eCommerce Market Germany 2024

The eCommerce Market Germany 2024: A Report By EHI & ECDB

Our annual study in cooperation with the EHI Retail Institute, “E-Commerce Market Germany 2024”, reveals valuable insights about the German market.

Article by Cihan Uzunoglu | October 01, 2024Download

Coming soon

Share

eCommerce Market Germany: Key Insights

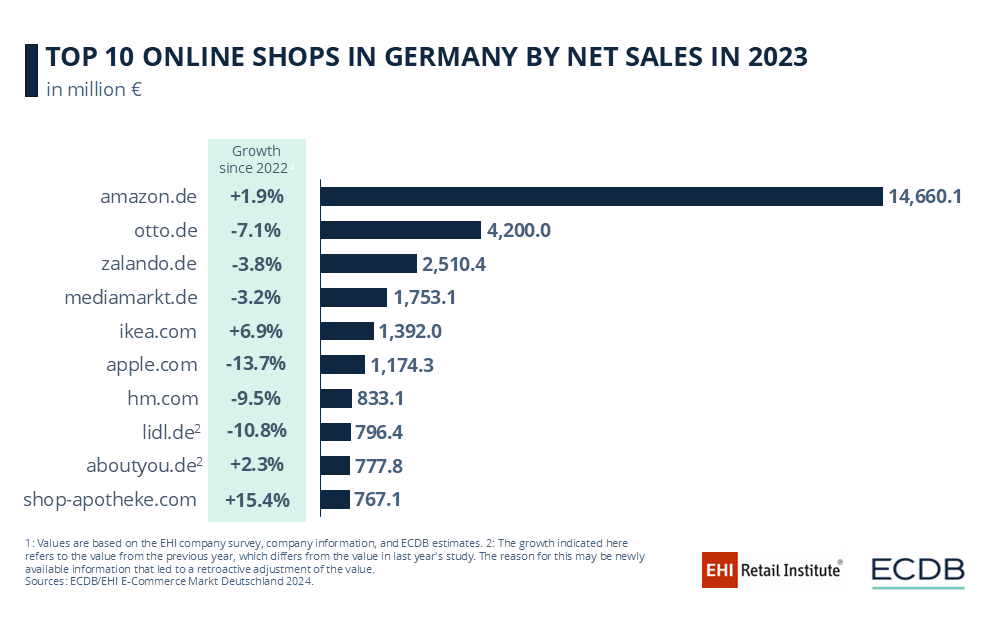

Top Stores: Amazon.de remained the top player in 2023 with modest growth, while other major retailers like Otto, Zalando, and Apple struggled. Ikea and Shop Apotheke were among the few to see noticeable gains.

Amazon’s Dominance in Top Categories: Amazon leads in both the Hobby & Leisure and Electronics markets in Germany, capturing a fifth and a quarter of their respective sales, while Zalando dominates the Fashion segment with nearly 10% of total sales.

The “E-Commerce Market Germany 2024” report uncovers key shifts in the country’s online retail scene, showing how some major players are losing ground while others rise quickly. With insights from the top 1,000 B2C online shops and leading marketplaces, the report dives into which sectors are growing and who’s falling behind.

Which online stores are thriving, and which product categories are leading the way? Let's delve into the report's findings.

Amazon.de Dominates in Germany

Despite Amazon maintaining its dominant position with modest growth, the rest of the top 10 reveals a mixed performance last year. Traditional heavyweights like Otto and Zalando continued to lose ground. Electronics giant Mediamarkt also saw a dip, while Ikea stood out with notable growth, counterbalancing Apple’s sharp decline.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Among the smaller players, Shop Apotheke emerged as a standout with a strong double-digit increase, while Lidl and About You struggled to maintain their previous momentum.

Amazon.de leads with €14.66 billion in 2023, an almost 2% increase from 2022.

Otto.de and Zalando.de are second and third, with €4.2 billion and €2.51 billion, down 7.1% and 3.8%, respectively.

Mediamarkt.de is fourth with €1.75 billion, a 3.2% decline from 2022.

Ikea.com grew by 6.9% to €1.39 billion, while Apple.com dropped 13.7% to €1.17 billion.

Hm.com (€833 million, -9.5%) and Lidl.de (€796 million, -10.8%) saw declines, while Aboutyou.de grew by 2.3%, reaching €777 million. Shop-apotheke.com grew 15.4% to €767 million.

Top Online Stores in Top Product Segments

in Germany

It's not enough to just look at the top online stores in the market. To better understand the market, we need to dig deeper and see which players are leading in the top product categories.

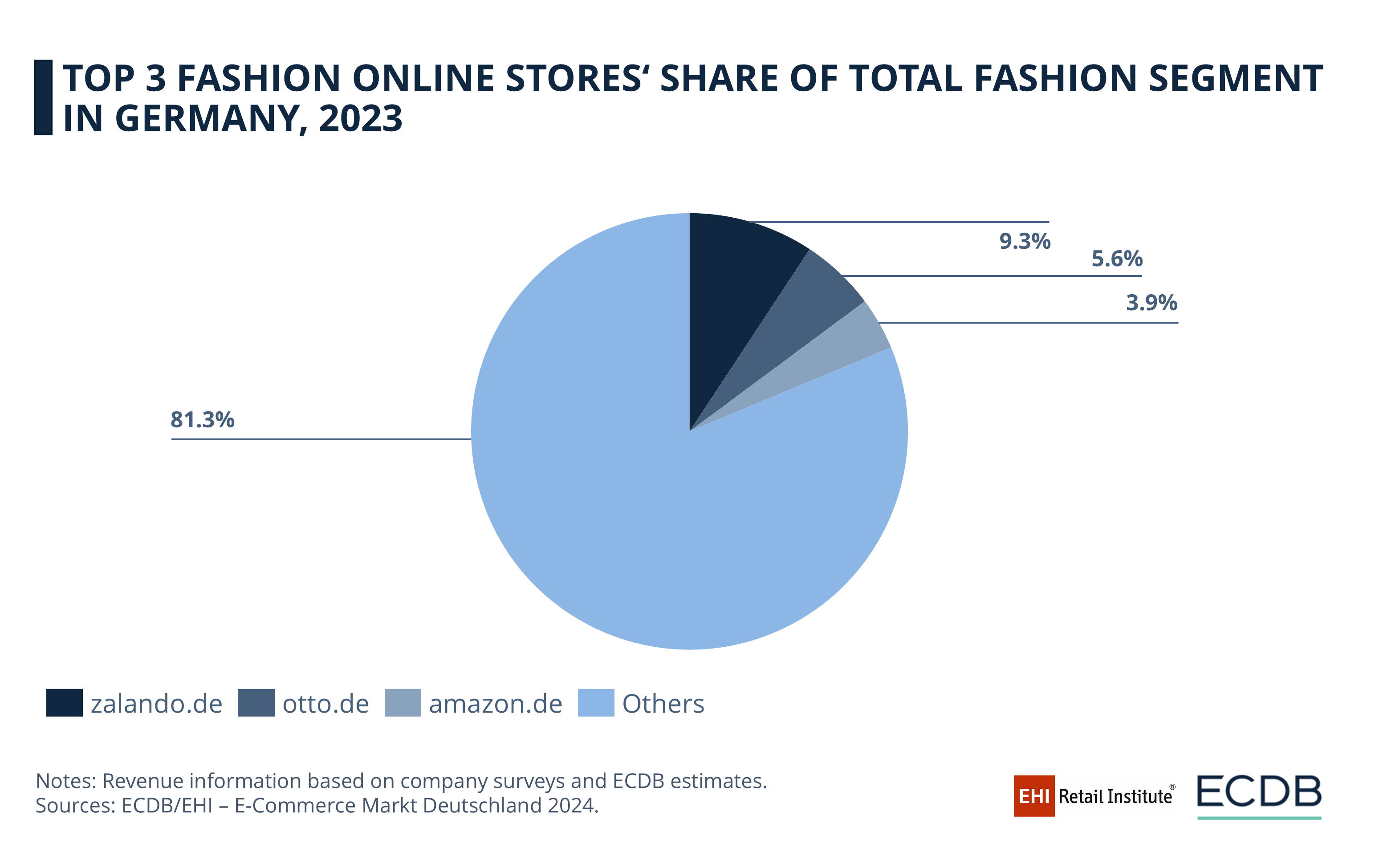

Nearly 10% of Online Fashion Sales in Germany

Come from Zalando

The largest product segment in the German eCommerce market is fashion. Unlike some other segments, the fashion market is diversified, with many players sharing the revenues.

Zalando.de leads the fashion sector, generating approximately US$2.49 billion from the total US$26.9 billion in online fashion sales.

Otto.de follows with around US$1.49 billion, and Amazon.de contributes US$1.04 billion.

The vast majority – close to US$21.9 billion – is earned by other fashion retailers.

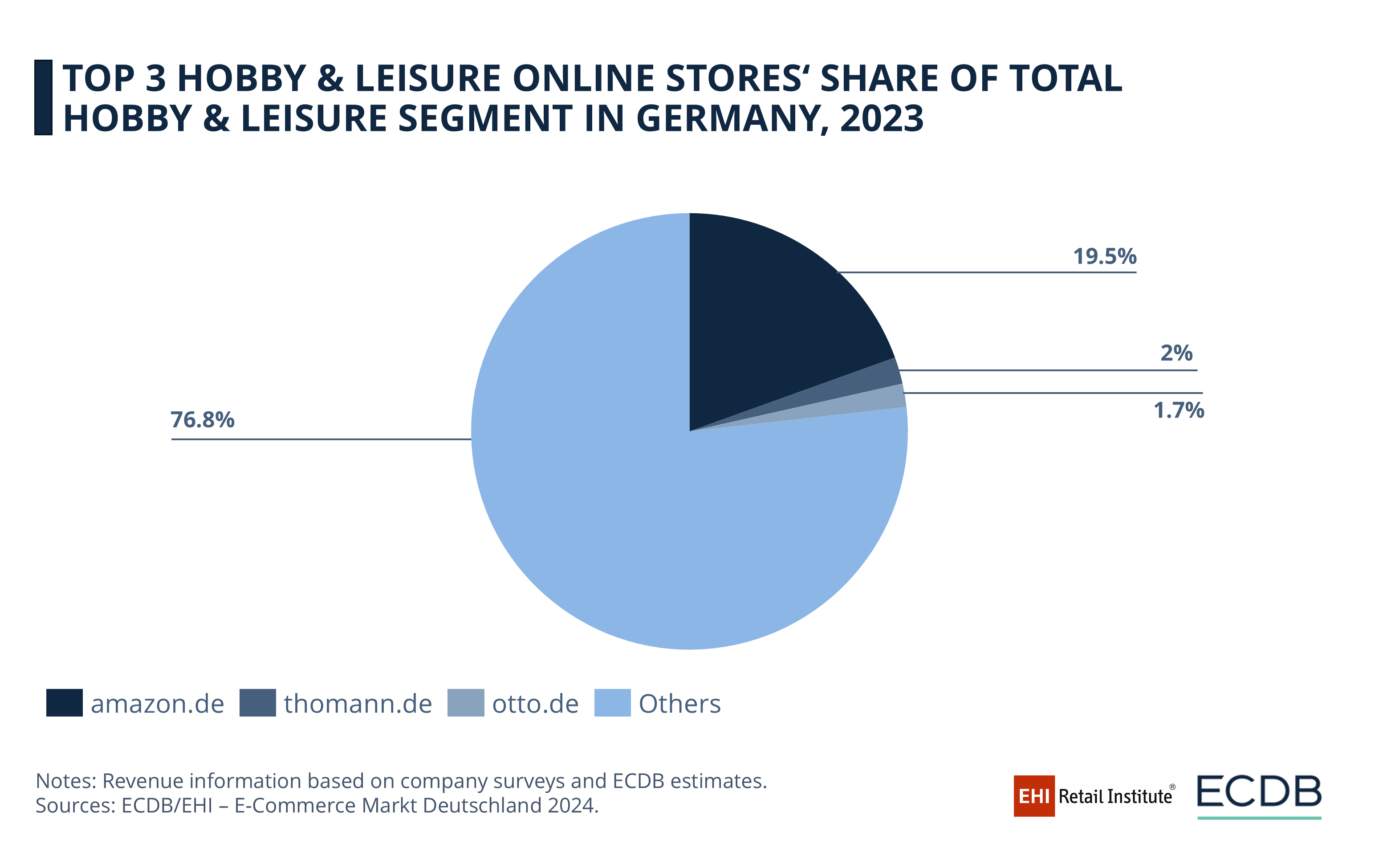

Amazon Accounts for a Fifth of the Online

Hobby & Leisure Market in Germany

The second largest segment is Hobby & Leisure. The market is largely dominated by Amazon while other players in the top 3 have minimal shares in the total market revenue.

Amazon.de dominates here, capturing US$5.1 billion of the US$26.15 billion in sales.

Thomann.de and Otto.de are much smaller players, with US$518 million and US$454 million respectively,

while roughly US$20 billion of the segment’s revenues come from other retailers.

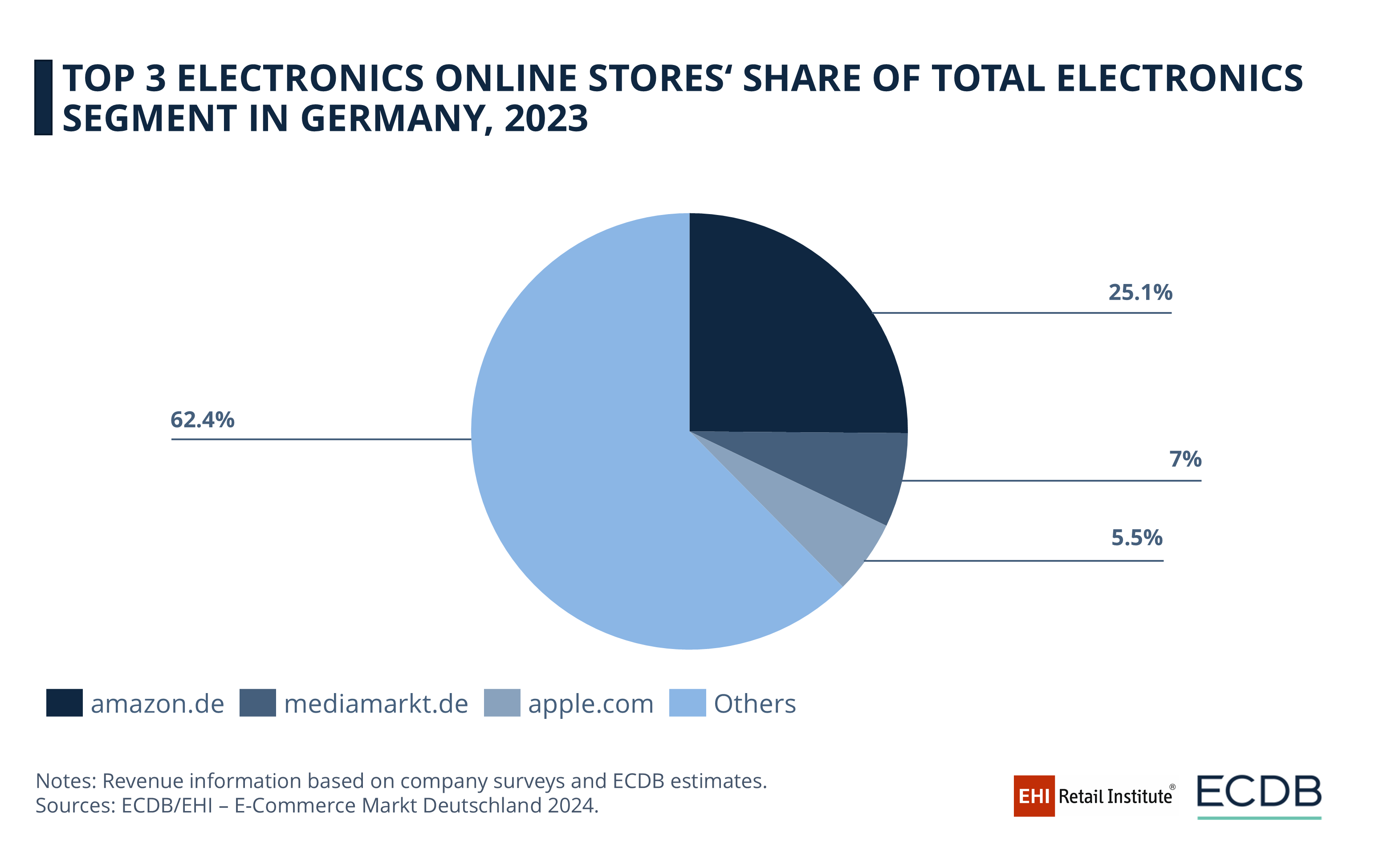

One in Four Online Electronics Sales in Germany

is Through Amazon

Electronics is the third largest segment in Germany’s eCommerce market. Amazon’s influence in this market is even more pronounced.

Amazon.de holds a commanding US$5.8 billion share of the US$23.08 billion in sales.

Mediamarkt.de follows with US$1.61 billion, and Apple.com takes US$1.27 billion.

The remaining US$14.4 billion is shared among other electronics retailers.

Study "E-Commerce Market Germany 2024" - Order Now

Are you interested in more details about the German eCommerce market, its top players, product segments, and revenue shares? Order the 2024 report here. ECDB and the EHI Retail Institute have included these and many other relevant metrics to measure the development of German eCommerce throughout 2023.

If you want to stay informed about the latest eCommerce trends and news around the world, follow us on LinkedIn.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

European Retailers Return to Physical Stores to Compete with Online Giants

European Retailers Return to Physical Stores to Compete with Online Giants

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Inflation's Impact on eCommerce

Inflation's Impact on eCommerce

Deep Dive

Older Consumers Drive Growth in the Chinese eCommerce Market

Older Consumers Drive Growth in the Chinese eCommerce Market

Deep Dive

Online Shopping in China: Where Chinese Consumers Shop Online

Online Shopping in China: Where Chinese Consumers Shop Online

Back to main topics