US$10.4 billion). Top online retailers in this market include amazon.de, ikea.com, and otto.de.

Again, this market is following a similar trend to the other sectors: the German Furniture & Homeware eCommerce market recorded a new high in 2021 with revenues of US$12 billion. After the eCommerce boom, it shrank by 16.5% to US$10 billion in 2022. The market then rebounded by 5.5% in 2023 and is forecast to keep growing at a CAGR of 5.8% between 2024 and 2028.

5. Care Products

Next up is the German care products eCommerce industry, which generated revenues of US$8.9 billion in 2023. Similar to furniture & homeware eCommerce, the German care products segment online ranks behind the South Korean (US$10.1 billion) and behind the Indian (US$7.4 billion) care products markets. This eCommerce category consists of three sub-categories in total: household, personal, and health care.

The care products eCommerce category saw an increase in revenues during the COVID-19 pandemic as well, resulting in a peak in 2021 with revenues of US$9.2 billion. This was followed by a reduction of 9.1% in 2021, bringing revenues to US$8.4 billion. Since 2023, the market shows signs of resuming growth, with an increase of 6.2% in 2023 and an expected CAGR of 7.2% between 2024 and 2028.

6. Grocery

The online grocery category ranks sixth, with revenues of US$6.4 billion in 2023. On a global scale, this German online segment ranks ninth, behind the Indian (US$7.4 billion) and just ahead of the Australian (US$6.2 billion) grocery markets. Overall, this eCommerce sector contains two subcategories – beverages and food – which are more or less equally divided in 2023.

Due to the development of the pandemic and the subsequent eCommerce boom, the grocery market in Germany jumped 66.2% in 2020 and then 39.8% in 2021, until it reached revenues of US$6.2 billion in 2021. The following year, the German grocery market decreased by 8.7%. Since then, this eCommerce segment has regained revenue – 13.1% in 2023 – and is projected to continue growing at a CAGR of 12.6% between 2024 and 2028.

7. DIY

At the bottom of the ranking stands the product category DIY, otherwise known as do-it-yourself, with revenues of US$6 billion in 2023. The global position of the German market is ahead of the Russian (US$5.9 billion) and behind the Indian (US$6.8 billion) DIY markets. Within this sector, there are smaller markets such as garden, tools & construction supplies, and vehicle parts.

Just like all other eCommerce categories in Germany, the DIY market has benefited from the global pandemic. The DIY market experienced the largest increase between 2019 and 2020, with an annual growth rate of 24.6%, peaking in 2021 at US$7 billion in revenue. In 2022, the eCommerce segment shrank by 20.7%, but stabilized in 2023 with a YoY growth rate of 7.6%. The German DIY market is expected to perform at a CAGR of 4.2% between 2024 and 2028.

Largest Product Categories in German eCommerce: Closing Thoughts

Overall, all the seven main eCommerce categories in Germany benefited from the eCommerce boom during the COVID-19 pandemic, although some sectors benefited more than others. However, all of Germany's major product markets have stabilized within a short period of time after suddenly experiencing strong ups and downs.

If the forecasts of the ECDB analysts prove correct, the German fashion market may sooner or later lose its leading position to the hobby & leisure market or even the electronics market. Only time will tell which product category will remain or become the largest one in Germany.

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics