CROSS-BORDER ECOMMERCE

German Cross-Border eCommerce: Marketplaces, Online Stores, Top Markets & Product Categories

Cross-border eCommerce is accelerating globally. When it comes to Germany, our data reveals interesting trends, such as the dominance of online stores over marketplaces, and a largely regional focus. Read on for an in-depth analysis of Germany’s cross-border eCommerce.

Article by Nashra Fatima | October 02, 2024Download

Coming soon

Share

Cross-Border eCommerce in Germany: Key Insights

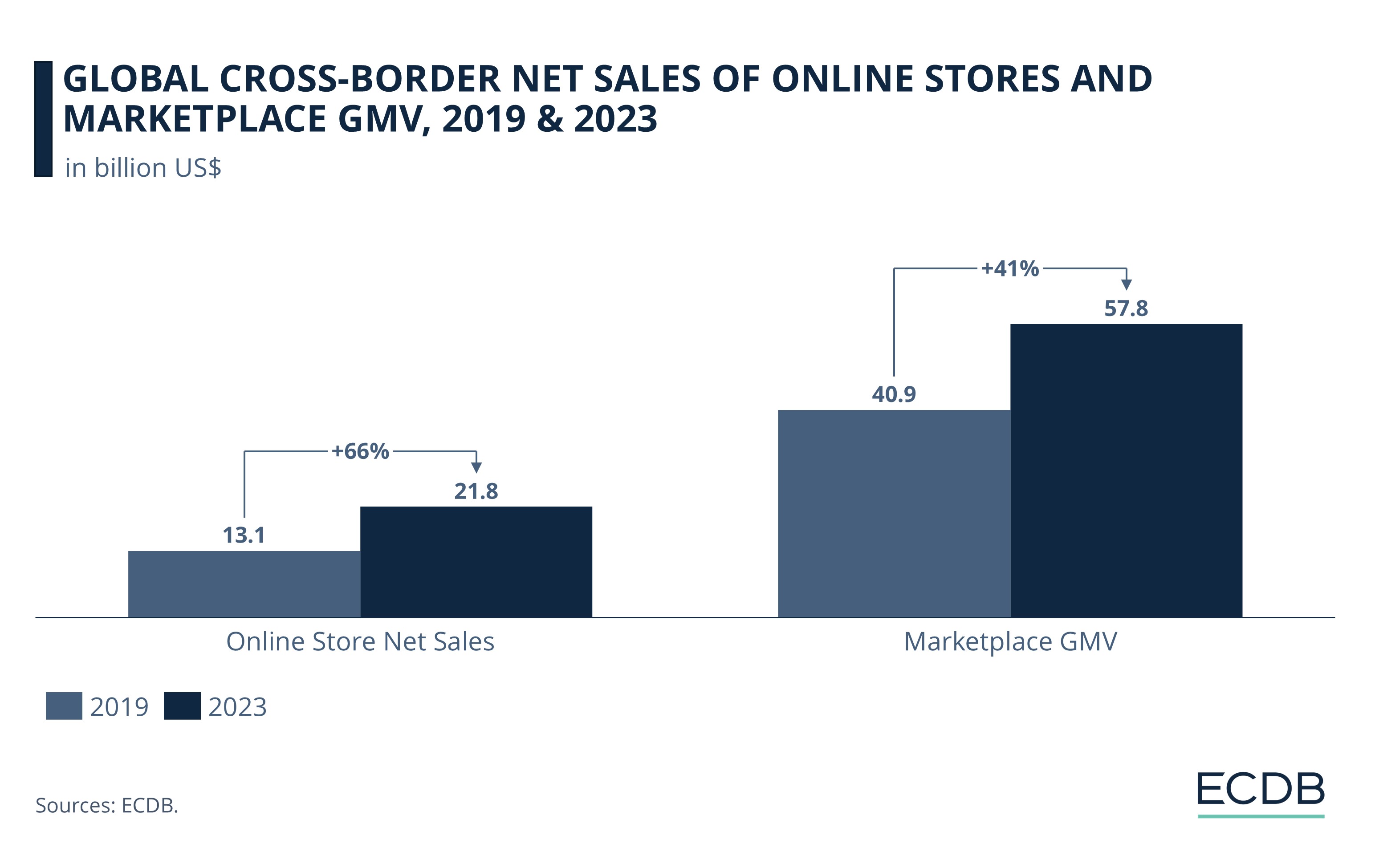

Global cross-border eCommerce: Marketplaces dominate in global cross-border eCommerce, generating a GMV of US$57.8 billion in 2023. Online store net sales are comparatively low, but have seen higher growth than marketplaces.

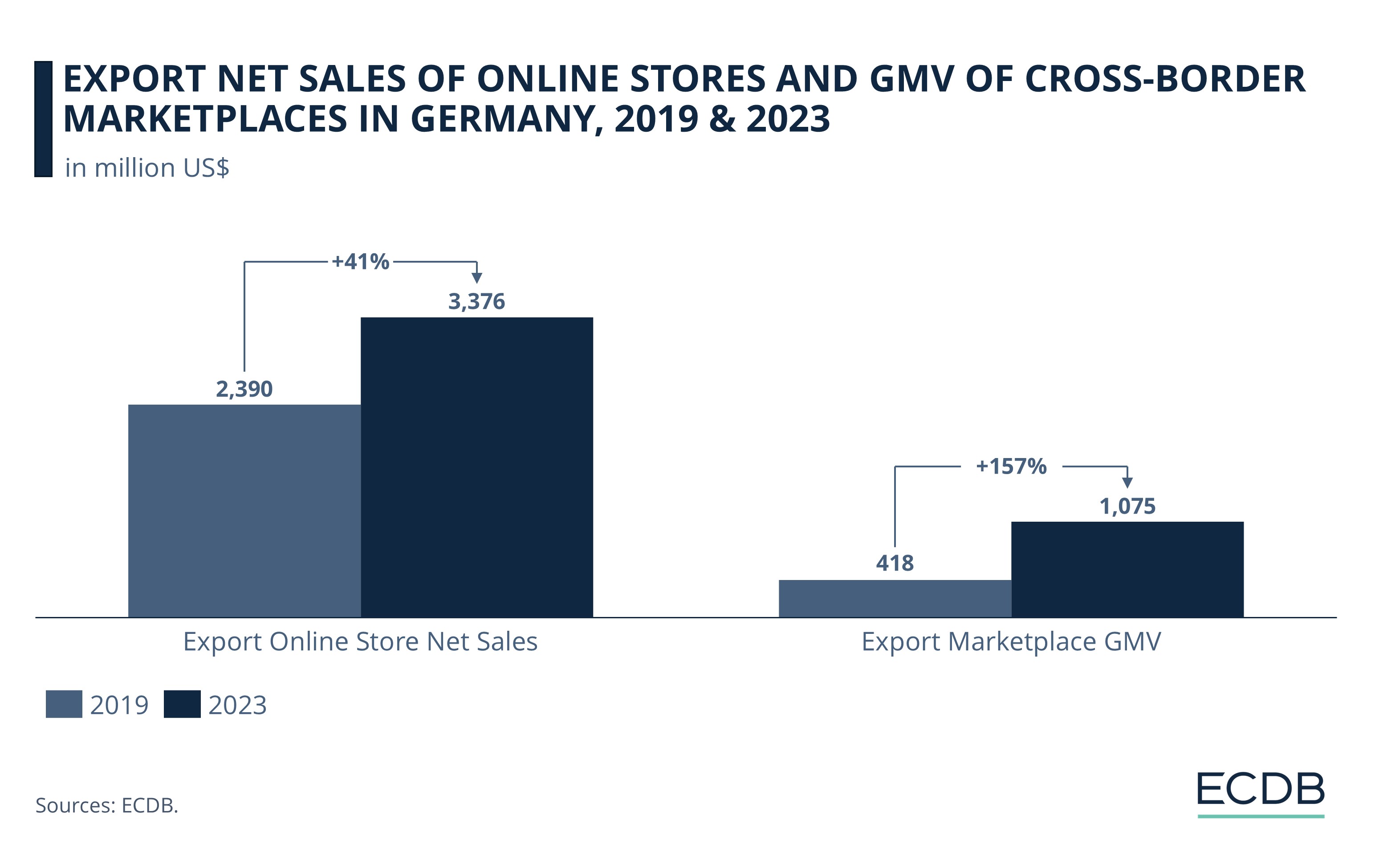

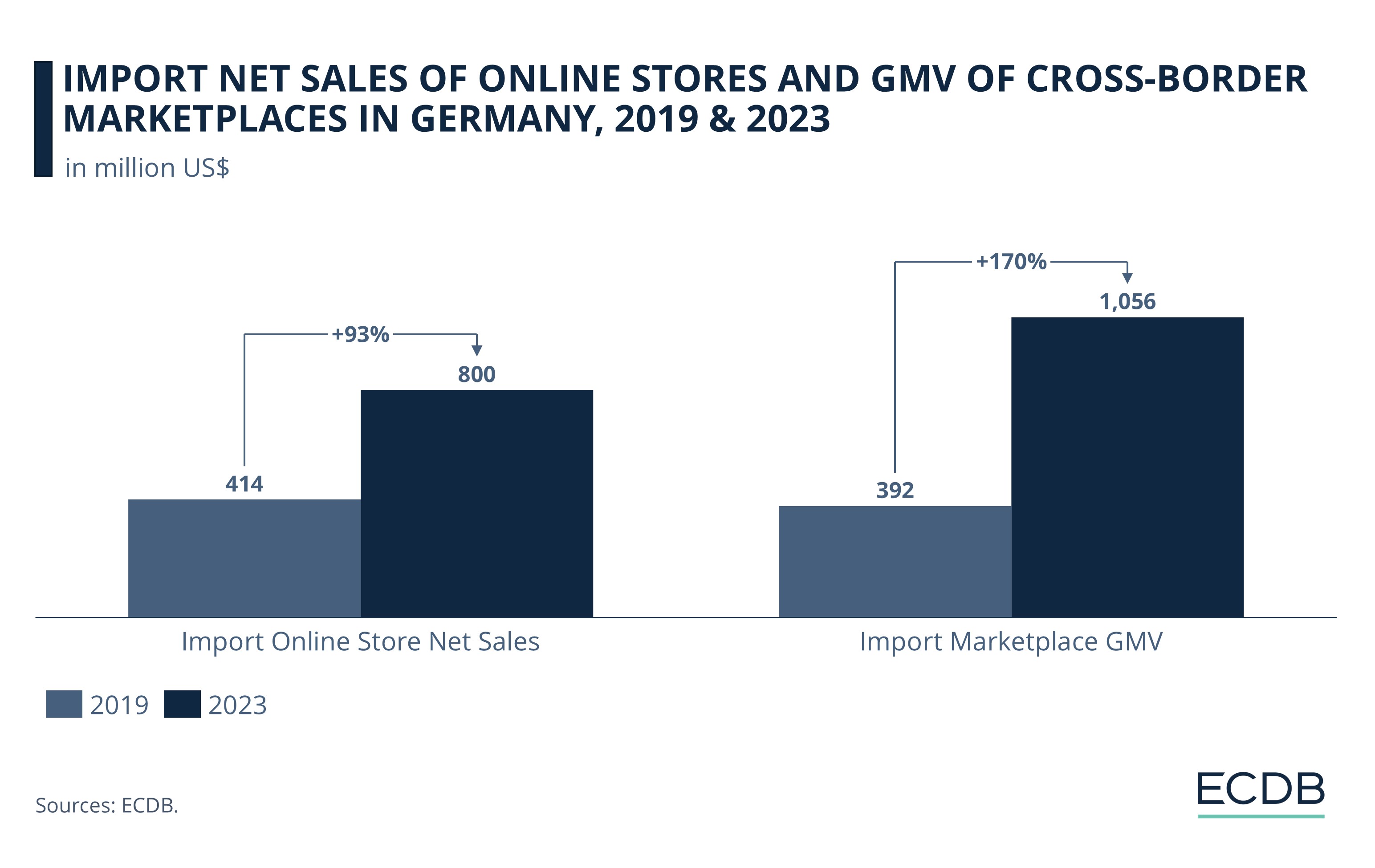

German cross-border eCommerce: In Germany’s cross-border market, online stores lead marketplaces in exports. The dynamics are inverse in imports, with marketplace import GMV higher than store net sales.

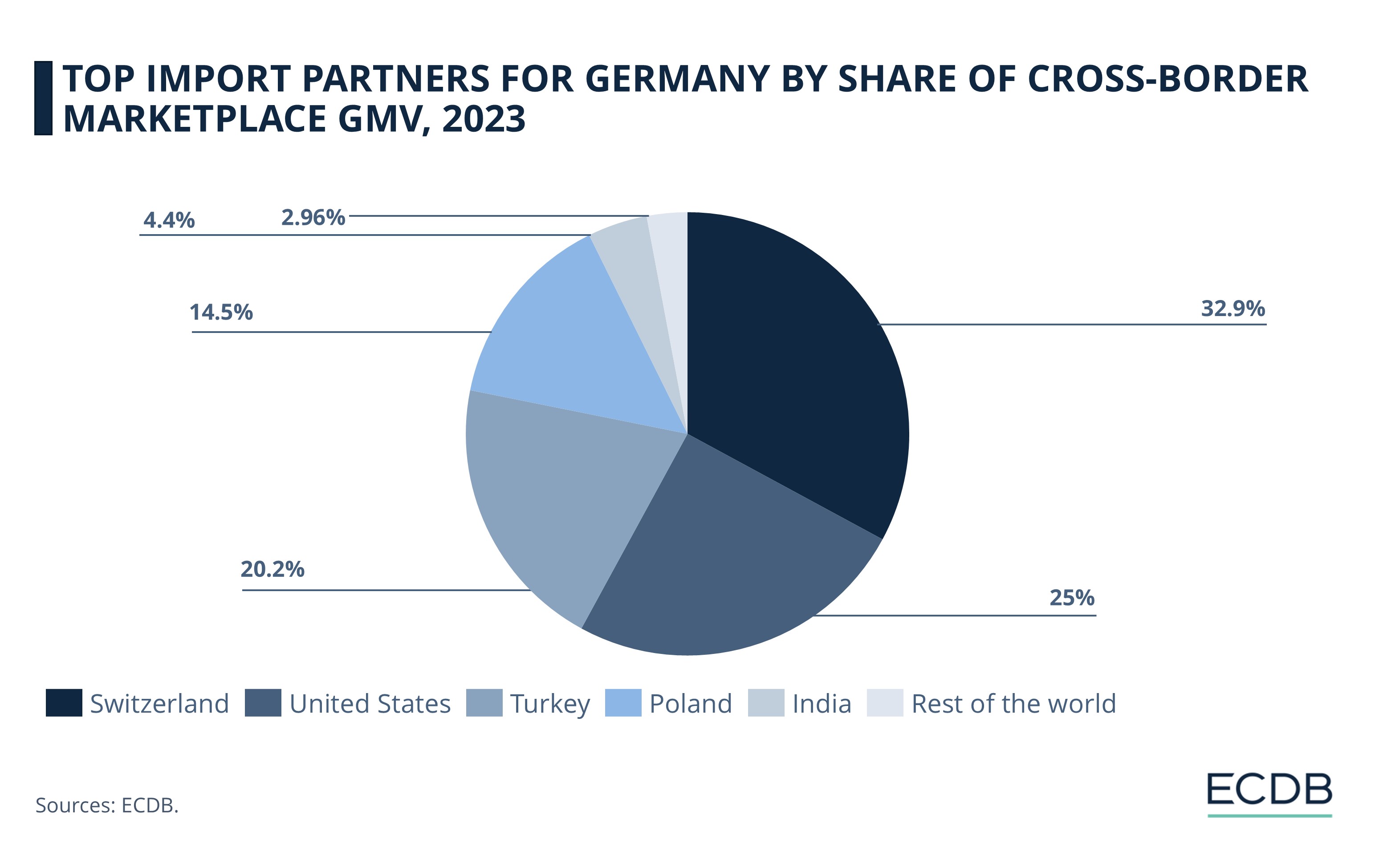

Top trading markets: Germany’s top eCommerce export partners are all European. Its import partners are more diverse and include Switzerland, the U.S., Turkey, and India.

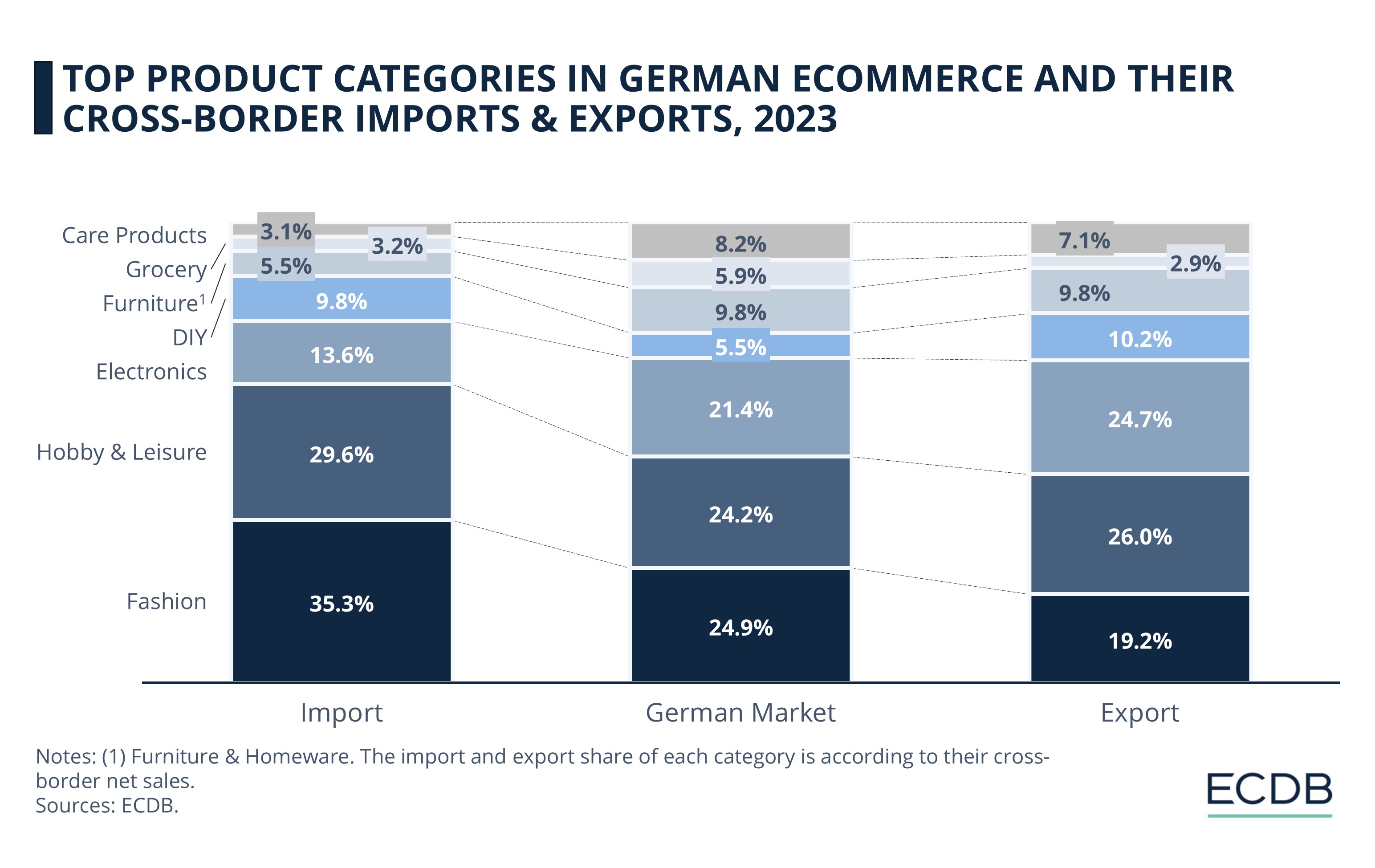

Top product categories: Fashion is by far the top imported product category in German eCommerce. In exports, hobby & leisure lead, followed by electronics.

When we talk about eCommerce, marketplaces dominate the conversation. Seen as the driving force behind cross-border trade, third-party platforms like Amazon and eBay have reshaped how online consumers shop. In the process, they have made marketplaces synonymous with cross-border shopping.

But as with any global trend, local dynamics can tell a different story.

In Germany, the world’s sixth largest eCommerce market, our ECDB data reveals a distinct pattern: while marketplaces lead in imports, the country’s online stores fuel its exports.

In preparation for the Marketplace Convention 2024, we spotlight the state of German cross-border eCommerce in this article. We assess global cross-border eCommerce before asking: How have German marketplaces and online stores performed across borders? Which countries are Germany’s top trading partners? And which product categories are popular in cross-border retail?

Cross-Border eCommerce - Definition

Cross-border eCommerce refers to online sale of goods from one country to customers in another country.

Cross-border imports are the purchase of goods from online platforms that only operate in other markets and do not have a presence in the country of purchase. In turn, cross-border exports describe the sale of goods by a domestic seller to customers in a foreign market without the official presence of the selling platform.

Per our definition of cross-border eCommerce, we only include sales by platforms that do not have a significant presence in the respective market. For this reason, sales of Chinese platforms like Temu do not fall under cross-border activity, as these retailers operate an official platform in most markets.

German sales of amazon.de do not fall under cross-border since this is Amazon’s official store in the country, while sales of amazon.co.uk, the British domain, in Germany are included. A retailer’s corporate strategy and the regional focus of a platform is also considered in defining cross-border eCommerce.

Global Cross-Border eCommerce: Marketplaces Outperform Online Stores

Our data shows that in global cross-border eCommerce, marketplaces are bigger than online stores. This has been the case since 2019, though post-pandemic, online stores saw higher growth rates.

Cross-border net sales of an eCommerce store refer to revenues generated outside of their country of origin, while cross-border marketplace GMV (gross merchandise volume) refers to the total value of merchandise sold by marketplaces outside of their main country.

Let’s look at how cross-border eCommerce net sales of online stores compare to the marketplace GMV.

In global cross-border eCommerce, marketplaces dominate. Compare their 2023 GMV of US$57.8 billion to online store net sales of US$21.8 billion. The difference is stark.

But drilling down into the year-over-year development of each, we see that online stores are on an upward trajectory since 2019, while marketplace growth slowed after the pandemic period boom. Between 2019 and 2023, cross-border marketplace GMV grew by 41% while online store net sales increased faster globally, at 66%.

Consumers had flocked to marketplaces during the pandemic, attracted to their diverse offerings and convenience. With time, their preferences evolved. By 2022, many felt familiar with online shopping. Branded online stores that had worked on building relationships with customers stepped in to fulfil the demand for niche products. Moreover, eCommerce sales stagnated overall this year, as in-store shopping resumed. On their end, marketplaces also dealt with saturation and competition.

Our projections put global cross-border online store net sales at US$23 billion in 2024. Marketplace GMV is also expected to surpass its previous cap and hit US$60.7 billion this year. Interestingly, in Germany, the trend is different.

German Cross-Border eCommerce: Stores Exported More, But Marketplaces Grew Faster

Our ECDB data shows that in cross-border eCommerce exports, German online stores outperform marketplaces.

In 2019, online stores export net sales of US$2.4 billion were significantly higher than marketplace export GMV of just US$418 million. By 2023, export marketplace GMV hit US$1.1 billion. Though still lower than online store net sales, their growth rate was much higher at 157%.

In imports, marketplaces take the lead – meaning that compared to foreign online stores, international marketplaces generated a higher GMV in Germany. This was not the case in 2019, when foreign online stores were bigger than marketplaces.

In 2019, import net sales from foreign online stores were US$414 million—a fraction of export sales in the same year, but higher than the marketplace imports GMV. By 2023, international marketplaces made greater gains in Germany, with their import GMV crossing US$1 billion as well as surpassing import sales of online stores.

German online stores lead in exports, thanks to their strong customer relationships and brand reputations in neighboring countries. But in imports, marketplace GMV increased faster as German online consumers became more open to shopping outside of their home market. Marketplaces offer competitive pricing and have strong logistical infrastructure. Such factors help them win over German consumers.

The marketplace growth in Germany is catching up with the global trend of marketplace domination and emphasizes their central role in cross-border eCommerce.

So, which German marketplaces and online stores are top exporters and importers?

German Marketplace: Otto Tops Exports, Galaxus Leads in Imports

As we established earlier, marketplaces dominate in terms of imports. Data further shows that the difference between the top exporting and importing marketplaces is not very sizeable.

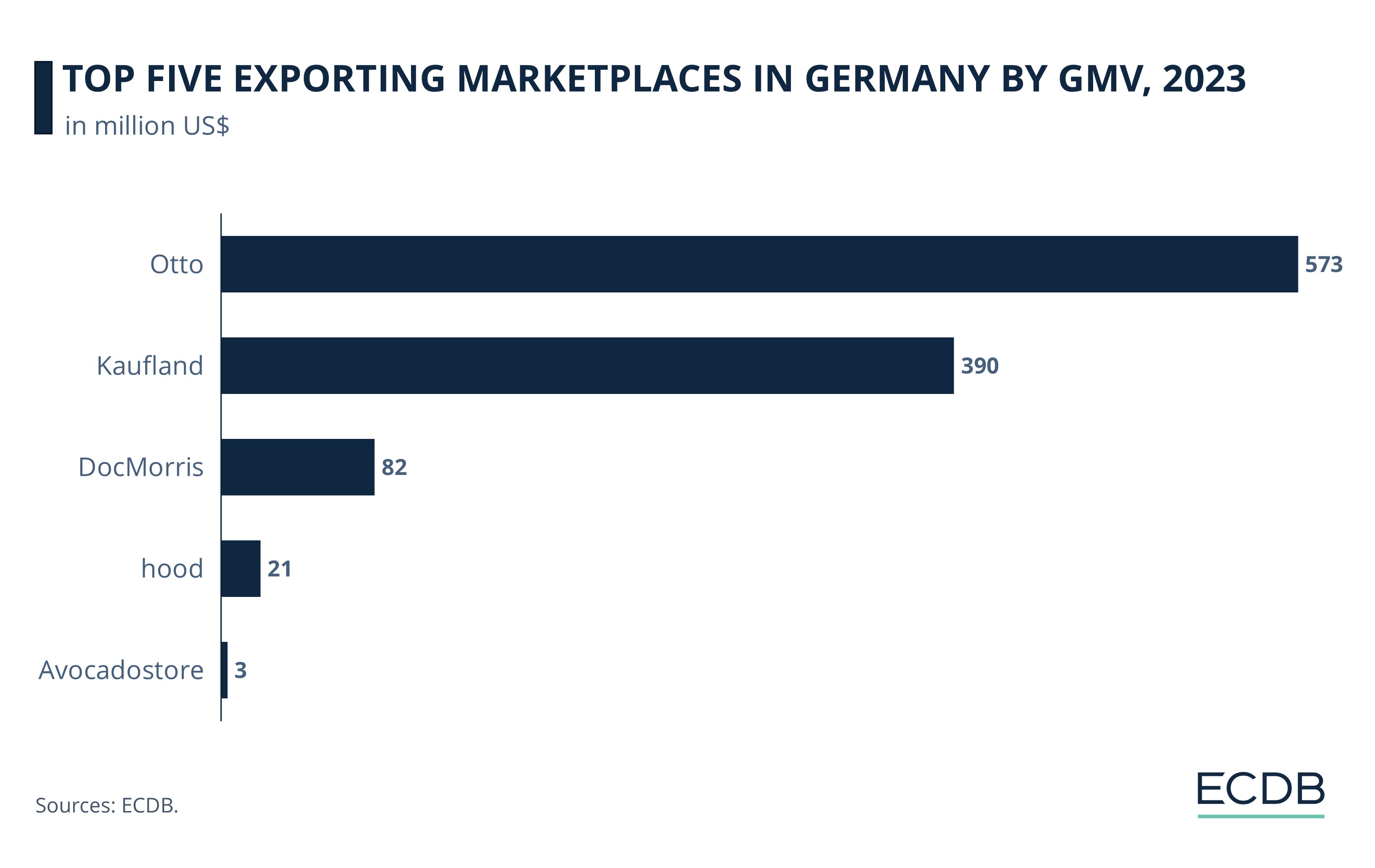

Top Five Exporting Marketplaces in Germany

Here are the top five exporting marketplace in German cross-border eCommerce in 2023:

Otto generated cross-border export GMV of US$573 million in 2023, taking the first spot. Though high up in this ranking, this marketplace’s export GMV is nearly one third the export net sales of the top-ranking online store Amazon.de (US$1.6 billion). It mainly sells fashion, followed by electronics. Its only cross-border partners are Austria and Netherlands, which contributed 4% and 3.8% to its total GMV respectively in 2023.

Kaufland ranks second in exports, with a cross-border GMV of US$390 million. It sells products in several categories including furniture & homeware, DIY, and hobby & leisure, and generates more of its GMV outside of Germany than Otto. Its main destination markets are Czechia (12.2%) and Slovakia (7.8%).

DocMorris is third in cross-border exports. With a GMV of $82 million, it lags behind the top competitors. It mainly exports to France, where it generated 8.6% of its total GMV in 2023. Hood and Avocadostore rank next. Austria and Switzerland are the top two export partners for both these marketplaces.

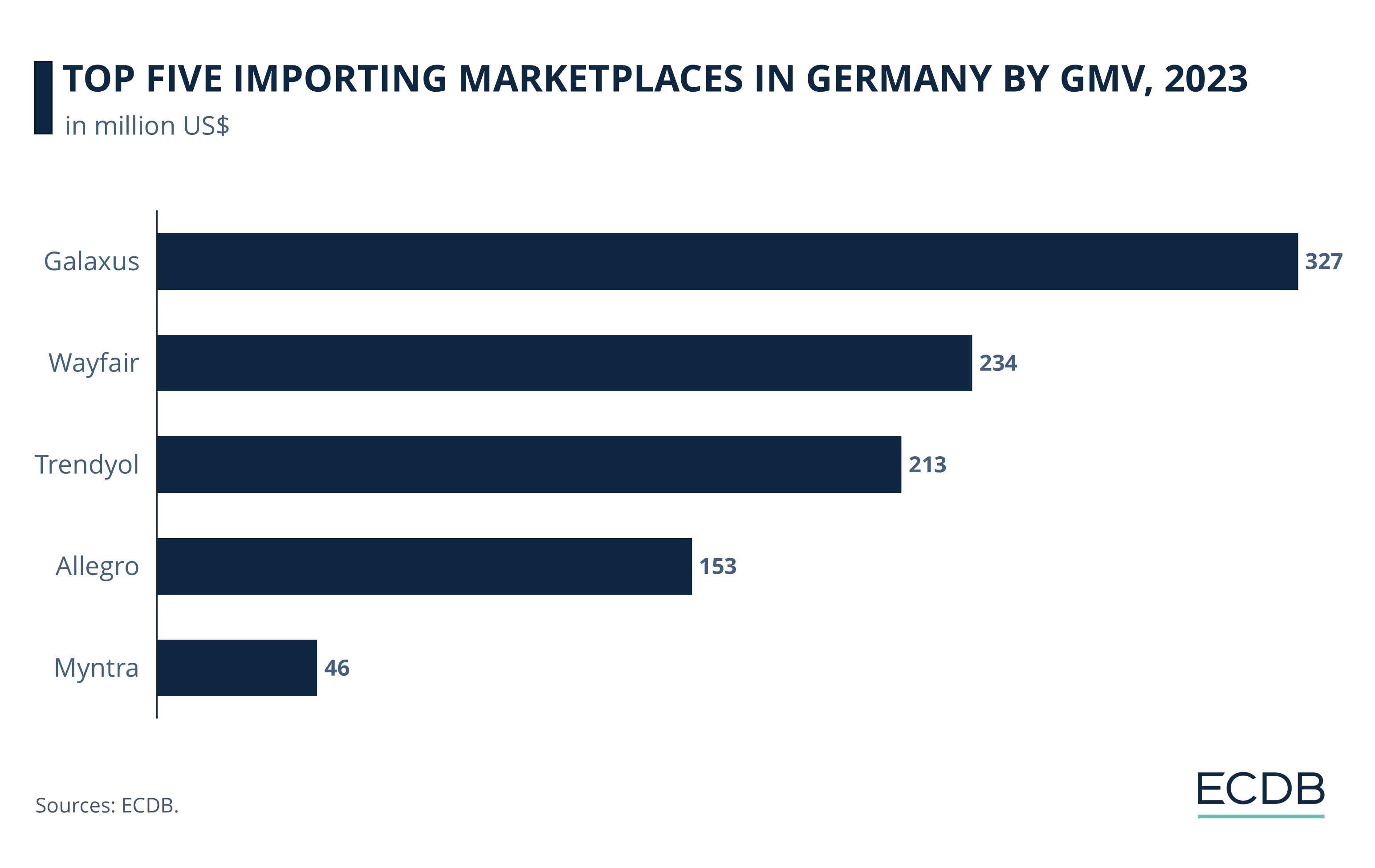

Top Five Importing Marketplaces in Germany

In 2023, the top five importing marketplaces in Germany were:

Galaxus, the top importing marketplace, generated an import GMV of US$327 million in Germany. This is more than double the import net sales of the top online store Amazon.com (US$118 million). Galaxus is a multinational marketplace which operates mainly in Switzerland. Germany is its second-largest market, where it generated nearly 20% of its total GMV in 2023.

Wayfair stands second with an import GMV of US$234 million. This is a furniture & homeware focused marketplace with the U.S. as its main market. Germany only accounted for 2% of its total GMV in 2023, making it a small market for Wayfair.

Trendyol is third largest, with an import GMV of US$213 million. This is a Turkish marketplace owned by Alibaba. It also operates the online store Trendyol.com which features among the top importing stores in Germany. But notably, the import GMV of this marketplace is much higher than the import net sale of its online store (US$96 million).

The Polish marketplace Allegro is fourth with import GMV of US$153 million, followed by the Indian Myntra with US$46 million.

Several reasons drive Germany’s higher marketplace import GMV. Marketplaces have broader product offerings but more importantly, they can be better equipped than individual stores to navigate German import regulations, VAT, and customer protection laws. This ensures transparency in duties and prevents unexpected costs upon delivery.

Online stores are less familiar to people unless operated by well-known brands. In comparison, awareness of marketplaces tends to be high, allowing shoppers to feel more comfortable sharing sensitive information like their payment details. Marketplaces may also offer a more localized experience – for example, language support and local payment options like Klarna and SEPA. Such factors likely encourage German consumers to shop abroad through a marketplace more so than at online stores.

German Online Stores: Amazon Leads Both Exports and Imports

According to our ECDB data, Amazon’s online stores are prominent in Germany’s cross-border eCommerce landscape, appearing on our top five list for both, top importing and exporting online stores.

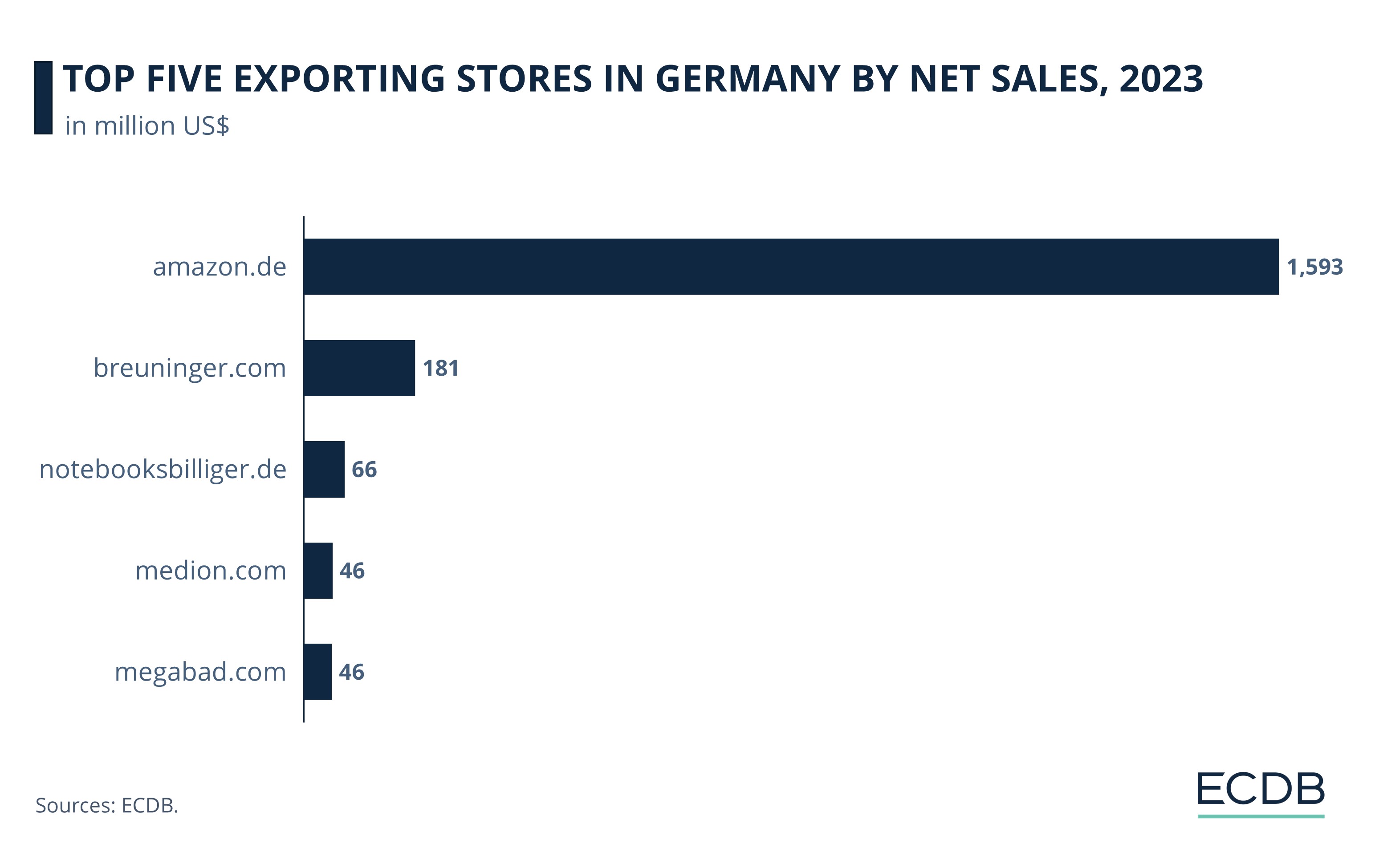

Top Five Exporting Online Stores in Germany

Here are the top exporting stores in German cross-border eCommerce in 2023:

Amazon.de had cross-border net sales of around US$1.6 billion—nearly half of all export net sales made by German online stores in 2023. As Amazon.com Inc’s fourth largest store worldwide, it dominates the German eCommerce export landscape. Its top cross-border partner is Austria, which contributed 5.2% to its net sales in 2023. Switzerland, where Amazon has struggled to find a foothold, is next with 1.8%.

Breuninger.com is second, with much smaller export net sales of US$181 million. It largely sells fashion products, and its top cross-border shares come from Switzerland (6.9%), Poland (4.8%), and Austria (4.3%).

Notebooksbilliger.de is third, followed by Medion.com and Megabad.com.

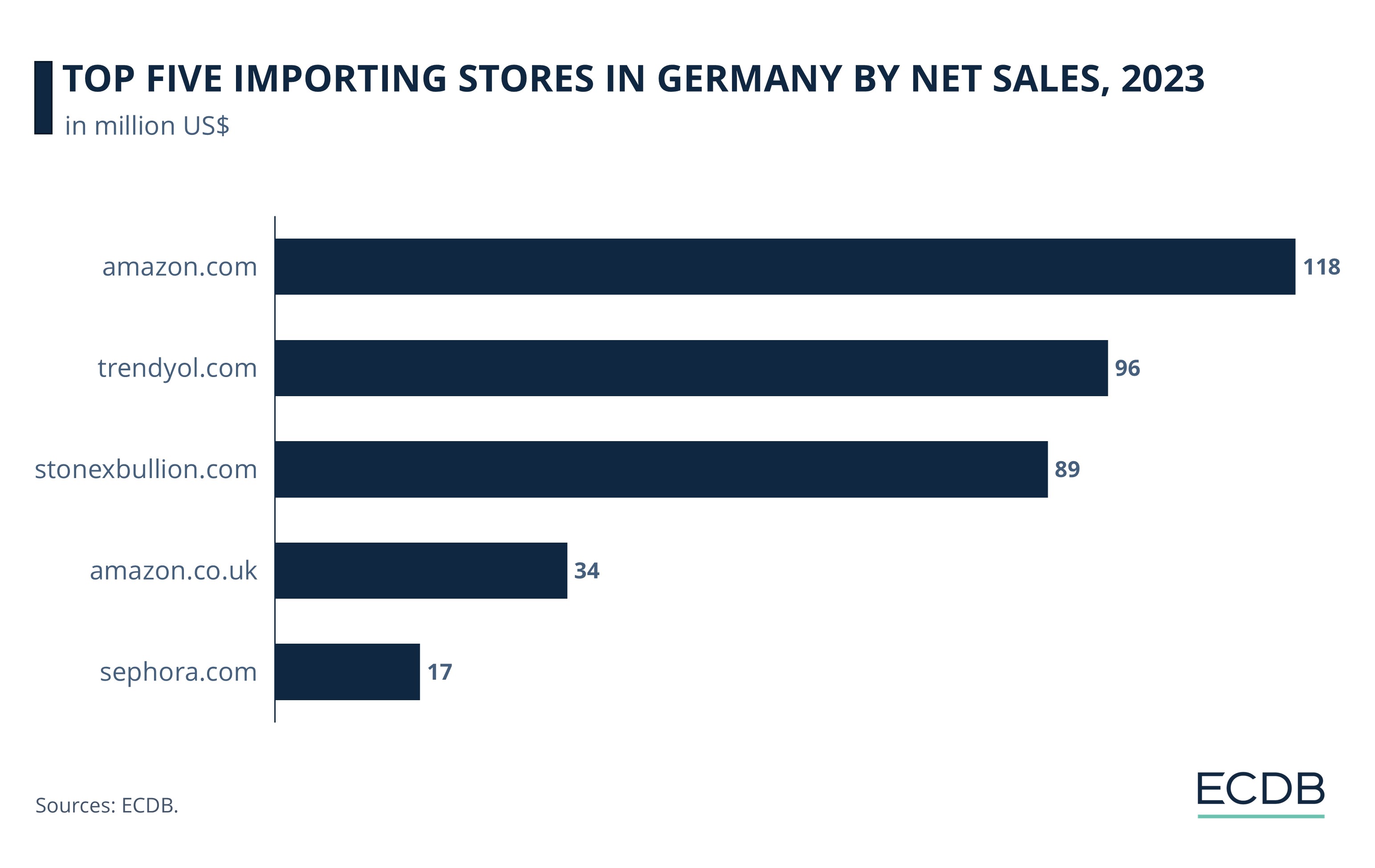

Top Five Importing Online Stores in Germany

Although several stores on our list have their country-specific domain, German consumers may turn to international stores if they find more product offerings or better pricing.

Here are the top five importing stores in Germany, as of 2023:

Amazon.com generated net sales of US$118 million in Germany, making it the top foreign domain. But Germany is a very small market for Amazon.com, making up only 0.1% of its net sales in 2023.

Comparison against the top exporting store puts things into perspective: the cross-border export sales of Amazon.de were over ten times higher than the import net sales of Amazon.com. The Germany-specific store meets local demands, thus reducing the need for domestic consumers to buy from the international domain.

The Turkish Trendyol.com ranks second with import net sales of US$96 million. Germany, where it generated 2.3% of its total GMV last year, is its biggest market outside of its home turf. Operating mostly in Fashion, this online store opened an office in Berlin in 2021, from where it is angling to enter other European markets.

Stonexbullion.com is third, followed by Amazon.co.uk and Sephora.com.

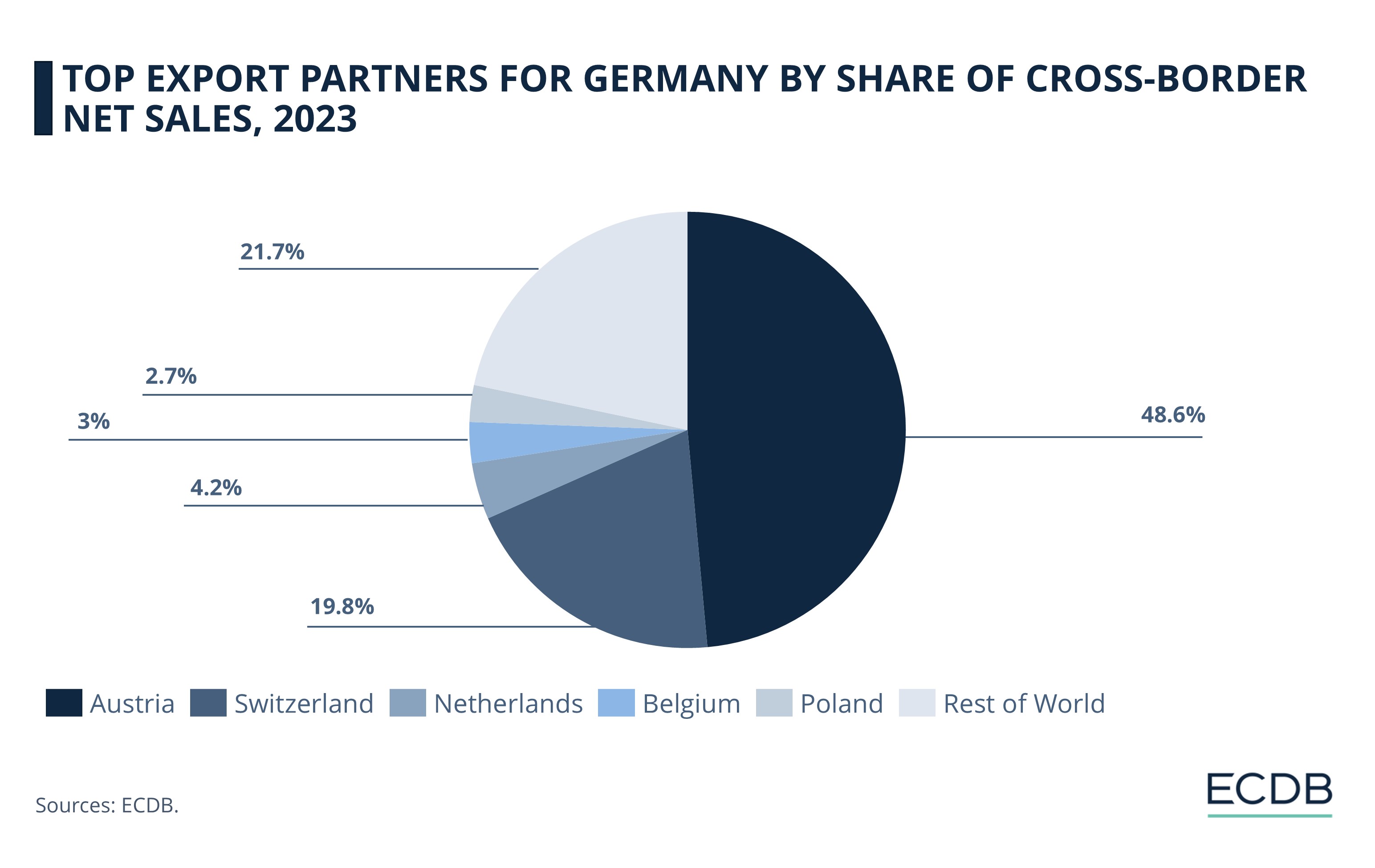

Germany’s Top Cross-Border Markets: Austria for Exports, Switzerland for Imports

As we saw, online stores are at the forefront of Germany’s eCommerce exports. Our ECDB data further shows that the top cross-border export markets by net sales in 2023 were all European.

The neighboring Austria takes the largest piece of the eCommerce export pie. It makes up nearly half of all German cross-border eCommerce net sales, at 48.6%. Switzerland is second but by a wide margin, accounting for 19.8% of all export net sales.

Netherlands is third with 4.2%, followed by Belgium (3%) and Poland (2.7%). The remaining group also purely consists of European countries such as Italy, France, and Spain.

A 2023 survey by Avalara identified the main barriers to cross-border shopping for consumers: custom delays and regulatory compliance, supply chain costs, and added tariffs. But for European consumers of German online stores, these barriers are significantly lowered.

The EU's Single Market facilitates cross-border eCommerce across Europe by making trade tariff-free and simplifying VAT compliance. This streamlines exports for German eCommerce stores. Geographical proximity and linguistic similarity are also important factors, particularly for Austria and Switzerland where the largest share of Germany’s cross-border exports land.

In comparison, for imports, Germany is open to marketplaces outside of the European region:

Switzerland is the top country for imports in Germany by marketplace GMV, at 32.9%. As explored earlier, the top importing marketplace is Galaxus which operates mainly in Switzerland.

The United States is second, accounting for 25% of all eCommerce import GMV. Turkey is also attractive for German consumers, with its marketplaces taking 20.2% share of the total import GMV.

Next up are Poland (14.5%) and India (4.4%), with relatively smaller shares. Under 3% of eCommerce import GMV comes from other parts of the world, including France, Japan, and Sweden.

German online consumers cite lower prices and the unavailability of a product or brand in their country as their top reasons for shopping cross-border. As Europe’s second-largest eCommerce market, next only to the UK, Germany is well-integrated into global supply chains. Imports from marketplaces outside of Europe can be fast and price-competitive, while meeting niche demands.

For example, the U.S. offers branded smartphones and popular fashion brands on third-party platforms like Amazon. Turkey and India are more affordable sources for apparel and other consumer goods. A case in point is the Turkish marketplace Trendyol, which is Germany’s second biggest importing marketplace.

This brings us to the next question: which products top the list of cross-border exports and imports in Germany?

Top Cross-Border Products: Fashion Most Imported, Electronics Most Exported

The top categories in German eCommerce market are fashion, hobby & leisure, and electronics. Our data shows different dynamics for each product category in German cross-border eCommerce.

For fashion, the share of imports (35.3%) is significantly higher than its market share within Germany (24.9%), suggesting a strong reliance on cross-border imports. Affordability, easy shipment, and the appeal of global fashion brands drive its higher imports.

The integration of AI and AR in eCommerce platforms, with features like virtual try-outs, also minimizes hassles in fashion shopping. In comparison, fashion’s export share is smaller at 19.2%, likely as German fashion stores face stronger competition from international counterparts in key export markets.

For hobby & leisure, both the import (29.6%) and export (26%) shares exceed their home market share (24.2%). Media, sports equipment, and smoking supplies are among the top sub-categories within hobby & leisure and may be easily sourced from overseas stores.

Despite electronics accounting for a significant portion of the German market (21.4%), its imports are lower (13.6%), while exports (24.7%) are notably high. Exports take place to neighboring countries, where electronics may not be easily available or as affordable. It helps that the European Union member states share a common regulatory framework – for instance, the CE certification for electronics to ensure products meet with the EU's safety, health, and environmental protection standards.

For furniture & homeware, import (5.5%) shares are lower than the domestic market share (9.8%), suggesting strong local consumption. It is also not a very shippable category – higher logistical complexity and costs of shipping keep its exports (9.8%) lower than other categories.

Care products have a significantly lower import share (3.1%), and a moderate export share (7.1%) compared to the home market (8.2%). Grocery, especially perishable items, is also a more localized product category. While niche products may be traded via specialized online stores, its cross-border movement remains complex and less profitable. So, both its import (3.2%) and export (2.9%) shares are lower than the domestic market (5.9%).

For DIY products, imports (9.8%) and exports (10.2%) exceed the domestic market share (5.5%). German consumers may turn to international online stores for specialized equipment not readily available locally. German DIY stores like megabad.com and bosch-professional.com have reliable reputations and online presence across Europe, which boosts their export.

German Cross-Border eCommerce: Closing Thoughts

In global cross-border eCommerce, marketplaces far surpass the sales of online stores, but Germany is an exception: here, online stores collectively generate higher export net sales than marketplace GMV. Germany’s full potential for cross-border market penetration is untapped, particularly given the success of marketplaces globally as well as in markets like the United States.

This raises an important question for German eCommerce players: why not focus on the marketplace model?

German marketplaces export mainly to German-speaking countries, with their presence beyond very limited. Online stores also export within Europe. These dynamics are driven by cultural similarities, proximity, and logistical ease, but they restrict Germany’s cross-border reach and pose their own set of perils. There is rising competition from global players now operating in Europe, particularly those from China. Regional saturation is another aspect, with well-established German retailers already maintaining a strong Europe-wide foothold.

The time is ripe for German eCommerce players to explore emerging markets across Asia and Latin America, where a demand for European goods might exist. Marketplaces can be quite effective in this case as they provide retailers with immediate access to international audiences without requiring huge infrastructure investments.

There are good reasons for targeting these diverse markets: they recorded the highest eCommerce growth rates in 2024, have rising middle classes with expendable incomes, as well as young and tech-savvy populations. Markets beyond the EU may pose greater logistical and regulatory challenges, but these are not non-navigable problems, as proved by Chinese and U.S. based cross-border retailers. Better profit margins, diversification of export revenue streams, and a decreased dependence on Europe are some benefits to be found on this route.

For German eCommerce companies eyeing global expansion, two factors will prove vital: technology integration and strategic partnerships. An advanced digital infrastructure and localization in terms of language and payment systems – like Amazon is preparing to do in India – can ease moving into new markets. Partnerships with local marketplaces – for instance, the influential MercadoLibre in Latin America or as Walmart did through Flipkart in India – can also bolster German attempts to attain cross-border success beyond Europe.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Zalando and About You Raise Positive Outlook for the Holiday Season

Zalando and About You Raise Positive Outlook for the Holiday Season

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Deep Dive

The eCommerce Market Germany 2024: A Report By EHI & ECDB

The eCommerce Market Germany 2024: A Report By EHI & ECDB

Deep Dive

EHI: eCommerce Market Germany - Top 1,000 Online Stores Made €77.5 Billion in 2023

EHI: eCommerce Market Germany - Top 1,000 Online Stores Made €77.5 Billion in 2023

Deep Dive

Online Shopping Habits in Germany: Consumers Buy More During the Week

Online Shopping Habits in Germany: Consumers Buy More During the Week

Back to main topics