eCommerce: Europe

European Retailers Return to Physical Stores to Compete with Online Giants

European retailers are revitalizing physical stores to boost online sales, counter eCommerce giants, and meet growing demand for seamless, hybrid shopping experiences.

Article by Cihan Uzunoglu | October 28, 2024Download

Coming soon

Share

Omnichannel Retail in Europe: Key Insights

Retailers Expand Physical Footprint: European retailers are amplifying their presence in physical stores to boost customer engagement and online sales, in response to competition from platforms like Shein and Temu.

Elevating Key Shopping Categories: With Fashion and Electronics leading eCommerce categories, European brands are enhancing in-store experiences and expanding click-and-collect options.

Although online shopping is growing, many European retailers are returning to brick-and-mortar stores. This is in response to consumer demand for in-person experiences while bolstering online sales.

In essence, this shift aims to counter rising competition from eCommerce giants like Shein and Temu. Another motivation here is to meet the public’s rekindled interest in physical shopping since the pandemic.

Physical Stores Drive Online Sales

Retailers across Europe are finding that physical stores have a tangible impact on local online sales. According to industry data, stores boost online sales within a 20-minute drive by 10% to 20%, encouraging multi-channel shopping. What does this actually mean? Consumers may browse online but often visit a store to complete transactions or try products before purchase. This trend is so strong that store closures frequently lead to reduced online sales, proving the synergy between physical and digital channels.

Retailers like Decathlon and Inditex are capitalizing on this trend by expanding their presence. Decathlon, for example, has added roughly 80 stores globally this year, enhancing customer experience with sports hubs for repairs, rentals, and interactive sports spaces. Inditex’s Zara has innovated with group fitting rooms featuring touch screens, merging convenience and a social element into the shopping process.

Meeting Consumer Demand: A Hybrid Approach to Popular Categories

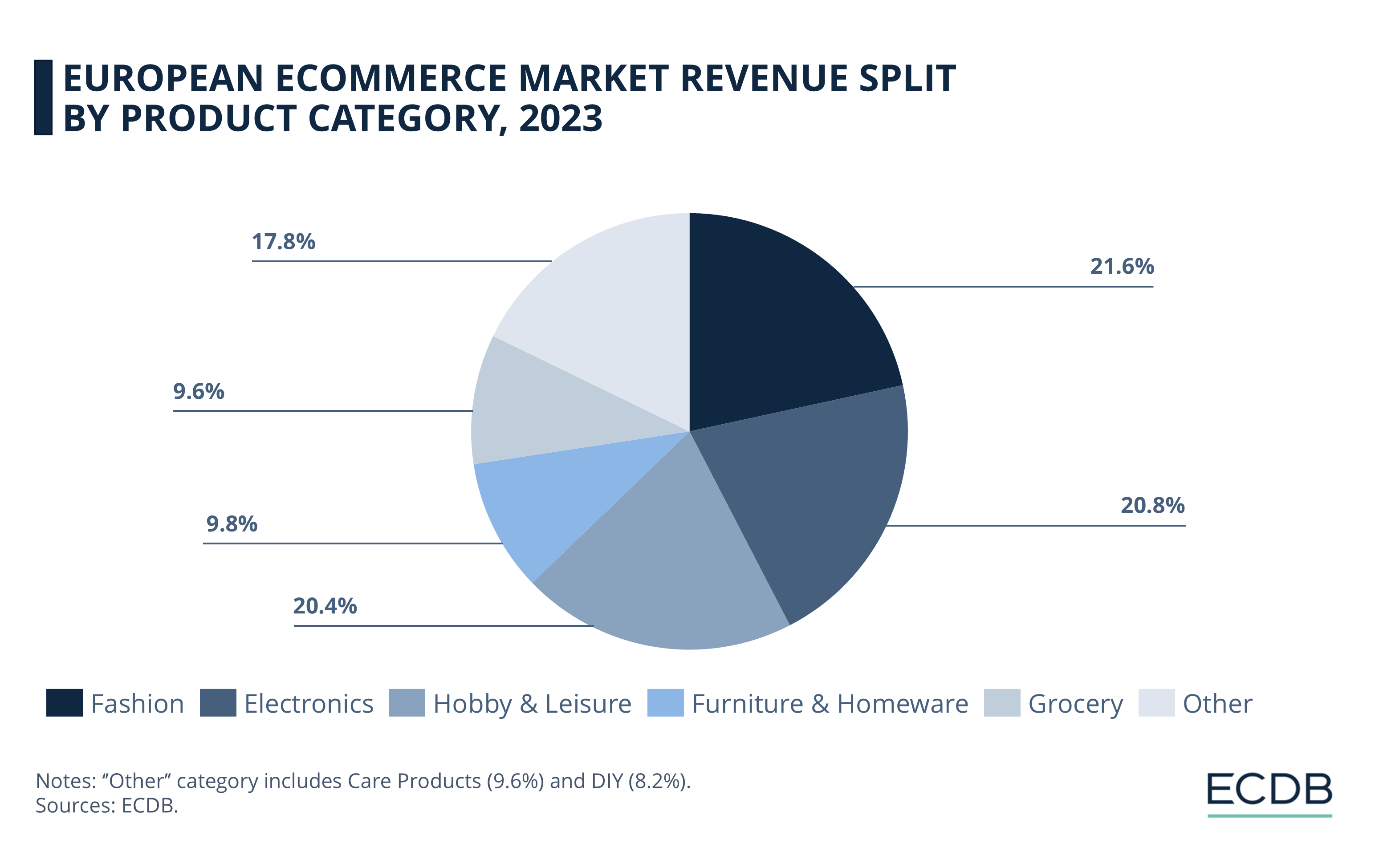

Fashion is a big part of the European eCommerce market. But how big is it, or does it actually outstrip categories like electronics or groceries? ECDB data shows that:

Fashion is the top revenue driver for European eCommerce in 2023, holding close to a quarter (21.6%) of the market.

Electronics and Hobby & Leisure are close behind, each around 20%.

Furniture & Homeware (9.8%), Grocery, Care Products (both at 9.6%), and DIY (8.2%) round out the list.

Retailers in Europe are enhancing in-store experiences, especially for Fashion and Electronics, blending the benefits of digital and physical shopping. In other product areas, like Furniture, Food, and Beverages, with market shares between 4.4% and 7.3%, expanded click-and-collect options offer immediacy for items traditionally bought in-store, now increasingly shifting online.

Dominant Players & Rising Challenges

The European eCommerce space itself is dominated by a few major players. Other than the dominance of players like Amazon, Apple and Shein, European retailers are also strong, with firms like Sainsbury’s, Tesco, and IKEA holding a significant market share.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

The rise of low-cost platforms like Temu, however, has intensified the competition, particularly among price-sensitive consumers in Germany and Denmark. Local businesses argue that less stringent regulations for Chinese platforms challenge European companies, pushing them to innovate further.

In response, European brands are doubling down on physical stores and hybrid shopping experiences. Amazon’s influence remains formidable; its GMV in Europe was 60% higher than the combined sales of the top online marketplaces in 2023.

Enhanced In-Store Experience

to Attract Shoppers

To draw customers back into stores, many retailers in Europe are also incorporating more experiential elements. Decathlon’s table tennis tables, set up in Rome, invite mall-goers to engage in sports, creating an interactive experience. Similarly, Inditex's high-tech fitting rooms and Zalando’s expanding network of stores in Germany are designed to provide a seamless mix of online and in-store shopping.

As European consumers rediscover the leisure and immediacy of shopping in person, retailers are enhancing their store offerings to satisfy this demand, integrating physical locations to complement and strengthen their online sales.

Sources: Reuters, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Inflation's Impact on eCommerce

Inflation's Impact on eCommerce

Deep Dive

Older Consumers Drive Growth in the Chinese eCommerce Market

Older Consumers Drive Growth in the Chinese eCommerce Market

Deep Dive

Online Shopping in China: Where Chinese Consumers Shop Online

Online Shopping in China: Where Chinese Consumers Shop Online

Deep Dive

Top Online Payment Methods in the United Kingdom: Cards & eWallets

Top Online Payment Methods in the United Kingdom: Cards & eWallets

Back to main topics