eCommerce: Pet Supplies

Top Online Pet Supply Stores in the United States

Where do American pet owners find the best treats and toys for their pets online? Learn who the key players in the U.S. pet supply market are and what sets them apart.

Article by Cihan Uzunoglu | June 25, 2024Download

Coming soon

Share

Top Online Pet Supply Stores in the United States:

Key Insights

Market Leaders: Chewy.com dominates the U.S. online pet supplies market, generating US$11.14 billion in revenue, leading ahead of Petsmart.com at US$1.01 billion, Petco.com at US$495 million, Barkbox.com at US$444 million, and 1800petmeds.com at US$219 million.

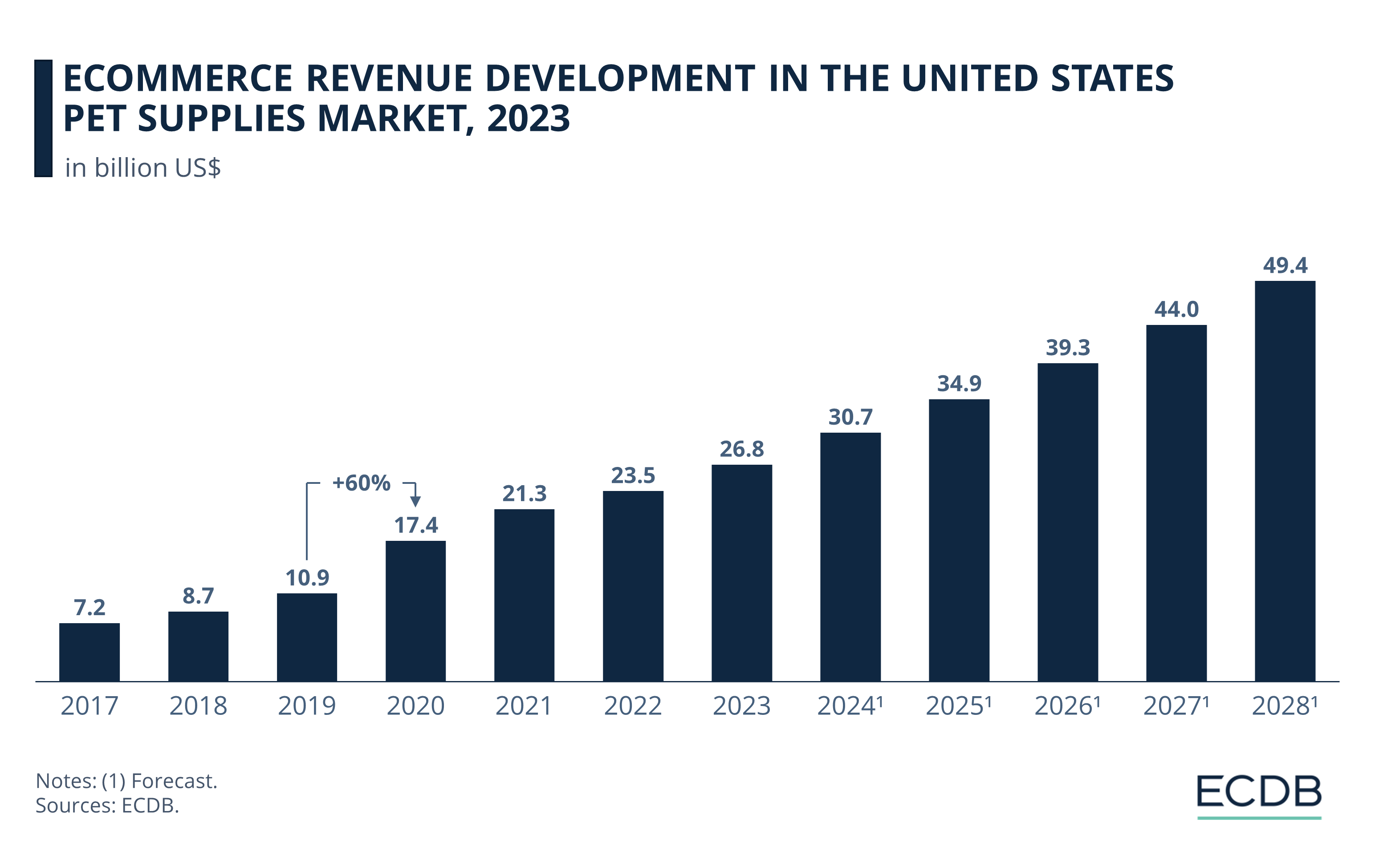

Pandemic Growth: In 2020, the U.S. online pet supplies market experienced substantial growth, with revenues soaring from US$10.9 billion in 2019 to US$17.4 billion due to increased pet ownership and the shift towards online shopping during the pandemic.

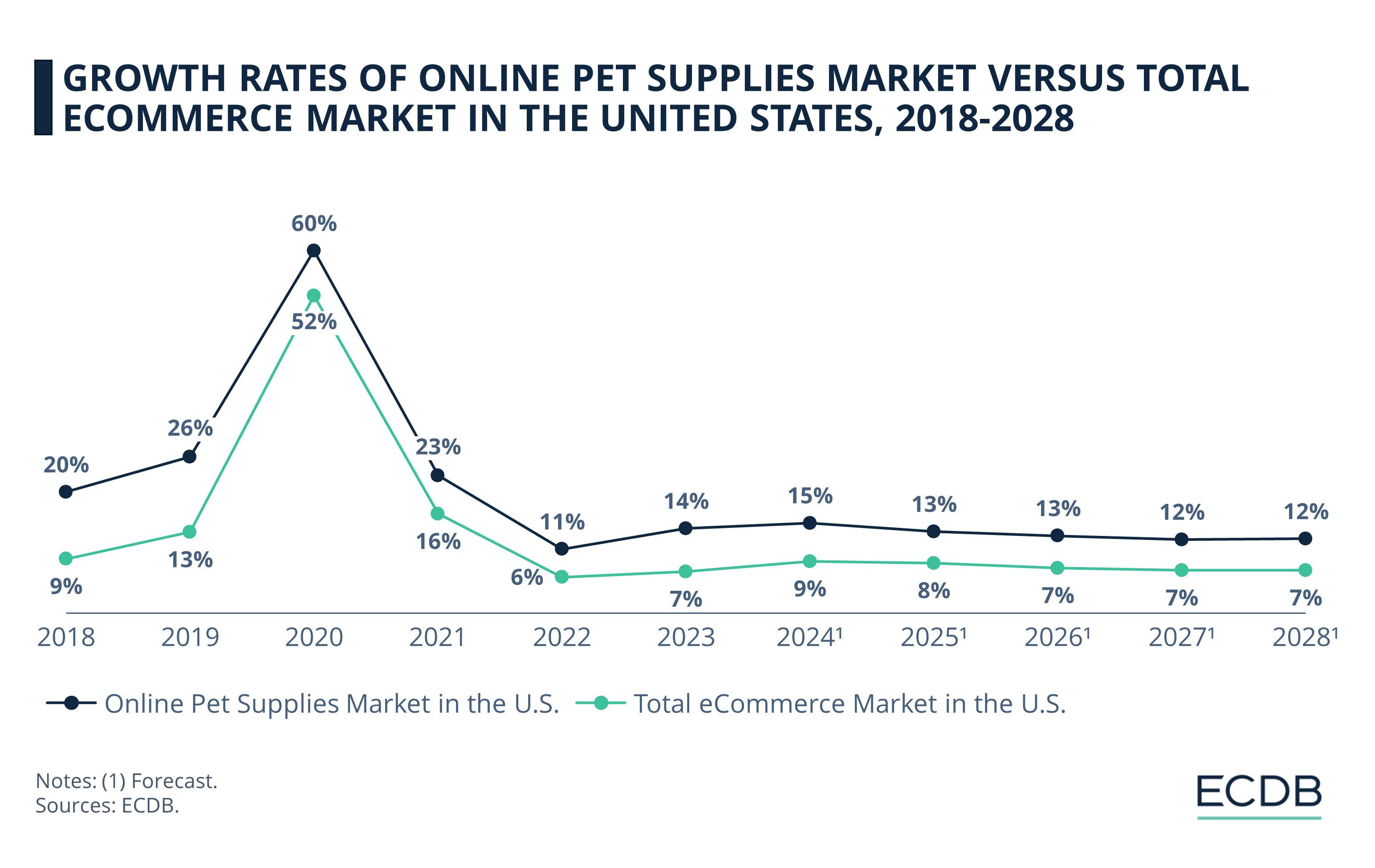

Comparative Growth: The growth rate of the U.S. online pet supplies market consistently outstripped that of the overall eCommerce market, especially in 2020 when it escalated by 60%, significantly higher than the eCommerce market's 52% increase, again influenced by the pandemic.

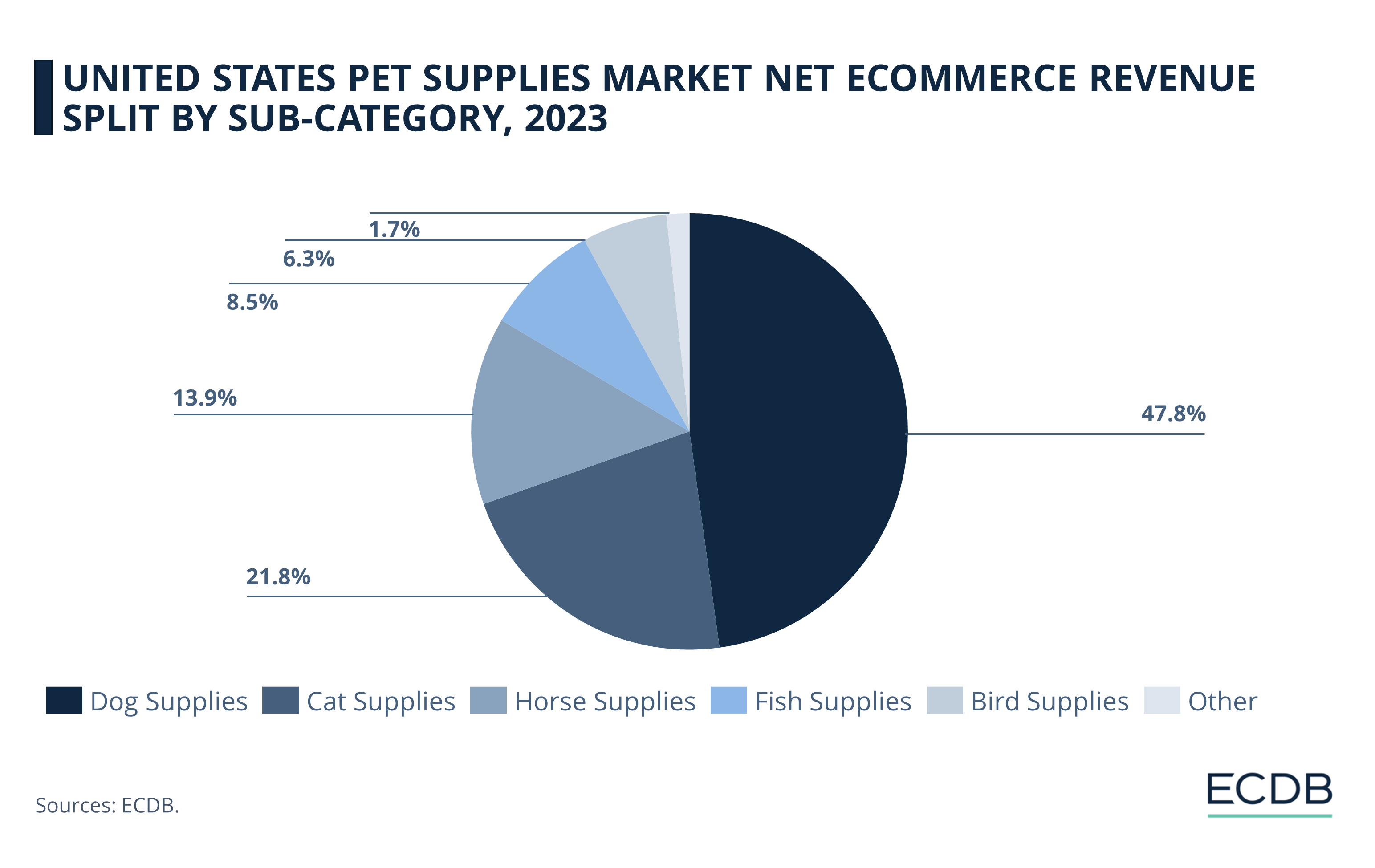

Category Share: In 2023, dog supplies dominated the U.S. online pet supplies market, representing about half of the revenue. They were followed by cat supplies at 21.8% and horse supplies at 13.9%.

Imagine you need a special treat or the perfect toy for your pet - where would you look first, local store or your trusted online platform?

The online pet supply market has exploded, providing pet owners with an array of options just a click away. From everyday essentials to unique pet products, these stores have changed the way we care for our pets.

Who are the key players driving this market, and what sets them apart in a crowded field? Join us as we explore the leading online pet supply stores in the U.S.

What Are Pet Supplies?

As per ECDB’s definition, the Pet Supplies market is a segment of the Hobby & Leisure market, encompassing the digital sales of pet food, treats, toys, crates, carriers, aquariums, tanks, enclosures, collars, leashes, grooming supplies, clothing, accessories, and pet pharmaceuticals and nutrition.

This market excludes pet care services such as dog walking, grooming, pet training, and medical treatments like veterinary care.

Top Online Pet Supply Stores in

the United States: Chewy Dominates

Before diving into the market, let's take a look at the top specialized online pet supply stores in the United States by revenue in 2023:

1. Chewy.com

With a revenue of US$11.14 billion, Chewy.com dominates the online pet supplies market in the United States, far outpacing its competitors.

Founded in 2011 and acquired by PetSmart in 2017 for US$3.35 billion, Chewy, Inc. has become a significant player in U.S. eCommerce, in addition to being one of the most valuable eCommerce players in the country.

The company offers a vast range of pet products, including food, health items, toys, and habitats, with about 110,000 items from over 3,500 brands. Chewy's success is driven by its Autoship service for regular deliveries and outstanding customer service, including sending flowers to bereaved pet owners. Additionally, Chewy provides same-day delivery through Instacart, ensuring prompt service.

2. Petsmart.com

Petsmart.com ranks second with a revenue of US$1.01 billion. Founded in 1986, PetSmart has grown into one of North America's largest pet supply retailers, with over 1,670 stores across the U.S., Canada, and Puerto Rico.

Its online platform offers a wide range of pet products and services, including grooming and pet training. PetSmart is known for its in-store PetSmart PetsHotel® boarding facilities and has facilitated over 10 million adoptions through partnerships with nearly 4,000 animal welfare organizations. Same-day delivery options are available through partnerships with services like Instacart.

3. Petco.com

Petco.com holds the third spot with a revenue of US$495 million. Established in 1965, Petco has evolved into a comprehensive pet health and wellness provider, with over 1,500 locations across the U.S., Mexico, and Puerto Rico.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

Petco's eCommerce platform specializes in pet supplies, including food, toys, and health products, and offers in-store services like grooming, training, and veterinary care. Petco also provides same-day delivery through partnerships with DoorDash and Instacart.

4. Barkbox.com

Barkbox.com ranks fourth with a revenue of US$444 million.

BARK, Inc., known for its flagship product BarkBox, offers subscription-based products and services for dogs. Founded in 2011, BarkBox provides monthly themed boxes of toys, treats, and essentials tailored to each dog's needs. BARK also sells products through retail partners like Target and Amazon and offers same-day delivery through services like DoorDash and Instacart.

5. 1800petmeds.com

1800petmeds.com holds the fifth position with a revenue of US$219 million. Founded in 1996, 1800PetMeds, also known as PetMed Express, Inc., is a leading online pet pharmacy in the United States.

The company offers a wide range of prescription and non-prescription pet medications, health products, and supplies. PetMeds focuses on providing affordable and convenient pet health solutions, supported by excellent customer service and fast delivery options, including same-day delivery through various partners.

Online Pet Supplies Market in

the United States: 60% Growth in 2020

Pet supplies is a convenient category for eCommerce, providing an easy way for shoppers to browse and purchase treats and essentials for their pets. Whether it's a new pet bed for your dog or a replacement toy for your cat, online shopping offers a wide variety of options to meet your pet's needs.

Online pet supplies is one of the fastest growing product categories in the global eCommerce market. Amazon Prime Day 2023 also highlighted the popularity of pet products, ranking 8th among categories purchased.

The U.S. Pet Supplies eCommerce market is projected to continue growing. Looking back, a significant growth was observed in 2020, with revenues jumping from US$10.9 billion in 2019 to US$17.4 billion, driven by increased pet ownership and online shopping during the pandemic.

By 2023, revenues reached US$23.5 billion, with forecasts predicting continued growth to US$30.7 billion in 2024 and nearly US$50 billion by 2028.

Market Outpaces the Total eCommerce Market Growth in the U.S.

The online pet supplies market in the U.S. has consistently outpaced the overall eCommerce market growth in the country over the past decade:

In 2018, the online pet supplies market grew by 20%, compared to a 9% growth rate for the total U.S. eCommerce market.

This trend continued, with a notable spike in 2020 (due to increased pet ownership and a shift to online shopping during the pandemic) where the growth rate for online pet supplies surged to 60%, significantly higher than the 52% growth of the total eCommerce market.

Post-pandemic, growth rates stabilized but remained robust. In 2023, the online pet supplies market grew by 14%, double the 7% growth rate of the total eCommerce market.

Projections for 2024 indicate a growth rate of 15% for the online pet supplies market, compared to 9% for the overall eCommerce market.

By 2028, the growth rate for online pet supplies is expected to settle at 12%, still outpacing the 7% growth forecast for the total eCommerce market.

Dog Supplies Make Up Half of the Market

The U.S. pet supplies market's eCommerce revenue in 2023 reveals that dog supplies take the largest share:

While dog supplies dominate the market with 47.8% of the total eCommerce revenue,

Cat supplies follow with 21.8%, indicating a robust market for feline products.

Horse supplies account for 13.9% of the revenue, showing a specialized yet substantial niche.

Fish supplies make up 8.5%, driven by the popularity of home aquariums.

Bird supplies contribute 6.3% to the market, catering to bird owners' needs for food, cages, and toys.

Top Online Pet Supply Stores in

the United States: Closing Thoughts

The online pet supplies market has shown remarkable growth, significantly outpacing the overall eCommerce market. This trend, driven by increased pet ownership and the convenience of online shopping, particularly surged during the pandemic. As we look forward, the market is poised for continued growth, expected to approach the US$50 billion mark in a few years.

The post-pandemic landscape will undoubtedly bring changes. For example, forecasts suggest a shift in the market share among pet categories. While dog supplies currently dominate, their share is expected to decrease, with cat supplies anticipated to grow. Only time will tell how these changes will unfold, but it is clear that the online pet supplies market will remain a strong and growing segment of the online shopping world.

Sources: Chewy, PetSmart, Petco: 1, 2, 3, Stock Analysis, BarkBox: 1, 2, 3, PetMeds: 1, 2, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Deep Dive

German Cross-Border eCommerce: Marketplaces, Online Stores, Top Markets & Product Categories

German Cross-Border eCommerce: Marketplaces, Online Stores, Top Markets & Product Categories

Deep Dive

EHI: eCommerce Market Germany - Top 1,000 Online Stores Made €77.5 Billion in 2023

EHI: eCommerce Market Germany - Top 1,000 Online Stores Made €77.5 Billion in 2023

Deep Dive

Top eCommerce Countries in Africa

Top eCommerce Countries in Africa

Back to main topics