Social Commerce: China & the U.S.

Social Commerce in China and the United States: Consumer Preferences, Leading Platforms and Product Categories

China and the U.S. are the top two eCommerce markets globally, but their social commerce landscape is far from similar. We analyze how Chinese and American online shoppers use social commerce: their attitudes towards it, preferred platforms, and the product categories they most buy via social media.

Article by Nashra Fatima | August 26, 2024Download

Coming soon

Share

Social Commerce – China vs. the United States: Key Insights

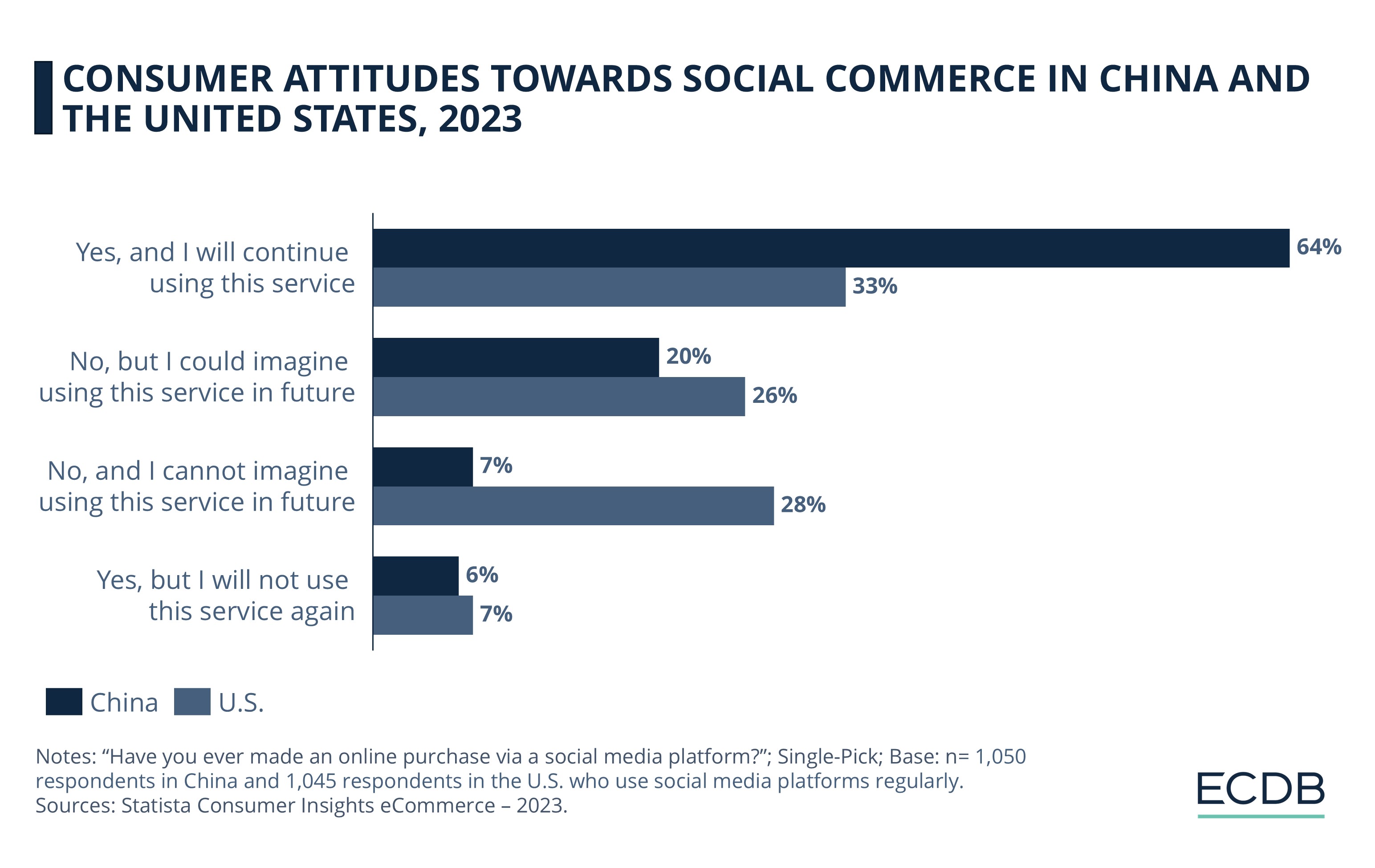

Attitudes towards Social Commerce: The share of shoppers in China who have used social commerce and intend to keep using it is nearly double that of the U.S. On the other hand, the share of shoppers who have neither used social commerce nor imagine using it in the future is four times higher in the U.S. than in China.

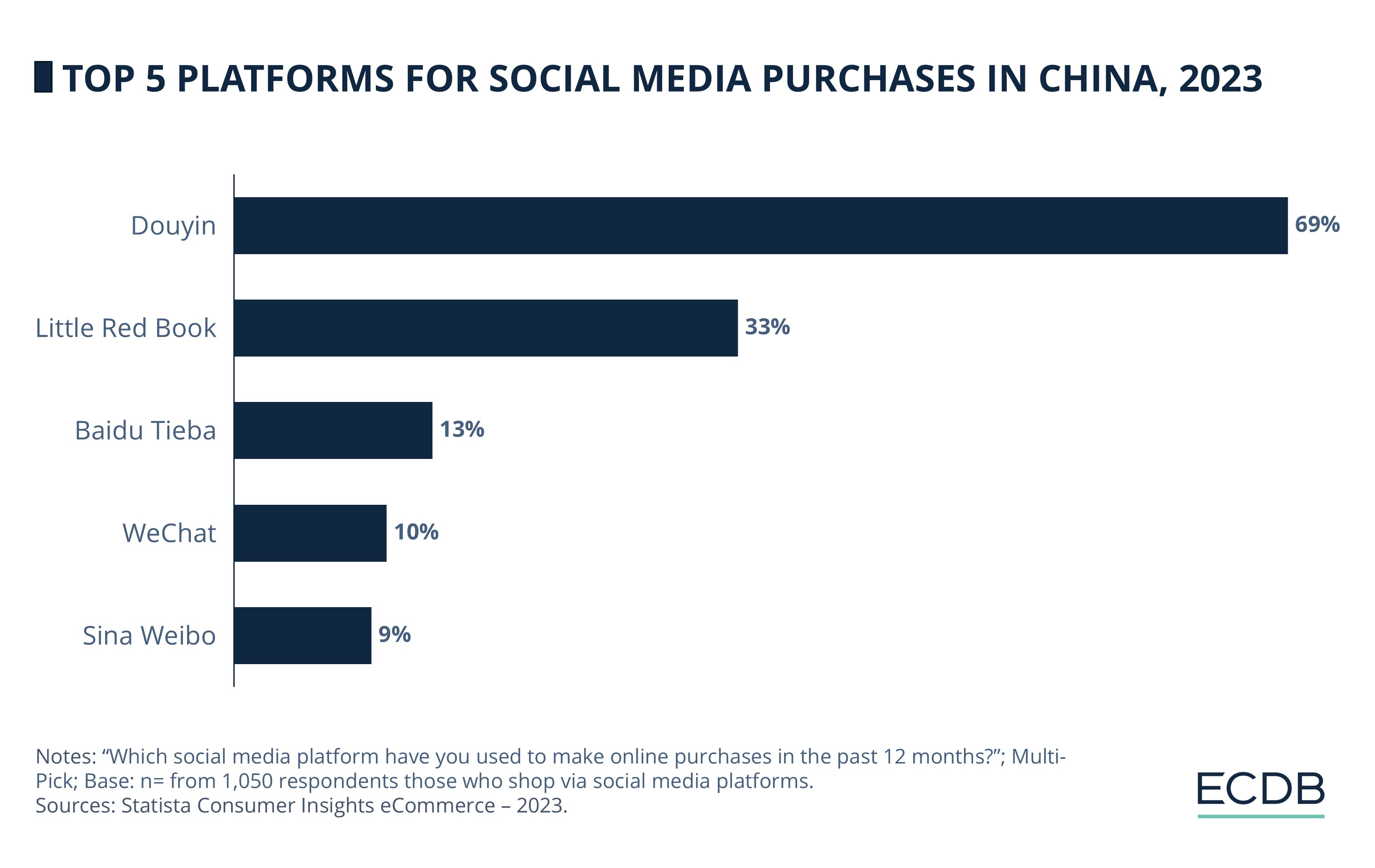

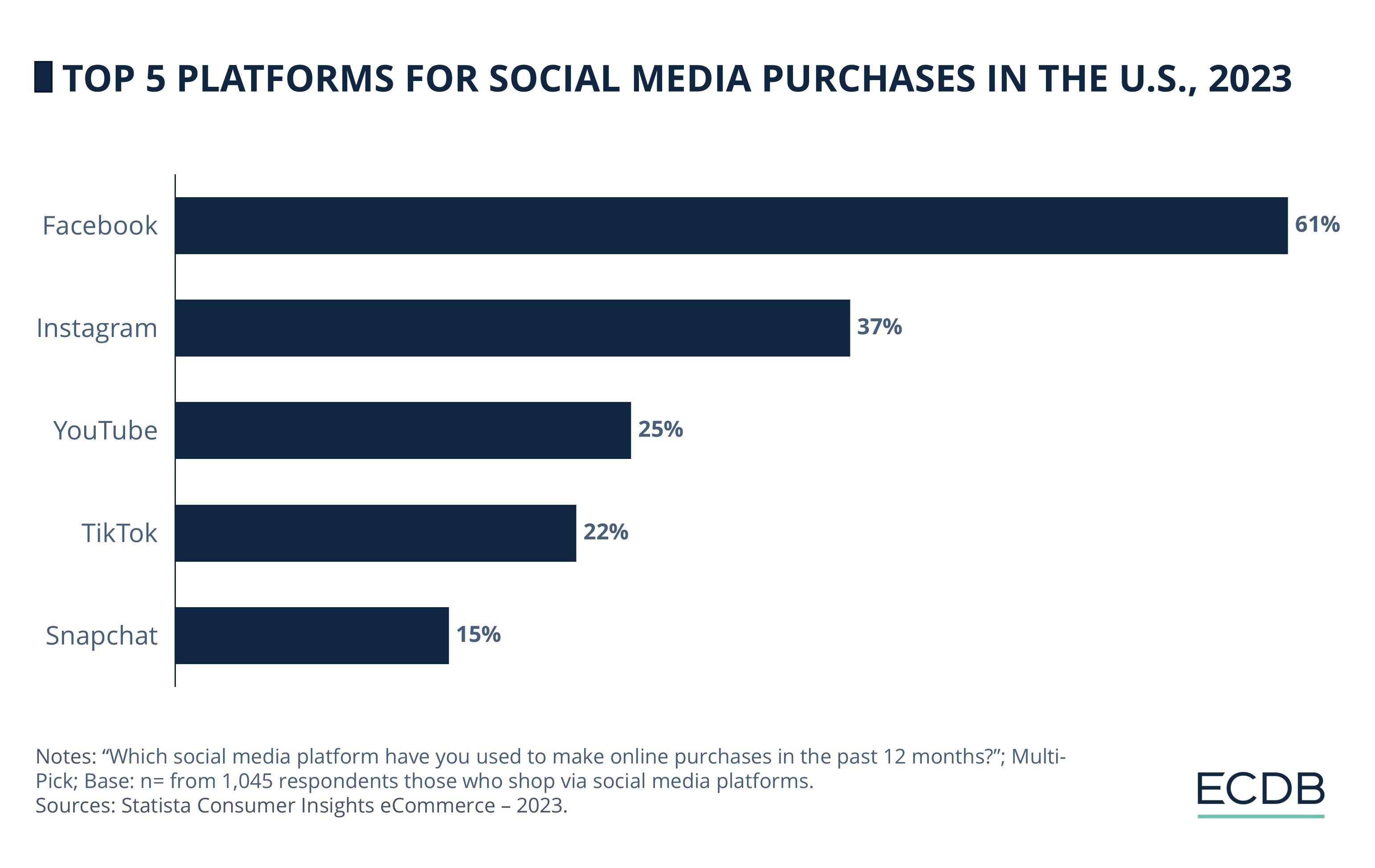

Top Platforms: In China, the leading social commerce platform is Douyin, used by 69% of social shoppers. Facebook leads in the U.S., used by 61% of respondents.

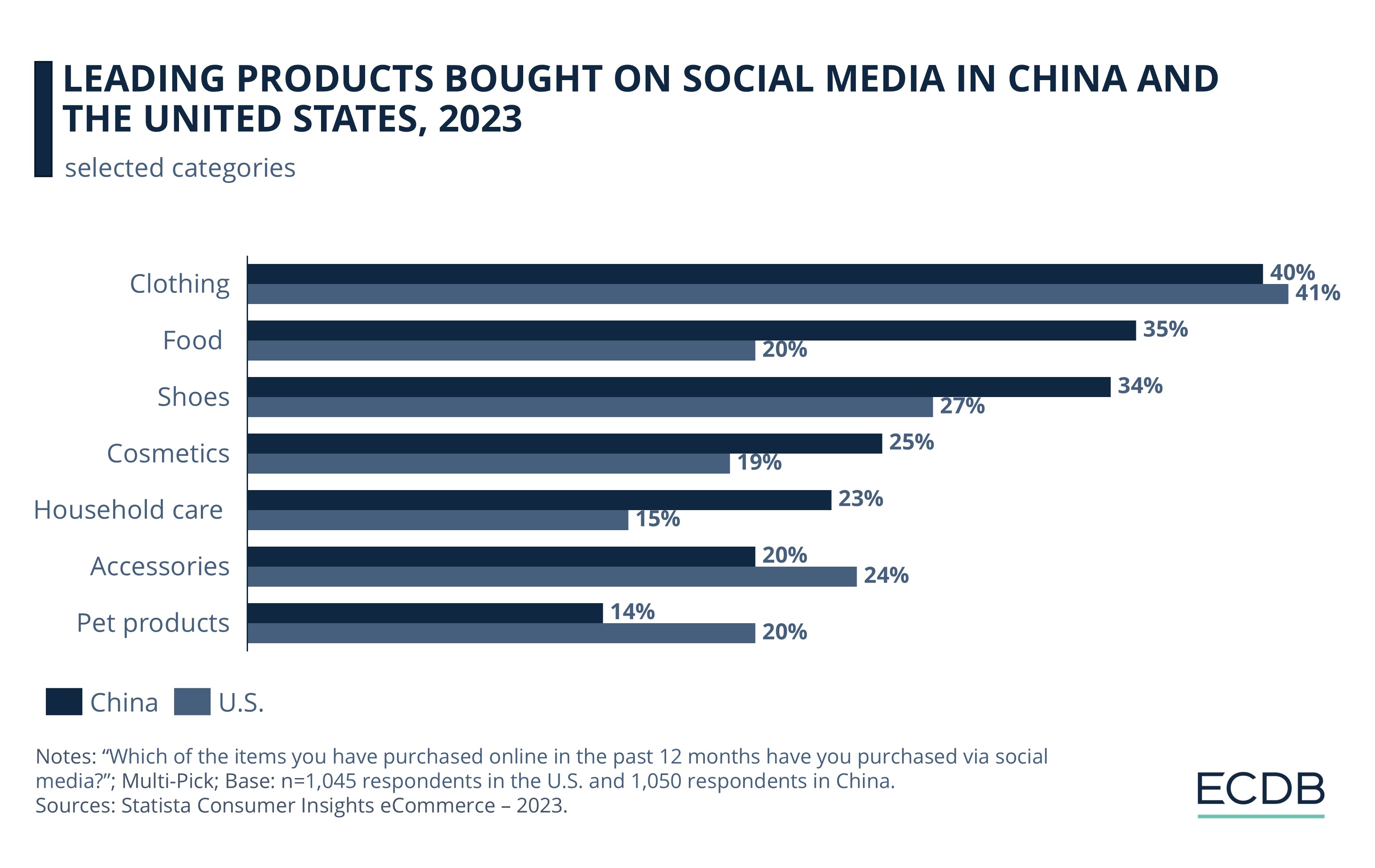

Leading Categories Bought on Social Media: Clothing tops the list of products purchased on social platforms in both China and the U.S. in 2023. But in general, the most popular categories bought on social media in both countries tend to be different.

Social commerce revenues are projected to hit US$6.2 trillion by 2030. But not all countries are equal participants in this rising trend.

And perhaps nowhere is this difference more pronounced than in the top two global eCommerce markets, China and the United States: while the first powerfully drives social commerce practices like live commerce, the second is slow to embrace it.

In this article, we spotlight the consumer behavior of Chinese and American social shoppers. Specifically, we decode data on attitudes towards social commerce, top platforms, and leading categories bought via social media in China and the U.S.

Attitudes Towards Social Commerce: Chinese Shoppers More Open Than Americans

When it comes to social media penetration, China (75.2%) takes the lead over the United States (69.7%) in 2024, according to DataReportal. But more than this gap, it is the market difference that shapes the acceptance of social commerce in these two countries.

The Statista Consumer Survey of 2023 shows a significant divergence in consumer attitudes towards social shopping in China and the United States:

64% of survey respondents in China have not only purchased through social media, but they will continue the practice, indicating high usage as well as purchase intention on social platforms. In comparison, only half the U.S. shoppers (33%) stated the same.

20% of Chinese respondents have not used social commerce, but they can imagine using it in the future. At 26%, the share of U.S. shoppers demonstrating this openness is higher, likely because of a currently lower usage rate.

In China, 7% of respondents have neither used social commerce nor do they want to try it in the future – a fairly small group. But the share of U.S. consumers closed off to social commerce experiences is four times higher, at 28%.

When it comes to having used social commerce but deciding not to use it again, the share of Chinese and U.S. shoppers is similarly small, at 6% and 7% respectively.

The data highlights a fundamental contrast in consumer views about social commerce in the two countries:

China is already a mature social commerce market. Its collectivist social setup plays a key role in driving social commerce trends like group buying which remain unpopular in the U.S. Chinese companies like PDD have capitalized precisely on these inclinations by designing their shopping platforms with social referrals in mind.

American consumers are found to be wary of social commerce. A 2023 survey showed that 63% of U.S. shoppers worried about illegitimate merchants and scams on social media. Other concerns include privacy issues, counterfeit products, and discomfort in sharing personal information over social media.

Live commerce, one of the most lucrative social commerce trends, has seen its heyday in China, with platforms like Taobao and Douyin recording enormous successes. But the U.S. has been slow in adopting it. Now, eCommerce platforms like Amazon have started integrating live commerce features, but a possible ban on TikTok may deal a blow to the budding industry.

Unlike in China, the U.S. consumers’ approach towards social commerce is fraught with concerns. But the trend is still likely to accelerate in the U.S. market, riding on the global wave of rapid social commerce adoption. Popular social media platforms have incorporated social commerce features, which is a positive sign.

Which Social Commerce Platforms Do Chinese and U.S. Shoppers Use?

Chinese and U.S. American companies are behind the world’s leading social media platforms. So, when it comes to social commerce, consumers in both countries incline towards social sites developed nationally, with the exception of TikTok in the U.S.

The top social commerce platforms in China in 2023 were:

Douyin not only ranks first but dominates the Chinese social commerce market. 69% of consumers who shop via social media regularly have used this platform in the past year. This is the Chinese version of TikTok. With its focus on engaging short-form videos, it is a live commerce dynamo.

Little Red Book, dubbed ‘the Chinese Instagram’, stands second with a third (33%) having shopped on it. With over 212 million monthly active users as of June 2024, the platform primarily targets young, urbanite female consumers.

Baidu Tieba is next, with 13% of Chinese social commerce buyers having used it. It functions as an online community board, like Reddit. The focus on user-generated content makes it a solid marketing platform.

WeChat, the all-rounder Chinese app, is also active in social commerce. It takes the fourth spot, with 10%.

Sina Weibo is fifth, with 9%. Although its market share is small, features like Weibo Mini Shop and livestreaming tools put it in the ranking.

Meanwhile, the top platforms for social commerce in the United States were:

Facebook ranks first, with 61% of social commerce users having shopped on it. Although Meta shut down its livestream function, the dedicated Facebook Marketplace – a C2C platform – continues to draw in social shoppers. Facebook is, in fact, the top social commerce platform across the world.

Instagram stands second with 37%. Also owned by Meta, its features include Instagram Shop, product detail pages, and in-app checkout.

YouTube stands third with 25%. It has a store tab, with product lists and video descriptions. Older content can also be monetized as products can be tagged along several videos.

TikTok, the international version of the Chinese Douyin, is fourth with 22%. The dedicated social commerce function on TikTok – called TikTok Shop – was only launched in the U.S. in 2023, making its ascendance to the top 5 list remarkable. Features include a shop, shoppable ads, and live video shopping.

Snapchat stands third with 15%. It has a young user base and Augmented Reality (AR) features. However, its strategic shift away from AR and towards web tools in view of rising competition may impact its appeal for social shoppers.

Notably, all top-ranking social commerce platforms in China are Chinese-owned. The government has blocked international social media platforms with its Great Firewall. This step thwarted global social media giants like Facebook from capturing the Chinese market and in the process, boosted the ecosystem of domestic social media sites.

In the U.S., Meta’s dominance in social commerce is visible. Although TikTok broke into the top echelons, its position remains uncertain: the U.S. officials’ distrust of this China-origin app means a ban looms on the horizon. If this happens, the landscape might shift again, allowing other platforms to acquire larger market shares.

Which Product Categories Do Chinese and U.S. Shoppers Buy via Social Media?

A wide variety of products are sold on social platforms – ranging from fashion to beauty to household care.

In both China and the U.S., the below product categories were popularly purchased on social commerce sites in 2023:

Clothing is the largest category that survey respondents purchased through social media in both China (40%) and the U.S., with the latter taking a slight lead at 41%.

Food is the second most popular category in Chinese social commerce, at 35%. But in the U.S. (20%, ranking fifth) it is not as commonly purchased on social platforms.

Shoes are bought on social media by 34% of Chinese respondents and 27% of Americans. It is similarly popular for social shoppers in both countries, ranking second in the U.S. and third in China.

Cosmetics is bought by a quarter of Chinese social shoppers, where it ranks fourth. In the U.S., it ranks eighth, with 19% of respondents having bought it via social media.

Household care is also bought by a larger share of respondent in China (23%, ranking sixth) than the U.S. (15%, ranking twelfth).

Accessories, on the other hand, are bought by a larger share of social shoppers in the U.S. (24%, ranking third) than in China (20%, ranking seventh)

Pet products are also purchased on social platforms more in the U.S. (20%, ranking sixth), than in China (14%, ranking fifteenth).

Overall, the category of Fashion – under which ECDB groups the sub-markets of clothing, shoes, and accessories – emerges as a leading category in social commerce, mirroring traditional eCommerce where fashion is the third-largest category worldwide.

Also, some categories like Shoes although ranked higher in the U.S., the share of U.S. shoppers who bought it remains smaller than their Chinese counterparts. This underscores the comparatively advanced nature of the Chinese social commerce market.

Closing Remarks

The social commerce market operates differently and has seen varying levels of success in China and the United States.

The difference is visible in consumer usage of and inclination towards social commerce. Where Chinese consumers readily shop on social media platforms, U.S. shoppers remain cautious. The tide is likely to shift, however, as social commerce use accelerates worldwide.

As an ECDB insight explains, influencers play a decisive role in social commerce. Attempts to catalyze social commerce adoption in the U.S. market must capitalize on them, as influencers’ ability to connect with the audience promotes sales. At the same time, existing consumer concerns about trust, privacy, and ethics must be adequately addressed for social commerce to reach its full potential in the U.S.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics