eCommerce: Pet Supplies in Germany

Top Online Pet Supply Stores in Germany

Where do pet owners in Germany buy their beloved animals' favorite treats and toys online? What has been the development of the online pet supplies market in recent years?

Article by Antonia Tönnies | August 13, 2024Download

Coming soon

Share

Top Online Pet Supply Stores in Germany: Key Insights

Leading Online Retailer: Zooplus.de is the top online pet supply store in Germany, generating US$423.7 million in 2023, representing 16.6% of the market, with a significant presence across Europe.

Competitive Landscape: Other leading online pet supply stores in Germany include fressnapf.de, zooroyal.de, bitiba.de, and medpets.de.

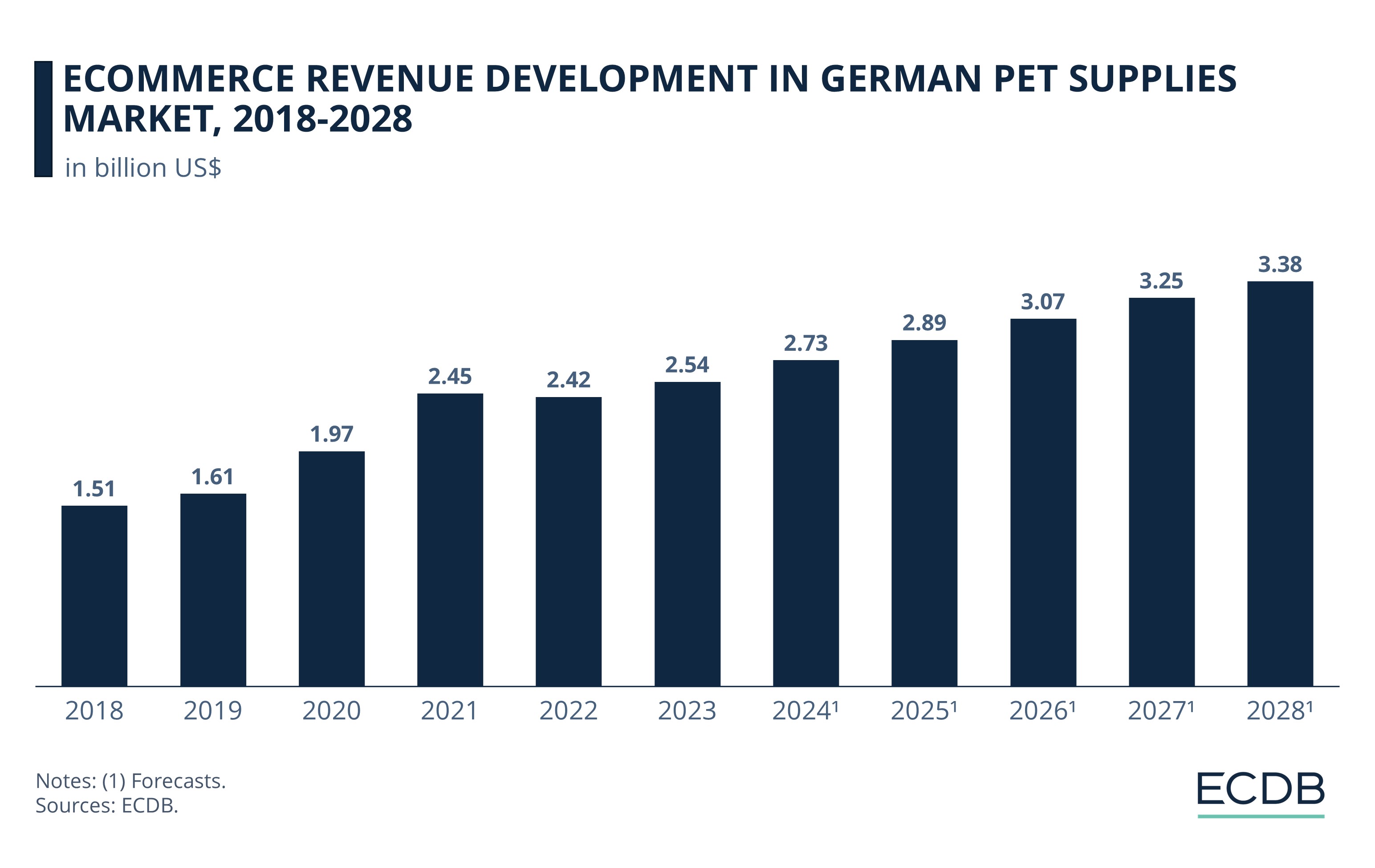

Market Revenue Trends: The German Pet Supplies market experienced significant growth during the pandemic, peaking at US$2.45 billion in 2021, followed by a slight decline in 2022 but rebounding to US$2.54 billion in 2023. The market is projected to continue to grow, reaching US$3.38 billion by 2028.

In 2023, there were 34.3 million pets living in Germany, the majority of them being cats (15.7 million). Despite a slight decline in the number of pets in recent years, the total number of pets has increased significantly compared to 2007 (23.3 million pets).

More pets mean more demand for products for our companion animals. So where do pet owners in Germany shop online? Join us as we explore the leading online pet supply stores in Germany.

What Is the Online Pet Supplies Market?

ECDB defines the Pet Supplies market as a submarket of the Hobby & Leisure market and accounts for 14% of the total eCommerce market in Germany.

The category encompasses the commercial (B2C) sale of pet food and treats, pet toys, crates, carriers, aquariums, tanks & enclosures, collars & leashes, pet grooming supplies, pet clothing & accessories, and pet pharmaceuticals & nutrition. Excluded from the Pet Supplies are pet care services (e.g. dog walking, grooming, pet training), and medical treatments (e.g. veterinary care).

Who Is the Leading Online Pet Supply Store

in Germany?

While the market as a whole has performed well over the past few years, it is worth looking at the different online shops that have driven this performance. The top 5 include stores such as zooroyal.de, fressnapf.de, zooplus.de, bitiba.de and medpets.de.

1. Zooplus.de

Zooplus.de leads the ranking by far with a generated revenue of US$421.1 million in 2023, representing 16% of the total pet supplies market in Germany. The German domain of the operating company zooplus SE generates the largest revenue share of the eCommerce activity with 92.2% in Germany. Consequently, Germany is the most important region for the online store.

The eCommerce company was founded in 1999 in Germany. Over the years, they have expanded their activities across Europe and ship their products to over 25 countries around the world. As reported by the German newspaper Lebensmittel Zeitung, Zooplus is currently working on its own online marketplace. The marketplace is planned to be launched in November 2024, while it is expected to increase the overall revenue of the company.

2. Fressnapf.de

In second position stands the German domain of the company Fressnapf Holding SE, fressnapf.de, with a turnover of US$181.2 million last year. The company is specialized as well as zooplus SE onto the Pet Supplies market and generates most of its eCommerce activities in Germany (60.9%). With a difference of US$240 million in net sales, fressnapf.de has a long way to go to catch zooplus.de at #1.

Launched in 2009, Fressnapf.de has grown to become the second-largest online pet supply store in Germany – and it continues to build on its success. With their latest partnership with apo.com, the online store is expanding into the pet medication market.

3. Zooroyal.de

The third place is again a long way away from the second place: Zooroyal.de comes next with US$93.3 million in revenue in 2023. This is equal to half of fressnapf.de’s net sales and even less (22%) of zooplus.de’s. As part of the REWE Group, the online store contributes to the 14.3% net sales of the Company generated in the Pet Supplies category.

The pet supply store specializes in a wide range of products for different pets and their needs. In 2022, the online store faced some difficulties and had to take a hit in growth with a loss of 20.1%, but recovered soon after.

4. Bitiba.de

In fourth place positions the online Pet Supply retailer bitiba.de, which is operated by bitiba GmbH. The online shop in 2023 achieved an eCommerce revenue of US$63.9 million. Zooplus SE, which also owns the market leader zooplus.de, is the parent company of bitiba.de.

Bitiba.de is the discount brand of the operating company. It advertises with "permanently low prices and savings campaigns for satisfied customers". Similar to zooroyal.de, bitiba.de had a sharp decline in YoY growth in 2022 with losses of 13.8% but has also recovered in 2023 with new growth of 11.7%.

5. Medpets.de

Last but not least, medpets.de completes the ranking of the top 5 specialist online Pet Supply stores in Germany. The online store, which is owned by Onlinepets B.V. has recently seen its revenue decline from US$38.5 million in 2021 to US$21.7 million in 2023. According to ECDB’s latest data, this downward trend is expected to continue until 2025.

The online store had been founded in 2010 and is specialized in medical pet supplies, starting from food to medicine. This online shop is the only medical specialty retailer to have made it into the top 5 specialist online Pet Supply stores in Germany, quite unlike the market in the United Kingdom, for example.

Online Pet Supplies Market in Germany: New Growth Trend

Over the years, the eCommerce sector for pet supplies has developed and reached a turnover of US$2.54 billion in the last year. Now that the market has returned to normal following the pandemic and is facing a slowdown in growth, let's take a closer look at recent sales trends and the future of the market:

In the years leading up to COVID-19, the market showed strong growth, especially in 2018 when the revenue increased by 19.5% hitting US$1.5 billion. Compared to 2018, the year-over-year growth slowed to 6.6% in 2019, resulting in a revenue of US$1.6 billion.

The pandemic years led to a global eCommerce boom. In the first year with Corona, sales rose 23.1% to US$1.97 billion, followed by a jump of 23.9% to US$2.45 billion in 2021.

After the high in 2021 came the low. The YoY growth crashed in 2022 to -7% with a turnover of US$2.28 billion. In the following year, the German Pet Supplies market got back on track and gained 3.2% with US$2.35 billion.

The growth trend is set to continue by reaching until 2028 US$2.87 billion in revenue by 2028.

All in all, the German eCommerce sector for pets and more benefited from the boom and continues its upward trajectory after the short dip in 2022.

Top Online Pet Products in Germany

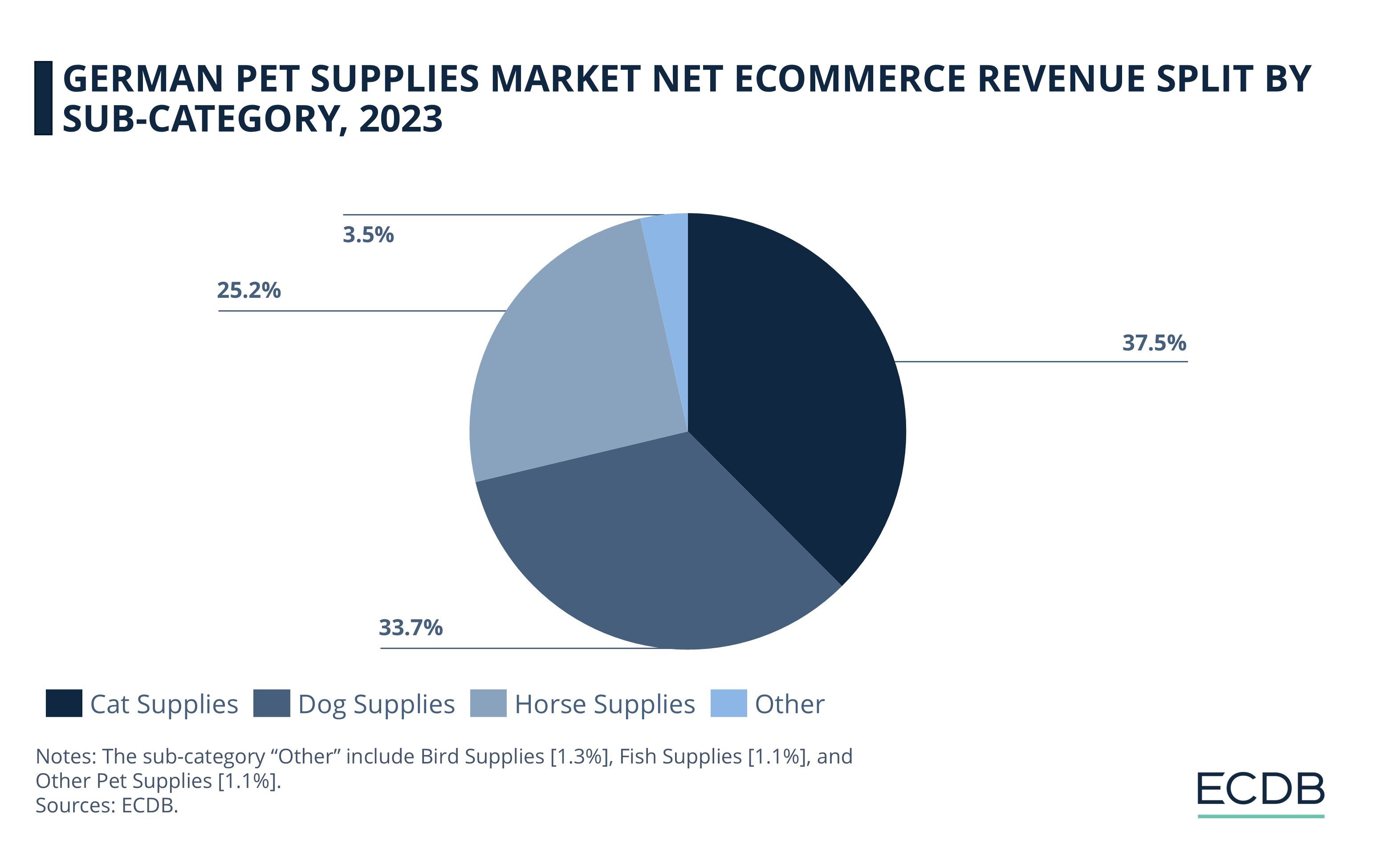

In the Pet Supply market can be found in total six additional different sub-categories: Bird Supplies, Cat Supplies, Dog Supplies, Fish Supplies, Horse Supplies and Other Pet Supplies. In Germany, there was one category that surpassed all others in 2023:

Cat Supplies: 37.5%,

Dog Supplies: 33.7%,

Horse Supplies: 25.2%,

Bird Supplies: 1.3%,

Fish Supplies: 1.1%,

Other Pet Supplies: 1.1%.

If we look at this distribution, the sub-category for cat supplies is the most popular, whereas in the United States, for example, supplies take up the largest share with 47.8%.

Top Online Pet Supply Stores in Germany: Closing Thoughts

The online Pet Supplies market has certainly benefited from the eCommerce boom along with the COVID-19 pandemic. However, this rapid growth has led to a decline in 2022, albeit a brief one. Looking ahead, the submarket is positioned for continued growth, with revenues projected to reach US$3.38 billion by 2028.

Our view into the crystal ball is limited, but it is already clear that this sector will remain a strong and growing segment of the online shopping world.

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Social Commerce in China and the United States: Consumer Preferences, Leading Platforms and Product Categories

Social Commerce in China and the United States: Consumer Preferences, Leading Platforms and Product Categories

Deep Dive

Top Online Pet Supplies Stores in the United Kingdom

Top Online Pet Supplies Stores in the United Kingdom

Deep Dive

Top Categories for Online Shopping in Spain: Food and Beverages Lead

Top Categories for Online Shopping in Spain: Food and Beverages Lead

Deep Dive

Top Online Wine and Liquors Online Stores in France

Top Online Wine and Liquors Online Stores in France

Article

Revenue Distribution Among the Global Top 100 Apparel Online Stores 2023

Revenue Distribution Among the Global Top 100 Apparel Online Stores 2023

Back to main topics