eCommerce: Trend Report

EHI: eCommerce Market Germany - Top 1,000 Online Stores Made €77.5 Billion in 2023

ECDB and EHI Research Institute have released the “E-Commerce Market Germany 2024” report, featuring insights, data, and detailed analyses on the German eCommerce market.

Article by Nashra Fatima | October 01, 2024Download

Coming soon

Share

Top Online Stores in Germany: Key Insights

Performance of Online Stores in Germany: In 2023, the top 1,000 online stores made net sales worth €77.5 billion. Growth declined slightly compared to past year, but the market has largely stabilized after the pandemic boom.

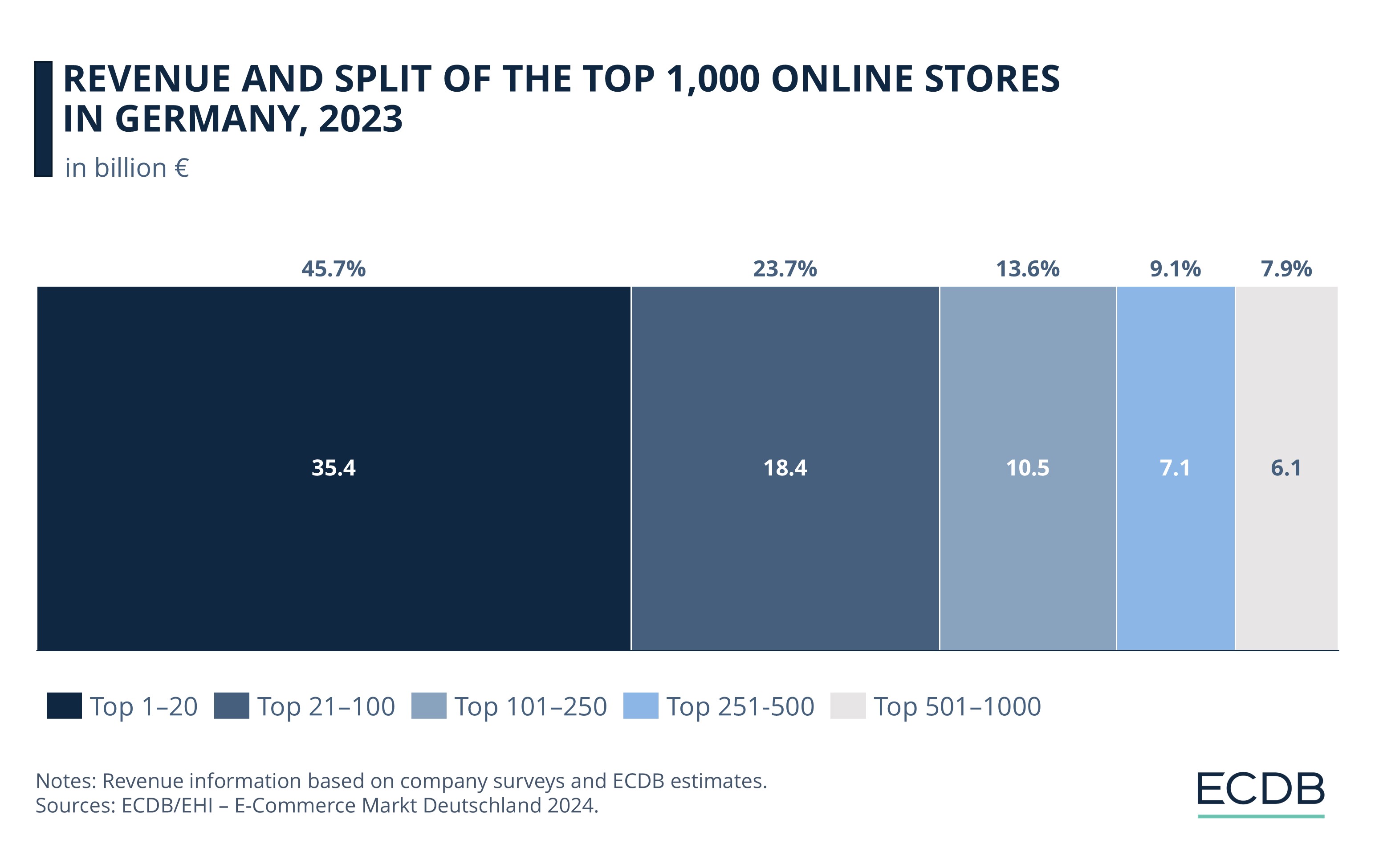

Revenue distribution: The top 20 online stores by revenue generated nearly half of total net sales (45.7%) while the smallest stores contributed much less, hinting at market concentration in the industry.

E-Commerce Market Germany 2024: The study, completed in collaboration with the EHI Research Institute, analyzes the performance of Germany’s online market in 2023, key eCommerce players, product categories, sales channels, marketing strategies and more.

Our study “E-Commerce Market Germany 2024” provides in-depth insights into the country’s online retail industry, including revenues, GMV growth, the top online stores and marketplaces.

This article on the top online stores offers you a sneak peek into our 50-page report.

Top 1,000 Online Stores in Germany Generated Net Sales of €77.5 Billion in 2023

Substantial eCommerce growth took place in Germany during the pandemic. Net sales of online stores grew at an unprecedented CAGR (2019-2021) of 24.3%, but the impact subsided. We covered this slowdown of eCommerce sales by stores that occurred in 2022.

Our latest findings show that, in 2023, the downward trend continued. Net sales of online stores decreased slightly year-on-year to reach €77.5 billion in 2023.

This marks a two-year period of decline for first-party net sales of online stores in Germany. But compared to 2022, when the market contraction was more significant at 2.8%, the drop in net sales in 2023 is less pronounced at only 0.2%.

In 2022, the resurgence of in-store shopping as pandemic lockdowns ended, as well as inflation and economic uncertainties, had led to the restrained performance of online stores. The developments in 2023 hint at the stabilization of the eCommerce market, now that the unusual boom seen during the pandemic has well and truly subsided.

Despite the return to brick-and-mortar retail, consumers are committed to online shopping. At the same time, trends like omnichannel retail, which integrate the benefits of online and offline shopping, are gaining traction, which may lead to lower growth rates for pure online sales.

Our projections put net sales of the top 1,000 online stores at €78.3 billion in 2024 – a yearly increase of 1%. The moderate growth outlook indicates that the future increase in eCommerce store sales will likely occur in small increments rather than massive leaps as observed in the pandemic years.

Top 20 Online Stores in Germany Account for Nearly Half of Top 1,000 Revenues

Our study “E-Commerce Market Germany 2024” shows the market dynamics beyond absolute numbers.

The distribution of revenues among online stores, based on their ranking in the top 1,000, shows the pattern of market concentration in the country’s eCommerce market.

In 2023, the top 20 highest-revenue stores in Germany generated over €35 billion altogether. This is 45.7% of the total revenues of the top 1,000 stores.

As we move further down the rankings, the contribution to total revenue declines significantly.

For instance, the top 21-100 stores contribute 23.7% to the total revenues or €18.4 billion. In comparison, stores ranked 101-250 and 251-500 contribute much less, at 13.6% and 9.1% respectively. The smallest share comes from stores ranked 501-1000: 7.9% of the total revenues, or €6.1 billion.

This tiered breakdown highlights the market disparity, where the top players continue to dominate in terms of revenue generation.

Study “E-Commerce Market Germany 2024” - Order Now

In its 16th consecutive year, this study, conducted in partnership with the EHI Retail Institute, provides an in-depth analysis of Germany’s eCommerce landscape.

Beyond online store sales and revenue distribution, the report offers the latest insights into marketplaces, product categories, sales channels, marketing strategies, case studies, and more.

Order the E-Commerce Market Germany 2024 report to learn more.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Zalando and About You Raise Positive Outlook for the Holiday Season

Zalando and About You Raise Positive Outlook for the Holiday Season

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Deep Dive

German Cross-Border eCommerce: Marketplaces, Online Stores, Top Markets & Product Categories

German Cross-Border eCommerce: Marketplaces, Online Stores, Top Markets & Product Categories

Deep Dive

The eCommerce Market Germany 2024: A Report By EHI & ECDB

The eCommerce Market Germany 2024: A Report By EHI & ECDB

Deep Dive

Online Shopping Habits in Germany: Consumers Buy More During the Week

Online Shopping Habits in Germany: Consumers Buy More During the Week

Back to main topics